Let us learn about the Effect of Imposing Tax on Sellers and Buyers.

The government may also intervene in the market through taxes.

Taxes are mainly of two types:

Direct and indirect.

ADVERTISEMENTS:

Here we will examine the effect of an indirect tax. To analyse the effect of indirect tax we must know what are meant by the impact and incidence of a tax.

Every tax has a burden. That is why a taxpayer tries to shift his burden of taxes on to someone else. The man who initially bears the burden of a tax is said to have its impact and the man who ultimately bears the burden of a tax is said to have its incidence.

Thus, impact is the primary burden while incidence is the final burden of a tax. In the case of indirect tax, such as sales tax or excise duty, impact of such tax is usually borne by producers and incidence of such tax is borne by consumers. Incidence of sales tax depends on a variety of factors, of which elasticities of demand and supply are fundamental.

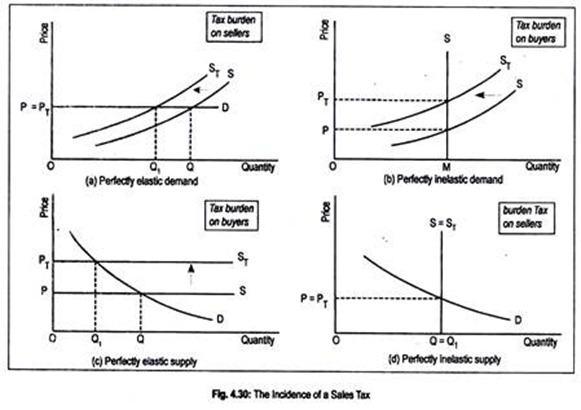

Fig. 4.30 demonstrates the sharing of the burden of a sales tax between buyers and sellers. In Fig. 4.30(a), we have drawn a perfectly elastic demand curve, D, and a normal-shaped supply curve, S. Intersection of these two curves define equilibrium price and equilibrium quantities prior to the imposition of sales tax.

ADVERTISEMENTS:

They are OP and OQ, respectively. After the imposition of sales tax, supply curve shifts to the leftward direction. Here ST is the post-tax supply curve.

The difference between the two supply curves— S and ST—determines the volume of tax. However, demand being perfectly elastic, price is not altered. In other words, pre-tax and post-tax price (P = PT) are the same. Thus, the incidence of a sales tax falls entirely upon the sellers.

Fig. 4.30(b) displays a perfectly inelastic demand curve. Pre-tax price is OP. After the imposition of a tax, price rises to OPT. Thus, the entire burden of tax will have to be borne by the buyers.

In the case of perfectly elastic supply curve [Fig. 4.30(c)], price rises to OPT due to the imposition of a sales tax. So, taxes are to be paid entirely by the buyers. Panel (d) shows no change in price even after tax is imposed. So, sellers must bear the burden of tax.

Thus, greater the elasticity of demand and lower the elasticity of supply, greater will be the burden of tax on sellers.

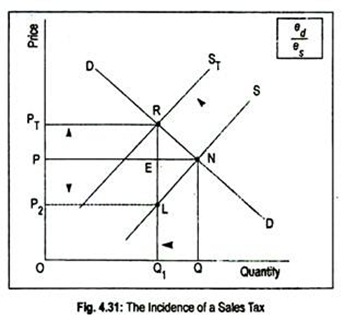

However, in real life, demand and supply the curves are neither perfectly elastic, nor inelastic. In the case of normal-shaped demand and supply curves, burden of a sales tax is distributed between the buyers and sellers. How much the burden of a tax will be on either the buyers or the sellers—or on both—depends on the ratio of elasticity of demand and elasticity of supply. Fig. 4.31 demonstrates this possibility.

D and S are usual-shaped curves that intersect each other at point N. Thus, OP and OQ are the equilibrium price and the equilibrium quantity, respectively.

Supply curve shifts to ST after the imposition of a sales tax. Consequently, price of the commodity rises to OPT. RL is the volume of tax—the difference between S and ST curves. Out of RL, buyers will pay RE and sellers will pay EL (= PP2). Thus, the burden of tax is distributed between buyers and sellers.

This can be verified by studying the ratio of elasticity of demand (symbolized by ed) and elasticity of supply (symbolized by es):

ed/es seller’s burden of tax/buyer’s burden of tax

ed= QQ1/OQ÷ RE/NQ = QQ1/OQ.NQ/RE

and es= QQ1/OQ ÷ EL/NQ = QQ1/OQ. NQ/EL

ADVERTISEMENTS:

ed/es = QQ1/OQ. NQ/REW/QQ1/OQ.NQ/EL = NQ/RE/NQ/EL

= NQ/RE. EL/NQ = EL/ RE

= seller’s share of tax/ buyre’s share of tax

If es/ed happens, then the burden of tax will be RE/EL

ADVERTISEMENTS:

i.e., es/ed = buyer’s share/seller’s share