Let us make an in-depth study of time element, market price and normal price:-

1. Significance of Time Element or Importance of Time in the Determination of Value 2. Market Price and Normal Price.

Significance of Time Element or Importance of Time in the Determination of Value:

The time factor has a very great importance in the theory of value.

The element of time occupies a pivotal place in the Marshallian theory of value. According to the traditional value theory, the forces of demand and supply determine the price.

ADVERTISEMENTS:

The position of supply is greatly influenced by the element of time taken into consideration.

Here time refers to the operational time period pertaining to economic action and forces at work. Functionally, the supply of a commodity relates to this operational time involved regarding adaptations of firms in their production activity. Supply is thus adjusted in relation to the changing demand in view of the time span given for such adjustment.

It is well known that both demand and supply like the two blades of scissors, exert their influence on the determination of value. But their relative importance depends on the period of time given to the forces of supply to adjust themselves to the changes in demand.

In Marshall’s words—”As a general rule the shorter the period which we are considering the greater must be the share of our attention which is given to the influence of demand on value; and longer the period the more important will be the influence of the cost of production on value. The actual value at any time, the ‘market value’ as it is often called, is often more influenced by passing events and by causes whose action is fitful and short-lived, than by those which work persistently. But in the long periods these fitful and irregular causes in large measure efface one another’s influence, so that in the long-run persistent causes dominate value completely”

ADVERTISEMENTS:

Marshall has given such a great importance to the time element in the theory of value and has divided the pricing of products into four time periods:

1. Very Short Period or Market Period

2. Short Period

3. Long Period

ADVERTISEMENTS:

4. Secular Period or Very Long Period

1. Very Short Period or Market Period:

Market period is a very short period in which supply being fixed, price is determined by demand. The time period is of a few days or weeks in which the supply of a commodity can be increased out of a given stock to meet the demand. This is possible for durable goods. The time period for perishable commodities is only a day. In reality market price is that price which is determined by the forces of demand and supply in the market at a point of time. The determination of market price is explained separately for perishable and durable commodities.

In case of Perishable Commodities like milk, vegetable, fish etc. the price is influenced by its demand. Supply has no influence on price because it is fixed. Therefore the price of a perishable commodity rises with the increase in its demand and falls with the decrease in its demand.

In case of durable commodities which can be kept in stock; when the price of commodity increases with the increase in its demand, its supply can be increased out of the given stock. Such commodities are cloth, wheat, tea etc. They have two price levels.

First a minimum price below which a seller will not sell his commodity. This is known as the reserve price.

Second, a minimum price at which the seller will be prepared to sell the entire quantity of his commodity.

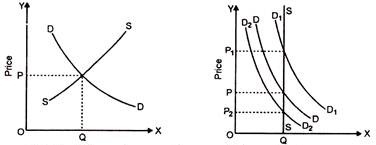

Thus, the very short period price or for brevity the market price is determined by the interaction of market period demand and supply as shown in figures given below:

In the figure (A) the SS supply curve is a vertical straight line, representing perfectly inelastic supply. DD is the demand curve. The intersection between these two curves determines the equilibrium price OP at which demand equal to supply (OQ).

ADVERTISEMENTS:

Supply being fixed during the market period, the equilibrium price—the market period price tends to be solely governed by the changes in demand condition. Evidently as demand increases, the market price rises correspondingly and when demand decreases, the price also decreases to that extent. The point is clarified in figure (B).

A shift in the demand curve from DD to D1D1 means an increase in demand, along with it the new equilibrium price rises from OP to OP1. Similarly, if there is decrease in demand as represented by the curve D2D2; the new price is also set at OP2 level.

2. Short Period Market Price:

The short period market price is that functional time period price during which the size of the firm and its plant cannot be altered, thus a set of fixed factors remains unchanged in its production function and more output can be produced only by increasing the inputs of variable components under the given state of technology.

Thus, during the short period, the stock of a given commodity can be increased but to a limited extent by an intensive use of the given production plant. As such the supply curves of the existing firms will tend to be relatively inelastic. Therefore, the supply curve of industry will be relatively inelastic.

ADVERTISEMENTS:

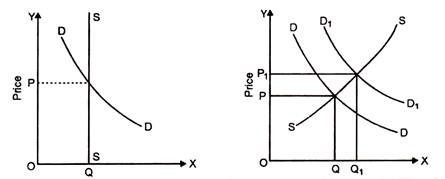

The short period price is thus determined by the interaction of the forces of short-run demand and supply. In graphical terms, the short-period equilibrium price is determined at the point of intersection between short-run demand curve and short-run supply curve as shown in figure given below in (C) and (D).

In figure (C) SS is the short-run market demand curve which has a steeper slope, indicating relatively inelastic supply. DD is the short run market demand curve. OP is the equilibrium price, at which OQ is the quality of demand as well as supply. The short-run price is also described as ‘sub-normal price.’

At this price, the industry may not be in equilibrium, as some efficient firms might be earning super-normal profits, which may attract the entry of new firms. Again, some inefficient firms might be incurring losses, yet they continue in business in the hope of improvement in the market situation in the long run.

ADVERTISEMENTS:

In the short-run price determination also, demand forces tend to have a greater impact as compared to the supply forces. Thus, when the short-run demand increases, there is some variation in supply in the process of adjustment but the adjustment being imperfect and much less than the market requirement, the equilibrium price tends to rise.

However, the rise in the short-run price is not of the same range as in the case of the market period price; since there is some adjustment due to a degree of variation in supply. The point may be elucidated as in figure (D). With a shift in the demand curve from DD, D1D1 the short period equilibrium price rises from OP to OP1 and the new equilibrium quantity of demand and supply is OQ1.

3. Long Period Market Price or Normal Price:

Long period market price is also known as the ‘normal price’. Normal price is that price which is likely to prevail in the long run. In the words of Marshall—”Normal or Natural value is that which economic forces would tend to bring about in the long run.” This price is determined by the equilibrium of demand and supply. For the equilibrium of firms and industry in the long-run it is essential that normal price should be equal to the long-run marginal cost and average cost.

During this period all factors of production in the input components of the firms in an industry become variable. As such, in the long-run, the firms can change the scale of production. The size of the firms and their plant capacity can be altered. Thus, in the long-run supply can be fully adjusted to the changing demand conditions.

In the long-run, therefore, the supply curve of an industry tends to become relatively elastic. In the long-run, demand firms may also enter the industry till full equilibrium position is reached. Hence, the long-run provides enough scope for a reasonable adjustment of supply in relation to demand. Therefore, the interaction between long-run supply and demand determines the long period equilibrium price.

This can be shown in figure as follows:

ADVERTISEMENTS:

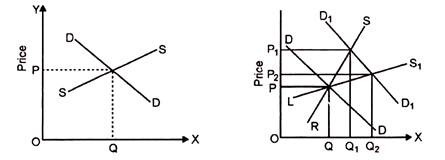

Long-run price is determined at the point of intersection between the long-run demand and supply curves as shown in fig. (E). In fig. (E) SS is the long-run supply curve which is a flatter curve indicating relatively elastic supply. DD is the long-run demand curve. OP is the equilibrium price at which OQ is demand as well as supply.

In the long-run, as compared to the demand force the supply force becomes a dominant factor in determining the equilibrium price. The long-run price is also described as the normal price. A comparison between short-run and long-run equilibrium price may be made as in figure (F). In this figure, the SR curve represents the short-run supply curve and LS1 curve represents the long-run supply curve. The original demand curve is DD. Hence, OP is the original equilibrium price. Now, if the demand curve shifts to D1D1, the short-run equilibrium price rises to OP1and short-run quantities of demand and supply amount to OQ1, as the supply is adjusted to QQ1.

However, with the same magnitude of demand change, the long-run changes to OP2. The long-run supply is adjusted to QQ2. Apparently, the long-run price change tends to be lesser than the short-run price change, and the supply adjustment in the long-run tends to be more adequate than in the short-run.

In short, it can be said that the Marshallian Time Analysis suggests that the degree of elasticity of supply tends to vary in relation to time. The supply tends to be relatively inelastic in the short-run and relatively elastic in the long-run. Again in short period, the demand factor has greater influence on price determination. Demand relates to utility. Thus, in short period, the utility of the commodity concerned has greater significance in the determination of its value i.e., value in exchange or price.

In the long-run, the supply factor bears greater influence upon the equilibrium price determination. The supply factor is based on the element of cost. Thus, in the long-run, consideration has greater significance in the determination of value.

ADVERTISEMENTS:

Further, we may write that Marshall has said that the “Actual value at any time, the market value as it is often called, is often influenced by passing events and causes whose action is fitful and short-lived than by those which work persistently. But in long periods these fitful and irregular causes in a large measure efface one another’s influence, so that in the long run, persistent causes dominate values completely.”

4. Secular Period:

The Secular period is very long period. Regarding this period Marshall has said that—”It is a period of more than ten years in which changes in demand fully adjust themselves to supply. Since it is not possible to estimate the changes in demand due to changes in techniques of production, population, raw-materials etc. over a very long period, therefore, Marshall did not make any analysis of pricing under the secular period.”

Conclusion:

To conclude it can be said that the above analysis shows the importance of time element in the theory of price. It points out that of the two forces, demand and supply, which force may be considered as more important in the price determination depends on the time period. Generally, the shorter the time period, the greater will be the influence of demand on pricing ; and the longer the time period, the greater will be the influence of supply on the determination of prices of commodities.

Market Price and Normal Price:

What is Market Price?

Market price is the real price which prevails in the market at any time.

Normal Price:

Normal price is a hypothetical price. It is an abstraction, a myth, something unreal and imaginary. It is like a mirage. The small waves in the sea are real but the calm water of the sea in the distant horizon looks like a mirage.

In this connection the opinion of Stonier and Hague is as follows:

ADVERTISEMENTS:

“In practice, a long period normal price will never be arrived at. There will usually be a change in some of the conditions underlying the long period equilibrium before it has had time to come into being. The long-run like tomorrow never comes, and the price that rules in the market is always the market price rather than the normal price.”