The below mentioned article provides study notes on Economic Models, Equilibrium, Statics and Dynamics.

Study Notes # 1. Meaning of Economic Models:

For quite sometimes economists have been using various models for describing, analysing and predicting various economic concepts and events. A model is an abstract, simplified design of a working system. The working system may be a single system like a market, such as the market for an agricultural commodity or the economic system as a whole.

An economic model is a construct incorporating two or more variables that:

(a) Describes the relationship which exists between variables (such as the level of company sales and advertising);

ADVERTISEMENTS:

(b) Depicts the economic outcome of their relationships; and

(c) Predicts the effects of changes in the variables on the economic outcome.

An economic model is a simplified version of economic reality. A model can be presented in different ways — in the form of a diagram, a flow chart (such as the circular flow diagram of national income), statistical tables, or a system of equations.

Now most economic models are presented in the form of a system of equations. Though different economic models are expressed in different ways, mathematical methods appear to be the most widely used form for presentation of a working system.

ADVERTISEMENTS:

Most of the economic analysis has its origins in microeconomic theory. Topics like the theory of demand, the profit-maximising model of the firm, optimal prices and advertising expenditures and the impact of market structure on firms’ behaviour are all approached using the economist’s standard intellectual ‘tool-kit’, which consists of building and testing various models.

A simple two-equation macro model is the Keynesian national income determination system. The first equation is an accounting identity or income definition in which income comprises consumption and investment expenditure (C + I). The second-equation is the consumption function. It expresses consumption as a function of income C = f(Y). The Keynesian theory suggests that consumption is an increasing function of income.

In order to solve the system, we need to assume a specific functional form. For the sake of convenience, we assume here that, the function is linear (C = a + bY). It will then possess properties specific to the Keynesian consumption function if the constant term ‘a’ is positive (a > 0) and the slope coefficient is between zero and one (0 < b < 1).

Y = C + I … (1)

ADVERTISEMENTS:

C = a + bY … (2)

An example of micro model is the very simply supply-demand model often used in microeconomics.

The supply and demand equations say that the quantities supplied and demanded are functions of the price of a commodity:

D: qd = a + bP …….(1)

S: qs = c + dP …….(2)

where, b > 0 and d < 0

Here b is the slope of the demand curve which is negative because of the Law of Demand. But, the slope of the supply curve (d) is positive due to the Law of Supply. We may finally add the market clearing equation or equilibrium condition to complete the Marshallian partial equilibrium model (i.e., model representing the market for a single commodity).

qd = qs ……….(3)

Equation (3) simply states that for the market to be in equilibrium the quantity demanded of a commodity must be equal to the quantity supplied of the same commodity.

Study Notes # 2. Uses of Economic Models:

ADVERTISEMENTS:

Economic models are used in various ways.

The following are the most important uses of such model:

1. To work out theoretical implications of economic analysis,

2. To test economic theories,

ADVERTISEMENTS:

3. To make economic forecasts,

4. To plan for economic development of a country,

5. To examine alternative economic policies,

6. To simulate alternative scenarios of the economy, and

ADVERTISEMENTS:

7. To replay economic history.

Much theoretical analysis of economic models is carried out by examining the mathematical properties of solutions to a system of equations, both static and dynamic. The long-run implications of a solution to a model are used to establish or test long-run properties of economic theory.

Such long-run properties might be stability of key ratios such as saving-income ratio, capital-output ratio, or wage-national income ratio. It is necessary for certain key balances to hold in the long-run, as the balance between real interest rate and real growth rate and between international receipts and payments.

Numerical economic models are generally solved by computers for the purpose of projecting the values of key variables. The best known use of such models lies in economic forecasting. The input-output model may be used to illustrate this point.

A Final Point:

In more complex models historical values of lagged variables (the initial conditions) and future values of exogenous (external) variables are assembled as model inputs. Also tax coefficients and technological parameters are assumed to remain fixed. The models with these inputs are fed into electronic computers and the solutions of the models over future time constitute the forecast.

ADVERTISEMENTS:

The procedure is not automatic. The judgment of the forecaster is required to adjust the model so that it approximates the observed levels of the economy at the initial stages which precede the forecast. The adjusted model is then extrapolated over the forecast horizon for the purpose of prediction.

The Proper Use of Models:

The main point to vote here is that, economic models are aids to thought and not substitutes.

In this context the following quote from K. Boulding is highly relevant:

“We must beware of too great reliance on the so-simple models, for the assumptions of such models are always likely to be falsified. Nevertheless, without the aid of these models the complexity of the subject matter leads either to complete bewilderment or to a retreat into the rituals of pure empiricism, and the endless recording of data whose meaning always escapes us, as it leads to thinking with the aid of implicit models which we never openly recognise, and which therefore are all the more likely to lead us astray”.

Study Notes # 3. Meaning of Equilibrium:

Equilibrium is a term which is often encountered in economics textbooks. We read about equilibrium prices, equilibrium quantities, and equilibrium levels of employment, equilibrium levels of national income and so forth. Every economic model includes a definition of equilibrium. It also includes the identification of forces that can change the equilibrium and move the system toward a new equilibrium.

ADVERTISEMENTS:

The notion of equilibrium in economics is actually borrowed from physical sciences. A system is set to be in equilibrium in which it is at rest or when it is moving at a constant rate in a steady direction. That is, all the forces acting on the system are in balance and there is no tendency to change.

Equilibrium carries no sense of being a state that is good or bad, desirable or undesirable. In economics, as in physics or chemistry, if we leave a system alone equilibrium is where it will come to rest. Disequilibrium is a state in which the variables are moving away from old equilibrium values and toward new values but have not yet arrived there.

As applied to an economic agent, such as a consumer or a firm, equilibrium denotes a situation in which the agent is under no pressure or has no incentive to alter the current levels or states of economic action, because given his aspirations and the constraints he faces he cannot improve his position in terms of any economic criteria.

When applied to markets equilibrium denotes a situation in which, in the aggregate, buyers and sellers are satisfied with the current combination of prices and quantities bought or sold, and so are under no incentive to change their present actions.

If, for some reason, the equilibrium price is not observed then forces will occur which bring the market back to the equilibrium price. Thus, if supply exceeds demand, producers’ stocks (inventories) will increase, signalling to them a state of excess supply. They will lower prices until supply and demand are just again equal. Such an equilibrium is known as stable equilibrium.

Study Notes # 4. Properties of Equilibrium:

An equilibrium has three important properties, viz., existence, uniqueness and stability. The first question is whether equilibrium exists or not. If it exists, the next question is whether there is only one equilibrium or multiple equilibria. The third question is whether equilibrium is stable or not. An equilibrium is said to be stable if a small deviation from it tends to create forces that bring the system back to equilibrium.

ADVERTISEMENTS:

If there is further and further deviation from the original equilibrium point, the system is said to be unstable. Unstable equilibria will occur if some divergence from equilibrium price sets up forces which move price further and further away from the original price. In the supply-demand analysis this can occur if both supply curve and demand curve are negatively sloped and the supply curve cuts the demand curve from above. If it cuts it from below, the equilibrium will still be a stable one.

Equilibria may not, in fact, exist. Using the supply and demand example again, the curves may not intersect at all in which case no equilibrium price exists since there is no price at which suppliers and demanders are willing to trade. Lastly, supply and demand curves may intersect more than once in which case it is possible to have more than one equilibrium price, each of which is stable. This is said to be a situation of ‘non-uniqueness’.

Although the supply-demand example has been used here, these three aspects of equilibrium, viz., of existence, uniqueness and stability assume more relevance in the context of general equilibrium theory. All three features are regarded as desirable attributes of a general equilibrium system.

Study Notes # 5. Difference between Statics and Dynamics in Economic Theory:

Static analysis is timeless analysis — any analysis in which the passage of time does not play an essential role. A static analysis is usually applied to stock variables. But, it can also be applied to flow variables (which have time dimension) if the flows do not change any stocks which affect the equilibrium.

Classical economists referred to the stationary state which illustrates static analysis. Following David Ricardo, W.J. Baumol has referred to a model in which the equilibrium, once achieved, remains unchanged period after period. Such an equilibrium is termed ‘a stationary state’.

The stationary state derives its name from the fact that in it the general conditions of production and consumption, of distribution and exchange, remain motionless; but yet it is full of movement. An economy in a stationary state functions as if output in every period is consumed in the same period.

ADVERTISEMENTS:

The stock of consumer goods is used up through the period, but it is always exactly replaced at the end of each period. The growth theory of the classical economists is described as a progression towards the situation of a stationary state or zero economic growth.

Furthermore, economists often seek to analyse the final effects of such change in a parameter of the model — say, in a tax or a price. In such problems, they have to examine the equilibrium only at one arbitrary point in time, since the equilibrium is the same at any other time.

In economics, we encounter the term ‘equilibrium’ again and again.

Comparative static analysis examines the change in final equilibrium that result from some specified changes in the parameters of the model. Most of the graphs used in economics will show the original equilibrium, the new equilibrium and will also give some indications of the process by which the market or the economy moves from one equilibrium to another.

This kind of analysis is called comparative statics. Comparative statics starts by describing the initial state of the market (or the economy). The initial state is then compared to some later state in which some element has changed. Thus, comparative statics looks at changes in equilibrium positions between two different time periods.

Another way of looking at comparative statics is to see it as the snapshot of the economy or a part of the economy, for instance, a market, and to analyse the relationships that exist among the variables. We then change one variable, which causes the economy to move to a new equilibrium. Then, we take another snapshot of the economy and make a similar analysis. We then compare these two snapshots to see what has changed and why. We are comparing static pictures of the economy.

Two Types of Comparative Static Problems:

According to Paul Samuelson, comparative statics analysis examines the changes in the final equilibrium that result from some specified changes in the parameters of the model.

He observed that comparative static problems fall into the following two types:

(1) The first describes the optimising behaviour of individual economic agents (consumers, factor-owners, firms, or the like) as a function of the opportunities available to the agents. The solution of these problems normally involves finding a maximum or minimum of some objective function (say, profit) subject to constraints (fixed cost or expenditure).

(2) The second type of problem studies an equilibrium involving the interaction (normally across the markets) of a number of economic agents. In such cases, the equilibrium cannot be described as a maximum or minimum of some function. Instead, conditions for the stability of the equilibrium must be specified.

Sometimes, comparative static problem is fruitful because it focuses on the information required to make definite qualitative statements about the effects of a change in a parameter of the problem.

The Correspondence Principle:

In the second type of problem, Samuelson showed that a correspondence often exists between the condition of stability of the equilibrium and conditions for definite results in a comparative static problem. This duality is called the correspondence principle.

The principle allows us to find definite results for comparative static problems conditioned upon the observed stability or to infer stability given observed comparative static results. Thus, it is often necessary to carry out a formal analysis of the conditions for stability in order to obtain definite comparative static results.

Dynamic Analysis:

A stability analysis examines whether, beginning from a point away from equilibrium, the model moves to the equilibrium as time goes to infinity. One may consider any feasible starting point or points near the equilibrium (local stability). Stability analysis is essentially dynamic analysis, in which the only important question is whether the model converges to the stationary state equilibrium.

In dynamic analysis the passage of time is explicitly or essentially considered. Such analysis refers, generally, to any analysis in which changes that occur only with the passage of time. Such changes normally involve changes in stock variables due to flows-in or flows-out over time.

Dynamic analysis has applications in both branches of economics — micro and macro. But, it is particularly helpful in analysing inflation, business cycles and economic growth which are by their nature inherently dynamic.

Stops Involved:

A dynamic analysis begins with a compact description of the equilibrium of the system being examined. Then, it investigates the final effects on the equilibrium of alternative assumed values of initial conditions or other parameters in the model. If the equilibrium were a stationary state the analysis would reduce to comparative statics.

Dynamics are used to trace adjustment of the economy from the old equilibrium to the new due to an unpredictable change in the nature of the economy, such as a discovery of new technology or resource. Dynamic analysis also considers the evolution of the economy when the economic agents adjust their expectations and hence, their behaviour by learning over time of changes in the nature, structure and characteristics of the economy.

Study Notes # 6. Uses of Dynamic Analysis:

Dynamic analysis is used to address various macroeconomic questions. One such question is also how price and quantity in a particular industry adjust after a permanent change in a parameter such as a tax rate. An approach suggested by Alfred Marshall and formalised by John Hicks examines a sequence of short periods in which supply curves and demand curves shift over time.

Supply curves shift as resources in industries producing complements and substitutes adjust. This reduces the analysis to a sequence of comparative static problems that converge to specified long-run equilibrium. Recently more sophisticated tools have been applied to study other dynamic microeconomic problems, such as the firm’s investment plan and the use and pricing of exhaustible resources.

In short, dynamic economics is the inter-temporal analysis of the economic system. The economy may be passing from one equilibrium point to the other (i.e., two comparative static equilibria) or it may be continuing through time without reaching a state of static equilibrium.

The essence of such models is the introduction of lags in the adjustment of the variables, the current values of which depend on past values of themselves and/or other variables. In truth, any economic model which simultaneously contains variables dated in more than one time period may be considered dynamic.

Study Notes # 7. Difference between Partial Equilibrium and General Equilibrium:

Economists often draw a distinction between partial equilibrium and general equilibrium. Alfred Marshall adopted partial equilibrium approach throughout his analysis of microeconomics. Partial equilibrium refers to the study of a market for a commodity in isolation. Given the prices of all other commodities the conditions for equilibrium in a single market are examined.

This technique ignores the effect of changes in the price of a commodity on all other related market prices including the prices of factors of production. These changes may have feedback effects on the original market which can only be analysed in terms of general equilibrium.

While analysing how the price of bread is determined, the partial equilibrium approach totally ignores what happens to all other markets. But, in reality all markets are interrelated and commodities are classified into substitutes and complements. If the price of sugar increases the demand for tea is likely to be affected. Similarly, if the price of coffee rises the demand for tea is likely to rise.

So, all commodity markets are interrelated through interrelationship of consumption. Moreover, commodity and factor markets are also interrelated. If the price of coal, for example, rises the prices of steel as also transportation charges will increase. The same thing will happen if the price of petrol or diesel rises.

A number of industries will be affected because they all use coal and oil as their main or subsidiary inputs. There will be a chain reaction throughout the economy. Thus, if we are to capture the full effect of changes in market prices we have to consider the behaviour of all markets at a time.

Such an approach goes by the name ‘general equilibrium approach’ which is essentially a multi-market approach. General equilibrium refers to a situation where all markets in the economy are simultaneously in equilibrium and we are in a position to determine a consistent set of commodity and factor prices.

In partial equilibrium, only a part of the economic system is examined. For example, the market for orange, on the assumption of unchanged conditions in the rest of the economy. By contrast, general equilibrium analysis looks at an economic system as a whole and observes the simultaneous determination of all prices and quantities of all goods and services in the economic system. The general equilibrium approach was developed by Leon Walras in 1874, even before the publication of Marshall’s Principles of Economics in 1890.

Three important questions arise in the context of general equilibrium systems usually on the assumption of perfect competition. These are: (1) Does a general equilibrium system have a solution, in the sense that the values of the variables are consistent with each other? (2) Is the solution unique in that there is just one value for each variable consistent with the overall solution? (3) Is the system stable, so that it will return to the equilibrium values after some disturbance? Theoretical work has enabled definitive statements to be made on these questions.

In the language of Paul Samuelson “the general equilibrium of markets determines prices and outputs so that the marginal utility of each good to consumers equals the marginal cost of each good to society”. Partial equilibrium analysis involves the behaviour of a single market, household or firm taking the behaviour of all other markets and rest of the economy as given. By contrast, general equilibrium examines how the simultaneous interaction of all households, firms and markets solves the questions of what to produce, how to produce, and for whom to produce.

Study Notes # 8. Uses of General Equilibrium Approach:

In general equilibrium theory, the structure of the economy is analysed as a system of interrelated markets. The theory assumes that, if all participants are given such information as consumer demand schedules, resource supply schedules, production functions and the demand for money in each particular market, equilibrium forces will cause prices of all goods and resources prices to adjust themselves in a mutually consistent manner. The entire system can then settle down in a stable equilibrium of supply and demand.

However, any change in the determinants affecting the price and quantity of a good or resource can upset the entire system. This will have widespread repercussions on the equilibrium prices and quantities of all other goods and resources. Therefore, in the real world, there is often a significant degree of interdependence among various markets.

Study Notes # 9. Circular Flow Model of the Economy:

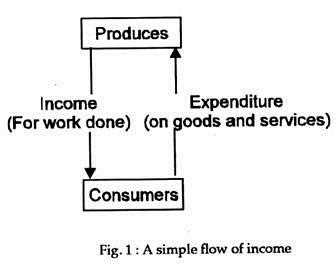

An important tool of economic analysis is the circular flow model of the economy. It is used to study how the national income of a country is measured. It shows three types of flows: (i) the flow of factors of production from the household sector to the business sector, (ii) the flow of money; and, (iii) the flow of commodities.

The circular flow model shows how people spend their money on final goods. The total rupee flow of these each year is one measure of gross domestic product. It also measures the annual flow of costs and out- put – the earnings that businesses pay out in wages, rent, interest, dividends and profits. A typical circular flow diagram is presented in Fig. 1.

Study Notes # 10. Circular Flow of Economic Activity: A Complete Model:

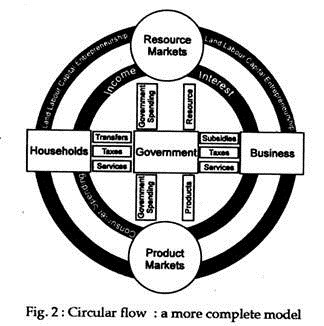

So money, goods and services flow through the economy in a circular manner, as depicted in Fig. 2. Notice that there are three major transactors (government, business, and households) and two basic kinds of markets (resource markets and product markets). The participants in free enterprise markets exchange the resources that business and government need in to operate: land, labour, capital and entrepreneurial talent.

For example, a business buys land, labour, and capital from resource markets and pays rents, wages and interest for these resources. Households contribute land, labour,’ capital and entrepreneurial talent to resource markets in exchange for income! In product markets, households spend money for consumer goods and services, and businesses provide these goods and services in exchange for sales revenue.

The government provides services in exchange for sales revenue. The government provides services, such as the court system, to households and business. In turn, it receives taxes from them. It also uses the markets to purchase resources and products (e.g., guided missiles and the services of school teachers), paying for them with tax revenue.

Business, government and households are interdependent. Each of these groups helps create and maintain economic activity in a process that continues over and over again, as shown in Fig. 2. From this pattern, business people learn that they must keep abreast of changes in households and government, as well as the activities of other businesses.