Learn about the Interrelation between Money, Interest Rates and Prices.

Role of Money:

Money is one of those concepts which, like a teaspoon or an umbrella, but unlike an earthquake or buttercup, are definable primarily by the use or purpose which they serve. Ralph G. Hawtrey, 1928. We all know how important money is in our lives.

Without money one cannot manage our day to day activities smoothly, easily and quickly. Money exists in three different forms—as currency notes and coins in our pockets, as entries in our bank accounts, and as the value of our wealth.

We all put hard labour and toil throughout the day to earn money which ultimately appears to be just a piece of paper with no intrinsic value.

ADVERTISEMENTS:

However, only the government has legal authority to print currency-called legal tender money and it is surprising that the money supply with the public in bank accounts, far exceeds the amount of money created or supplied by the government initially through its own bank, viz., the Central Bank.

However, money plays a very important role in the economy. It has enormous effect on national income, output (GNP), the level of employment and the general price level.

The Central Bank which is the central, monetary authority can use its control over the supply of money to stimulate the economy when the growth rate slows down, or to put a halt to the economy’s growth when the rate of price increase is accelerating.

When the Central Bank is able to manage the money supply well, GNP can grow smoothly even in the absence of inflation. But when the monetary system is not in order and is not operating smoothly the money supply can grow smoothly or fall sharply, leading to either accelerating inflation or deep depression.

ADVERTISEMENTS:

The truth is that most of the world’s pressing economic problems can be traced to crises in the management of money and finance.

Money and Interest Rates:

Our modern financial system consists of currency (notes and coins), cheques, automated teller machines, and numerous sophisticated financial instruments with different degrees of liquidity. However, money still occupies the central place in any financial system.

What is Money?

Anything which is commonly and universally accepted as a medium of exchange or means of payment is called money.

Before money was introduced commodities were directly exchanged for commodities. This was known as the barter system. But the barter system created various problems and money was introduced to solve these problems. In a modern economy, called a monetary economy, commodities are first sold for money and then money is again used to buy other commodities.

ADVERTISEMENTS:

Money as a medium of exchange first came into existence in the form of commodities like wine, copper, iron, gold, diamonds, or even cattle. These forms of money had intrinsic value, meaning that they had value in themselves.

The age of commodity, which lasted for quite a long-time, yielded p lace to paper money. It is a convenient medium of exchange. It has value due to limited supply.

Today is the age of bank money cheques written on funds deposited in a bank or any other financial institution. Now-a-days cheques are accepted in place of cash payment for many, goods and services. In fact, most transactions now take place through bank money and only a small portion by currency.

Today, we find extremely rapid innovation in the different forms of money. Now credit cards and traveller’s cheques are often used for various transactions. However, such fast-changing nature of money makes it difficult for the Central Bank to smoothly conduct its monetary policy (whose basic objective is to control the nation’s money supply).

Components of the Money Supply:

The concepts and definitions of money supply differs from country to country and period to period. Two widely used definitions of the money supply are transactions money (M1) and broad money (M2).

While M1 consists of currency and bank deposits withdraw able by cheques (called narrow money), M2 adds to these certain money substitutes or near-money assets such as fixed deposits, life insurance policies, national saving certificates and so on (called broad money).

The last few assets are no doubt as liquid as money but they are not money in the true sense because they are not accepted in day- to-day transactions.

Indian Definition:

The Reserve Bank of India has adopted four concepts of money supply in India. These are known as money stock measures or measures of monetary aggregates.

ADVERTISEMENTS:

The four components of money supply are the following:

M1 = currency with the public, i.e., notes + coins + demand deposits (withdraw able by cheques) of the public, known as narrow money.

M2 = M1 + post office savings deposits.

M3 = M1 +Time (fixed) deposits of the public with banks, known as broad money.

ADVERTISEMENTS:

M4 = M3 + total post office deposits.

N.B. In India small savers maintain fixed deposits of various maturities with post offices, apart from savings deposits.

Interest Rates: The Price of Money:

Like all other commodities, money has also a price. And the price of money is the rate of interest. It is the periodic payment made for the use of money. The cost of borrowing money, measured in rupees per year per rupee borrowed, is the interest rate.

Interest is the charge made to the borrower by the lender for the use of money, expressed in terms of an annual rate of percentage upon the principal. In other words, the interest rate is a percent of the principal or an amount borrowed or lent, expressed as the ratio of the amount of interest paid or earned, during a certain period of time, to the amount of principal.

ADVERTISEMENTS:

An Array of Rates:

In traditional economic theory we speak of ‘the’ rate of interest: but in today’s complex financial system we come across a vast array of interest rates. Interest rates differ mainly due to differences in the characteristics of the loan or of the borrower.

The main differences are the following:

1. Term or Maturity:

Loans differ in their maturity the length of time until they are repaid. Short-term loans are usually made for periods up to one year. Long-term loans which have maturities of 5 to 10 years usually command higher rates of interest. The reason is easy to find out. People will be ready to sacrifice their liquidity for a long period of time if and only if they get a higher return.

2. Risk:

ADVERTISEMENTS:

Loans made for certain purposes (e.g., speculation) are more risky than loans made for other purposes (e.g., transport business or house construction). Those who lend money in risky ventures usually expected higher returns than those who make comparatively safe loans. The safest loans are the bonds of the government (called gilt-edged securities which are free from default).

This is why those who buy government bonds get less interest than those who prefer to buy risky private bonds or debentures. Slightly risky loans are borrowings of creditworthy corporations. Highly risky investment, which bear a significant chance of default or non-payment, include those in companies close to bankruptcy.

3. Liquidity:

Any asset which can easily be converted into cash with little, if any, loss of value is called a ‘liquid’ asset. Most marketable securities, including corporate and government bonds, are highly liquid assets because they may quickly be turned into cash for close to their current value. Illiquid assets are those which cannot he sold easily and quickly in the market at a fair price.

An example of such an asset is a losing private company or a house located in a backward region. Such illiquid assets or loans usually command considerably higher interest rates than do liquid, risk- less ones because of the higher risk and the difficulty of extracting the borrower’s investment.

ADVERTISEMENTS:

4. Administrative (transactions) Cost:

If the cost of administering a loan is high the interest on such loans will also be correspondingly high. Similarly, if the collecting periodic interest on loan is high the interest charged on such loans will be correspondingly high.

The Demand for Money:

Wealth can be held in various forms—money, fixed interest securities (bonds), shares, property, jewellery, valuable paintings etc. Keynes first analysed, in detail, the reasons why people will hold wealth in the form of money. This has come to be known as the Liquidity Preference Theory of Interest.

At a fixed point of time, a certain stock of money is held, i.e., people wish to hold a certain amount of wealth in ‘liquid’ form. ‘Liquidity’ refers to the ease with which assets can be changed into cash without loss or delay. It is property which is enjoyed by all assets to some extent. Obviously, money is the most liquid of all assets. The demand for money was, therefore, termed by Keynes ‘liquidity preference’.

The demand for money refers to the desire to hold money (in liquid form) as an alternative to investing it in income-earning assets like bonds or equity shares or debentures.

According to J. M. Keynes, people hold money for three purposes:

ADVERTISEMENTS:

(1) Transactions: for purchasing goods and services;

(2) Precautionary: to be able to overcome an unforeseen situation and

(3) Speculative: to purchase bonds at a lower price with the expectation of selling the same at a higher price in future. The third type of money is called asset demand and is a part of modern ‘portfolio’ theory.

There are three determinants of the demand for money:

(1) National income.

(2) The price level and

ADVERTISEMENTS:

(3) The rate of interest.

Keynes pointed out that it costs money to hold money and the rate of interest is the opportunity cost of money holding, i.e., by holding money people lose the opportunity to earn interest.

1. The Transactions Motive:

Individuals and business firms hold money in order to carry out day-to-day transactions. Each individual or firm has a time gap between receipts (income) and payments (expenditure) and will need to hold money to cover this.

The average amount held will depend primarily on the system of payments, i.e., on the frequency of the receipts. For example, if a person is paid weekly and receives Rs. 300 a week, and he has spent it all by the next pay-day, his average cash holding is Rs. 150, i.e., the amount he had at the beginning (Rs. 300) and the amount he has at the end (zero), divided by 2.

If he receives monthly salary of Rs. 1,200 then, assuming that his spending habits do not alter, his average cash holding will rise to Rs. 600, i.e., (Rs. 1200 + 0) ÷ 2.

The amount of cash held for transactions and precautionary purposes also depends on incomes and prices. If income increases, then more money will be held. Similarly, if prices rise, more money will be required to purchase the same amount of goods and services.

2. The Precautionary Motive:

People and business firms hold some money as a reserve to meet unforeseen contingencies, such as sickness or accidents or the need to take advantage of an opportunity to buy something which is being offered at a specially reduced price for only a limited period, e.g., during a sale.

3. The Speculative Motive:

The classical economists considered it irrational for people to hold wealth in the form of money other than that held for transactions and/or precautionary purposes. It is because any money left over could be invested in interest-earning assets like bonds. Keynes, however, argued that it was not necessarily irrational to hold idle money balances.

He pointed out that at times it might be preferable to hold idle money (cash) then to buy government securities (bonds).

If a person holds money, he loses interest but he does not suffer capital loss (due to fall in the value of his assets) either. (Here we ignore the effect of inflation and leave aside any reduction there from). By holding securities, however, he earns a fixed sum as interest, but its market value can (and does) vary.

Therefore, in certain situations, money is preferable to securities. For example, if a person pays Rs. 100 for a Rs. 100 bond whose rate of interest is 10%, then at the end of the year he received Rs. 10 (or Rs. 110 in all, i.e., including the principal). But if in the mean time the value of the bond has fallen to below Rs. 90, the loss on this amount more than offsets the interest.

The market value of a bond is inversely related to the market rate of interest. Thus, if the rate of interest goes up, the market value of a bond will fall. The market value is shown in the following formula:

Market value = Original value x original rate of interest/Market rate of interest

In the case of a Rs. 100 bonds whose original rate of interest is 10%, Rs. 10 interest will be paid at the end of the year. If the market rate of interest rises to 20% and the bondholder wishes to sell it for some reason, he will not find a buyer ready to give him Rs. 100 for it. The reason is very simple.

If the buyer pays Rs. 100 and at the end of the year receives Rs. 10 as interest, then his investment has yielded interest of only 10%, whereas elsewhere he could have gained 20%.

The buyer can at best offer Rs. 50 for the bond, so that when he receives the Rs. 10 interest, his investment has earned 20% (which is indeed the market rate of interest). Thus, because the market rate of interest has risen, the market value of the bond has fallen.

The converse is also true: if the market rate of interest falls, the market value of a bond will rise. If, in the example, the rate of interest falls to 5%, the value of the bond will rise to Rs. 400. It is because the return from this bond at 5% interest will now be Rs. 20.

According to Keynes, the speculative demand for money will be determined by people’s expectations regarding the market rate of interest. If the rate of interest is very low and people expect it to rise (or the value of bonds to fall), then they will consider it more judicious to hold money rather than bonds.

If, on the other hand, the rate of interest is very high and people expect it to fall, then they will prefer to hold bonds instead of money.

Thus there is an inverse relation between the rate of interest and the demand for money. At high rates of interest people hold less money and vice versa. Another reason why this is so is that if the rate of interest is high, it is ‘more expensive’ to hold money, i.e., the interest which is foregone by not investing the money is at a high level.

For these two reasons, the demand for idle money balances is inversely related to the rate of interest. Keynes assumed that the demand for money for the other two motives is not affected by changes in the rate of interest, i.e., is perfectly inelastic with regard to the rate of interest.

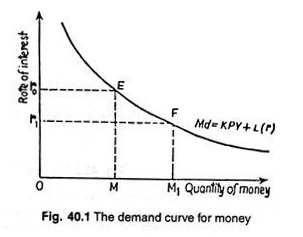

Therefore, if all three elements in the demand for money are added together to derive the total demand curve for money, the result would be a curve of the type shown in Fig. 40.1. (A demand curve for money is also known as a ‘liquidity preference curve’).

The curve shown that if the rate of interest falls, e.g., from Or0 to Or1, the demand for money increases, from OM to OM1. According to Keynes, at some low rate of interest the demand for money becomes perfectly elastic because if the rate falls below this level, no one would be prepared to buy bonds.

The Determination of the Rate of Interest:

The rate of interest, which is the ‘price’ of money, is determined by demand and supply in a competitive situation. We have seen that the demand curve for money is downward sloping.

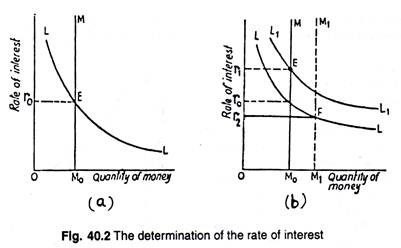

We assume that the supply curve will be perfectly inelastic with regard to the rate of interest, i.e., that the supply is determined by the monetary authorities and does not vary with the rate of interest in the short-run. Thus, in Fig. 40.2(a) the supply of money is represented by the perfectly inelastic supply curve, M.

The equilibrium rate of interest is Oro because it is the only rate of interest at which the money market is in equilibrium, e.g., the demand for money is equal to its supply.

What is the logic of this equilibrium? If the rate of interest goes above the equilibrium level there will be excess supply of money or excess demand for bonds. The price of bonds will rise or the rate of interest will fall.

On the other end if the rate of interest goes below the equilibrium level, there will be excess demand for money, i.e., people will need more money to hold than is currently being supplied by the Central Bank. To meet this demand people will sell bonds. There will be excess supply of bonds. Bonds price will fall or, what comes to the same thing, the rate of interest will rise.

Shifts of Supply and Demand Curves:

Both the demand and supply curves may shift to left or right if circumstances change. For instance, if incomes rise the demand for money will shift to the right, because people will need more money for transaction purpose. Consequently, the rate of interest will rise. This is indicated by the curve L, which intersects the supply curve of money at point E so as to cause the rate of interest to rise to Or1.

By contrast the supply curve will shift if the monetary authority (i.e., the central bank) increases or reduces the supply of money. The effect of an increase in the supply of money is illustrated in Fig. 40.2 (b). If supply of money is increased from OM0 to OM1 the rate of interest will fall from Or0 to Or2 .

The reason is that at the old rate of interest the supply of money has become greater than demand and people use the surplus money to buy bonds. The increased demand for bonds causes the price (or the value) of bonds to rise. The rate of interest will, therefore, fall.

Criticisms:

Keynes’ liquidity preference theory has been severely criticized on various grounds:

1. In his theory, speculative demand for money is included and the other two sources of demand are ignored. It implies that they are known and subtracted from total money supply. But they can be known only when income is in equilibrium, i.e., Y = C + I or S = 7.

Hence, liquidity preference theory requires as a pre-condition saving-investment equality, already postulated by classical scholars. Hence, the rate of interest is neither a purely monetary phenomenon nor a purely real phenomenon.

2. So far as the main content of the Keynesian interest theory is concerned, it is the determination of the rate of interest through equality between demand for, and supply of, money. But one of the components of total money demand, known as speculative demand, is assumed to depend on the rate of interest. Hence, the logical circularity in the model can be mentioned as one of its principal sources of weakness.

3. Keynes ignored real factors like productivity of capital and thriftiness in the determination of interest rate.

4. As Jacob Viner has remarked, “Without saving there can be no liquidity to surrender.” According to Keynes, interest is a reward for parting with liquidity and in no way an inducement for saving, but it is ridiculous to think of surrendering liquidity if one has not already saved money.

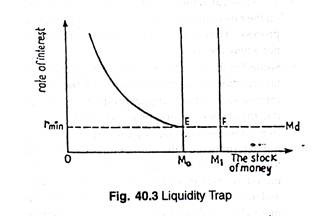

Liquidity Trap:

At the concluding part of his interest theory, Keynes introduced a new term, viz., liquidity trap, to refer to a situation where the rate of interest is so low that people prefer to hold money (liquidity preference) rather than invest it in bonds (to earn interest).

At low rates of interest the demand curve for money (or liquidity preference curve) becomes completely (infinitely) elastic. So the liquidity preference curve is not downward sloping throughout.

This usually happens during depression. During depression any attempt by the Central Bank to reduce the rate of interest by increasing the stock of money will be futile. In such a situation, no change in money supply is sufficient to alter the rate of interest.

So it is not possible to stimulate more investment. In fact, any increase in the stock of money by the Central Bank will be held by the people in the form of liquid balance. This will prevent the rate of interest from falling further. See Fig. 40.3 where the completely elastic portion (EFMd) of the liquidity preference curve is called liquidity trap.

The reason is simple. People feel that the rate of interest has fallen enough. It cannot fall further. Thus, if it rises in near future the price of bonds (purchased now) will fall. So purchase of bonds is risky. Money- holding is not that costly because the rate of interest is low. Thus, people prefer to hold as much money as possible, with the expectation that the rate of interest will rise in future.

As soon as it rises they will buy bonds. In such a situation any additional money supplied by the Central Bank will be absorbed by the people and this will prevent the rate of interest from falling further. Another theory as to why people hold money has come to be known as the Loanable Funds Theory of Interest.

The Loanable Funds Theory:

We have noted that the rate of interest is price paid for using someone else’s money for a specified time period.

According to Dennis Robertson and neoclassical economists, this price or the rate of interest is determined by the demand for and supply of loanable funds. The market for loanable funds consists of arrangements and procedures to carry out transactions between people who want to borrow money and people who want to lend money.

Demand:

The demand for loanable funds originate from two basic units of the economy, viz., consumers and business firms. (a) Consumers demand loanable funds because they prefer current goods to the same amount of future goods. According to Balm- Bawerk, on average, people have a positive rate of time preference.

This simply means that people subjectively value goods obtained in the immediate or near future (including the present) more highly than goods obtained in the distant future. Most people would prefer to have a new television set today rather than the same set after ten years.

There is nothing unusual about a positive rate of time preference. In a world characterized by uncertainty most people prefer the reality of current consumption to the uncertainty of some large amount (in physical or monetary terms) of future consumption. As the old saying goes, “A bird in hand is worth two in the bush.”

Consumers are also ready to pay interest for earlier availability to durable goods like cars or refrigerators. Thus, from economics’ point of view interest is the cost of easier and earlier available goods.

Business firms or investors demand loanable funds because they are a form of capital (i.e., money capital). Capital is demanded because it is productive. Capital makes other factors more productive. In other words, investors demand loanable funds so that they can invest in capital goods and finance round about methods of production.

Such methods of production are usually more productive than simple methods of production. Since roundabout methods of production often make it possible to produce a larger output at a lower cost, investors can gain, even if they pay interest to purchase the machines, buildings and other resources required by the production process.

Thus an investor’s demand for loanable funds arises due to the productivity of the capital investment. An increase in the rate of interest is, in essence, an increase in the cost of larger availability of consumption goods made possible by a machine.

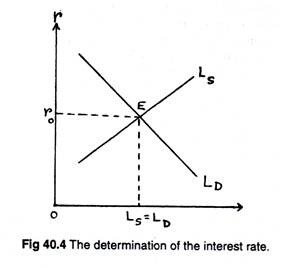

As Fig. 40.4 shows consumers and investors would borrow more at low rates of interest (or curtail their borrowing in response to increase in the rate of interest). Likewise some investment projects that would lead to gain at a lower interest rate will not be profitable at higher rates. Thus, the amount of loanable funds demanded varies inversely with the rate of interest.

Supply:

Even though higher interest rates lead to a fall in the amount of borrowing by consumers and investors, they encourage lenders to make a larger volume of funds available to the market. Even individuals with a positive rate of time preference will curtail current consumption to supply more loanable funds in the market if the rate of interest is reasonably high or sufficiently attractive.

People no doubt prefer current (earlier) consumption to future (deferred) consumption. But they also prefer more goods to few goods. So they are ready to sacrifice current consumption if they expect to get more consumption goods in exchange at some future date.

A rise in the rate of interest increases the quantity of future goods available to people willing to sacrifice ‘current consumption. This increase in the quantity of future goods that cart be acquired for each rupee supplied in a supply curve that slopes upward from left to right.

In Fig. 40.4 the demand curve for loanable funds intersects the supply curve at point E and the equilibrium rate of interest is automatically determined (by market forces). The interest rate brings the plans of borrowers in harmony with the plans of lenders. In equilibrium, the quantity of funds demanded by borrowers is equal to the amount supplied by the lender.

Criticisms:

Three major criticisms of the loanable funds theory are as follows:

(a) The classical writers noted the effect of money on the rate of interest through the saving-interest process. Hence, the Loanable Funds Theory is not a new theory.

(b) Secondly, the loanable funds theory ignores certain real forces exerting influence on the rate of interest such as the marginal productivity of capital, the abstinence, and time preference.

(c) In most modern economies, the rate of interest is not determined by the market forces, i.e., by the forces of demand and supply. Instead, it is determined by institutional forces, i.e., by the policies and actions of the Central Bank and the Government. Their policies exert the most important influence on the rate of interest by determining both the demand for and supply of loanable funds in the country.

Conclusions:

However, Haley and others claim that the loanable funds theory is better than the liquidity preference theory “because it correspondences more closely to the way in which the business world thinks of the determinants of the rate of interest and because it shows more directly the relation between the marginal efficiency of investment and the rate of interest.”

The points to be said in favour of the loanable funds theory are the following:

1. Firstly, it appeals to common sense.

2. Secondly, it is related to money.

3. Thirdly, it gives due recognition to the role played by the banking system in the determination of interest.

4. Fourthly, due importance is assigned in this theory to demand for cash balances for precautionary and speculative purposes.

5. Finally, it admits the fact that the value of saving is positively related to the level of income.

In theory, the rate of interest is determined by the demand for and the supply of money. But in practice we observe that it is determined by the Central Bank of the country and is thus treated as a policy variable.

It is a strategic variable not only because it affects the volume of investment and the level of national income as also the rate of interest and the general price level, but also because it is controlled by the Central Bank on behalf of the government.

Functions of Money:

Money performs a number of important functions in a modern economy.

The three most important functions of money are the following:

1. Medium of Exchange:

Prima facie, money serves as a medium of exchange. Without money we would be back to the barter system with all its inconveniences.

2. Unit of Account:

Money is the unit by which we measure the value of things. This not only simplifies our economic life enormously but enables us to add up diverse commodities like steel (measured in tons), oil measured in barrels), milk (measured in litres), and motor cars (measured in numbers) into a final figure called gross national product (which is another name of social product).

3. Store of Value:

Money allows us to store our saving for future use. Compared to risky assets like stocks or real estate, money is relatively stable and riskless.

Money and Prices:

There is a close relation between money and prices. This was first discovered by David Hume and then by Irving Fisher who developed the quantity theory of money which seeks to establish a relation between money and prices at a fixed point of time. However, it was Keynes who first developed a complete theory of inflation.

Inflation:

Inflation is a sustained rise in the average level of prices. The word ‘sustained’ carries the significance that inflation does not mean a short-term increase in prices; it means prices are rising over a prolonged period of time. Inflation is measured by the percentage change in the general price level (which is a weighted index of all commodity and factor prices.)

Absolute Vs. Relative Price Changes:

In a modern economy, over any given period, some prices rise faster than others. To evaluate the rate of inflation in a country, the community have to know what is happening to prices on average. Here it is important to distinguish between absolute and relative price changes. If all absolute prices go up by the same percentage, the relative prices remain unchanged.

Inflation measures changes in absolute prices. Inflation does not proceed evenly throughout the economy. Prices of some goods rise faster than others, which means that relative prices are changing at the same time that absolute prices are rising. The measured inflation records the average change in absolute prices.

The Value of Money:

To understand the effects of inflation, we have to understand what happens to the value of money in an inflationary period.

The real value of money is the amount of goods and services it can buy, i.e., its purchasing power:

Real value of Re. 1 = Re. 1/Price level

The higher the price level, the lower the real value (or purchasing power) of the rupee.

Why is Inflation a Problem?

If prices and income rise by the same percentage, inflation is not a problem. It does not matter if it takes twice as many rupees now to buy fruits and vegetables than it did before, if we have twice as many rupees in income available to buy the products. Inflation appears to be a genuine problem only when income rises at a slower rate than prices.

Inflation hurts those whose income does not rise as fast as the prices of purchasable goods and services.

Expected and Unexpected Inflation:

It is important to distinguish expected (anticipated) and unexpected (unanticipated) inflation. Unexpectedly higher inflation redistributes income from those who receive fixed incomes toward those who make expenditures. It not only affects borrowers and lenders, but others as well. Any contract calling for fixed payments over some long-term period, changes in value as the rate of inflation changes.

Nominal and Real Interest:

Economists distinguish between nominal and real interest rates to adjust interest rates for inflation. The nominal interest rate is the observed interest rate in the market. The real interest rate is the nominal rate minus the rate of inflation: Real interest rate = nominal interest rate — rate of inflation.

Types of Inflation:

Cost-push inflation is sometimes attributed to profit-push or wage-push pressures. Profit-push pressures are created by suppliers who want to increase their profit margins by raising prices faster than their cost increase. Wage-push pressures are created by labour unions and workers who are able to increase their wages faster than their productivity.

Three Misconceptions about Inflation:

Inflation often creates confusion. There are three common misconceptions about inflation.

1. Firstly, inflation does not necessarily mean that all goods are expensive. It only means that the average price level is rising.

2. Secondly, inflation does not necessarily mean that most people are getting poorer. The fact is that our money incomes tend to rise rapidly during inflationary periods, but our real incomes (incomes deflated by the price index) may go up or down during an inflationary period.

3. Thirdly, because people do not necessarily get rich at the expense of workers in an inflationary environment, the effect of inflation on the distribution of income depends largely on the cause(s) of inflation.

Economists often find it useful to classify inflation into three broad categories: moderate inflation, galloping inflation and hyperinflation. Moderate (or mild) inflation is characterised by slowly rising prices, i.e., single digit annual inflation rates. When prices are fairly stable, people have confidence in the monetary (currency) system of the country and they thus sign long-term contracts.

Galloping inflation refers to inflation in double- or triple-digit range of 30, 100, or 300% per annum. When this type of inflation occur, serious distortions arise. Consequently, people hold the minimum amounts of money required for transactions purposes and financial markets virtually collapse.

While an economy may just manage to survive under galloping inflation, it receives a severe blow when hyperinflation (like a cancerous disease) strikes.

The worst hyperinflation occurred in Germany in 1923 when prices rose by a million or even a trillion percent per annum. In such a situation, the real demand for money falls drastically. Commodities are demanded against commodities. The monetary system collapses and the money economy yields place to a barter economy.

The Causes of Inflation:

At present there are three explanations of inflation: cost-push; demand-pull and monetary. We will now consider these.

Demand-Pull Inflation:

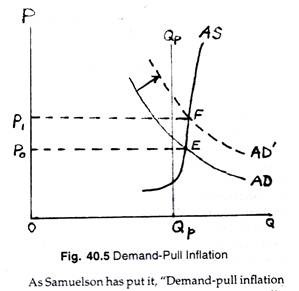

Such inflation occurs when aggregate demand exceeds the value of output (measured in constant prices) at full employment. This type of inflation was first explained by Keynes. According to Keynes, at full employment, the excess demand for goods and services cannot be met in real terms and therefore, it is met by rises in the prices of goods.

Fig. 40.5 shows that demand-pull inflation occurs only when there is an inflationary gap in the economy. The aggregate demand line AD intersects the 45° line at point E, which is to the right of the full employment line. Thus at full employment there is excess demand which pulls up prices.

As Samuelson has put it, “Demand-pull inflation occurs when aggregate demand rises more rapidly than the economy’s productive potential, pulling up prices to equilibrate aggregate supply and demand.”

This simply means that increasing quantities of money are competing for the limited supply of commodities and bid up their prices. As the rate of unemployment falls and the labour market becomes tight [i.e., workers become scarce), wages are bid up and the inflationary process accelerates.

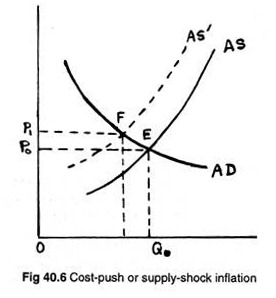

Cost-Push Inflation:

An explanation of inflation from the supply side of the economy goes in terms of cost-push inflation. Such inflation occurs when the increasing costs of production push up the general price level.

In fact, Keynesian theory of demand pull inflation does not have much relevance today. Prices today move in only one direction rise in recession, rises faster in boom. And this type of price behaviour is observed in all market economies of the world today.

The present-day inflation is different from Keynes’ demand-pull variety in that prices and wages start rising even when full employment has not been reached (i.e., even when there is unemployment of labour and idle capacity). This type of inflation is known as ‘cost- push’ or ‘supply-shock’ inflation.

The causes of such inflation are the following:

(a) Wage-Push Pressures:

Cost-push inflation is often attributed to wage-push or profit-push pressures. Wage-push pressures are created by labour unions and workers who are often able to increase their wages faster than their productivity. It is widely believed that powerful trade unions cause inflation by pushing up wages.

This variant of cost-push inflation, called wage-push inflation, occurs when wages rise faster than labour productivity. Statistical studies indeed corroborate this view. Empirical evidence demonstrates that there is indeed a correlation between earnings and the general price level. However, such correlation is not always perfect.

(b) Profit-Push and Mark-Up Pricing:

In the real world of imperfect competition most large firms fix their prices on a unit-cost-plus-profit basis. This makes prices more sensitive to supply than to demand influences. Consequently prices go up automatically with rising costs, whatever the state of the economy.

Profit-push pressures are created by suppliers who want to increase their profit margins by raising prices faster than their costs increase. In fact, in some countries, greedy business people and powerful trade unions have been blamed for inflation.

(c) Import Prices:

Since no country in the present- day world is self-sufficient imports play some part in cost-push inflation. Thus, inflation is often transmitted from country to country.

The sharp increase in world commodity prices, especially oil, in the 1970s undoubtedly contributed to inflation. Since inflation is a global phenomenon it cannot be avoided. It is not possible for a country to cut itself off completely from rising prices in the rest of the world.

(d) Exchange Rates:

Exchange rates movements also cause price level changes. This is, in fact, the essence of the purchasing power parity theory of exchange rate determination. As far as the Indian economy is concerned the depreciation of the external value of the rupee since the floating of rupee in 1975 has certainly been an inflationary factor.

Monetary Inflation:

According to the Nobel Laureate economist Milton Friedman, ‘Inflation is always and anywhere a monetary phenomenon in the sense that it can only be produced by a more rapid increase in the quantity of money than in output’. This statement simply implies that inflation is entirely caused by a too-rapid increase in the money stock and nothing else. This is also the main prediction of the classical quantity theory of money.

Economic Insight: Inflationary Shocks:

Lipsey has distinguished between the forces that cause once-for-all increase in the price level, and the forces that can cause a continuing (or sustained) increase. According to Lipsey, “Any event that tends to drive the price level upward is called an inflationary shock.” Such shocks are of two types: supply shocks and demand shocks.

Supply shocks refer to such things as a rise in the costs of imported raw materials, or by a rise in domestic wage cost per unit of output. As a result the aggregate short run supply curve shifts to the left. This means that output falls and the price rises.

The rise in the price level shows up as a temporary burst of inflation. Whether this is a once-and- for-all rise in the general price level or a continuous rise in the price level largely depends on whether or not it is accommodated by monetary expansion. As Lipsey has put it, “Monetary accommodation can return the economy to full employment quickly, but at the cost of a once-and-for-all increase in the general price level.”

An example of repeated supply shocks is wage rise in excess of productivity rise. If wages rise faster the productivity even when there is excess supply of labour, firms will then pass these higher wages on in the form of higher prices.

This type of supply shock causes wage-cost inflation which is the most important variety of cost-push inflation. Such inflation refers to an increase in the price level caused by increases in money wages that are not associated with excess demand for labour.

If wage-cost inflation is not accommodated by monetary expansion, it will be self-destroying. The reason is easy to find out: the rising unemployment that it causes tends to restrain further wage increases. But if it is fuelled by monetary accommodation, it will set off a wage-price spiral.

Demand Shocks:

Examples of demand shocks are an increase in autonomous expenditure or an increase in the money supply. These are reflected in rightward shifts of the aggregate demand curve. Such shifts cause both price level and output to rise.

However, Lipsey has pointed out that “a sufficiently large rise in the price level will eliminate any inflationary gap, provided the nominal money supply remains constant.” However, if money supply increases, a transitory inflation will be converted into a sustained inflation.

Multi-Causal Inflation:

What does cause inflation then? The answer is probably that inflation has a number of causes— increases in the money supply, excessive wage demand, excess demand, budgetary deficit expectations and so on.

In fact, there is no logical contradiction between demand-pull inflation and monetary inflation. One variant of demand-pull theory holds that the supply of money is a primary determinant of inflation. The basic point here is that growth of nominal money supply increases aggregate demand which, in its turn, increases the general price level.

Of course, demand-pull inflation may occur for other reasons as well such as excessive fiscal deficits during a major war. Such a deficit raises the demand for output well above its potential (full employment) level and causes rapid inflation.

Expectational Inflation:

People’s expectations also play an important role in accelerating, if not causing, price inflation. In modern economy inflation is highly inertial and gains momentum for the simple reason that most prices and wages are set with an eye to future economic conditions. Such inflation will persist at the same rate until economic events cause it to change.

As Paul Samuelson has correctly put it, “When prices and wages are rising and are expected to continue doing so, businesses and workers tend to build the rapid rate of inflation into their price and wage decisions. High or low inflation expectations tend to be fulfilling prophesies.”

In fact, “the process of setting wages and salaries with an eye to expected future economic conditions can be extended to virtually all employers inertial inflation will yield only to major shocks or changes in economic policy.”

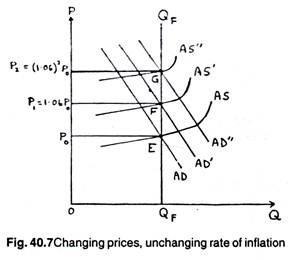

Fig. 40.7 illustrates the process of inertial inflation. Fig. 40.7 shows that an upward spiral of wages and prices occurs when aggregate supply and demand shift up together and at the same rate. This diagram shows that production costs are rising by 6% per annum. Thus, for each level of output, the curve will be 6% higher next year, another 6% higher the following year; and so on.

If AD and AS shift upward at the same rate, actual output (or GNP) will stay very near to its potential (full employment) level, and the general price level will move up by 6%. As the economy moves from the original equilibrium point E, to F and G, prices move up at a steady rate because of inertial inflation.

Samuelson, however, has made a very important point in this context. He writes: “Economic forces may reduce the price level below the level it would otherwise have attained. Nonetheless, because of the momentum of costs and prices, the economy may continue to experience inflation even in the face of these contractionary shocks.”

This point is of crucial importance in any study of the phenomenon of stagflation, or high inflation in periods of high unemployment. So long as the inertial elements driving up costs remain powerful, a recession may occur simultaneously with high inflation (although with inflation rate below the previous inertial rate).

This point is illustrated in Fig. 40.7 where actual GNP is much below its potential level at recessionary point G. But prices continue to rise since the general price level corresponding to G is higher than the previous period’s price level at P1. So Fig. 40.7 shows two things at the same time—changing prices, but an unchanged inflation rate even in the face of demand and supply shocks.

The Consequence of Inflation:

Inflation and Growth:

Monetarists argue that inflation acts as a growth- retarding factor because it increases uncertainty and discourages savings. Inflation also means high rates of interest which discourage investment. No doubt high rates of inflation are damaging to the economy. However, some inflation is conducive to growth.

This is because during inflation costs do not rise as fast as prices and profits soar. Thus inflation stimulates profits by reducing the fixed cost of doing business. This means that fixed cost as a proportion of sales revenue (or total turnover) falls.

For example, a business may lease factory land at, say, Rs. 20,000 per annum for ten years. Inflation has the effect of reducing this lease rental in real terms while the price of the business’s product (and therefore its revenues) rise with inflation.

History, however, shows that in the 1970s high rates of inflation in major industrial nations were also accompanied by unprecedented increases in the savings ratio. However, increased savings were not accompanied by increased investment, thus creating macroeconomic disequilibrium.

Inflation and the BOP:

Inflation is likely to have an adverse effect upon the BOP of a country because it makes imports cheaper and exports expensive.

However, as far as BOP is concerned, it is not the absolute but the relative rate of inflation which is important, i.e., the rate of inflation in India compared with that of her trading partners. If, for example, the domestic rate of inflation is 10% but that of a trading partner is 20%, then as far as foreign trade is concerned the price of exports will be falling and that of imports rising.

Inflation and the Distribution of Incomes:

Inflation reduces the real income or purchasing power of those living on fixed incomes, such as salary- earners, pensioners, and redistributes it towards those whose income vary with market prices.

This is illustrated as follows:

1. Profits—variable incomes.

2. Wages and salaries—partly fixed and partly variable incomes.

3. Rent and Interest—fixed incomes.

The ability of wage-earners to keep up with or ahead of inflation depends largely upon their bargaining power.

This simply means that those whose skills are in demand and who are members of strong and well-organised trade unions (such as pilots or railway employees) succeed in keeping ahead of inflation while those lacking the correct skills and/or who are poorly unionised, such as shop-workers, agricultural workers, carpenters, and mansions, lag behind.

Inflation and Unemployment:

There is controversy regarding the relationship between the rate of inflation and the degree of unemployment. For a long time it was claimed that there was a trade-off between the two, i.e., reducing inflation would cause more unemployment and vice- versa.

But modern economists both monetarists and neo-classicists have argued that reducing inflation would simultaneously reduce unemployment. The controversy surrounds one of the best-known hypothesis of our times—the stagflation hypothesis, which is explained with the Philips curve.

Control of Inflation:

Direct Intervention: Price and Incomes Policy:

If monetary and fiscal measures are not sufficient, a government has to use a third weapon in the form of incomes policy, whereby the government takes measures to restrict the increase in wages (incomes) and prices.

Like monetary and fiscal measures—which are the traditional instruments of inflation control—a prices and incomes policy tries to ensure that wages and other factor incomes do not rise faster than the improvement in productivity in the economy.

If incomes can be kept below that level some resources (used in the production of consumption goods) will be freed in the process. Such resources can be utilised to produce capital goods and thus expand society’s production capacity which will ultimately act as an anti-inflationary measure by making the aggregate supply curve more elastic.

Types of Incomes Policy:

Incomes policies are those that attempt to lower inflation without raising unemployment. These are government actions that attempt to moderate inflation by direct steps, by verbal persuasion, legal controls or other incentives.

There are, in fact, two main types of prices and incomes policy:

(a) Statutory:

This occurs when the government passes legislation to limit or to freeze wages and prices. Such policies are difficult to apply in modern democracies due to political problems

(b) Voluntary:

Alternatively, the government may try through argument and persuasion to impose a wages and prices policy. However, the success of such a measure largely depends on co-operation from trade unions and political parties.

While making an overall evaluation of incomes policies John Beardshaw writes: “An incomes policy is thought to be effective as a method of counteracting cost-push inflation caused by increasing wages. The rationale behind the Phillips curve is that it is wage costs which push up prices. Incomes policy could, therefore, be seen as a way to move the Phillips curve leftwards, achieving lower inflation without causing employment. If inflation results from excess demand, an incomes policy is only likely to lead to employers finding disguised ways of paying higher rewards to labour in order to attract people to jobs.”

However, in practice, incomes policy has not been very much successful. Experience suggests that in several countries where it has been tried, incomes policy has failed in its fundamental objective of making full employment consistent with a reasonable degree of price stability.

Indexation:

In some countries like Brazil and Australia a new method of controlling inflation has been adopted. This is known as indexation. Indexing is a mechanism by which commodity and factor prices as also contracts and assets values are partially or wholly adjusted for changes in the general price level. Examples of partial indexation are various labour contracts which guarantee workers cost-of-living adjustments.

A simple example of indexation may now be given. Next year a firm will raise wages by 3% if there is no inflation. However, if the rate of inflation rises to 10% within a year or so from now, the firm will raise wages by another 5% as a cost-of-living adjustment. It is also possible to index the tax system, asset values, rents of land, building, machine rentals as also long-term industrial contracts.

Some economists have gone to the extent of arguing for indexing the whole economy. If this becomes possible, there would be no confusion between real and nominal income changes (i.e., no money illusion).

In such a situation the government could simply ignore the problem of inflation and concentrate fully on tackling the other social evil, viz., unemployment. This no doubt makes enormous good sense, but it is difficult to implement this idea in practice.

As Paul Samuelson has rightly cautioned, “Full indexation is impossible because it guarantees a certain level of real income that may simply not be producible. Moreover, the greater the indexation, the more an inflationary shock will rage through the economy like an epidemic.”

Full indexation creates other problems as well. It amplifies external price shocks. Thus it is an invitation to galloping inflation. Thus, society is faced with a basic paradox when it tries to adapt itself to inflation: the more a society insulates itself from inflation, the more unstable inflation is likely to become.

This explains why Brazil, New Zealand, and Australia which have thoroughly indexed their economies have found it virtually impossible to eradicate inflation even by adapting various drastic measures. So the cure is worse than the disease.

MAP:

In his The Economics of Control, A.P Lerner has opined that the size of government budgetary deficits and surpluses are to be judged solely with reference to the levels of employment and prices in the economy. He amplified this particular interpretation of Keynes’ message while expressing misgivings about the problem of containing prices at high levels of employment.

This theme of inflationary pressures at high levels of employment emerges boldly in Lerner’s Flation and his MAP—A Market Anti-inflation Plan (1980) which proposes an ingenious scheme for controlling inflation by the state issue of ‘permits’ for wage and price increases, which any business firm can buy and which are trade-able on the market like stocks and shares; the total supply of such ‘permits’, however, is only allowed to grow at the same rate as real GNP.