The cost of production of a commodity is composed of two types of costs:

1. Variable Costs and Fixed Costs also called Prime and 2. Supplementary costs respectively.

1. Prime or Variable Costs:

Prime costs mean variable or direct costs. They include the money cost of the raw material used in making a commodity, the wages of the labour directly spent on it, and the extra wear and tear of the machine that makes it. For example, if you ask a carpenter what he would charge for a chair, he would first think of the wood and cane that he used and the number of days he spent in making it. This is the prime cost.

It is clear that the prime cost of a commodity varies with the quantity produced. If more chairs are made, more money will have to be spent on carpenter’s wages as well as on wood. If production is stopped, the prime costs disappear. Prime costs, therefore, are also called the Variable Costs.

2. Supplementary or Fixed Costs:

ADVERTISEMENTS:

Will the carpenter charge for the chair only, for the wood and his wages? These things are, of course, the first that he will think of. But this is not the only amount he will charge for it, and he would be a fool if he did. Besides, these, he will think of including in the cost a portion of rent that he is paying and also interest on the capital invested, the municipal taxes, etc.

A big company will further have to include a portion of the salaries of the manager, the clerks, the peons, the cost of advertisement and salesmanship, etc. These costs must also be covered. They ‘are called supplementary costs, on-costs or over-head charges or fixed costs.

The supplementary costs do not vary with the volume of production. Whatever the quantity of goods produced, big or small, charges on account of rent, taxes, interest, salaries, etc., must be paid. Even if the orders cease to flow in and the factory is closed, these costs will continue. They are fixed costs.

Normally, or in the long run, a producer must recoup himself for both prime and supplementary costs. Each article sold must fetch a price sufficient to compensate the producer for the raw material used, the wages paid to make it, and a fair proportion of the supplementary costs or over-head charges.

ADVERTISEMENTS:

But if times are not normal, for example, if there is depression in business, or dumping is being done by foreign competitors, then it will not be possible to recover both the prime and supplementary costs. Rather than close down the factory, the manufacturers may rest content with only the prime costs and perhaps a small proportion of the supplementary costs besides.

It may be noted that the distinction between the variable and fixed costs applies only to the short period, because nothing can really remain fixed in the long run. For instance, in the long run, even the strength and the salary bill of the staff may change; the amount of capital invested may be different, hence the amount of interest would vary; and the dimensions of the factory may have to be changed, and hence the amount of rent would vary. In this way, all costs, which were regarded as fixed in the short run, may vary in the long run. Thus, in the long run, all costs are variable.

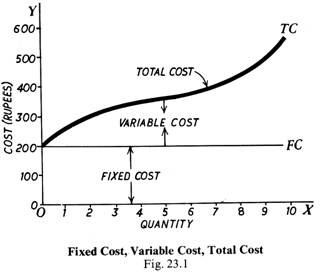

Diagrammatic Representation:

As we have explained,total cost is made up of both the fixed cost and the variable cost. They are represented in the diagram 23.1. OX and OY are the two axes; along OX is represented the quantity produced and along OY the cost. FC, a straight horizontal line, represents the fixed cost and the area above it the variable cost, so that the TC is the total cost curve.

ADVERTISEMENTS:

Total Cost = Fixed Cost + Variable Cost.

Average and Marginal Costs:

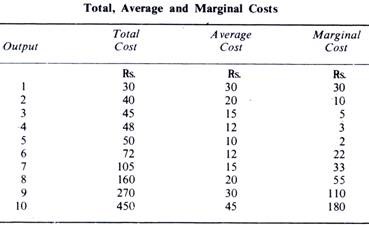

We have seen above what the total cost (i.e., fixed cost + variable cost) is. Now let us familiarize ourselves with the concepts of average and marginal costs. Average cost is the total cost divided by the number of units produced. Thus average cost at any output = total cost/units of output Average cost is the sum of average variable cost and average fixed cost. It is also called average total cost. If the total cost of producing 60 units of a good is 1,200 rupees, then average cost will be 1200/60 = Rs 20.

On the other hand, marginal cost is the cost of producing an additional unit of output. In other words, marginal cost is the addition made to the total cost by producing one more unit of output. For example, if the total cost of producing 60 units is 1,200 rupees and the total cost of producing 61 units is 1,218 rupees, the marginal cost in this case will be equal to 18 rupees (1,218 — 1.206).

The concepts of total cost, average cost and marginal cost can be understood easily from the following table:

In the above table, marginal cost of the second unit is found out by subtracting Rs. 30 from Rs. 40 (40 — 30= 10). Marginal costs of subsequent units are obtained in the same manner. We repeat, marginal cost is the addition made to the total cost at each step.