Let us make an in-depth study of the effect of an indirect tax on a commodity.

The imposition of an indirect tax on a commodity such as a sales tax or excise duty causes the supply curve for that commodity to shift to the left because when a tax is imposed the cost of supplying the commodity to the market increases. At each price a smaller quantity is supplied.

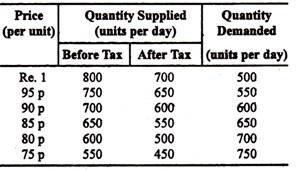

The reason for this can be seen in the example given, in Table 9.3. The first two columns give the initial situation. Then a tax of 10 paise per unit is imposed upon the commodity in question and so now at a price of Re. 1 the producers receive only 90 paise. Therefore, at a price of Re. 1 they will now supply 700 units per day because this is what they are prepared to supply when they receive 90 paise.

In this way at a price of Re. 1 supply has been reduced from 800 to 700 units per day. Similarly, at a price of 95 paise, producers receive only 85 paise and so supply is reduced from 750 to 650 units per day. A new column of supply figures is prepared in Table 9.3 to show the situation after the imposition of the tax.

ADVERTISEMENTS:

Table 9.3: Demand and Supply Schedules before and after tax

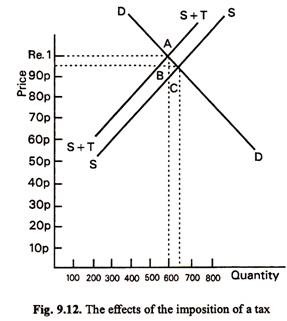

The figures given in Table 9.3 may now be plotted on a graph. The result is shown in Fig. 9.12. The imposition of the tax has caused the supply curve to shift to the left from SS to S+T. Actually the imposition of a tax upon a commodity causes the supply curve to move vertically upwards by the amount of the tax, i.e., the distance AC in the diagram represents the amount of the tax, in this case 10 paise. The price has risen from 85 paise to 90 paise, i.e., the distance AB.

Thus, it is seen that the whole amount of the tax has not been passed on to the consumer in the form of higher price. In this example, half the tax has been passed on to the consumers with the other half being borne by the producers. Thus, the prediction is that in case of normal downward sloping demand curve and upward sloping supply curve the price of a commodity rises by less than the amount of the tax. In other words, the burden of the tax is not fully shifted on to the consumers. Instead it is shared by the two groups — the buyers and the sellers.

ADVERTISEMENTS:

Extreme Cases (Optional):

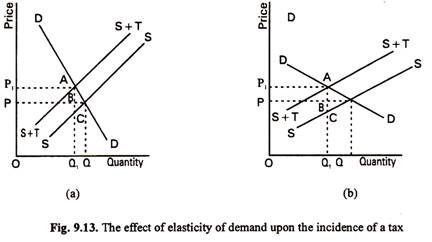

The important point to note is that the distribution of a tax between producer and consumer depends upon the elasticities of demand and supply. In Fig. 9.13(a) a greater proportion of the tax is passed on in a higher price than in Fig. 9.13(b). In both cases the amount of the tax per unit is AC and the amount passed on is given by the distance AB. The amount passed on is greater where demand is more inelastic.

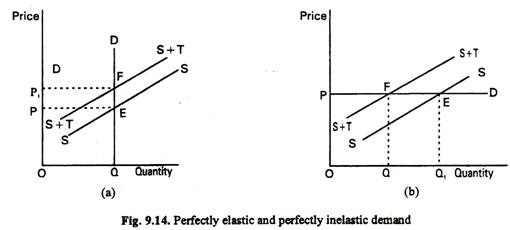

If demand is perfectly inelastic, as in Fig. 9.14(a), the whole amount of the tax can be passed on to the consumer in the form of higher price. It is because consumers will continue to buy the same quantity of the commodity whatever the price. In Fig. 9.14(b) demand is completely elastic.

ADVERTISEMENTS:

So not even a small part of the tax can be passed on, i.e., the market price remains unchanged. In fact, if the demand for a commodity is completely elastic, consumers will quickly reduce their purchase of the commodity in order to escape the tax. In this case the whole of the tax must be borne by the producers because if they pass on eyen a small part of it they will lose all their customers.

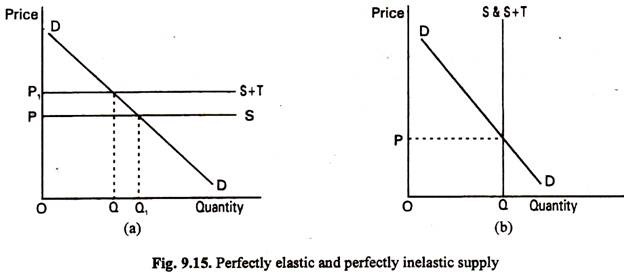

The distribution of the incidence of a tax is also affected by elasticity of supply. The more elastic the supply, the greater will be the proportion of a tax that will be passed on to consumers.

Again we are faced with two extreme situations, i.e., perfectly elastic and perfectly inelastic supply. In the former situation, as illustrated in Fig. 9.15(a) the whole amount of the tax is passed on to the consumers, because if the amount received by the producers is reduced even slightly, they will not offer anything for sale. If supply is perfectly inelastic, as in Fig. 9.15(b), there will be no effect on price, because the producers will pay the whole of the tax themselves. (The producers will supply OQ at all possible prices.)