Let us make an in-depth study of the classification of fixed costs.

(i) Recurrent Fixed Costs are those which give rise to cash outlays, as certain explicit payments like—rent, interest on capital, general insurance premiums, salaries of permanent irreducible staff etc. are to be made at a regular time-interval by the firm.

(ii) Allocable Fixed Costs refer to implicit money costs like depreciation charges which involve no direct cash outlays but are to be reckoned on the basis of time rather than usage.

Variable Costs or Prime Costs:

ADVERTISEMENTS:

Variable costs are those costs incurred on variable factors. These costs vary directly with the level of output. In other words, variable costs are those costs which rise when output expands and fall when output contracts. When output is nil, they are reduced to zero.

Variable costs are frequently referred to as Direct Costs or Prime Costs. Briefly, variable costs or prime costs represent all those costs which can be altered in the short-run as the output alters. These are regarded as “Avoidable Contractual Costs.” (When output is nil).

The short-run variable costs include:

(i) Price of raw-materials,

ADVERTISEMENTS:

(ii) Wages of labour,

(iii) Fuel and power charges,

(iv) Excise duties, sales tax,

(v) Transport expenditure etc.,

ADVERTISEMENTS:

Costs of Variable Costs:

Variable costs may be classified into:

(1) Fully Variable Costs, and

(2) Semi-variable Costs.

1. Fully Variable Costs:

This costs vary more or less at the same rate of output e.g., cost of raw materials, power etc.

2. Semi-variable Costs are however those costs which do not change with output, but they will be completely eliminated when output is nil.

Distinction between Variable Cost (Prime Costs) and Fixed Costs (Supplementary Costs)—Distinction between the two are as follows:

1. The variable costs and the fixed costs applies only to the short period, because it has been seen that nothing can remain fixed in the long-run, because in the long-run, even the strength and the salary bill of the staff may change, the amount of capital invested may be different, hence the amount of interest would vary and the dimensions of the factory may have to be changed and hence the amount of rent would vary.

ADVERTISEMENTS:

2. All costs which were regarded as fixed in the short period may vary in the long period. Therefore, it can be said that in the long-run, all costs are variable.

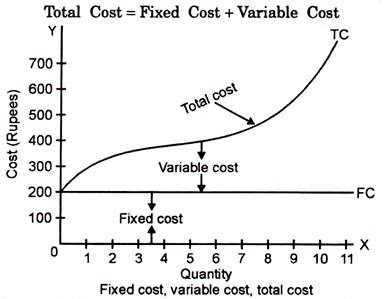

Diagrammatic Representation:

As we have seen above that the total cost is made up of both the fixed cost and the variable cost. They are represented in the diagram given below—here OX and OY are the two axes; along OX is represented the quantity produced and along OY the cost. FC, a single horizontal line, represents the fixed cost and the area above it the variable cost, so that the TC is the total cost curve.