Let us learn about the equilibrium of a competitive firm in the short run and long run.

Equilibrium of a Competitive Firm in the Short Run:

The fundamental goal of a business firm is the maximization of profit, irrespective of the time period under consideration. Profit becomes maximum only when a firm reaches equilibrium.

A firm will reach equilibrium when the following two conditions are fulfilled simultaneously:

(i) MC = MR.

ADVERTISEMENTS:

This is the necessary condition or first- order condition (FOC) for equilibrium, and

(ii) MC curve must cut MR curve from below, or slope of MC > slope of MR.

This condition is known as the sufficient condition or second-order condition (SOC).

Economists call MC = MR = P as the ‘golden rule of output’ determination of a competitive firm.

ADVERTISEMENTS:

Here, we will first examine short run equilibrium situation of a competitive firm:

A competitive firm is characterized by:

(i) Large number of sellers

(ii) Homogeneous product

ADVERTISEMENTS:

(iii) Free entry and exit of firms.

So far as the ‘short run’ time is concerned, no new firms can enter the industry or the existing firms exit from the industry. However, in the long run, entry or exit is free.

We know that under perfect competition every firm/buyer behaves as a ‘price-taker’. To all, price is given and known. However, this price is determined in the competitive industry in the short run by short run demand and supply curves for the industry.

This price, once determined in this way, is accepted by all firms and buyers. No one has the power to influence the price. Against this backdrop of market price, a firm aims at maximizing its profit by producing a certain level of output where P = MC.

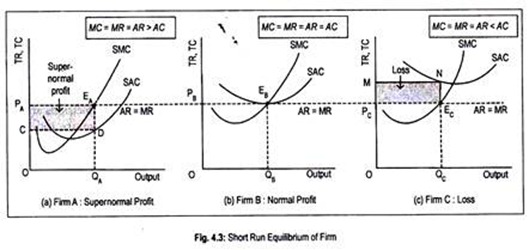

The equilibrium output of a competitive firm operating in the short run has been shown in Fig. 4.3 where the revenue and cost curves have been drawn. It is to be kept in mind that a firm in the short run may enjoy abnormal profit if total revenue (TR) exceeds total cost (TC). Further, it may incur loss in the short run if TC exceeds TR. Or it may earn only normal profit if TR equals TC.

All these three possibilities have been shown in Fig. 4.3. Fig. 4.3(a) describes supernormal profit enjoyed by Firm A. Fig. 4.3(b) shows normal profit enjoyed by Firm B and Fig. 4.3(c) shows loss incurred by Firm C. In all the figures, curves labeled as SAC and SMC are known as short run average cost and short-run marginal cost curves.

Firm A is in equilibrium at point E A since at this point both the conditions for equilibrium have been satisfied.

Corresponding to this equilibrium point, profit- maximizing volume of output becomes OQA. Firm A now earns revenue to the extent of OPA EAQA from the sale of output of OQA. And, it incurs a cost of production to the extent of OCDQA. Since revenue exceeds cost, Firm A earns supernormal profit by the amount PAEADC.

ADVERTISEMENTS:

For Firm B, equilibrium output is QB corresponding to the equilibrium point EB. Since revenue (OPBEBQB) for OQB output is the same as that of its cost of production (OPBEBQB), Firm B enjoys only normal profit. Point EB may be called break-even point since revenue equals cost.

Firm C incurs a loss though it attains equilibrium at point EC. In other words, a competitive firm may reach equilibrium even after incurring losses. Here, loss amounts to the area PCECNM, since costs exceed revenue.

Thus, a firm in the short run may:

(i) Earn supernormal profit if

ADVERTISEMENTS:

SMC = MR = AR > SAC;

(ii) Earn normal profit if

SMC = MR = AR = SAC; and

(iii) Suffer a loss if

ADVERTISEMENTS:

SMC = MR = AR < SAC.

Note that although the ‘golden rule of output’ determination is satisfied, the firm in the short run incurs a loss.

Will a firm continue in business if it incurs a loss in the short run? In the short run, even after making negative profit (i.e., loss), a firm will stay in business if it can manage variable costs. A firm in the short run faces both fixed and variable costs.

If no output is produced, the firm should bear fixed costs. So it must produce in the short run in such a way that it covers up at least variable costs. Then loss will be equivalent to fixed costs only. However, it will go out of business only if it fails to cover up variable costs from the sale of goods.

It will maximize profit only if it becomes an ‘economic drop out’ by discontinuing production. Here ‘drop out’ is paying.

Equilibrium of a Competitive Firm in the Long Run:

Long run is that time period when firms can adjust their fixed inputs. In other words, a firm in the long run can change its scale of production as well as output to achieve maximum profit. If some firms earn excess profit in the long run, new firms will be attracted to enter the industry. Similarly, whenever some firms incur losses for a long time, they will go out of business.

ADVERTISEMENTS:

This happens because, in the long run, under perfect competition, entry and exit are easy and free. As a result, all firms in the industry enjoy only normal profit. In the long run, free entry and exit of firms ensure that abnormal profits or losses will be wiped out completely.

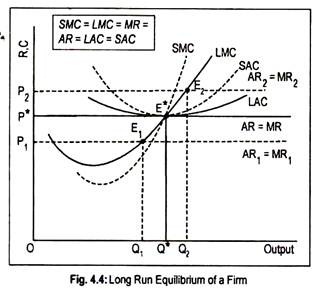

Fig. 4.4 explains long run adjustment of a competitive firm where LMC and LAC represent the long run marginal and average cost curves. Corresponding to the price OP, the typical firm is in equilibrium at point E. The equilibrium output, thus determined, is OQ* and the firm is making only normal profit.

Thus equilibrium conditions in the long run become:

(i) AR = P = LMC, and

(ii) P = LAC.

It can also be written as:

ADVERTISEMENTS:

LMC = LAC =P

LMC equals LAC at the latter’s minimum point i.e., point E*. At the equilibrium point, SMC equals LMC and SAC equals LAC. Thus, given the above equilibrium conditions, we have

SMC = LMC = SAC – LAC = P = MR

However, the firm cannot be in equilibrium in the long run at a price greater or less than OP*. At a price OP2, LMC > LAC. Thus, point E2 cannot be described as a long run equilibrium one. Corresponding to point E2, the firm produces OQ2 output and gets excess profit.

This will attract new firms to join the industry till excess profit is wiped out. Entry of new firms will cause output in the industry to rise. Thus, supply will rise and price will continue to decline until OP* price is reached where only normal profit will be enjoyed.

ADVERTISEMENTS:

Similarly, at the price OP1, though the firm is in equilibrium at point E1, it incurs a loss since LMC < LAC. Loss-making firms will, however, leave the industry. Consequently, output and supply in the industry will decline. This will cause price to rise to OP* where there is no incentive on the part of the firms to leave. At this price, every firm is making only profit. Pure profits or losses are eliminated in the long run.

Finally, long run equilibrium of a competitive firm is always attained at the minimum point of the LAC curve. This means that the firm is capable of utilizing its plant optimally. Operation at the lowest point of LAC also implies that the resources of the society get optimally utilized. This is where efficiency of perfect competition lies.