Let us make an in-depth study of the short-run profitability of a competitive firm.

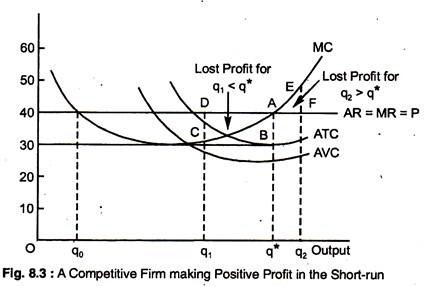

Fig. 8.3 shows the competitive firm’s short-run profit. The distance AB is the average profit per unit of output (i.e., P > ATC at output level q*) and the firm’s total profit is the rectangle ABCD.

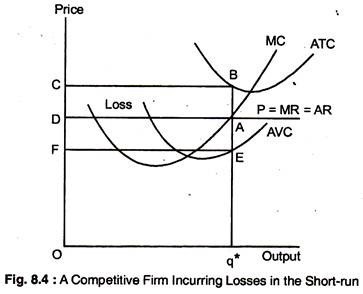

A firm need not always earn a profit in the short-run, as in Fig. 8.4. Where the fixed cost is higher than in Fig. 8.3, this raises ATC but does not change the AVC and MC curves. At the profit-maximising output, q* P < ATC, so that the segment AB measures the average loss from production.

ADVERTISEMENTS:

Thus, the rectangle ABCD measures the firm’s total loss. Why does not a firm leave the industry rather than earn a loss? A firm might operate at a loss in the short-run because it expects to earn a profit in the future as the price increases or the costs of production fall.

In fact, a firm has two choices in the short-run. It can produce some output or it can shut down production temporarily. It will choose the more profitable alternatives. In particular, a firm will find it profitable to shut down when the price of its product is less than the minimum AVC. In such a situation, revenues from production will not cover variable cost, and losses will increase.

Fig. 8.4 shows the case in which some production is appropriate. The output, q*, is at a point where short-run losses are minimised. It is cheaper to operate at q*, rather than not to produce any output because P > AVC at q*. Each unit produced generates more revenue than cost, thus, it is profitable to produce than to shut down.

ADVERTISEMENTS:

The area AEFD measures the additional profit that can be earned by producing at q*, rather at O, since the difference between price and AVC is AE.

We can see this another way, that the difference between ATC and AVC is AFC. Thus, in Fig. 8.4, line BE represents the AFC, and rectangle CBEF represents the TFC in production. When the firm produces no output, its loss is equal to its TFC or CBEF.

But when it produces at q*, its loss is reduced to ABCD. FCS, which are irrelevant to the firm’s production decision in the short-run, are crucial when determining whether the firm ought to leave the industry in the long-run.

The competitive firm produces no output if P < minimum point on AVC. When it does produce, it maximises profit by choosing the output level at which P = MC. At this output level, profit is positive if P > AC. The firm may operate at a loss in the short-run. However, if its expects to continue to lose over the long-run, it will go out of business.