How does fiscal policy affects the income level?

Government can increase aggregate expenditure either by increasing purchase of goods and services or decrease in taxes.

Goal of fiscal policy is stabilization of economy activity at full employment level under the conditions with which the economy is confronted.

If the need of the economy is expansion of income then fiscal policy should increase government expenditure and decrease taxes.

ADVERTISEMENTS:

However, the effect on the income level will depend on the proportion in which government expenditure and taxes are changed. If government spending and taxes change in equal amounts then income will change by an amount equal to the change in Government expenditure and the value of multiplier will be = 1.

This is called BBM, or Balanced Government Multiplier.

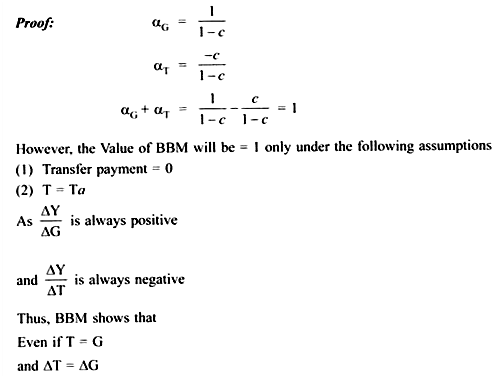

... Sum of (αG and αT) will always be = 1 whatever be the value of c (MPC)

income will increase because the contractionary effect of increase in T is less than the expansionary effect of increase in G.

ADVERTISEMENTS:

BBM will fail if:

Government expenditure is financed by taxes which is equal to R (Transfer payments) (i.e. no Government purchase, all Government expenditure is on transfer payments)

Then, value of BBM = 0

ADVERTISEMENTS:

This is because the expansionary effect of increase in transfer payment (R) is fully offset by the contractionary effect of increase in Taxes (T)

... BBM = 0.

Thus, BBM applies only to tax financed change in government expenditure (∆G) and not to tax financed change in transfer payments (∆R).

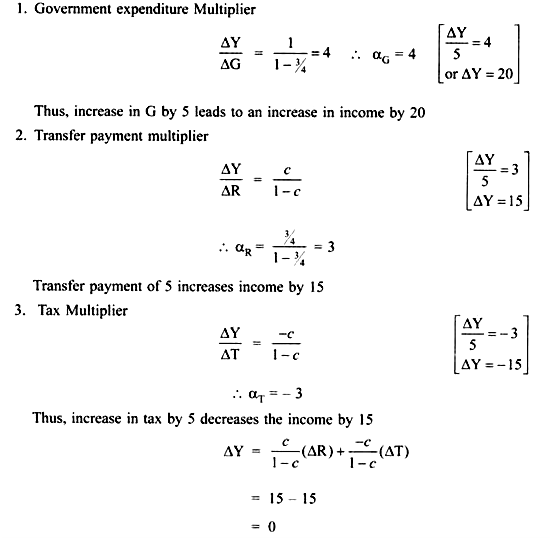

α∆R = α∆T = 0

∆Y = c/1 – c. ∆R + -c/1 – c. ∆T = 0

Thus, BBM will apply only when Transfer payments (R) = 0.

e.g., ∆G = 5, ∆T = 5, ∆R = 5, MPC = 3/4

Thus; value of BBM = 0 because the expansionary effect of an increase in R is offset by the contractionary effect of an increase in T.