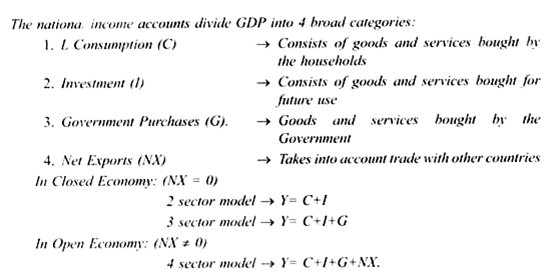

Consumption:

Consumption consists of goods and services purchased by the household.

Types of goods and services bought by household are:

ADVERTISEMENTS:

(a) Durable goods → last for a long time, e.g., TV, car.

(b) Non-durable goods → last for a short time, e.g., food.

(c) Services → work done for consumers by individuals and firms, e.g., service of doctors.

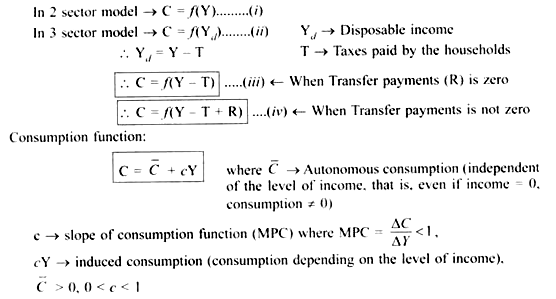

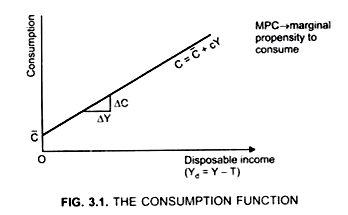

Consumption depends on the level of income (Y)

ADVERTISEMENTS:

C= f(Y) ………… Consumption function.

Consumption expenditure varies directly but not proportionately with the income level, all other things including price level remaining constant.

Keynes in his Fundamental Psychological Law of Consumption stated that:

“As income increases, consumers spend a small proportion of increased income and save a large fraction of income, that is, as income increases,- C increases at a lesser rate but S increases at a greater rate.”

The consumption curve has a positive slope showing that when the income increases consumption also increases.

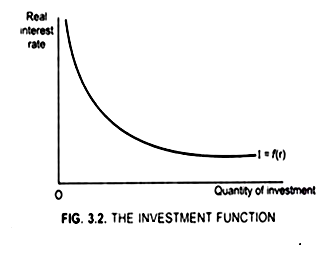

Investment: Investment Refers to the Addition to the Stock of Capital Goods:

Investment refers to the addition to the stock of capital goods.

Investment (I) depends negatively on the interest rate (r).

I = f(r)

This is because interest rate is the cost of borrowing and so when interest rate increases, cost of borrowing (funds) increases.

Result → Investment becomes unprofitable leading to fall in investment. Thus, investment curve has a negative slope.

Types of Investment:

ADVERTISEMENTS:

(a) Business fixed investment:

It includes purchase of new plant and equipment by the firms. It is the largest component of domestic investment.

(b) Residential fixed investment:

ADVERTISEMENTS:

It consists of purchase of new house by the households. As purchase of house involves the exchange of ownership of an existing house, it does not affect the demand for currently produced output and therefore, are not relevant in determining the current GDP. However, demand for housing is negatively related to the interest rate.

(c) Inventory investment:

It is the increase in firms inventories of goods. If inventories of firms are falling it implies that inventory investments are negative. It is negatively related to the rate of interest. Higher the rate of interest higher will be the opportunity cost of holding inventories and thus smaller will be the inventories desired.

Types of Interest Rate:

ADVERTISEMENTS:

1. Nominal interest rate → It is the interest rate that the investors pay to borrow money.

2. Real interest rate → It measures the true cost of borrowing. It is the nominal interest rate corrected for the effects of inflation.

Real interest rate = Nominal interest rate – Inflation

e.g., Nominal interest rate → 10%

Inflation → 4%

Real interest rate = 10% – 4% = 6%

ADVERTISEMENTS:

Government expenditure/purchases:

It is the goods and services purchased by Central, State and local Government. For e.g., expenditure on military equipment’s, bridges, etc. by the Government.

Government expenditure = Government purchases + Transfer payments (R)

While the Government expenditure increases the disposable income, taxes (T) reduces the disposable income.

Yd = Y – T + R

If, G=T → Balanced budget

ADVERTISEMENTS:

G > T → Deficit budget

G < T → Surplus budget

Net Export (Nx):

NX = Value of goods and services exported (EX) – Value of goods and services imported (IM)

NX = EX – IM

IM are excluded because the goods and services imported from abroad are not a part of the country’s output, that is, they are not produced domestically.

ADVERTISEMENTS:

. . . Y = C + I + G + NX

. .. NX = Y – [C + I + G]

... NX = Output – Domestic spending.

If, Output > Domestic spending → NX is positive → Trade surplus

Output < Domestic spending → NX is negative → Trade deficit

Output = Domestic spending → NX is zero → Balanced trade

ADVERTISEMENTS:

Thus, NX shows the trade balance.