Let us make an in-depth study of the Proportional Tax Function and the Balanced Budget Multiplier.

If we consider the SKM without foreign trade, i.e., if we take a closed economy the BBM can be less than one if we change the usual assumption about the tax function.

Normally, in the SKM with government we take taxes as fixed.

In case of fixed tax (such as 7) disposable income (Yd) is the difference between national income and tax paid Yd = Y – T.

ADVERTISEMENTS:

Now let us change the assumption about tax. Let us take taxes as proportional to income. Here we assume, more specifically, that taxes have both an autonomous and an induced (income-related) component. This means that there is an additional leakage from the circular flow of income.

If a certain portion of every extra rupee which is earned due to an increase in G is taxed away, consumption will not increase as much as it would otherwise (due to fall in disposable income). So the process of income generation will slow down and the increase in Y will be less than dG = dT, when the BBM is less than 1.

In fact, when taxes become a function of income, an increase in government purchases raises the level of disposable income only by (1 -1) times the increase in income. It is because a portion of t flows back to the government in the form of tax collections.

Since disposable income rises by only (1 – t) times the increase in government purchases (G) and since b times the change in disposable income is respent on consumption, the proportion b( 1 -1), instead of b will be respent on consumption. Thus the marginal propensity to consume national product is reduced and multiplier takes on a lower value given by the formula

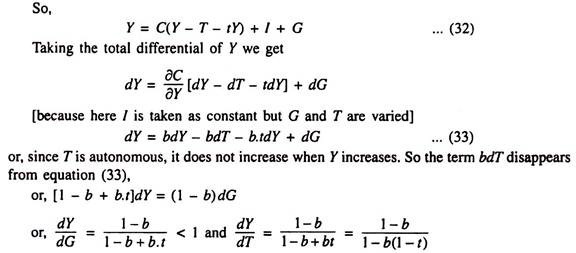

This important proposition may now be proved.

We start with the standard income equation of SKM:

Y = C + I + G

Now C = f(Yd) = Y – T – t.Y, where T is the autonomous component of tax and tY is the induced component (here t is proportional tax rate, under which the marginal tax rate is the same as the average tax rate).

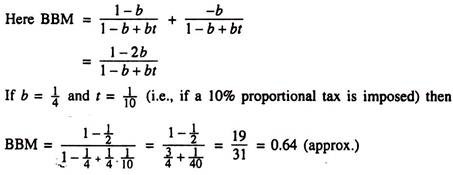

Thus we see that if taxes are partly fixed and partly proportional to income, the government-expenditure multiplier is less than 1. We know that in SKM the tax multiplier is less than the government expenditure multiplier. Tax multiplier is b x government expenditure multiplier. The reason why the tax multiplier is less than expenditure multiplier is simple.

When the government spends Re. 1 then it is spent directly on GDR On the other hand, when the government cuts taxes by Re. 1 only part of it is spent on consumption, while a fraction of that Re. 1 tax cut is saved. The difference in the response to a Re. 1 of G and Re. 1 of T is enough to lower the tax multiplier below the expenditure multiplier.

This analysis illustrates an important point. An increase in government purchases of Rs. X will not necessarily create a budgetary deficit of Rs. X, because part of the increase in Y that results from the increase in government purchases comes back to the government in the form of taxes.

This analysis also suggests that efforts to balance the budget by means of tax rate increases may, to some extent, defeat themselves because the tax rate increases lower the level of disposable income and tax collections may not, therefore, increase as much as anticipated.