Fiscal expansion:

Introduction:

(i) In a closed economy fiscal expansion will lead to an increase in the real interest rate and decrease in investment

(ii) In a small open economy fiscal expansion will lead to a trade deficit and appreciation in the real exchange rate,

ADVERTISEMENTS:

(iii) Similarly, in a large open economy, fiscal expansion will lead to:

(a) An increase in the real interest rate and decrease in investment and,

(b) Trade deficit and an appreciation of real exchange rate.

Three types of economies are closely related:

ADVERTISEMENTS:

S = I + NX

In all the three economies fiscal expansion leads to a decrease in the national savings.

In the closed economy:

Decrease in national savings = Decrease in investment (of an equal amount)

ADVERTISEMENTS:

... S-I = NX

... NX = 0

In a small open economy:

Decrease in national savings = decrease in NX (of an equal amount), with investment constant at the level fixed by the world interest rate.

A large open economy is the Intermediate Case:

Both I and NX decrease, but fall in both I and NX < fall in national saving.

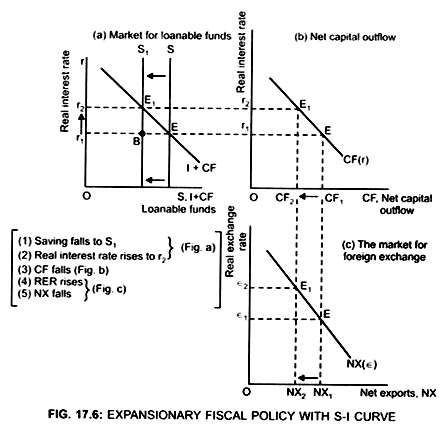

Expansionary Fiscal Policy at Home: with the Help of S and I Curve:

Expansionary fiscal policy, like an increase in the Government spending or decrease in the tax, decreases the national saving, because S = Y – C – G

Supply of loanable funds will decrease.

ADVERTISEMENTS:

Saving curve will shift to the left

Real interest rate will increase, CF will decrease, NX will fall and Real exchange rate will rise.

Initially the economy is in equilibrium at point E (Fig. 17.6(a))

ADVERTISEMENTS:

Reason: at point E: Supply of loanable fund = Demand for loanable fund

or

S = I + CF

Real interest rate → r1 (Fig. 17.6a)

ADVERTISEMENTS:

Since CF depends on the real interest rate

CF = CF(r)

Therefore, at interest rate → r1

CF is CF1 (Fig. 17.6b)

RER is determined at the point where

Supply of dollars = Demand for dollars

ADVERTISEMENTS:

Since demand for dollars comes from NX and CF determines the supply of dollars to be exchanged into foreign currency

Therefore, RER is determined where:

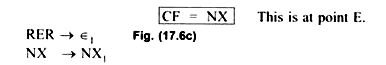

Due to expansionary fiscal policy: e.g. increase in government purchases National saving(S) decreases because S = Y – C – G

Since, savings represent the supply of loanable funds, therefore when saving decreases it implies that supply of loanable fund will decrease

... Saving curve shifts to left from S to S1 Fig. 17.6(a)

ADVERTISEMENTS:

As a result at given interest rate (r1):

demand for loanable fund (Er1) > Supply of loanable fund (r1 B)

... Real interest rate rises from r1 to r2.

Due to increase in interest rate, CF reduces from CF1 to CF2 Fig. 17.6(b)

This is because CF is inversely related to interest rate

Due to decrease in CF, the supply of dollars decreases

ADVERTISEMENTS:

As a result – RER appreciates (increases)

RER increases from є1 to є2 (fig. 17.6(c))

Due to increase in RER, net export falls from NX1 to NX2 because NX = S – I

(↓S→↓NX)

Thus, fiscal expansion causes a trade deficit and appreciation of RER.

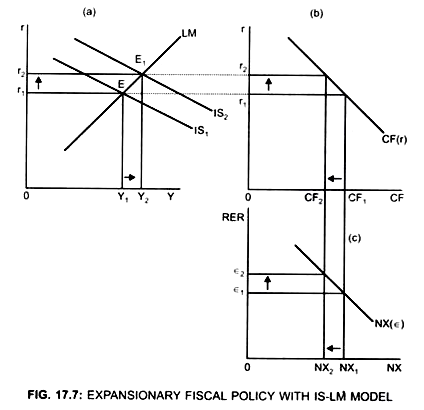

Expansionary Fiscal Policy with the help of IS-LM Model (in large open economy):

ADVERTISEMENTS:

Impact of fiscal expansion:

When G increases or tax decreases, IS curve will shift to the right

Income will increase

Interest rate will increase

When r increases CF will fall

ER will appreciate/rise (Reason: supply of $ falls)

NX will fall. (Reason: P > P*)

[Impact of increase in r on Y will be less in a large open economy as compared to the small open economy where the impact is very large]

Reason:

Foreign investors will invest in the domestic (home) country because interest rate in their country (abroad) is less than the interest rate in the home country.

Result:

Supply of dollar falls

ER appreciate from є1 to є2 (Fig. 17.7 (c))

NX falls from NX1 to NX2