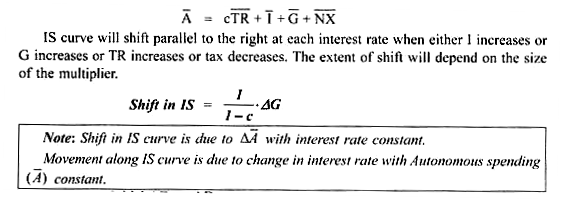

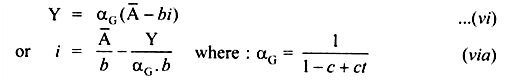

Shifts in Is/position of Is Curve:

Shift in IS curve is due to (a) change in Autonomous spending (A) with interest rate constant or (b) change in taxes

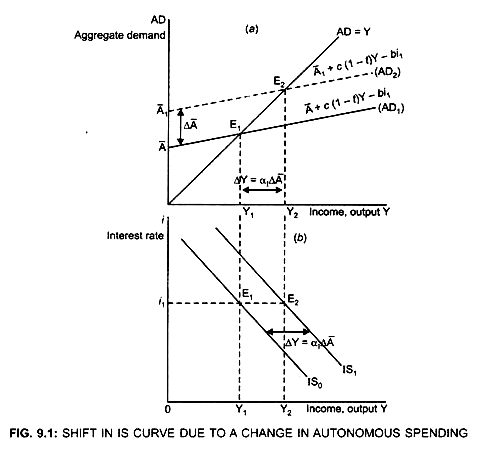

Assume: Initial AD → AD1

ADVERTISEMENTS:

Autonomous spending → A

interest rate → i1

goods market is in equilibrium at point E1 because Y = AD at point E1

Equilibrium output level → Y1

ADVERTISEMENTS:

Thus, point E1 corresponds to a point on the IS curve (IS0)

If Autonomous spending increases to A1 for e.g.

due to increase in I at a given interest rate → i1, firms plans to invest more,

or due to increase in government expenditure the IS curve will shift to the right from IS0 to IS1.

ADVERTISEMENTS:

As investment is a component of AD, increase in investment at a given interest rate i1 will lead to shift in AD curve.

... AD curve shifts parallel upwards to AD2

Y = AD at point E2 at same interest rate → i1

... Income level increases to Y2

Point E2 corresponds to a point on the new IS curve (IS1)

IS shifts horizontally by distance = αG.∆A or αI ∆ A

Thus, due to increase in A, the IS curve shifts to the right.

However, the change in income due to ∆A will depend on the value of multiplier.

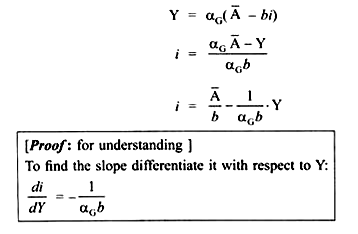

Slope of Is Curve:

ADVERTISEMENTS:

IS curve is negatively sloped because an increase in the interest rate decreases the investment, which in turn decreases AD and thus decreases the income level.

ADVERTISEMENTS:

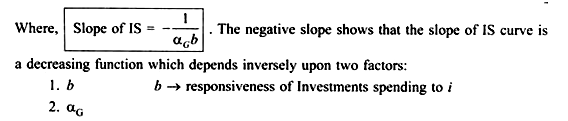

I. Value of b:

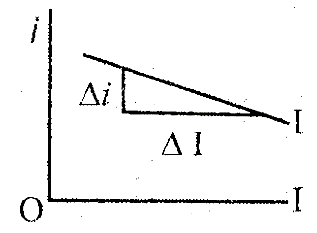

(a) If b is large (high) → IS curve will be almost flat because the Investment spending be very sensitive to i(∆I > ∆i)

A small change in interest rate will lead to a very large change in investment. Therefore, AD curve will shift by a large amount. A large shift in AD will produce a large change in the equilibrium income level. Since a small change in interest rate produces a large change in the IS curve, the IS curve is almost flat. (∆I < ∆i)

ADVERTISEMENTS:

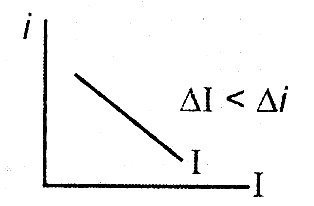

(b) If b is small → IS curve will be relatively steep (almost vertical) because investment spending is not very sensitive to interest rate. (∆I < ∆i)

II. Role of Multiplier:

Equation (via) shows that if b and αG are small then a change in income associated with a change in interest rate will be large, that is, ∆Y will be less. That is, lesser the value of αG and b, greater will be the slope and steeper will be the IS curve.

This implies that when interest rate changes, although the intercept of AD will change by same amount but, the change in income will be different. This is because the change in income due to change in interest rate will depend on αG.

ADVERTISEMENTS:

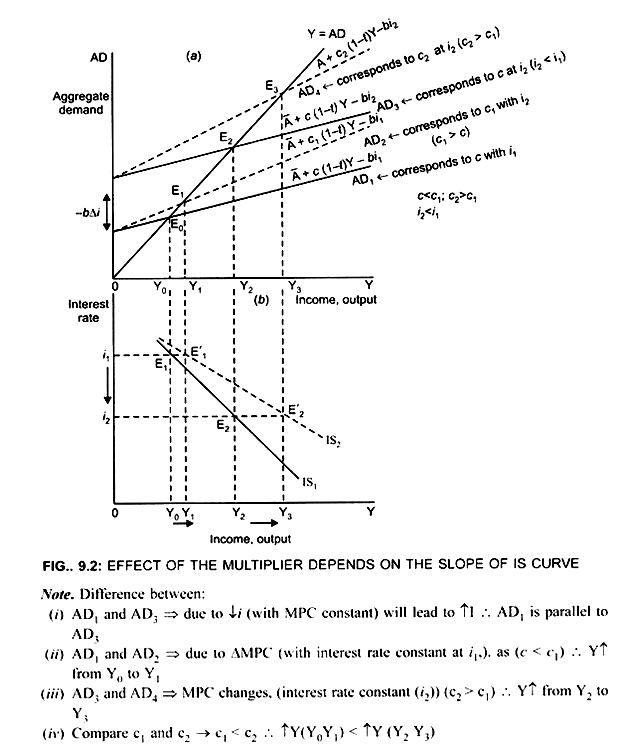

(a) Difference between AD1 and AD3 is due to the interest rate:

When interest rate decreases from i1, to i2, Fig. (9.2). Investment will increase. As investment is a component of AD, the intercept of AD will increase by the same amount (-b∆i).

Thus, AD curve shifts parallel upwards to AD3.

Income level increases from Y0 to Y2.

(i) It shows movement along the IS curve: (IS1), because interest rate has changed, that is, decreased from i1 to i2.

ADVERTISEMENTS:

(b) Similarly, parallel shift in AD curve from AD2 to AD4.

Shows movement along the IS curve: IS2, because interest rate has decreased from i1 to i2. (Fig. 9.2)

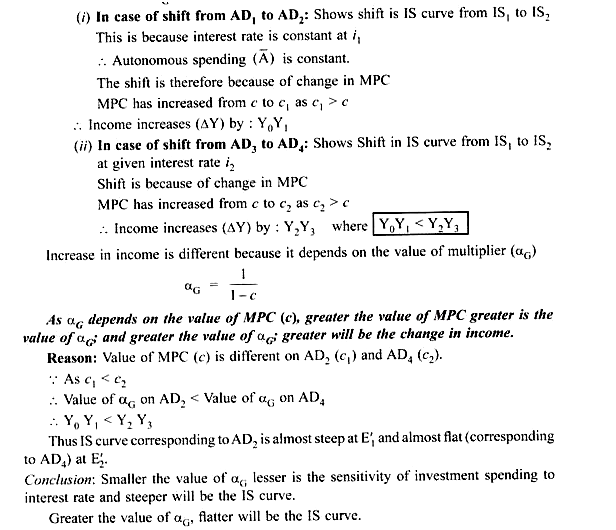

(ii) Difference between

(i) AD1 and AD2 and (ii) AD3 and AD4

is because of αG, but the increase in income is different.