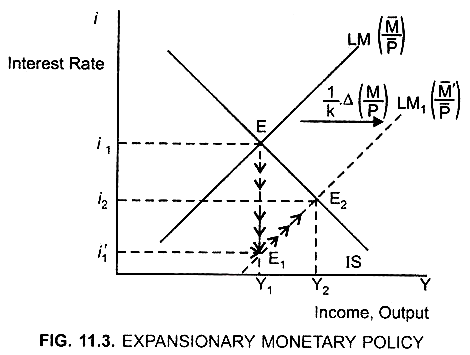

Expansionary Monetary Policy and Its Effect on Interest Rate and Income Level!

The Central Bank controls and regulates the money market with its tool of open market operations.

If the bank buys or purchases the bonds from the market, on the one hand the stock of money will increase and on the other hand quantity of bonds available in the market will decrease.

As a result bond prices will increase or the interest rate, that is, the yield will decrease. People will now prefer to buy less bonds and keep a greater fraction of their wealth in the form of cash. Due to increase in the money supply the LM curve will shift to the right.

When output increases, demand for money increases (because when income increases precautionary demand increases and when interest rate decreases the speculative demand increases). Thus due to fall in interest rate not only L2 increases but also L1 increases. Thus total demand for money increases.

Result:

People will sell bonds and thus asset price will fall leading to rise in interest rate.

ADVERTISEMENTS:

Thus, due to increase in demand for money the interest rate will increase and, thus, move up on the LM1 curve till a new equilibrium point is reached. This is at point E2.

Thus, At point E2: both product and money market is in equilibrium (IS = LM,).

Equilibrium income → Y2 (income increases)

Interest rate → i2 (decreases)

ADVERTISEMENTS:

Thus, due to open market purchases i decreases which in turn increases Investment and, thus, Y.

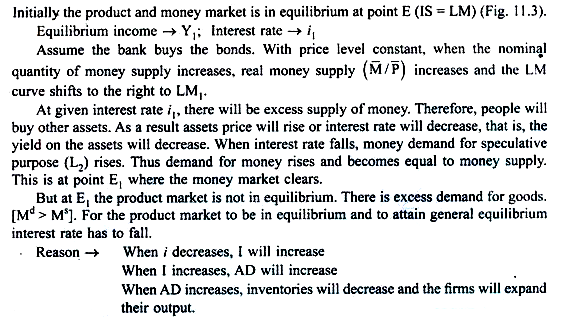

Transmission Mechanism:

Process by which changes in monetary policy affect AD.

Link between Changes in Real Money Supply and Output:

Changes in M/P affect the level of output in the economy through 2 linkages (Table 11.2).

1. Increase in real balances generates portfolio disequilibrium:

It means that when money supply increases then at the prevailing interest rate and income level people are holding more money than they desire/want, that is, there is excess money supply. As a result people will buy other assets. This will lead to a change in the assets price and the interest rate.

Equilibrium point shifts from E to E1

ADVERTISEMENTS:

Interest rate falls from i1 to i’1 (Fig. 11.3)

Thus ∆ (M/P) affects ∆i

2. But changes in interest rate affect AD:

A change in real balance affects AD through the real, balance effect. An increase in real money balance increases the wealth, which in turn increases the consumption demand and, thus, AD increases.

ADVERTISEMENTS:

Result:

Inventories will decrease. Firm will increase the output and it will move up on the LM curve till the equilibrium point E2 is not reached where IS = LM1 (Fig. 11.3).

Notes:

(a) In case of portfolio imbalances: ∆i does not change.

ADVERTISEMENTS:

(b) If spending does not respond to ∆i the link between money and output does not exist.

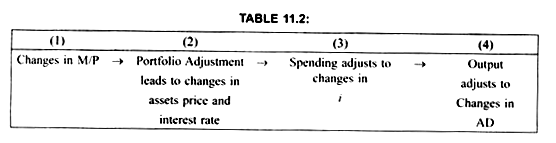

Expansionary Monetary Policy and Its Effect on Interest Rate and Income [Not in Syllabus but for Better Understanding Read this Topic]:

Assume: Government purchases bonds.

Result → Money supply increases, LM curve shifts to the right to LM1.

ADVERTISEMENTS:

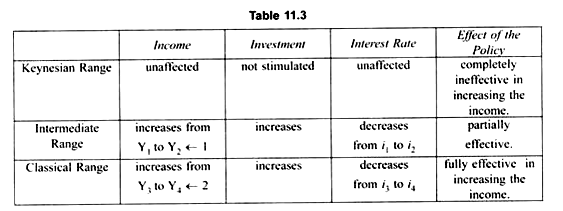

1. Change in M/P leads to a change in the income level but the change in the income level in Intermediate range < Change in income in the Classical range.

Reason:

A part of increase in income is used for transaction motive and part for speculative motive due to decrease in the interest rate. Therefore, investment increases but increase in investment in Intermediate range is less than the increase in Investment in the Classical range.

As a result increase in income in the Classical range is greater than the increase in income in the Intermediate range.

2. Income increases in the Classical range because when the Government buys bonds at a higher price, return on the bonds decreases. This will lead to an increase in the money supply. The bond holders will find other assets more profitable and they start selling their bonds at a higher price.

This will lead to decrease in the interest rate which on the one hand in the money market will lead to an increase in the demand for money for speculative motive and on the other hand in the product market will lead to an increase in investment leading to an increase in the income level.