(a) Change in Government Expenditure:

If Government Expenditure increases by ∆G

In goods market → Demand for goods and service will increase by AG

As total output is fixed, increase in Government expenditure is met either by decrease in Consumption or Investment.

As (Y – T) is constant because Y =

Therefore, increase in Government expenditure is met by an equal decrease in investment (I).

To decrease (I), interest rate will rise.

Thus, there is crowding out of Investment

In Money market →

Borrowing increases

Result → Public saving decreases

Reason: Public saving = Y – G

Since national saving = Private Saving + Public Saving,

ADVERTISEMENTS:

decrease in public saving will lead to decrease in national saving.

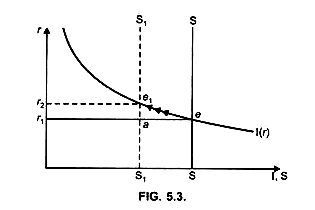

As a result, saving curve will shift to the left from SS to S1S1 (Fig. 5.3).

Supply of loanable funds will decrease at the given interest rate (r1):

Demand for loanable funds > Supply of loanable funds

r1 e > r1a

Thus, interest rate will increase from r1 to r2 (Fig. 5.3).

As demand for funds is inversely related to the interest rate, increase in real interest rate will lead to decrease in investment that is, demand for loanable fund will decrease [shown by movement from points e to e1 Fig. 5.3] leading to crowding out of investment.

(b) Effect of Decrease in Taxes:

When taxes decrease by ∆T, disposable income (Yd) increases by ∆T.

ADVERTISEMENTS:

Because C = f (Yd) or C = (Y – T)

This leads to an increase in consumption by (c.∆T) [where c is MPC],

... Y = C + S increase in consumption implies less income left for saving. Thus, national saving (Y – C – G) decreases.

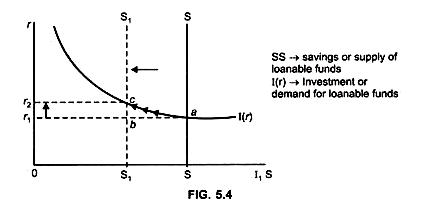

Saving curve will therefore shift to the left from SS to S1 S1 leading to crowding out of investment (Fig. 5.4).

ADVERTISEMENTS:

At the given interest rate (r1) : demand for loanable fund (r1 a) > supply of loanable fund (r1 b). Therefore, interest rate will increase till I = S.

Due to increase in the interest rate from r1 to r2 investment decreases shown by movement from points a to c.

This crowds out investment. It means that private investment falls due to rise in the interest rate.