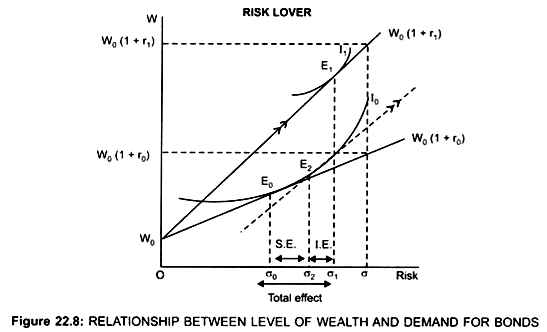

This is a case of risk lovers. Since he is a risk lover, when interest rate increases he is willing to take more risk (σ1)

σ1 > σ0

Total effect (σ0σ1) is the sum of substitution and income effect.

(i) If interest rate is r0

ADVERTISEMENTS:

Equilibrium is at E0 on I0

(ii) If interest rate rises to r1

Equilibrium is at E1 on I1

ADVERTISEMENTS:

Movement from E0 to E1 is the total effect.

Total effect = Substitution effect (S.E.) + Wealth (income) effect (I.E.)

Movement from E0 to E2 is the S.E.

less money will be invested at high interest rate.

ADVERTISEMENTS:

Movement from E2 to E1 is the I.E.

More money is invested at high interest rate.

As IE > SE → People will desire to hold more bonds and less money at high rate of interest.

Total effect (E0E1) = E0E2 + E2E1

Thus, when people expect return from bonds, they will invest more. Therefore, demand for bonds increases with expectation of increase in wealth.

This relationship between the level of wealth and demand for bonds seems so reasonable that perverse relationship between the demand for money and the rate of interest is ruled out.