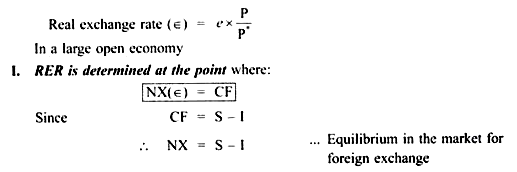

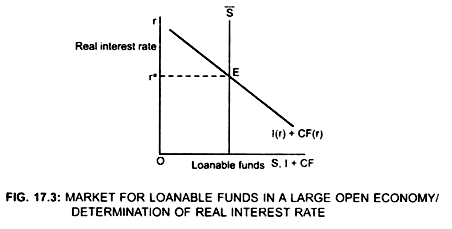

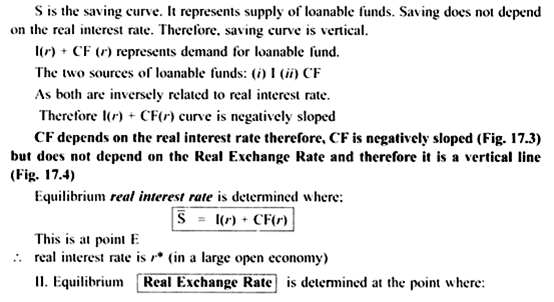

or S = I(r) + CF(r) … Equilibrium in the market for loanable funds.

Reason both I and CF depends on the domestic real interest rate

(i) Supply of loanable funds is the national savings, (S)

ADVERTISEMENTS:

(ii) Demand for loanable funds is the sum of domestic investment (I) and the demand for foreign investment (CF) i.e. (DF = I + CF)

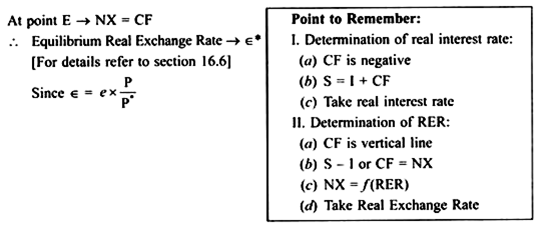

II. Equilibrium real interest is determined where:

Supply of loanable funds = Demand for loanable funds

ADVERTISEMENTS:

or,

S=I(r) + CF (r)

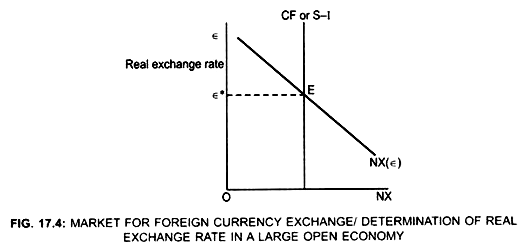

Trade balance = Net Capital outflow.

ADVERTISEMENTS:

i.e. NX = CF

or, where, demand for dollars from NX = supply of dollars from CF

Forces that move the RER or the price levels also move the nominal exchange rate, where as prices are determined by monetary policies here and abroad.