The striking feature of the Classical model is the Supply-determined nature of the real output and employment.

This property of the model follows from the vertical aggregate supply curve.

The vertical aggregate supply curve illustrates the supply-determined nature of output.

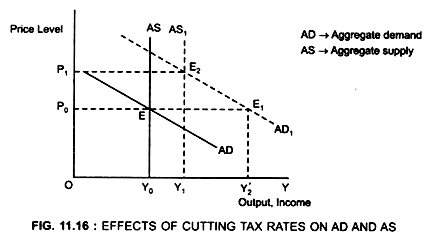

Supply-side economics proved that if tax rates are reduced, the aggregate supply will increase by such a huge amount that the tax collection will increase.

Decrease in tax rate effects both AD and AS.

The AD curve shifts to the right to AD1 (Fig. 11.16)

AS curve also shifts to the right to AS1.

But shift in AD > shift in AS.

ADVERTISEMENTS:

This is because due to decrease in tax rate, the incentive to work increases. However, the effect of such incentive is very small and that is why, shift in AS, that is (potential GDP), is very small.

Initially the economy is in equilibrium at point E.

Output → Y0

Price level → P0

ADVERTISEMENTS:

If there is reduction in the tax rates:

In the short run it will affect AD, that is, there will be AD effect.

The AD curve shifts to the right to AD1.

At the given price P0 the economy is in equilibrium at point E1, output increases by a large amount to Y’2. As a result, total tax revenues will fall by a lesser amount than the fall in the tax rate.—This is purely AD effect

But in the Long run

Economy moves to point E2.

GDP increases but by a lesser amount Y0Y1 < Y0Y’2

Result:

Total tax collections fall, the deficit increases, because the Revenue of the Government increases by a small amount.

ADVERTISEMENTS:

Reason:

Tax collection depends on the income level. Greater the income i.e., GDP, greater is the tax collection. Since income increases by a lesser amount, tax collection will increase by a lesser amount. On the other hand increase in AD is greater than increase in AS, as a result, prices will increase to P1.

In-spite of these fact supply-side policies are preferred because it is only the supply-side policies which can permanently increase the output. The demand policies are useful only for short-term results. That is why many economists strongly favour supply-side policies. Many economists also believe that if along with the tax cut, the Government spending is also reduced then the effect on the deficit will be neutral.

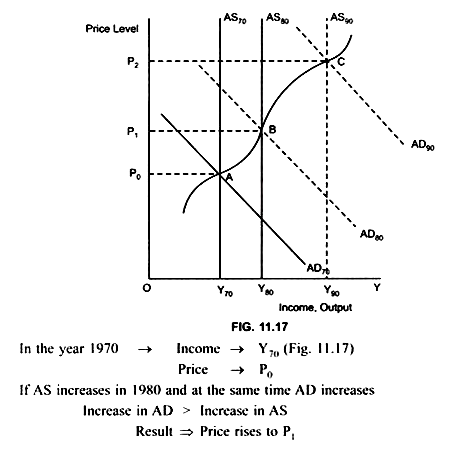

Over very long periods, movement in AD can be either large or small, depending mostly on movements in the money-supply.

ADVERTISEMENTS:

The output is determined by AS, and Prices are determined by the movement of AD relative to the movement of AS.

If Shift in AD > shift in AS → Price rise will be very high.

Shift in AD < shift in AS → Price rise will be less.

ADVERTISEMENTS:

On comparing the price level in 1980 with the price level in 1990, it is found that the increase in price in 1990 is greater than the increase in price in 1980. This is because the extent of shift in AD in 1990 is greater than the shift in AD in 1980. This reveals that prices rise whenever increase in AD is greater than increase in AS.