Effects of Expansionary Monetary Policy (With Diagram)!

Let us suppose there is monetary expansion due to open market purchase of securities by the central bank.

Suppose the central bank purchases the securities by printing new currency notes.

The objective is to change the interest rate by altering people’s asset preferences (i.e., preferences for money and bonds).

ADVERTISEMENTS:

When the central bank buys bonds there is a shortage of bonds in the open market. As a result the prices of bonds rise, which is equivalent to a fall in the rate of interest. When the rate of interest falls people hold more money and less bonds in their portfolio of assets.

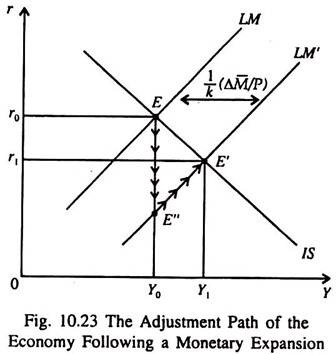

In Fig. 10.23 we show the effect of monetary expansion brought about by open market purchase of securities by the central bank. The initial equilibrium at point E is on the initial LM curve that corresponds to real money supply M / IP.

Now suppose an open market purchase increases the nominal quantity of money, and, due to the fixed aggregate price level, the real quantity of money. Consequently the LM curve will shift to the right to LM’ and the economy’s new equilibrium point will be E’ — with a lower interest rate and a higher level of income.

ADVERTISEMENTS:

The equilibrium level of income rises because the open market purchase reduces the interest rate and thus stimulates investment.

However, the effect of an open market purchase on investment spending and thus on income depends on interest elasticity of demand for money. If the demand for money is

highly interest-elastic, then a given change in the money supply will be absorbed by the people and this will prevent the rate of interest from falling much.

The converse is also true. If the demand for money is not much interest-elastic, a given change in the money supply will cause a large change in the interest rate and will have a big effect on investment. Similarly, if the demand for money is highly income-elastic, a given increase in the supply of money will be absorbed by the people, without causing much change in income.

We may now examine the adjustment process to the monetary expansion. At the initial equilibrium point E, the increase in the money supply creates an excess supply of money. People adjust to this by reducing their money holdings and increasing their purchase of income-earning assets. As a result assets prices rise and returns from such assets decline.

ADVERTISEMENTS:

Due to the assumption that assets markets adjust instantanuously, the economy moves immediately to point E’, where the money market is in equilibrium and where the people are willing to hold a larger real quantity of money due to a sufficient fall in r.

(In fact, the lower the interest elasticity of money demand, the larger is the change in r required to clear the money market.) At point E”, however, there is excess demand for goods.

The fall in r, at the initial income level Y0, has raised aggregate demand and has reduced the level of inventories. Consequently output expands and the economy moves up the LM curve. The interest rate rises in the adjustment process because the increase in output (income) raises the demand for money and the increase has to be held in check by raising the rate of interest.