Read this article to learn how to Determine the Real Exchange Rate and the Trade Balance!

Determination of RER, Determinants of RER and Relationship between RER and NX.

Determination of RER:

Determinants of RER:

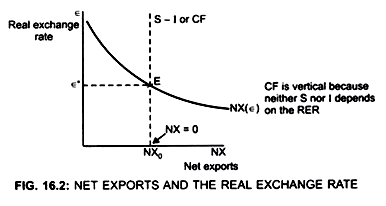

1. If RER is low, domestic goods are relatively cheap to foreign goods (P* > P) Domestic residents will buy less of foreign goods, and foreigners will buy more of our goods. Net exports will increase. Thus, RER is inversely related to NX.

ADVERTISEMENTS:

NX curve is downward sloping because it represents the net demand for dollars coming from foreigners who want dollars to buy our goods. It shows inverse relationship between RER and NX. Opposite will occur if RER is high.

Relationship between RER and NX can be written as:

NX = CF

ADVERTISEMENTS:

where CF = S-I

Saving depends:

(a) On the consumption and

(b) On the fiscal policy.

ADVERTISEMENTS:

Y = C + S

S = Y-C

If consumption increases, saving decreases and vice versa.

Y – C – G = National Saving (S)

If the Government expenditure increases, S decreases

Investment depends on the:

(a) Investment function and

(b) The world interest rate.

Saving is fixed because saving depends on the income level. It is not affected by the exchange rate [S = f(Y)]

ADVERTISEMENTS:

Investment depends on world interest rate. It is not affected by RER

Therefore, S – I curve is a vertical line because both S and I does not depend on RER. The vertical line, S-I, represents the net capital out flow, that is, excess of domestic saving over domestic investment, therefore, it shows, the supply of dollars to be exchanged into foreign currency and invested abroad (Fig. 16.1) RER is determined at the point where:

NX = S-I

This is at point E.

ADVERTISEMENTS:

Equilibrium RER is є*.

At point E, that is at the equilibrium RER, the supply of dollars available from the net capital outflow = demand for dollars by foreigners buying our exports.