The following points highlight the top ten techniques of Empirical Estimation of Demand. The techniques are: 1. Problems with Theoretical Analysis 2. Estimating Demand Curves 3. The Identification Problem 4. Consumer Surveys 5. Consumer Clinics 6. Market Experiment 7. Multiple Regression Analysis 8. Theoretical Formulation of the Demand Function 9. Regression Analysis of Demand 10. Power Function.

Technique # 1. Problems with Theoretical Analysis:

It is known that demand functions have two important properties:

(1) The demand for any commodity is a single-valued function of prices and income (i.e., a single commodity combination corresponds to a given set of prices and income) and

(2) Demand functions are homogeneous of degree zero in prices and income (i.e., if all prices and income change in the same direction and proportion, there is no change in the purchase plan of a consumer).

ADVERTISEMENTS:

These properties are well established in economic theory. But the businessman is actually interested in having firm knowledge of a portion of the demand curve for the product in which he is interested.

It is, of course, possible to estimate the demand function for primary products (e.g., agricultural commodities) since data on prices and quantities are readily available for a number of years. But this is not true in the case of manufactured goods.

There is another problem due to the existence of dealers in most markets. Most often than not manufacturers sell directly to dealers and not to the final consumers. In the short-run, the whole amount taken by dealers may not be sold to the consumers. The quantities taken by dealers tend to correspond with those taken by consumers only in the long-run.

Moreover, the assumption made in theory that all other factors remain unchanged is unrealistic when we are dealing with market data collected over a number of years. In the long-run, changes in consumers’ incomes, in the size of the population, in the price of related goods and in the conditions of supply, are likely. We have to take note of these realities in estimating the demand for a product.

Technique # 2. Estimating Demand Curves:

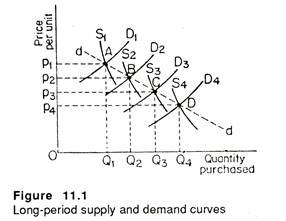

Suppose due to changes in income, population and other factors, the theoretical demand curve shifts from D1 to D2, D2 to D3 to D4 in Figure 11.1. The corresponding supply curve at each of these points occupies positions S1 to S4. The price-quantity observation which is recorded in period 1 (say, 1981) is given by the intersection of D1 to S1, namely, A. The next one is determined by the intersection of D2 and S2 at B (in 1982).

ADVERTISEMENTS:

Thus we get a series of observations A to D for four years, viz., 1981, 1982,1983 and 1984. These together trace out a demand curve DD. But this is not the same demand curve discussed in theory. More specifically, it is not reversible. It is improbable that we can move back from C to B and B to A.

It is unlikely that the precise combination of conditions which prevailed at these points will be repeated. In practice, the demand and supply curves may not move consistently in the same direction, as is assumed in this diagram. They may move up or down rather erratically.

In Figure 11.1, points A, B and C are not three points on a single demand curve for, say, product X. Each point is on a different demand curve — one that is shifting over a period of time. So just by connecting them we cannot trace out the product demand curve.

ADVERTISEMENTS:

A firm may interpret the line dd (which is a Iocus of points A, B, C and D) as the demand curve by mistake. Thus it might assume that a reduction in price from P1 to P2 increases sales from Q1 to Q2. An expansion of demand may well justify the price reduction.

But, in practice, such a price cut will result in a much smaller increase in demand. The true demand curve (D1) is much less elastic than the line dd. Thus, a price cut is much less desirable than it appeared at the first sight.

Simultaneous Relationship:

So there is interrelationship between demand and supply curves.

Now, data on prices and quantities purchased can be used to estimate a demand curve only under two sets of conditions:

(1) The demand curve has not shifted, but the supply curve has shifted; or

(2) We have almost complete information to determine just how each curve has shifted during the observation period (which covers four years in this case).

Suppose there is a technological change in the production of X. So costs in the industry will fall sharply within a short period but demand conditions are likely to be stable. The situation is illustrated in Figure 11.2. Here the demand curve, which initially was unknown, in now assumed to be stable. The supply curve shifts from S1 to S2, S2 to S3 and S3 to S4.

It is clear that each price/quantity point represents the intersection of the supply and demand curves. Since all the demand determinants except price are assumed to be stable, points A, B, C and D must be on the same demand curve. So the demand curve DD can be estimated by connecting the four points.

Technique # 3. The Identification Problem:

It now appears that “the problem of simultaneous relationships in demand analysis can be overcome only if one has enough information to identify the interrelated functions so that shifts in one curve can be distinguished from shifts in the other.” This is the reason why “the problem of estimating one function when simultaneous relationships exist is known as the identification problem..”

In fact, we must have sufficient information about price/quantity data to separate shifts in demand from changes in supply. We may note that information about which curve is shifting and to what extent, is necessary to identity and estimate the demand relationship. This information is not available most of the time.

In practice, some firms do make studies of the influence of price on sales volume, which provides a glimpse of a small section of the demand curve. Most companies rely on the instinct and experience of senior managers with regard to the responsiveness of sales of changes in price.

There is some evidence that businessmen tend to underrate the responsiveness of sales to downward adjustments of price. In such cases, statistical demand analysis, with the help of regression technique, is incapable of providing estimates of the parameters of the linear demand function.

ADVERTISEMENTS:

If it is not possible to solve the identification problem, other techniques such as consumer interviews and market experiments are used to obtain necessary information about important demand function relationships.

Four primary methods used to estimate the parameters (coefficients) of the demand function are: (1) consumer surveys, (2) consumer clinics, (3) market experimentation, and (4) regression analysis. Regression analysis is perhaps the most important tool of demand analysis for two reasons.

Firstly, in most situations it is perhaps the best, or the only technique of estimating the parameters of the demand equation. Secondly, this is perhaps the single-most important estimating technique used in managerial economics and all other areas of business administration.

Technique # 4. Consumer Surveys:

Consumer surveys involve questioning a sample of representative consumers to determine such factors as their willingness to buy, their responsiveness to price changes or to relative price levels and their awareness of advertising campaigns and various other variables considered to be important for the marketing and profit planning functions.

ADVERTISEMENTS:

This technique can be applied just by stopping purchasers and asking them questions about their intentions to buy at different prices. At the other extreme, to gather the necessary information, trained interviewers may be appointed to raise sophisticated questions to a carefully selected (representative) sample of buyers.

In theory, consumer surveys can provide necessary information on the most important demand relationships. A firm might question each of its customers or a sample of customers about projected purchases under a wide variety of conditions relating to price and other factors included in the demand function.

Then, by aggregating the data, the firm could forecast its total demand and might be able to arrive at an estimate of some of the important parameters in the demand function for its product.

Drawbacks:

However, the practical difficulty with this method is that the information obtainable by this technique, and its quality, is likely to be limited. As J. L. Pappas and E. F. Brigham argue, “Consumers are often unable, and in many cases unwilling, to provide accurate answers to hypothetical questions about how they would react to changes in the key demand variables”.

For example, most consumers are unable to say how they would react to a 1, 2 , or 3% increase (or decrease) in the price of a colour T. V. set. This makes if difficult to use such a technique to estimate the demand relationships for most consumer goods.

Merits:

However, there are two advantages of the method. First by using stable inquiries, it is possible for a trained interviewer to extract a good deal of useful information from consumers. For example, an interviewer might ask questions about the relative prices of several pressure cookers or bicycles (which compete closely with one another) and may discover that most people are unaware of existing price differentials.

ADVERTISEMENTS:

This is a good indication that demand is inelastic and consumers are not very much price-conscious. So it would not be necessary for a producer to try to cut price to increase demand for its products. Consumers may not even notice the reduction.

Moreover, the effectiveness of advertising campaigns may be tested by sampling the awareness of a group of consumers to the campaign. Thus, it is possible to obtain some basic information through such surveys which may be adequate and reliable for some decision making purposes.

Secondly, there is no substitute of this method for certain kind of information regarding demand for a product. For instance, in short-term demand (or sales) forecasting consumers’ intentions, attitudes and expectations about future business conditions make all the difference between an accurate estimate and an inaccurate one. It is possible to obtain such subjective information through interview methods alone.

For instance, consumer expectations regarding future business and credit facilities may provide significant insights into their propensity to buy many items, especially consumer durables like washing machines, refrigerators, T. V. sets, etc. Moreover, using a little imagination and asking less direct questions may provide substantial insights.

Technique # 5. Consumer Clinics:

An alternative means of recording consumer responses to changes in demand determinants is through the use of consumer clinics. This is like a laboratory test in physics or chemistry.

Here experimental groups of consumers are given a small amount of money with which to buy certain items. The experiment can reveal impact on actual purchases of the commodity under consideration as its price, prices of competing goods, and other variables affecting demand are manipulated.

Drawbacks:

ADVERTISEMENTS:

Although this method is more realistic than the direct interview method, it has two major shortcomings. Firstly, the costs of setting up and running such a clinic are substantial. Consequently, a very small number of consumers can participate in the experiment.

Secondly, since the participants are well aware that their actions are being observed, they may behave in a manner somewhat different from normal. This is known as the Hawthorne effect. A buyer of T. V. set taking part in consumer clinic may suspect that the experimenter is interested in sensitivity to prices and thus may be much more price conscious that he would otherwise be.

However, this approach like the previous one often provides some useful information to the decision-making process. In some situations, this is the only technique that can provide usable information.

Technique # 6. Market Experiment:

The market experiment method which is often used to gather information about the demand function involves examining the way consumers behave in real life markets. This method involves examination of consumer behaviour in actual markets. Companies may use this method to investigate the nature of their demand curves by experimenting with various prices.

This is also known as market testing. Experiments are made under laboratory conditions to derive a demand schedule. Attempts are made “to create the purchasing situation under controlled conditions to ensure that price is the only variable”.

Each consumer in the group is offered a choice between the product under investigation and a sum of money, and the number of persons in the group expressing a preference for the product is noted.

ADVERTISEMENTS:

Then a second group is offered a choice between the product and a different sum of money and the response again noted. By repeating the exercise the number of persons taking the product at different ‘prices’ may be plotted as demand schedule.

This method again has all the defects of the previous method. The consumer has only a choice between the product and a sum of money, whereas in the market he may make choice from competing products. Again, there is no guarantee that the consumers will behave under these controlled conditions as they do in the market place.

This method also poses difficulties. Firstly, it is necessary in the course of an experiment “to hold non-price factors constant, or at least to provide statistical methods for determining their separate effects. Then, demand may often depend not only on the prevailing price but also on the preceding price”. It is, therefore, difficult to disentangle (i.e., separate out) the effect of the prevailing price from the effect of the price change.

Secondly, competitors something try to interfere with market tests by, for example, running special promotions of their own.

Finally, businessmen often believe that “it is easier to lower price than to raise it. They are therefore, reluctant to experiment with a lower price for fear that, if the experiment is unsuccessful, the subsequent price rise will have exceptionally adverse effects”.

Technique # 7. Multiple Regression Analysis:

This is basically a statistical technique. It is used to “isolate” the effects of price from other factors influencing demand. To illustrate, suppose that the Godrej Company hypothesizes that the quantity demanded of its products depends, in addition to price, upon general economic conditions as reflected in the GNP and upon the size of its advertising budget.

ADVERTISEMENTS:

The assumed relationship can be expressed in the form of an equation where Y represents the dependent variable, viz., quantity demanded; X1, X2 and X3 represent the independent variables, viz., price, GNP, and advertising expenditures respectively; the coefficients b1, b2 and b3 represent the influence of the respective independent variables on quantity; and the coefficient b4 is a constant term. The equation is

Y = b1X1 + b2X2 + b3X3 + b4

If a number of past observations of the independent and dependent variables are available, these observations can be processed statistically to obtain estimates of the co-efficient. The estimated coefficient bi, then is taken to represent the influences of price on quantity demanded, other factors being held constant.

In many instances regression analysis is the best, or perhaps the only, means of estimating the demand equation.

Technique # 8. Theoretical Formulation of the Demand Function:

The initial step in carrying out a statistical study is to formulate a model based on economic theory. So to start with, we demonstrate how to make use of economic theory by means of mathematical tools to formulate a quantifiable statistical model.

The consumer’s demand curve for a given commodity can be derived from the analysis of utility maximization. The neo-classical (Marshallian) theory of consumer behaviour begins with a utility function that makes an individual’s level of satisfaction depend on the commodities he consumes.

Let a consumer’s ordinal utility function be

U = f(q1, q2, . . ., qn) (1)

where q1, q2, . . ., qn are the quantities of different commodities consumed in a single time period. It is assumed that the utility function in Equation (1) is not only an increasing and continuous function of each of the quantities, but is also twice differentiable.

Given the utility function in Equation (1), the theory assumes that consumer behaviour is explicable by maximization of Equation (1) with respect to the q’s, subject to budget constraint, namely,

The prices p1, p2, . . .,pn and income y are taken as given to the consumer, and they satisfy the following conditions:

The maximization of Equation (1) subject to Equation (2) is a constrained maximum problem. A necessary condition for the solution of this type of problem is that

where Ui = (∂U/∂qi) and λ is the Lagrange multiplier. In economic terms, λ stands for the marginal utility of money. From this it logically follows that

And so on

Ui/Pi = λ, i = 1,2,. . . , n (6)

Thus, in equilibrium, the ratio of the marginal utilities of two commodities is equal to their price ratio, that is, the marginal utilities are proportional to the prices.

Equations (2) and (4) provide (1 + n) relationships that permit (1 + n) unknowns, λ and qi(i = 1,…, n) to be expressed in terms of y and pi(i =1, …, n). Thus, the solution yields the following demand functions:

qi = fi (p1,p2,. . . ,pn,y), i = 1,2,. . . n (7)

In other words, Equation (7) states that consumer demand for the good depends on income and the prices of all commodities.

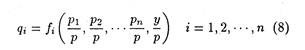

What is important to note at this stage is that equal proportionate changes in prices and income do not affect the constraint in equation (2) and thus will not affect the utility maximizing values of the q’s. Adopting this property of zero-degree homogeneity, equation (7) can be written as

where p is an index of general prices. Equation (8) states that the demand for is a function of relative prices of all commodities and real income.

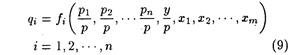

Apart from prices and income, other factors, such as tastes, determine consumer demand. The factors determining preferences, such as family size and composition and residential area, may be noted by xj, where j = 1, 2, . . ., m. Thus, the demand relationship for an individual consumer may be written in the form

Since the utility function is not measurable in practice, statistical analysis begins directly with the demand functions. The exact functional form is rarely deducted theoretically, but is usually determined empirically (statistically).

Equation (9) is a general function for empirical estimation of a demand function. However, there are several reasons that, in practice, a regression is not specified in a study so as to include all factors that may have causal influence on the dependent variable under analysis. Prima facie it is legitimate to make the demand theory as simple as possible, taking into explicit account only the main causal factors.

Secondly, statistical data are lacking for certain variables. Furthermore, the causal factors may be highly inter-correlated. Inclusion of a large number of explanatory variables in the model may increase the standard errors of the regression coefficients and tend to obscure the importance of explanatory variables in the equation.

Finally, before estimating a demand function empirically, the demand analyst faces an identification problem. Namely, how do we know that the specified function is not, rather, a supply curve? In other words, how can we distinguish the demand function from the supply function? In fact, the collected economic data are already in equilibrium condition where supply is equal to demand.

In spite of these pitfalls we often make regression analysis of demand. The pioneering work in this field was made by T. Schultz in 1938 in the U.S.A., and in 1945 Richard Stone carried out regression analysis in the U.K. We may now do regression analysis of demand against the backdrop.

Technique # 9. Regression Analysis of Demand:

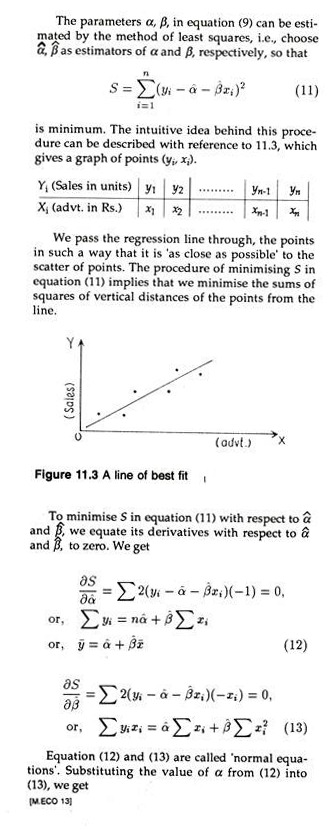

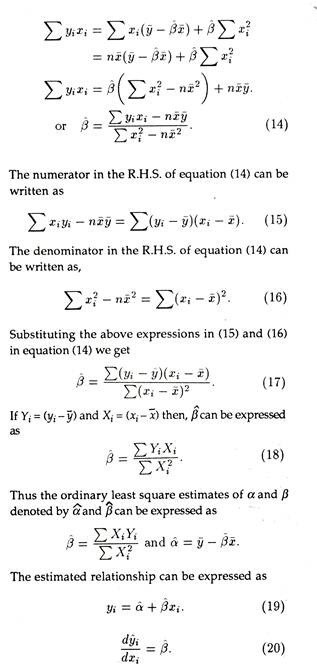

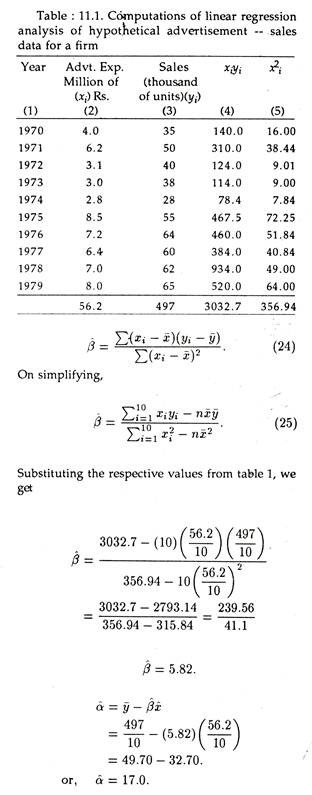

A frequent objective in business is the specification of a functional relationship between two variables such as Y =f(X). Here Y is called the dependent variable and X the independent variable. In the business world one has to find the relation between sales and advertisement, sales (Y) being the dependent variable and advertisement (X) being the independent variable.

We cannot expect a perfect explanation of sales by advertisement, and hence we write Y = f(X) + u, where u is a random variable called residual. This is called a regression equation of Y and X. The residual arises from measurement errors in Y , or imperfections in the specification of the function f(X). For example, there may be many other variables beyond X that influence Y, which we have left out.

Since u is a random variable, Y is also a random variable. The independent variable X is non- random as fir as business relations are concerned. Assuming f(X) to be a linear function i.e.,f(X) = α + βX., we have

yi = α + βxi + ui i = 1,. . .n (10)

where i = 1, 2, . . ., n denote the number of observations.

The slope coefficient β, gives us an estimate of change in sales associated with a one-unit change in advertising expenditures. The intercept term, α, generally has no economic meaning.

It might be true that the level of sales with zero advertising would equal the intercept term, α, but since there are no observations of sales at zero advertising expenditures, we cannot safely assume that α be sales with no advertisement expenditure.

The results of this simple 2-variable regression model can easily be extended to many variables. Suppose that we also have information on the average price p charged for the product. The new information can be added to the linear model in equation (10), resulting in the following regression equation:

Where more than two independent variables are used, we can work out the regression coefficients (in this case β and θ) by matrix method, which is beyond the scope of the title. Today, the statistical estimation of parameters/coefficients is done by computers. The fitted line is

When this is done, we interpret the coefficients as follows : α is again the intercept term, with little economic significance; β is the expected change in sales related to a one unit change in advertising expenditure, holding the price p constant; and θ is the expected change in sales related to a 1-unit change in price, holding advertisement expenditure constant. In mathematical notation,

Linear demand functions have great attraction in empirical work for two reasons. First, experience has shown that many demand relationships are in fact linear. Secondly, a convenient statistical technique, the method of least squares, can be used to estimate the parameters α, β, θ, or the regression coefficients for linear equations.

But, this is not the only form of demand function. There can be other forms of demand functions. In the following section we have given an example of how to work out the regression estimates α and β and draw the estimated relation in the case of a linear relation between sales (thousands of units) and advertisement expenditure (million of Rs.).

where yi represents sales and xi, represents advertisement expenditure.

Technique # 10. Power Function:

The second most commonly specified demand relationship is the case where two or more interrelated variable comes into picture. If one assumes constant elasticity’s, power functions can be of use, such as quantity demand Q

P,Y, A are respectively price, income and advertisement expenditure. The multiplicative form has a great appeal, since the marginal effects of each of the independent variables depends on the values of other variables in the function.

The marginal impact on the quantity demanded due to change in price will be different for different levels of income (Y) and advertisement expenditure (A). The multiplicative model described by (27) is in fact more realistic than linear functions, where the marginal impact of the independent variables are constant.

The multiplicative model can be made linear by taking logarithmic transformation. Taking log on both sides of equation (27) gives,

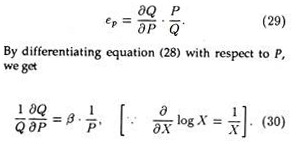

log Q = log α + β log P + θ log Y + 7 log A. (28)

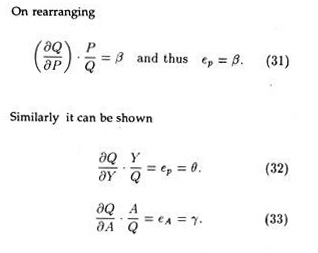

Since the equation is linear in logarithm, one can apply least square regression analysis in estimating the parameters α, β, θ and y. It can be shown that β, θ and y are constant elasticity coefficients.

We know that price elasticity of demand is given by the formula

These elasticities, income elasticity of demand (ey), advertisement elasticity of demand (eA) and price elasticity of demand (ep), are constant. The values, θ, y and β are not functions of the variables; for instance, y does not change with changes in P, Q, Y or A.

Constant elasticities are useful where they are appropriate. For example, if income elasticity of demand for television set is constant, then increase in income can be expected to produce proportionate changes in the demand for television over wide ranges of income.

If the income elasticity of demand for television set is not constant, then the decision maker cannot use the multiplicative model which is beyond the scope of this book. If there are opportunities to employ constant elasticities which may not be frequent, then the multiplicative model is very useful because it greatly simplifies the analysis.

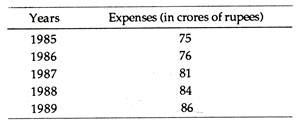

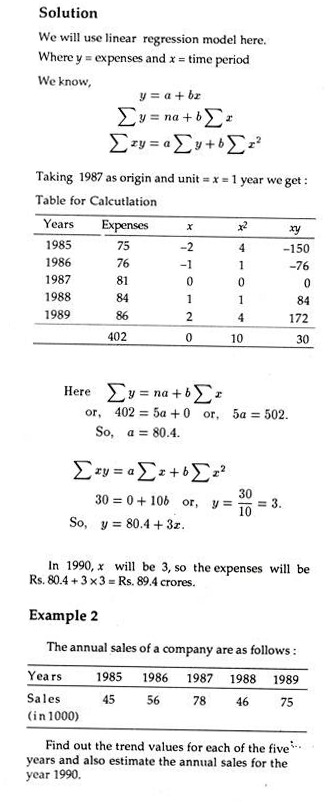

Example 1

The following table shows the business expenditure on new plant and equipment i.e., demand for capital goods.

Project the business expenditure on new plant and equipment for the year 1990.