The Revealed Preference Theory which has been put forward by Paul Samuelson seeks to explain consumer’s demand from his actual behaviour in the market in various price-income situations.

Thus, in sharp contrast to psychological or introspective explanation Prof. Samuelson’s revealed preference theory is behaviouristic explanation of consumer’s demand.

Besides, revealed preference theory is based upon the concept of ordinal utility. In other words, revealed preference theory regards utilities to be merely comparable and not quantifiable. Tapas’ Majumdar has described Samuelson’s revealed preference theory as “Behaviourist Ordinalist.” the description “Behaviourist Ordinalist” highlights the two basic features of the revealed preference theory first, it applies behaviouristic method, and secondly it uses the concept of ordinal utility.

The revealed preference theory is regarded as “scientific” (meaning behavioristic) explanation of consumer’s behaviour as against the psychological explanation provided by Marshallian and Hicks-Allen theories of demand. This shift from psychological to behavioristic explanation of consumer’s behaviour is a landmark in the development of the theory of demand. The urge among economists to have scientific explanation led to the emergence of the behaviouristic method which seeks to derive the demand theorem from actually observed consumer’s behaviour.

ADVERTISEMENTS:

Critical Appraisal of Revealed Preference Theory:

Samuelson’s revealed preference theory has gained some advantages over the Marshallian cardinal utility theory and Hicks-Allen indifference curve theory of demand. It is the first to apply behaviouristic method to derive demand theorem from observed consumer’s behaviour. In contrast, both the earlier theories, namely, Marshallian utility analysis and Hicks-Allen indifference curve theory were psychological and introspective explanations of consumer’s behaviour.

Both these earlier theories have been considered to be unsatisfactory by Samuelson who remarks, “For just as we do not claim to know by introspection the behavior of utility, many will argue we cannot know the behaviour of ratio of marginal utilities or of indifference directions. He further says, “The introduction and meaning of the marginal rate of substitution as an entity independent of any psychological, introspective implications would be, to say the least, ambiguous and would seem an artificial convention in the explanation of price behaviour.” Samuelson thinks that his revealed preference theory casts away the last vestiges of the psychological analysis in the explanation of consumer’s behaviour.

It has been claimed that behaviouristic method is more scientific than the introspective method. In fact, the behaviouristic method has been called ‘the scientific method’. Now, the question is whether it is the behaviouristic approach or the psychological approach which is more correct to explain consumer’s demand.

ADVERTISEMENTS:

Two opinions are held in this regard. Prof. Samuelson and others of his way of thinking contend that the behaviouristic method is the only valid method of explaining consumer’s demand. On other hand, Knight who belongs to the philosophical-psychological school of thought has called the scientific (behaviouristic) approach as the ‘recourse’ of those who worship the Occam’s razor.

We are of the opinion that no prior grounds for choosing between behaviourist and introspective methods can be offered which would be acceptable irrespective of personal inclinations. Commenting on the behaviourist-ordinalist controversy. Tapas Majumdar says, “Behaviourism certainly has great advantages of treading only on observed ground; it cannot go wrong.”

But whether it goes far enough is the question. It may also be claimed for the method of introspection that operationally it can get all the results which are obtained by the alternative method, and it presumes to go further, it not only states, but also explains its theorems. We therefore conclude that which of the two methods is better and more satisfactory depends upon one’s personal philosophical inclinations. However, behaviourist method has recently gained wide support from the economists and has become very popular.

Samuelson’s revealed preference theory also marks an advance over the earlier theories of demand by giving up the dubious assumptions underlying them. Both the Marshallian utility analysis and Hicks-Allen indifference curve theory were based upon the utility-maximisation postulate.

ADVERTISEMENTS:

In these theories, rational behaviour on the part of consumer is interpreted as the attempt on his part to maximise utility or satisfaction. But this utility-maximising postulate has been objected to on the ground that it is very severe and is therefore difficult of realisation in actual practice. Samuelson has given up utility maxmisation assumption and has instead employed consistency postulate to derive the demand theorem. Now, his assumption of consistency of choice in the consumer’s behavior is much less severe and conforms more to the real world behavior of the consumers.

Samuelson has likewise abandoned the assumption of continuity. The indifference curve theory involved the assumption of continuity. Indifference curves are continuous curves in which lie all conceivable combinations, whether they are actually available in the market or not. It may happen under indifference curve analysis that the budget line comes to be tangent to an indifference curve on the point which represents a combination which is not actually available.

Thus, continuity assumption is quite unrealistic. The real economic world exhibits discontinuity. Now, the continuity assumption is not involved in the revealed preference theory. Of course, in the graphic explanation of the revealed preference theory a continuous price income line, that is, a budget line is drawn within or on which the consumer has to choose any combination. But since the theory is based upon the actual observed choice of the consumer, and the consumer will choose a combination among all those actually available in the given price-income situation the continuity is not involved in the revealed preference theory.

The concept of reveal preference is a powerful tool which can provide significant information about consumer’s preferences from which we can derive law of demand or downward-sloping demand curve. Revealed preference theory does this without assuming that a consumer possesses complete information about his preferences and indifferences. In indifference curve analysis it is supposed that consumers have complete and consistent scale of preferences reflected in a set of indifference curves. His purchases of goods are in accordance with his scale of preferences.

It is as if consumers were carrying complete indifference maps in their mind and purchasing goods accordingly. Therefore, it was considered better to derive demand theorem by observing consumer’s behaviour in making actual choices. Most economists now-a-days believe that it is unrealistic to assume that a consumers have complete knowledge of their scale of preferences depicted in a set of indifference curves. The merit of revealed preference theory is that it has made possible to derive law of demand (i.e. downward-sloping demand curve) on the basis of revealed preference without using indifference curves and associated restrictive assumptions.

Further, it has enabled us to divide the price effect into its two component parts, namely, substitution and income effects through cost difference method and axiom of revealed preference. Cost difference method requires only market data regarding changes in price and quantities purchased of goods in different market situations. Cost difference (∆C) can be simply measured by change in price (∆P) multiplied by the quantity initially purchased by him. Thus,

∆C = ∆Px QX

Where AC stands for the cost difference, ∆Px stands for the change in price of good X, Qx is the quantity purchased by the consumer before the change in price of the good X. Further, with revealed preference theory we can even establish the existence of indifference curves and their important property of convexity. However, it is noteworthy that indifference curves are not required for deriving law of demand or downward-sloping demand curve. Indifference curve analysis requires less information than Marshall’s cardinal utility theory.

But it still requires a lot of information on the part of a consumer since indifference curve analysis requires him to be able to rank consistently all possible combinations of goods. On the other hand, in Samuelson’s revealed preference theory of demand the consumer does not require to rank his preferences on the basis of his introspection.

ADVERTISEMENTS:

It is based on the preferences revealed by his purchases or choices in the different market situations and on the axiom of revealed preference. If consumer’s preferences and tastes do not change, revealed preference theory enables us to derive demand theorem just from observation of his market behaviour, that is, what purchases or choices he makes in different market situations.

It is however assumed that his preference pattern or tastes do not change. As said above, we can even construct indifference curves from consumer’s revealed preferences even though they are not required for establishing law of demand.

A Critique of Revealed Preference Theory:

Although Samuelson’s revealed preference approach has made some important improvements upon the earlier theories of demand but it is not free from all flaws. Various criticisms have been levelled against it.

ADVERTISEMENTS:

First, Samuelson does not admit the possibility of indifference in consumer’s behaviour. As has been explained above, the rejection of indifference by Samuelson follows from his strong ordering preference hypothesis. J.R. Hicks in his later work Revision of Demand Theory” does not consider the assumption of strong ordering as satisfactory and instead employs weak ordering from of preference hypothesis.

Whereas under strong ordering, the chosen combination is shown to be preferred to all other combinations within and on the triangle, under weak ordering the chosen combination is preferred to all positions within the triangle but may be either preferred to or indifferent to other combinations on the same triangle (i.e. on the budget line).

Further, in Samuelson’s theory, preference is considered to be revealed from a single act of choice. It has been pointed out that if preference is to be judged from a large number of observations, then the possibility of indifference also emerges. Thus, an individual reveals preference for A over B if he chooses A rather than B more frequency than he chooses B rather than A over a given number of observations.

Now, we can say that an individual is indifferent between the two situations A and B if a definite preference for either does not emerge from a sufficiently large number of observations. Thus only because Samuelson regards preference to be revealed from a single act of choice that indifference relation is methodologically inadmissible to his theory. The possibility of indifference relation clearly emerges if the existence of preference or otherwise is to be judged from a sufficiently large number of observations.

ADVERTISEMENTS:

Furthermore, if we assume that an individual is able to compare his ends, which is a very valid assumption to be made about the individual’s behaviour, then the possibility of indifference or in other words, remaining at the same level of satisfaction by sacrificing some amount of one good for a certain amount of another good will emerge clearly.

Thus, commenting on the Samuelson’s revealed preference theory from ‘welfare’ point of view Tapas Majumdar remarks. “It may be remembered that in all forms of welfare theory, indeed in any integral view of human activity, we have to assume that the individual can always compare his ends. If this axiom is not granted, the whole of welfare economics falls to the ground. And if this axiom is granted, then the idea of remaining on the same level of welfare while sacrificing something of one commodity for something else of another will emerge automatically.”

Again, Armstrong has propounded the view that there are points of indifference on every side of a given chosen point. Thus, according to his view, the collection of goods actually selected by the consumer is one of the few between which the consumer is indifferent. If this contention of Armstrong is granted, then the proof which Samuelson’s theory offers to establish the Fundamental Theorem of Consumption Theory breaks down.

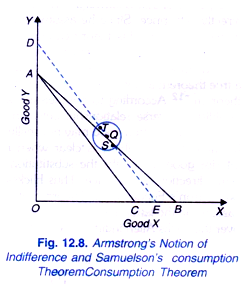

This is illustrated in Fig. 12.8. In price-income situation AB, the consumer chooses the combination Q. According to Armstrong’s notion, points around Q (within the circle) such as S, T etc. would be indifferent to Q. Suppose that the price of good X rises so that the price-income situation is now AC. If an extra grant of money is given to the consumer so that he can buy the same combination Q, the price-income situation is DE. Now, in price- income situation DE, the consumer can pick up a point like S below Q on QE.

Thus, choice of S instead of Q, or T (or any other point in the circle) is not inconsistent to his previous choice because he was indifferent between points such as Q, T, S etc. But the choice of S in price income situation DE means that the consumer buys more of X now when its price is higher (since DE is parallel to AC, it represents the higher price of X as represented by AC). It follows, therefore, that if Armstrong’s notion about points of indifference around the chosen point is granted, Samuelson’s proof that the demand for a good shrinks when its price rises breaks down.

ADVERTISEMENTS:

Further, it has been argued that Samuelson, because of his ruling out the relation of indifference, does not recognise or admit the substitution effect which is the operational consequence of the non-observable indifference hypothesis. It has been pointed out that Samuelson’s revealed preference theory is based upon observed consumer’s behaviour and on the plane of observation substitution effect cannot be distinguished from income effect.

Since response of demand to a change in price is a composite of income and substitution effects, it is concluded, that Samuelson’s theory offers a partial explanation of change in demand as a result of change in price. But to the present author, it seems that this criticism of Samuelson’s theory is misplaced.

In his article “Consumption Theorems in Terms of over Compensation, Samuelson draws clear distinction between income effect and what he calls over-compensation effect as a result of change in price. His over-compensation effect is similar to Slutsky’s substitution effect which involves the movement of the consumer from one level of satisfaction to another (that is, from one indifference curve to another).

Therefore, what Samuelson rejects is Hicksian type substitution effect which permits only movement along the same indifference curve (that is, level of satisfaction remains the same). And Samuelson’s rejection of Hicksian type substitution effect follows from his rejection of the relation of indifference in consumer’s behaviour.

Since Samuelson proves his demand theorem on the basis of positive income elasticity of demand, it cannot enunciate the demand theorem when income effect or income elasticity is negative. Thus, Samuelson is able to enunciate the demand theorem in the case in which, in terms of Hicksian indifference curve theory, substitution effect has been reinforced by positive income effect of the price change.

When the income elasticity is negative, Samuelson’s revealed preference theory is unable to establish the demand theorem. In other words, given negative income elasticity of demand, we cannot know on the basis of revealed preference theory as to what will be the direction of change in demand as a result of change in price. Thus, Samuelson’s revealed preference theory cannot enunciate the demand theorem when (i) the income elasticity is negative and the negative income effect is smaller than the substitution effect; and (ii) the income elasticity is negative and the negative income effect is greater than the substitution effect.

ADVERTISEMENTS:

From above it follows that Samuelson’s theory cannot account for Giffen’s Paradox. The case of Giffen goods occurs when the income effect is negative and this negative income effect is so powerful that it outweighs the substitution effect. In case of Giffen goods, demand varies directly with price. Since he assumes income elasticity to be positive in his establishment of demand theorem, his theory cannot include the Giffen-good case. Samuelson denies the validity of Giffen goods in which case demand seems to vary directly with price.

He thus says, “But the phenomenon of Giffen’s Paradox reminds us that the Marshallian proposition is not a true theorem and it is rather to a theory’s credit than discredit if it refuses to enunciate a false theorem. According to Samuelson, only valid theorem in demand theory is the one that establishes inverse relationship between price and demand.

Against this we may, however, point out that Giffen good may not really exist in the world, but it is theoretically conceivable. Its theoretical possibility is clear when negative income effect of a change in price of an inferior good outweighs the substitution effect with the result that demand changes in the same direction as the price. Thus Hicks-Allen theorem of demand is more general than the Samuelson’s Fundamental Theorem of Consumption since the former includes Giffen good case, while the latter does not.

We thus conclude that though Samuelson makes improvement over the Hicks-Allen indifference curves theory of demand in respect of methodology adopted (that is, its behaviouristic method is superior to Hicks-Allen introspective method) but in respect of the content of the demand theorem enunciated by it, it is a few steps backward than the Hicks-Allen demand theorem. In the end, we may emphasize the point that superiority of Samuelson’s theory lies in his applying scientific or behaviouristic method to the consumer’s demand and his enunciation of preference hypothesis.