The direction in which the income effect works, cannot be deduced from any theory.

The effect of the increase of income on the consumption of goods is known from empirical evidence.

In most cases it is observed that the income effect is positive, that is, increase in income leads to the increase in consumption of the good. But there are some goods of which the consumption is known to diminish with the increase in income, that is, income effect for them is negative. Such goods are called inferior goods.

The consumption of inferior goods decreases with the rise in income, for they are replaced by the superior substitutes at higher levels of income. The goods with income effect (or income elasticity) negative have been called inferior goods, since income effect is mostly negative in case of commodities which are of physically inferior quality.

ADVERTISEMENTS:

It may however be pointed out that inferior good need not be one which is of physically inferior quantity and also it is not necessary that the substitute which replaces the so called inferior goods should have any physical characteristics common with them.

Furthermore, it is not even essential that the ‘wants’ which are satisfied by the inferior good and the substitute which replaces it should be the same. Suppose an individual is induced to buy a car by a small rise in income, he will then be forced to economize on several goods which he was previously consuming.

As a result, the consumption of the goods on which the individual ordinarily spends his income will fall as a result of the particular small rise in income which induced the individual to buy the car. Thus, for the particular rise in income which has occurred, all the ordinary types of goods on which the individual spends his income will become ‘inferior goods’.

Let us now consider the effect of a change in price of an inferior good on its consumption or demand. Substitution effect of the fall in price of a good, as proved above, always tends to increase the consumption of the good. But the income effect of the fall in price of an inferior good will diminish the consumption of the good.

ADVERTISEMENTS:

Therefore, in case of inferior goods the income effect will work in the opposite direction to the substitution effect. But the income effect of the change in price of a good is generally quite small. This is so because a person spends no more than a small proportion of his income on a single good with the result that not even large proportional falls in the price of a good will produce a cost difference which is more than a small fraction of his income.

Thus, unless the demand for a good is exceedingly responsive to the changes in income, that is, unless the income elasticity of demand is extremely large, the income effect of the change in price must be quite small in relation to previous consumption. Therefore, in case of an inferior good although the income effect works in the opposite direction to the substitution effect, it is unlikely that it will outweigh the substitution effect.

The net result of the fall in price of an inferior good will then be the rise in its consumption because the substitution effect is larger than the negative income effect. Thus, the law of demand (i.e., inverse price-demand relationship) usually holds good in case of inferior goods too. Hicks rightly remarks, “Though the law of demand does not necessarily hold in the case of inferior goods, it is in practice likely to.”

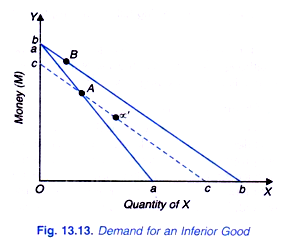

The case of inferior goods in which inverse price-demand relationship holds good is depicted in Fig 13.13 in which good X represented on X-axis is assumed to be an inferior good. Suppose the price of good X falls so that the opportunity line shifts from position aa to bb. As before, the amount demanded of the good increases between A and α’. In other words, substitution effect leads to the increase in the consumption of good X. But, since the good X is now supposed to be an inferior good, the income effect of the price change will tend to diminish the demand.

ADVERTISEMENTS:

Therefore, the amount demanded will fall between a’ and B. In other words, B will lie to the left of a’. But since the income effect is usually small and substitution effect much larger than it, position B, though lying to the left of a’, will remain to the right of A indicating that amount demanded increases as a net result of the working of substitution effect and negative income effect.

It is evident from Fig. 13.13 that when the price of an inferior good falls, its quantity demanded can rise even though the income effect is negative. Thus inverse price-demand principle will also hold in most cases of the inferior goods.

If follows from the above analysis that exception to the law of demand can occur if in the case of an inferior good the negative income effect is so large that it outweighs the substitution effect. Now, the income effect can be very large if the income elasticity of demand is very high and also the proportion of income spent on the good is quite large.

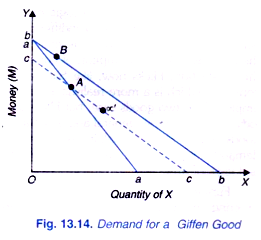

When the negative income effect overwhelms the substitution effect, the net result of the fall in price will be to diminish the amount demanded. The inferior goods for which there is direct price-demand relationship are known as Giffen goods.

Thus Giffen goods, which are exceptions to the Marshallian law of demand can occur when the following three conditions are fulfilled:

(i)The commodity must be inferior with a negative income elasticity of significant size.

(ii)The substitution effect must be small.

(iii) The proportion of income spent upon the inferior good must be large.

ADVERTISEMENTS:

The Giffen good case is demonstrated in Fig. 13.14. Here the position B lies to the left of original position A indicating that there is decrease in amount demanded of the good X as a result of the fall in price. Since substitution effect always tends to increase the amount demanded of the good whose price falls, in this case to the amount demanded increases between A and a’ Owing to the negative income effect, B lies to the left of a’. Since negative income effect is larger than the substitution effect, B lies even to the left of showing fall in consumption of X as a result of the fall in its price.

Appraisal of Hicksian Weak Logical Ordering Theory of Demand:

J R Hicks in his Revision of Demand Theory based on weak logical ordering goes deeper into the foundations of demand theory and derives in a more closely reasoned manner law of demand from a few simple and self-evident propositions of ‘logic of order. He does not follow Samuelson’s behaviouristic revealed preference approach to study consumer s behavior but instead adopts the technique of weak logical ordering on the part of consumer to establish the theorems of demand.

ADVERTISEMENTS:

To establish law of demand, he takes the assumption that consumer behaves according to a scale of preferences. Thus, it is the weak logical ordering and preference hypothesis which are the hallmarks of the methodology of Hicks in his new theory of demand as distinct from indifference curve approach.

Commenting on Hicks’ Revision of Demand Theory Fritz Machlup remarks, “The methodological position underlying Hicks approach is eminently sound. He is free from positivist behaviouristic restrictions on the study of consumer s behavior and he also avoids contentions about the supposedly empirical assumptions regarding rational action. Instead he starts from a fundamental postulate, the preference hypothesis.

Besides the innovation of logic of order and preference hypothesis, J. R. Hicks also corrects some of the mistakes of indifference curve analysis, namely, continuity and maximizing behaviour on the part of the consumer. He now abandons the use of indifference curves and therefore avoids the assumption of continuity. Instead of assuming that consumer maximizes the satisfaction. Hicks now, like Samuelson, relies on consistency in the behaviour of the consumer which is a more realistic assumption.

Further, indifference curves could be usefully employed for two goods case, but Hicksian new theory based on preference hypothesis and logic of order is more general and is capable of being easily applied in cases of more than two goods In fact. Hicks himself in his second part of this book presented a generalised version of demand theory covering cases of more than two goods by deducing from preference hypothesis and logic of order.

ADVERTISEMENTS:

Further credit goes to J. R. Hicks for distinguishing, for the first time, between strong ordering and weak ordering forms of preference hypothesis. By basing his theory on weak ordering which recognises the possibility of indifference in consumer’s scale of preferences, Hicks succeeds in retaining the merits of indifference curve analysis in his new theory also.

Thus even by giving up the unrealistic assumption of indifference curve analysis, Hicks in his new logical weak ordering theory decomposes the price effect into income and substitution effects and is therefore able to account for Giffen goods which Samuelson’s revealed preference theory cannot.

Further, by separating substitution effect from income effect with the weak ordering approach. Hicks has been able to explain complementary and substitute goods in his generalised version of demand theory. Hence, in our view. Hicks has been able to improve upon his own indifference curve analysis of demand and Samuelson’s revealed preference approach.