Let us make an in-depth study of the relationship between quantity demanded of a commodity and its price.

The Demand Function:

The quantity of each commodity that is demanded by an individual household is affected by five main variables:

1. The price of the commodity

2. The prices of other commodities

ADVERTISEMENTS:

3. The income of the household

4. Various ‘sociological’ factors, and

5. The tastes and preference of the household.

The above list pan be conveniently summarised in, what is called, a demand function.

ADVERTISEMENTS:

This is expressed as follows:

When qdn is the quantity that the household demands of some commodity, say n; pn is its price; p, …pn-1, are the prices of all other commodities’; Y is the income of the household; and S is a expression of various sociological factors, such as the number of children in the family, its place of residence (e.g., big city, small town, village). The form of the demand function, D, is determined by the tastes of the members of the household.

The demand function is a mathematical expression of the relation between the quantity demanded of a commodity and its various determinate—several variables listed on the right hand side. The form of the function determines the sign and the magnitude of that dependence.

ADVERTISEMENTS:

If we make the ceteris paribus assumption, i.e., if we assume that all except one of the variable or the right hand side of the demand function is held constant, the function may be expressed as:

We now allow the only variable, Pn to change and we may consider how the quantity demanded (qdn) changes.

The Law of Demand:

If we hold all other variables constant, the quantity demanded of a commodity will vary universally with its price. Since this relation holds true in case of almost all the commodities that we buy, this is known as the Law of Demand.

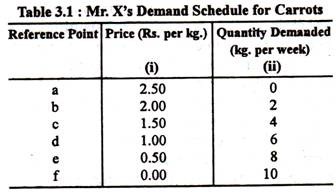

Table 3.1 illustrates the Law of Demand. It shows the relation between price and the quantity demanded of a particular commodity, say, carrots. Column (i) in Table 3.1 shows the different quantities of carrots a hypothetical consumer, say, Mr. X, would be ready to buy at 6 different prices. This Table is known as the demand schedule. It shows, for example, that at a price of Rs. 2.00 per kg his quantity demanded is 2 kg per week; at a price of Rs. 1.00 his quantity demanded is 6 kg per week and so forth. Each price quantity combination is indicated by a reference point such as a, b, c…… etc.

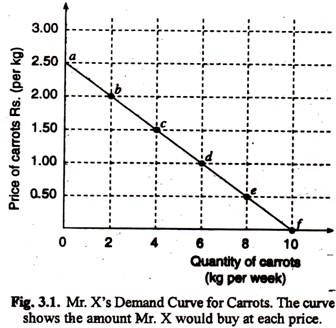

We can easily present the data of Table 3.1 in the form of a graph. This is done in Fig. 3.1, where we measure price on the vertical axis and quantity on the horizontal axis.

Point a shows that when price is Rs. 2.50 the quantity demanded is zero. Point b shows that when price is Rs. 2.00 the quantity demanded is 2 kg. Other points represent four other prices quantity combinations (originally shown in Table 3.1). The extreme point f shows that 10 kg of carrots would be demanded if it were a free good (where price was zero).

The Demand Curve:

The Law of Demand states that when the price of a commodity rises, there occurs a fall in the amount purchased. Conversely, when the price of a commodity falls, the amount purchased increases. From the Law of Demand it follows that the Demand Curve— which shows how much of a commodity is purchased in the market curve at different prices—is a curve sloping downwards from left to right.

ADVERTISEMENTS:

By connecting all the points we get a continuous line. This may be called the demand line for carrots.

The demand schedule is specified in nature because it shows only six possible combinations of price and quantity. The demand curve, on the other hand, is more general in nature because it shows not only these six but various other possible combinations of price, and quantity as well. In other words, the demand curve shows various other quantities of carrots that will be demanded by Shyam at various other prices, i.e., at all intermediate prices. For example, by the demand curve we can find out how much of carrots will be demanded at a price of Rs. 1.75.

In order to find it out we have to locate the price Rs. 1.75 on the vertical axis and find out a point which corresponds to this price on demand curve. We then draw a perpendicular from that point to find the associated quantity at the price. This is 3 kg in Fig. 3.1. It is possible to do this for any price. For example, when price is 75 paise the quantity demanded is 7 kg per week. The demand curve describes the complete relationship between the price of a commodity and the quantity demanded of the same.

The Slope of the Demand Curve:

ADVERTISEMENTS:

The demand curve in Fig. 3.1 illustrates the Law of Demand which states that the quantity demanded of a commodity increases when its price falls. The converse is also true the quantity demanded falls when price rises. Thus there is a negative (inverse) relation between price and quantity. They move in opposite directions. If one increases, the other falls.

The reason is simple. When the price of a commodity falls it becomes cheaper relative to other goods. So a consumer prefers to buy more of it and less of others (its substitutes) whose prices remain unchanged. At 50 paise a kg, carrots are cheap relative not only to potatoes, but cauliflowers and brinjals. At Rs. 2.00 per kg carrots look more expensive than potatoes, beans and its various other substitutes. So the consumer would buy more of other vegetables and less of carrots. Here, however, we are making the ceteris paribus assumption, i.e., the price of all other types of vegetables remain constant.

Reasons underlying the Law of Demand:

The inverse variation between price and demand can be explained by the following reasons:

1. Law of Diminishing Margined Utility:

ADVERTISEMENTS:

The purchase of a commodity involves a sacrifice. The sacrifice is measured by the price paid. The consumer will never pay for a commodity more than the money value of its marginal utility to him. But the larger the amount of a ‘ commodity purchased, the less is the marginal utility. Therefore, the consumer will not buy a large quantity unless the price is low.

This follows from the Law of Diminishing Marginal Utility. Suppose that a man derives utility worth 50 p from the first orange consumed and 30 p from the second. If the price of orange is 50 p each, he will buy only one. If the price is 30 p, he will buy two. When price falls, the consumer increases his purchases for thereby he increases his total utility. When price rises, the consumer must reduce his purchases by cutting out those units of the commodity which yield to him less utility than the price.

2. Income effect:

The fall in the price of a commodity is equivalent to an increase in the income of the consumer because now he has to spend less for purchasing the same quantity as before. A part of the money, so gained, can be used for purchasing some more units of the commodity. Therefore, when price falls the amount purchased increases. When price rises, the consumer’s income is, in effect, reduced and he has to curtail his expenditure on the commodity. So the amount purchased falls.

3. Substitution effect:

When the price of a commodity falls it will be substituted for costlier things because thereby the consumer will gain. If the price of coffee falls it will be used by some people in place of other beverages to some extent. Conversely, when the price of a commodity rises, other commodities will be used in its place to some extent at least. Therefore, a fall in the price of a commodity increases demand and a rise in its price reduces demand.

ADVERTISEMENTS:

4. Change of the number of buyers:

When the price of a commodity falls some people, who were formerly unable to buy it, would be able to do so. “Lowering price brings in new buyers” (Samuelson). Therefore, the total demand will rise. Conversely, when the price of a commodity rises, some people will find it impossible to buy it and will go out of the market.

5. Change of the number of uses:

When the price of a commodity falls it is used for various uses. For example, when the price of mango falls it is used not only for more consumption and also for preparing chutney. Similarly, when price rises, the uses of the commodity are restricted.

Assumptions of the Law of Demand:

The Law of Demand is based upon the following assumptions:

1. The habits and tastes of the demanders remain unchanged:

ADVERTISEMENTS:

The amount of a commodity which a person consumes depends on his taste and habits. If they change, the amount consumed will also change. When a commodity becomes fashionable its consumption will increase, irrespective of price changes. The demand curve is drawn on the basis of a particular level of habits and tastes. When tastes and habits change, the demand curve has to be redrawn. But, at the new level, the curve will have a downward slope.

2. The income remains the same:

When income changes the consumer’s scale of choices usually becomes entirely different. He may purchase more of a commodity at the same price. On the other hand, if the commodity concerned is an inferior good, he may replace it by a better variety. Hence his demand curve has to be redrawn, when his income is changed.

3. The prices of other goods remain the same:

A change in the prices of substitutes and complementary goods may cause demand to shift. The demand for tea will be affected if the price of coffee falls or if sugar is scarce.

Comments:

ADVERTISEMENTS:

From the above assumptions, it follows that Demand Curve is a static one. It does not show the effects of change in demand caused by time.

Exceptions to the Law of Demand:

The Law of Demand does not hold good in the following cases:

1. Conspicuous consumption:

There are some goods (like gold and diamond) which are purchased, not for their intrinsic worth, but for their “snob-appeal”. They are cases of what Veblen called “conspicuous consumption” or articles of ostentation. When prices of such goods rise their use becomes more attractive and they are purchased in larger quantities. If fish becomes more costly, some people will buy more of it just to show that they are rich enough to afford it. On the other hand, when such goods become cheaper, they are purchased less.

2. Speculative markets:

In the speculative markets a rise of prices is frequently followed by larger purchases and a fall of prices by less purchases. When the price of a share rises, people expect further rise and rush to buy. When price falls, they wait for a further fall and stop buying. The same thing may happen in the case of other commodities when purchases are made on a speculative basis. But it is a short period phenomenon.

ADVERTISEMENTS:

3. Giffen Effect and Giffen Goods:

Giffen found that in 19th century Ireland the people were so poor that they spent the major part of their income on potatoes and a small part on meat. Potato was cheap but meat was dear. When the price of potatoes rose, they had to economise on meat. To fill up the resulting gap in food-supply more potatoes had to be purchased. Thus rise in the price of potatoes led to increased sales of potatoes. This is known as the Giffen Effect. This effect is usually found in the case of cheap necessary foodstuffs.

4. Income effect:

The demand curve may be affected by the income effect. If the income effect is positive (i.e. income elasticity of demand exceeds zero) we can expect a downward sloping demand curve. But, on the other hand, if the income effect is negative, particularly in case of inferior good, the result may not be a downward sloping curve. If the total expenditure of the commodity is small, the income effect will have less implication on the demand curve and there will be an inverse relation between price and demand.

Conclusion:

In the cases noted above, an increase of price leads to greater demand and a fall of price leads to less demand. The demand curve in such cases slopes upwards from left to right. Demand curves of this type are very exceptional. Sometimes the demand curve may slope upwards for a short range and then slope downwards again. These effects can be called perverse demand relations.