The effect of changes in income on purchases or consumption of a good. An important factor responsible for the changes in consumption of a good is the substitution effect. Whereas the income effect shows the change in the quantity purchased of a good by a consumer as a result of changes in his income, prices remaining constant, substitution effect means the change in the purchases of a good as a consequence of a change in relative prices alone, real income remaining constant.

When the price of a good changes the real income or purchasing power of a consumer also changes. To keep the real income of the consumer constant so that the effect due to a change in the relative price alone may be known, price change is compensated by a simultaneous change in income. For example, when the price of a good, say X, falls the real income of the consumer would increase.

In order to find out the substitution effect i.e., change in the quantity of X purchased which has come about due to the change only in its dative price, the consumer’s money income must be reduced by an amount that cancels out the gain in real income that results from the decrease in price.

Now, two slightly different concepts of substitution effect have been developed; one by Hicks and Allen and the other by Slutsky. These two concepts of substitution effect have been named after their authors. Thus, the substitution effect which is propounded by Hicks and Allen is called Hicksian Substitution Effect and that developed by E. Slutsky is known as Slutsky Substitution Effect.

ADVERTISEMENTS:

The two concepts differ in regard to the magnitude of the change in money income which should be affected so as to neutralize the change in real income of the consumer which results from a change in the price. We shall explain here Hicksian substitution effect.

In Hicksian substitution effect price change is accompanied by a so much change in money income that the consumer is neither better off nor worse off than before. In other words, money income of the consumer is changed by an amount which keeps the consumer on the same indifference curve on which he was before the change in the price. Thus Hicksian substitution effect takes place on the same indifference curve.

The amount by which the money income of the consumer is changed so that the consumer is neither better off nor worse off than before is called Compensating Variation in Income. In other words, compensating variation in income is a change in the income of the consumer which is just sufficient to compensate the consumer for a change in the price of a good.

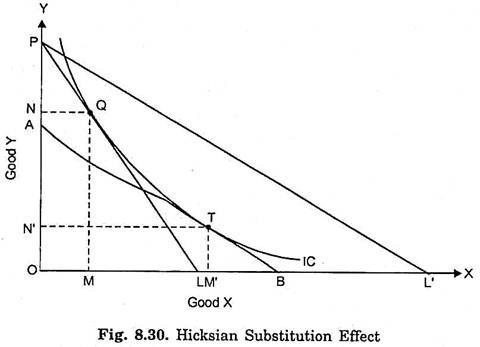

Thus, in Hicksian type of substitution effect, income is changed by the magnitude of the compensating variation in income. Hicksian substitution effect is illustrated in Fig. 8.30. With a given money income and given prices of the two goods as represented by the budget line PL, the consumer is in equilibrium at point Q on the indifference curve IC and is purchasing OM of good X and ON of good Y.

ADVERTISEMENTS:

Suppose that the price of good X falls (price of Y remaining unchanged) so that the budget line now shifts to PL’. With this fall in price of X, the consumer’s real income or purchasing power would increase. In order to find out the substitution effect, this gain in real income should be wiped out by reducing the money income of the consumer by such an amount that force him to remain on the same indifference curve IC on which he was before the change in price of the good X.

When some money is taken away from the consumer to cancel out the gain in real income, then the budget line which shifted to position PL’ will now shift downward but will be parallel to PL’. In Fig. 8.30, a budget line AB parallel to PL’ has been drawn at such a distance from PL’ that it touches the indifference curve IC.

It means that reduction of consumer’s income by the amount PA (in terms of Y) or L’B (in terms of X) has been made so as to keep him on the same indifference curve. PA or L’B is thus just sufficient to cancel out the gain in the real income which occurred due to the fall in the price of X. PA or L’B is therefore compensating variation in income.

Now, budget line AB represents the new relative prices of goods X and Y since it is parallel to the budget line PL’ which was obtained when the price of good X had fallen. In comparison to the budget line PL, X is now relatively cheaper. The consumer would therefore rearrange his purchases of X and Y and will substitute X for Y.

ADVERTISEMENTS:

That is, since X is now relatively cheaper and Y is now relatively dearer than before, he will buy more of X and less of Y. It will be seen from Fig. 8.30 that budget line AB represents the changed relative v prices but a lower money income than that of PL, since consumer’s income has been reduced by compensating variation in income.

It will be seen from Fig. 8.30 that with budget line AB the consumer is in equilibrium at point T and is now buying OM’ of X and ON’ of Y. Thus in orders to buy X more he moves on the same indifference curve IC from point Q to point T. This increase in the purchases of good X by MM’ and the decrease in the purchases of good Y by NN’ is due to the change only in the relative prices of goods X and Y, since effect due to the gain in real income has been wiped out by making a simultaneous reduction in consumer’s income.

Therefore, movement from Q to T represents the substitution effect. Substitution effect on good X is the increase in its quantity purchased by MM’ and substitution effect on Y is the fall in its quantity purchased by NV’. It is thus clear that as a result of substitution effect the consumer remains on the same indifference curve; he is however in equilibrium at a different point from that at which he was before the changes in price of good X.

The less the convexity of the indifference curve, the greater will be the substitution effect. As is known, the convexity of indifference curve is less in the case of those goods which are good substitutes. It is thus clear that the substitution effect in case of good substitutes will be large.

It is thus clear that, a fall in relative price of a commodity always leads to the increase in its quantity demanded due to the substitution effect, the consumer’s satisfaction or indifference curve remaining the same. Thus the substitution effect is always negative. The negative substitution effect implies that the relative price of a commodity and its quantity demanded change in opposite direction, that is, the decline in relative price of a commodity always causes increase in its quantity demanded.

This inverse relationship between relative price and quantity demanded holds good in case the indifference curves are convex to the origin. Given that indifference curves are convex to the origin, a fall in the relative price of a commodity causing an increase in its quantity demanded moving along a given indifference curve is known as Slutsky theorem as this proposition was originally put forward by Slutsky. It is this negative substitution effect which lies at the root of the famous law of demand stating inverse relationship between price and quantity demanded.