Meaning of Demand:

In ordinary speech, the word demand is used rather loosely, and it is often confused with desire.

Desire is the wish to have something or to enjoy a service. But demand implies more than mere desire.

It means that the person is willing and able to pay for the object he desire.

ADVERTISEMENTS:

A beggar’s desire to travel by air from Delhi to Bombay has no signifies as he cannot pay for it. On the other hand, a businessman’s desire to go to Bombay by air is demand, as he is able to pay for it and is willing to do so. Demand thus means desire backed by willingness and ability to pay.

Both willingness and ability to pay are essential. If a man is willing to pay but he is unable to pay, his desire will not become demand. In the same manner, if he is able to pay but is not willing to pay, his desire will not be changed into effective demand. In order to change desire into demand, it is essential that he should be both willing and able to pay.

Besides, demand also signifies a price and a period of time in which demand is to be fulfilled. It is obvious that a person’s demand for anything varies with the price at which it is offered. He buys more of it at a lower price, and less of it at a higher price. Similarly, his demand varies with the period of time. A family’s demand for wheat is much more for a month than for a day.

It may be noted that there is no isolated demand. Things are demanded as part of a system. For instance, a student does not want books alone but also books, stationery, etc. We demand things in groups. The standard of living of a person governs the system of demand.

ADVERTISEMENTS:

The following is therefore a good definition of demand:

“By demand we mean the various quantities of a given commodity or service which consumers would buy in one market in a given period of time at various prices, or at various incomes, or at various prices of related goods.”— (Bober).

We can represent demand symbolically as a functional relationship as under:

DA=F (Pa, Pc, Pd………………….: I: T)

ADVERTISEMENTS:

In this equation DA stands for the households demand for goods A: Pa, Pc, Pd denote the prices of other goods: I stands for (he income of the household, and the households’ tastes are represented by T.

Kinds of Demand:

Three kinds of demand may be distinguished:

(a) Price demand,

(b) Income demand, and

(c) Cross demand.

Price Demand:

This demand refers to the various quantities of a commodity or service that a consumer would purchase at a given time in a market at various hypothetical prices. It is assumed that other things such as consumers’ income, his tastes and prices of related goods remain unchanged.

The demand of the individual consumer is called Individual Demand and the aggregate demand of all the consumers combined for the commodity or service is called Industry Demand. The total demand for the product of an individual firm at various prices is known as firm’s demand or Individual Seller’s Demand.

ADVERTISEMENTS:

Income Demand:

The income demand refers to the various quantities of goods and services which would be purchased by the consumer at various levels of income. Here we assume that the prices of the commodity or service as well as the prices of related goods and the tastes and desires of consumers do not change.

The price demand expresses relationship between prices and quantities and the income demand brings out the relationship between income and quantities demanded. For preparing demand schedule of income demand, we write incomes in one column and quantities purchased at these incomes in the second column. Superior goods or high-priced articles command brisk sales when income increases. On the other hand, inferior goods command large sales when incomes are at a lower level.

Cross Demand:

ADVERTISEMENTS:

Cross demand means the quantities of a good or service which will be purchased with reference to changes in the price not of this good but of other related goods. These goods are either substitutes or complementary good. A change in price of tea will affect demand for coffee. Similarly, if horses become sheep, demand for carriages may increase. In order to prepare demand schedule of this type of demand, we write prices of one commodity in one demand the quantities purchased of the other commodity in the second column.

Demand Schedule:

If we write down the different quantities that an individual or a group of individuals would buy at different prices, we get that individual’s or that group’s demand schedule. Thus, a demand schedule is a table or a chart which shows the quantities of a commodity demanded at different prices in a given period of time.

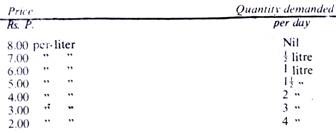

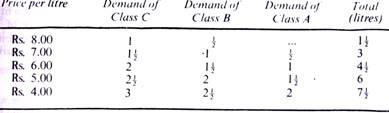

The following is the demand schedule of an imaginary consumer of milk:

ADVERTISEMENTS:

Market Schedule:

The above is the demand schedule of a particular individual. But we can also construct a market schedule showing the total quantity of milk demanded at different prices in a market by the whole body of consumers. We can divide them into three classes: ‘A’—with u monthly income up to Rs. 500, ‘B’—Rs. 501 to Rs. 1000 and “C”—above Rs. 1000. We can see how much will each class buy at each price, and then total them up

Difficulties in the Construction of a Demand Schedule:

It is difficult to frame the demand schedule of an individual. It is all hypothetical. An individual cannot positively say how much he would purchase it the prices were different. Some prices in the schedule are unreal. The price of milk may never be Rs. 8 or Re 1 per liter. What is the use of asking an individual how much he would by at these prices? To construct a market schedule is still more difficult. Market schedule is even more hypothetical.

ADVERTISEMENTS:

Practical Utility of a Demand Schedule:

It is not possible to construct a scientifically accurate demand schedule. But it is true that different quantities are bought at different prices.

The demand schedule is useful as follows:

(i) After all, businessmen do make an intelligent forecast of the quantity they could dispose of at higher or lower prices. Monopolists sometimes deliberately lower prices to stimulate demand. Businessmen would like to know the various quantities that are likely to be demanded at different prices. This would help them to forecast profits and to arrange production.

(ii) In order to find out the effect of different rates of taxes on the sale of a commodity, a Finance Minister has to get the help of demand schedules. The calculations may be rough, but they are all the same useful. Imposition of tax is bound to raise prices which would in turn reduce demand. The Government revenue will depend on how much is actually sold. Demand schedule is helpful in making these calculations.

Demand Curve:

ADVERTISEMENTS:

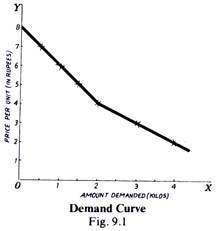

With the help of the demand schedule of an individual given above, we can draw the curve as shown on the previous page. The quantities are measured along OX and prices (in rupees) along OY.

When the price is Rs. 7.00 a liter, the consumer purchases only half a liter. We travel half a point on OX-axis and plot a point against the price of Rs. 7.00; we plot the other points in the same manner, and by joining these points we get the curve. Like the individual demand curve, we can also have a market demand curve by plotting the market demand schedule given above.

Why Demand Curves Slope Downwards:

Generally the demand curve slopes downwards. This is in accordance with the law of diminishing utility. The purchases of most of us are governed by this law. When the price falls, new purchasers enter the market and old purchasers will probably purchase more. Since this commodity has become cheaper, it will be purchased by some people in preference to other commodities.

Only in a curve of this slope shall we find shorter price lines cutting longer pieces in the quantity axis. If the law of diminishing utility is true—and it is generally true—the curve must slope downward, for only then the phenomenon of increasing demand with falling prices can be represented.

ADVERTISEMENTS:

These are the three obvious reasons why people buy more when the price falls:

(i) A unit of money goes farther and one can afford to buy more.

(ii) When a thing becomes cheaper one naturally likes to buy more.

(iii) A commodity tends to be put to more uses when it becomes cheaper. Thus, the old buyers buy more and some new buyers enter the market. The cumulative effect is an extension of demand when price falls. But let us go a bit deeper and try to find out why the demand increases when the price falls, other things being equal. Having a limited amount of money at his disposal, every consumer wants to get the maximum satisfaction out of it. Knowing his own scale of preferences he will, according to the law of substitution and equimarginal returns, so arrange his expenditure that he gets equal marginal utility from the last paisa that he spends in different ways.

He will keep to this arrangement if the prices remain the same. But if the price of a certain commodity included in his assortment of goods and services falls, then lie must make a corresponding alteration in his scheme of expenditure. By the fall in price, divergence has been created between the marginal utility and price and this must be rectified. This can be done by buying more of the cheaper commodity, thus bringing its marginal utility to the level of the price. That is why people buy more when the prices fall.

Substitution Effect, Income Effect and Price Effect:

ADVERTISEMENTS:

If the price of a commodity rises relatively to other goods, the consumer will buy less of that commodity and buy more of the other goods in place of this particular good. This is called Substitution Effect in Economics. Another reason for buying less of goods whose prices have risen is that raise in prices means a loss of purchasing power. It is as it were that the consumer’s income has come down. This is called the Income Effect.

This is, the consumer has become relatively poor or wane off since his real income (i.e., income in terms of goods) has fallen. When the price of a commodity falls, more of it is demanded and substituted for of the commodities and there is income effect too, for the purchaser feels better o when the price falls and is able to buy more.

The combination of the substitution effect and income effect is known as the price effect. This is the case with normal or ordinary goods. But if the goods are considered inferior, the effect will be opposite, i.e. less will be purchased even if the price falls. But if the substitution effect is greater than the negating income effect, the law of demand will apply even to inferior goods, i.e. demand will extend when price falls.

Exceptional Demand Curves:

Sometimes the demand curve, instead of sloping downwards, will rise onwards. In other words, sometimes people will buy more when the price rises. This can be represented only by a rising curve. Such occasions are very rare, but we can imagine some.

We can think of the following four cases:

(a) In case a serious shortage is feared, people may be in a panic and buy more even though the price is rising. They are anxious to avoid the necessity of having to pay a still higher price in future.

(b) When the use of a commodity confers distinction, then the wealthy will buy more when the price rises, to be included among the few distinguished personages. Conversely, people tend to cut their purchases, if they believe the commodity to be inferior.

(c) Sometimes people buy more at a higher price in sheer ignorance.

(d) If the price of a necessary of life goes up, the consumer has to readjust his whole expenditure. He may cut down his expenses on other food articles and, in order to make up, more may have to be spent on this particular food, more of which will, therefore, be purchased in spite of its high price.

These are a few cases in which demand curve will rise upwards instead of sloping downwards.