This article will help you to learn about the difference between individuals demand and market demand.

Difference between Individuals Demand and Market Demand

The demand schedule is a list of alternative price-quantity combinations. It shows the different quantities of a commodity that are likely to be demanded at alternative prices. According to R. G. Lipsey, the quantity demanded actually is a desired flow per period.

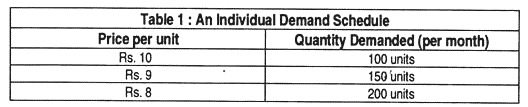

An individual demand schedule is a table showing how much of a commodity is purchased by an individual consumer at its different prices during a particular period of time. It shows that a consumer buys different quantities of an article at different prices.

It is constructed on the assumption that a person’s money income, tastes and preferences, etc., remain constant. Here, the only variable is the price of the commodity. The schedule does not indicate what the price is; it simply states the different quantities that are demanded at different prices.

ADVERTISEMENTS:

The following is an example of the Individual Demand Schedule:

When the price of a commodity (say, soap) is Rs. 10, a buyer wants to buy 100 units (per month); if the price is Rs. 8, he demands 150 units; and, if it is Rs. 8, his demand is 200 units. The above schedule shows that the demand for a commodity (i.e., soap) is high at a low price, and it is low at a high price.

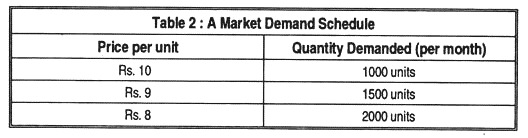

By aggregating sideways the individual demand schedules of all individual buyers in a market, we can prepare the market demand schedule. Such a schedule does not say what the price is; it simply shows how much of a commodity is purchased in a market by all the buyers at different prices.

ADVERTISEMENTS:

If there are 10 buyers and if they demand the commodity uniformly (not a realistic assumption), the market demand schedule will be as follows:

The above market demand schedule shows that at a price of Rs. 10 per unit (of soap), the market demand for the commodity is 1000 units (per month); at a price of Rs. 9, it is 1500 units, and at a price of Rs. 8, it is 2000 units.

It is to be noted that, it is not always possible to draw a market demand schedule for a commodity by aggregating sideways the individual demand schedules of all the buyers, as it is not likely that all of them will buy the same amount at a particular price. For this reason, it is almost impossible to prepare a market demand schedule. All that we can say is that, the quantity demanded of a commodity falls with a rise in its price and rises with price fall.