Let us make an in-depth study of the effect of tax rate change on disposable income and national income.

If tax rates change, the relationship between disposable income and national income changes.

As a result, the relationship between desired consumption expenditure and national income also changes.

For any given level of national income, there will be a different level of disposable income and thus a different level of consumption. Consequently, a change in tax rates will also cause a change in the marginal propensity to spend out of national income.

ADVERTISEMENTS:

Consider a decrease in tax rates. If the government decreases its rate of income tax so that it collects 5 paise less out of every Re. 1 of national income, then disposable income rises in relation to national income. Thus consumption also rises at every level of national income.

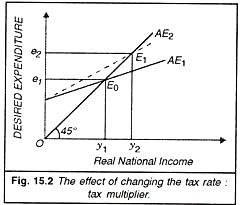

This results in a non-parallel upward shift of the aggregate expenditure (AE) curve. In other words, there is an increase in the slope of the AE curve as shown in the figure given below. The result of this shift will be a rise in equilibrium national income.

Tax Rates and the Multiplier:

We know that the simple multiplier is equal to the reciprocal of one minus the marginal propensity to spend. That is, the multiplier equals 1/ (1 – z), where z is the marginal propensity to spend out of national income. The simple multiplier tells us how much equilibrium national income changes when autonomous expenditure changes by Re 1 and there is no change in prices.

In the figure given above, changing the tax rate changes equilibrium income by changing the slope of AE curve. A reduction in tax rate pivots the AE curve from AE1 to AE2. The new curve has a steeper slope because the lower tax rate withdraws a smaller amount of national income from the desired consumption flow. Equilibrium income rises from Y1 to Y2, because at every level of national income, desired consumption and hence aggregate expenditure is higher. Therefore

Tax rate multiplier Kt = Y1Y2/∆t,

where ∆f is the change in tax rate.

When tax rates change, the multiplier also changes. Suppose that the MPC is 0.8 and the tax rate falls by 5 paise per rupee of national income. This would increase the marginal propensity to spend by 4 paise per rupee of national income. (Disposable income would rise by 5 paise per rupee at each level of national income and consumption would rise by the marginal propensity to consume, 0.8, times 5 paise which is 4 paise). The increase in the value of z, the marginal propensity to spend, would push up the multiplier, making equilibrium income more responsive to changes in autonomous expenditure from any source.

ADVERTISEMENTS:

We can conclude. The lower is the income tax rate, the larger is the multiplier. Thus, the lax multiplier concept has been used by some economists to justify reduction in the income tax rate to fight secular stagnation.