Let us make an in-depth study of the economic development of India through structural changes in national income.

By economic structure we mean interrelationship among different productive sectors—agriculture and allied activities, manufacturing and mining and trade and commerce.

The relationships among these sectors change gradually as economic development proceeds.

In other words, structural changes indicate economic development. In the course of economic growth, the high rates of increase in population and output have been associated with noticeable changes in the relative shares of various sectors in total output and in total resources used.

ADVERTISEMENTS:

Colin Clark viewed economic development through a triad of structural changes. Nations beginning as initial primary goods producers (agriculture and fishing) move to a higher level of development with the production of manufactured goods. The secondary stage comes through advancement in knowledge and skill.

With the concomitant material accumulation, nations then seek greater welfare through higher forms of culture and labour moves from a goods-orientation to a service-orientation. Contribution of this sector toward national product rises.

Representative of the tertiary stage is the growth’ in the transport, distribution and public administration sector. The highest levels of income are attained through non-material output.

The process of economic development as experienced by the developed nations is marked by three distinct phases: an early initial phase of the dominance of the primary sector, an intermediate phase dominated by industry and manufacturing and, a final phase dominated by the services sector.

ADVERTISEMENTS:

At its peak, the secondary sector’s contribution stood at around 50 p.c. of the total output in many of the developed countries. Later period showed its decline in contribution to one-fourth of the total output. Tertiary sector in these countries now contribute 70-75 p.c.

In the course of economic growth, the high rates of increase in population and output have been associated with noticeable changes in the relative shares of various sectors in total output and in total resources used.

Here we distinguish three major sectors: primary (agriculture, forestry, fisheries, hunting, mining and quarrying), secondary (manufacturing, construction, electricity, gas and water supply), and tertiary (trade, transportation, communication, finance, tourism, insurance and real estate). The subtotal of net value added of these three sectors constitute the Net Domestic Production (NDP) of an economy.

With the launching of the Five Year Plans, far-reaching changes in India’s economic structure involving more and more direct participation of the State have taken place. This is described below.

ADVERTISEMENTS:

First, as the pace of economic development quickens, the importance of primary sector towards its contribution to national income declines while secondary and tertiary sectors attain more prominence in terms of its contribution to national income. This sort of change in the sectoral distribution of national income has taken place in India during the planning period, thereby indicating economic development.

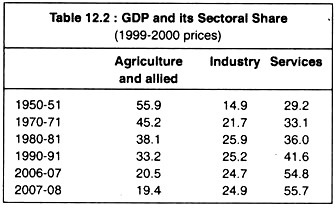

In 1950-51, the share of the primary sector in GDP was as high as 55 p.c., while it was 16.1 per cent for the secondary sector. There has been a steady decline in the share of primary sector in GDP and it declined to 19.4 p.c. in 2007-08. On the other hand, over the planning period, as the industrial sector expanded, its contribution towards GDP had been on the increase and it rose to 24.9 p.c. in 2007-08.

Along with the growth of the secondary sector, the service sector has also registered a higher growth during the last 58 years of planning. Table 12.2 shows that, compared to the secondary sector, the share of the tertiary sector (comprising mainly the service sector) improved much, from 29.2 p.c. in 1950- 51 to 55.7 p.c. in 2007-08.

The increase in contribution has been shared equally by the sub- sectors like transport, communication and trade, finance and real estate, community and personal services. The tertiary sector, whose present contribution is more than one-half of the GDP, grew at the rate of 6.8 p.c. p.a. in the 1990s and about 9 p.c. in 2000s.

Table 12.2 indicates the sectoral distribution of GDP during the period between 1950-51 and 2007-08.

The changing structure of national income, therefore, indicates industrialisation, albeit at a slow pace. Further, one also notices structural changes within the industrial sector. During the planning period, India’s industrial structure has undergone a change. Till the mid-1960s, India’s industrial structure tilted heavily in favour of capital goods industries. This, of course, is a sign of industrialisation. But, since then, industrial structure is heavily biased in favour of consumer goods industries which mainly cater to the needs of the rich urban population.

Again, among the industries, it is the organised manufacturing and mining industries that have fared well as compared with unorganised small enterprises. Still then, unregistered small and tiny sectors occupy a dominant position in the Indian economy as necessary supports to these industries are given by the Government.

The tertiary sector is not a homogeneous category. It indicates trade, transport and communications, banking and insurance, real estate and dwellings, public administration, community and personal services. The share of these heterogeneous activities rose from 29.2 p.c. in 1950-51 to 55.7 p.c. in 2007-08 at 1999-2000 prices. As a result of a better growth recorded in the tertiary sector, one sees a significant change, a “change from a subsistence to a market-oriented economy.” This suggests modernisation of the economy.

ADVERTISEMENTS:

Thus, over the period under discussion, the Indian economy today is now less geared to the primary sector and more attuned to the secondary and tertiary sectors. And between the last two sectors, the growth of the tertiary sector is remarkable. Such growth rate has become possible due to the employment of modern technology- intensive computers, automation, and telecommunications.

Coupled with this, one notices massive growth of informal sector both in rural and urban areas. Informal sector includes casual building labour, domestic servants, cottage industries not subject to licence, taxation, etc. This may be regarded from the development point of view as a progressive change in the structure of the Indian economy during this period.

However, these is a caveat. During the last 20 years or so, we see a steady decline of the agricultural sector while the share of industry remains somehow constant at around 24-25 p.c. But the share of tertiary sector is more than 55 p.c. “Such a large share for services in the total output at a relatively early stage of development is untypical—a trend that has prompted some economists to wonder if India has defied the conventional paradigm of economic development by ‘leapfrogging’ over the manufacturing sector by shifting directly from agriculture to services.”

Secondly, as regards structural change in the distribution of GDP between commodity and service sector, one finds a faster growth of the latter. Such a shift in favour of the service sector indicates modernisation. But the growth of the non- commodity sectors at the expense of the commodity sector does not augur well as far as structural changes are concerned.

ADVERTISEMENTS:

Finally, another aspect of India’s national income growth is the rise in contribution of the public sector in GDP. The contribution of the public sector in GDP rose from 10.7 p.c. in 1960- 61 to 20.8 p.c. in 1981-82 and to 24 p.c. in 2000- 01. This increase is attributed to the massive extension of government activities and their diversification. However, in 2005-06 the contribution declined to 11.12 p.c. of GDP.

On the basis of these national income trends and structural changes, we can conclude that the Indian economy can no longer be described as a typical underdeveloped country. Definitely some developments have taken place.

Most importantly, she is one of the great economic powers of the world. The growth model that the country has been pushing since 1991 is, thus, an exemplary one. Over the last four or five years her steady economic growth rate is only comparable with the neighbouring country- China.

However, this quantitative growth is not the only yardstick of development. Indicators of human development such as literacy and education, and maternal and infant mortality rates show steady improvement, but they also suggest that the progress is slow and we continue to lag behind many neighbouring Asian countries.