Let us make an in-depth study of the slow and fluctuating growth of national income in India.

Raising of national and per capita incomes has been one of the basic objectives of Indian planning. This is known as “growth objective.”

Despite some gains in this direction, freakish and erratic growth trends continue.

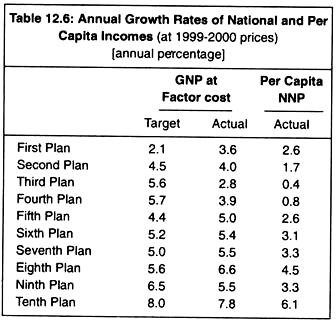

Above all, the growth rates are low and are less than those of some African countries. Table 12.6 highlights the slow and fluctuating growth trends of national and per capita incomes.

Growth of national income in the First Plan was well ahead of the target. Between Second and Fifth Plans, growth rate of national income fell below the targeted rate. The growth rate picked up marginally in later plans. Ninth and the Tenth Plan also exhibited an actual growth rate that remained below the target rate. However, not only actual growth rate was low but it also exhibited ups and downs.

For instance, both national income and per capita income dropped very sharply in the Third and Fourth Plans as compared to that in the Second Plan. Though both national and per capita incomes rose in the Fifth Plan, they again showed accelerating trends in the Sixth Plan. Tempo of higher growth rate has been maintained all along during the 1980s and 1990s.

From 1975 onwards, one finds a steady growth rate of national income at a rate of roughly 5.70 p.c. Year to year there may be fluctuations, but trend growth suggests a growth rate of more than 5 p.c. Thus, the growth of national and per capita income has never been uniform during the entire plan period. Now we will explain and analyse the reasons of slow and fluctuating trends of national income.

In the first place, the performance of the Indian economy is very much linked with the performance of the agricultural sector. When agricultural production suffers due to some accidental factors like flood or drought, India’s national income is bound to decline. This is happening even after 58 years of planning!

ADVERTISEMENTS:

If normal weather conditions prevail, a relatively higher growth rate could be struck. Thus, the dependence of the economy on agriculture does not only cause wide fluctuations in growth rate but also results in a slow growth. This dependence on agriculture must be liquidated so that stability in the growth rate could be maintained.

Secondly, population growth in India at a rate of slightly less than 2 p.c. per annum has resulted in a low per capita income. Resources for investment in productive sectors are now being diverted to feed extra mouths that are appearing in the economy every year. Consequently, standards of living have fallen and the number of people below the poverty line is on the rise.

Thirdly, the high capital-output ratio is also contributing towards slow growth of income. Capital-output ratio (K/O) is defined as the ratio of investment to change in output. If 5 rupees worth of capital or investment results in an addition of one rupee, then capital-output ratio (K/O) becomes 5: 1. In India, capital-output ratio has been rising at a faster rate which appears to be non-plausible and undesirable in the present context.

This ratio has been doubled to above 6.0 in the Sixth and Seventh Plans from 3.0 in earlier plans. This ratio hovered between 4 and 4 in the last three plans. This higher K/O has failed to result in an increase in income. Under-utilisation of capacity is one of the contributing causes of high K/O in India, though it is expected that the ratio would increase as economy advances and modernizes. Lack of demand, slowdown of public investment, inefficiency of management, industrial recession, etc., have all contributed towards low level of capacity utilisation.

ADVERTISEMENTS:

Fourthly, slowdown of public investment is another cause. Thus, the phenomenon of underinvestment has resulted in a small output growth of investment goods. Further, this has created various types of infrastructural bottlenecks, resulting in a low growth of various sectors. Above all, following the slowdown of public investment, investment in the private sector has been crowded out. That is to say, all these have led to the slow expansion of output in all the sectors of the economy.

Fifthly, power generation has an important bearing on economic activity. Terrific power shortage that has gripped the Indian economy has had a disastrous effect on agricultural and industrial output. Power supply has been deteriorating in most states and power shortages are becoming endemic and acute. The consequence of all these is the low growth rate as well as unstable growth rate of the Indian economy.

Finally, fluctuations in the international market as well as global recession have had an important bearing on the nation’s output.

What is clear from this discussion is that an unstable (virtually inherent) growth rate affects the average level of performance not just in terms of the volume of production but also in terms of quality of production in the sense that instability affects (i) income distribution, and (ii) price expectations.