The following points highlight the top three methods of calculating national income of a country. The methods are: 1. Production Method or Value Added Method 2. Income Census Method 3. Expenditure Method.

Method # 1. Production Method or Value Added Method:

To obtain national product figure of a country, we aggregate the money value of all final goods and services produced in a country in a year. The figure that we obtain is called GNP or GDP. [For the moment, we won’t make any distinction between these two concepts.

We will use them interchangeably.] The words ‘money value’ and ‘final’ require little elaboration. We cannot really add up the physical quantities of all goods and services produced in a year. It is meaningless to compute the sum of 10 Indica cars + 70 liters of kerosene oil + 50 meters of cloth +….

Thus we have to transform these physical quantities into money values by multiplying the quantity of each good produced multiplied by price per unit of each good. That is: price per car x 10 cars + price per litre x 70 liters of kerosene + … When this is done we get money value of all goods.

ADVERTISEMENTS:

The word ‘final’ deserves elaboration. Only final goods are to be taken into account. Intermediate goods are not to be used to compute national product to avoid the problem of multiple counting. Thus, the final goods approach to national income adds up the total money value of all final goods and services produced.

Instead of counting the value of final goods, one can adopt an alternative method and arrive at the same result. The alternative is the value added method in which we add up all the values at each stage of production. Value added method measures each firm’s own contribution to value added. Each firm’s value added is the value of its output minus the value of inputs that it purchases from other firms.

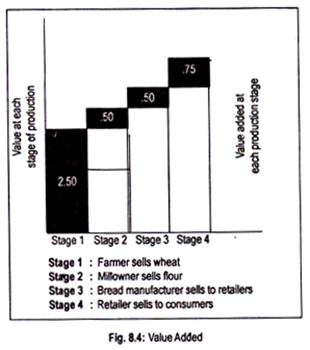

Thus, value added = firm’s revenue – costs of intermediate goods. In brief, value added is the increase in the value of goods as a result of the production process. To illustrate this, we consider an example in which bread-making (final good is the bread) involves the following stages of production shown in Fig. 8.4.

Suppose, a farmer sells wheat of Rs. 2.50 only to a flour mill owner. If the mill owner now sells flour to a bakery at Rs. 3.00 only, then the mill’s value added is 50 paisa only. Bread manufacturer then sells it to retailers at Rs. 3.50 only; therefore its value added is 50 paisa only.

ADVERTISEMENTS:

Retailer then sells bread to the consumers at Rs. 4.25 only. If all these value added to intermediate stages of production are summed up (i.e. Rs. 2.50 + .50 + .50 + .75), the price of bread becomes Rs. 4.25 only. The value added is just equal to the value of final bread.

GNP is thus measured by calculating the value added at every stage of production: GNP = sum of value added of all firms.

ADVERTISEMENTS:

Some Precautions:

While computing GNP or GDP, one has to take certain safeguards:

i. Avoiding Double Counting:

While calculating GNP/GDP one must avoid double counting since outputs of some firms are inputs of others. For this, either value added at each stage of production needs to be recorded or only final goods, not intermediate goods, are to be taken into account.

Note that final goods (such as consumer goods, capital goods) are purchased or consumed by the final users (i.e., both consumers and firms). As intermediate goods are partly final goods which form inputs to another firm’s production process, these are not included in national income accounting.

ii. Current Year’s Output Only:

Value of goods and services produced in the current year is to be reported. If the value of goods and services produced in the earlier years or second-hand goods are taken into account, we would then either overestimate or underestimate the value of the country’s total output.

iii. Self-Provided/Produced Goods:

There are some goods and services that do not come to the market for transactions. Should these non-marketed products and services be excluded from the GNP estimate? In poor agriculture-dominated countries, a large portion of the agricultural output is consumed by the farmers themselves. In fact, there does not arise any surplus left after consumption.

In other words, production virtually equals consumption. This is called subsistence agriculture. Thus, agricultural commodities are not exchanged for money. The commodities which do not have market valuations must be imputed at current prices. In other words, these are to be valued at resource cost—the cost of the resources required to produce these goods and services.

Such is true in the case of services received from owner-occupied housing. In this case what is required is the imputation of rent— the amount which the house-owners would have had to pay if they were in rented houses, even though no such rents are actually paid. Likewise, free lunch coupon issued to workers is to be valued at current market prices to estimate GNP.

ADVERTISEMENTS:

However, the value of a husband’s services or a housewife’s performance in preparing meals and other household activities—though an important economic activity—are not considered here because of the practical difficulty of valuing such activity. That is why these are unpaid activities.

But, public goods and services e.g. park and defence, do not have market price since these are not bought and sold in the market. However, we cannot exclude these commodities from the GNP estimate. To tackle this problem, values are imputed for these services. GNP includes these services by valuing them at their cost.

iv. Quality of the Product:

GDP data do not take into account improvement in the quality of the product. The quality of car manufactured in 1999 has improved definitely in the current year. Same is true about electronic goods. But these are not taken into account while measuring national product.

v. Environmental Hazards:

Environmental costs are ignored at the time of measuring national product. It is pointed out that GDP figures do not make any distinction between green and polluting industries. Social welfare is thus not reflected in GDP figures.

vi. Exports and Imports:

ADVERTISEMENTS:

While using output method as a method of measuring national income, we must take into account those goods and services that go out of the country and move in the country. In the four-sector circular flow model, we have seen that a nation’s entire output is not consumed domestically.

Part of these goods is exported outside the country. The value of such exports needs to be added. Likewise, a country imports many things from outside the country. Since this constitutes outflow, the value of imports needs to be subtracted from the output figures.

Method # 2. Income Census Method:

Instead of concentrating on output data, now we use income figures to obtain a measure of output. This method of calculating GNP involves measuring the income generated by selling output. By selling outputs, firms earn revenue. This revenue is utilized for the payment of rent, interest, wage, indirect tax payments as well as for buying inputs and enjoys what is left-over as profits.

Revenue = rent + interest + wage + costs of intermediate inputs + indirect taxes + profit

ADVERTISEMENTS:

If costs of intermediate goods are deducted from revenue we obtain value added. Thus, value added = rent + interest + wage + indirect taxes + profit

Since the value of GNP is equal to the sum of the value added of all firms operating, GNP must also equal the sum of all payments, i.e.,

GNP = rent + interest + wage + indirect taxes + profit

This means that GNP is the sum of all payments to the input owners plus government revenue from indirect taxes.

Or national income is the sum of the values earned by each factor of production— land, labour, capital and entrepreneurship. The measures derived are comparable to those obtained from the product side of the accounts. Since GNP is the sum of all values added, it must also be the aggregate of all incomes subdivided into rent, wages, interest, and profit, plus indirect taxes.

Some Precautions:

ADVERTISEMENTS:

While measuring national product as a flow of incomes we must take into account the following factors to have an accurate estimate of national income:

i. Transfer Payments:

In the first place, national income accountants consider only those incomes that arise from the current production of final goods and services. Thus, some incomes are excluded. The principal exclusion is transfer payments that include unemployment allowance, retirement pensions, flood or drought relief, etc.

Transfer payments are the payments for which no direct service is rendered by the beneficiaries. As these payments involve no exchange of goods and services and only incomes are redistributed from one pocket to another, these transfer payments are not included in the GNP.

ii. Capital Gains and Windfall Gain:

Capital gains arising out of asset transactions are excluded from GNP. If the sale price of a house exceeds its purchase price, a situation of capital gains emerges. Such gains are coincidental. Any such gain may lead to a rise in personal incomes but not national income since there is no economic production. Similarly, any windfall incomes (i.e., incomes from lottery, word puzzle) are not included in GNP.

It is thus clear that although most of national income (NI) is received by households as their personal income (PI), NI and PI are not exactly the same. For instance, profits retained by companies are included in NI but individuals do not get these as profit of their incomes.

iii. Self-Owned Inputs:

Owner’s own capital and labour required to produce goods may create problem while estimating national income. Even if no money is paid for these self-owned input services, an imputed value is assigned to each of all these and included in national income. Likewise, undistributed corporate profits are included in national income estimation.

iv. Illegal Earnings:

ADVERTISEMENTS:

Though illegal activities like gambling may provide a great deal of income to the gamblers, they are excluded from the accounts even though a market price is charged for these activities.

v. NGO Activities:

Voluntary work by social institutions, NGOs, etc. are not recorded in national income statistics. In recent years, activities of these institutions have expanded phenomenally. For instance, environment- related or health-related voluntary organizations are doing remarkable jobs but, in the official statistics, their contributions are ignored. This result in underreporting of the value of output produced in a country.

vi. Net property Income from Abroad:

GNP is a broader concept than GDP. GNP takes into account net property income from abroad plus GDP. To arrive at the figure of either GNP or NNP from the GDP, it is necessary to add net property income from abroad.

Method # 3. Expenditure Method:

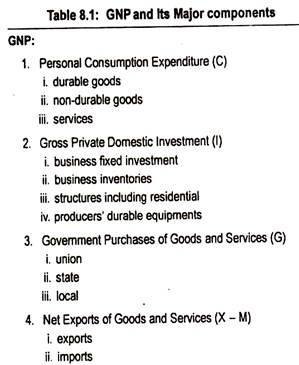

The third or final approach is to add up all expenditures on final goods and services. In fact, this approach is another way of calculating the value of final goods of the economy. This approach considers where those goods go. There are four possibilities— some final goods are consumed by individuals, some are used by firms, some are purchased by the government, and some of them go abroad.

In a two-sector economy consisting of consuming sector and producing sector, total expenditure is divided into consumption spending (symbolized by C) and investment spending (symbolized by I). ‘C’ includes expenditure on all types of goods (both durable and non-durable) and services produced and sold.

ADVERTISEMENTS:

‘I’ is defined as the expenditure on newly produced capital goods acquired for the purpose of providing services in the future. It includes investment in fixed capital formation, stock building and residential housing.

Again, investment may be gross or net. Net investment is obtained by subtracting depreciation expenditure or capital consumption allowance from gross investments.

Thus,

GNP = C + I

If we now consider a three-sector economy (i.e., a closed economy) that includes governmental sector, then GNP from the national expenditure side becomes

GNP = C + I + G

ADVERTISEMENTS:

G’ consists of expenditures on goods and services provided by the government. However, not all government expenditures are included in the GNP accounts. Expenditure on government transfer payments (e.g., unemployment benefit, welfare grants, interest on national debt, etc.) are excluded.

The fourth category of expenditure in a four-sector economy, i.e., an open economy, arises from international trade.

Here we will now include export (symbolized by X) and exclude imports (symbolized by M). Market value of all exportable goods should be included in national income. But market value of all imported final goods and services are to be subtracted from the GNP figure. This is because national income figures of any country must not reflect the contribution of foreign nationals.

Thus, in an open economy,

GNP = C + I + G + (X-M)

This equation is called an identity. By definition, thus, GNP equals consumption plus investment, plus government expenditures, plus net exports.