The upcoming discussion will update you about the differences among GNP, NNP and Disposable income.

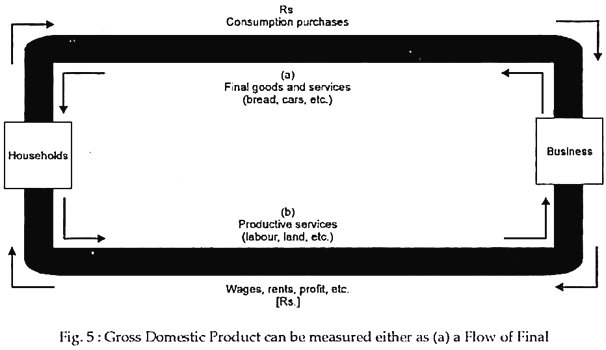

We can measure ‘GNP’ in two different ways. As Fig. 5 shows, GNP can be measured either as a flow of products or as a sum of earnings.

In the upper loop, people spend their money on final goods. The total dollar flow of these each year is one measure of gross domestic product. The lower loop measures the annual flow of costs of output: the earnings that businesses pay out in wages, rent, interest, dividends, and profits.

The two measures of GDP must always be identical. This figure is the macroeconomic counterpart of Fig. 5, which is presented the circular flow of supply and demand.

ADVERTISEMENTS:

In short, GDP, or gross domestic product, can be measured in two different ways:

(1) as the flow of final products, or

(2) as the total costs or earnings of inputs producing output. Because profit is a residual, both approaches will yield exactly the same total GDP.

ADVERTISEMENTS:

Net domestic product (NDP) equals the total final output produced within a nation during a year, where output includes net investment or gross investment less depreciation:

NDP = GDP – depreciation

Gross national product (GNP) is the total final output produced with inputs owned by the residents of a country during a year.

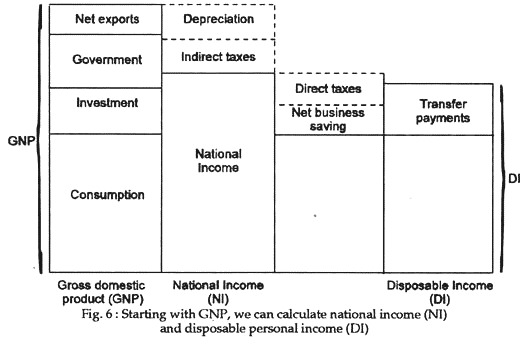

In Fig. 6, starting with GNP, we can calculate national income (NI) and disposable personal income (DI).

Important income concepts are:

(1) GDP, which is total gross income to all factors;

(2) National income, which is the sum of factor incomes and is obtained by subtracting depreciation and indirect taxes from GDP; and

(3) Disposable personal income, which measures the total incomes, including transfer payments, but less taxes, of the household sector.

Adding up GNP:

When the compensation of employees, proprietors’ income, rental income, corporate profits and net interest are all added national income is obtained. The national income however is smaller than GNP. To understand why national income is smaller than GNP, let us reconsider the Rs.10, 700 that we paid for a new car. This amount is a business income. Not all business income is distributed as earned income to the suppliers of resources used in production.

There are three components of business income that do not reach individuals as earned income. One is the capital consumption allowance set aside by businesses to replace wearing capital goods. Another is the amount of business transfer payments that businesses subtract from total revenue before computing profits.

Business transfer payments are payments made by businesses to persons who perform no current services. Business transfer payments are not a national income, since national income is the sum of all earned incomes only. Business transfer payments include corporate gifts to non-profit institutions such as charities and colleges, liability payments for personal injury, and defaults by consumers on debts owed to business.

The third component is the amount of tax liabilities that business collect from consumers for government or can charge as business expenses in the calculation of business profits. These payments to the government are known as indirect business taxes, and include sales tax, excise tax, and property tax. These payments are indirect because consumers pay to the government indirectly through business, and they are business taxes because it is businesses that actually submit them to the government.

ADVERTISEMENTS:

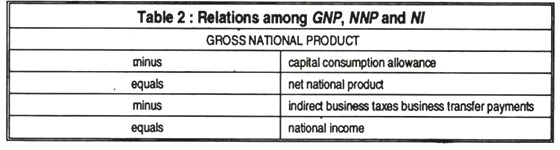

A concept called the net national product bridges the gap between national income and GNP. The net national product is obtained by subtracting capital consumption allowance from gross national product. National income is obtained by subtracting indirect business taxes and business transfer payments from net national product. The relations among GNP, net national product and national income are shown in Table 2.

National Income Concepts: A Summary:

Let us summarise all major national income concepts and their relations to one another.

ADVERTISEMENTS:

Equations for gross national product (NNP) and national income (NI) are:

GNP = C + I + G + (X – M) (1)

NNP = GNP – D (2)

NI = NNP – IBT – BTP (3)

ADVERTISEMENTS:

where,

C = personal consumption expenditures

I = gross private domestic investment

G = government expenditures on goods and services

X – M = net exports

D = depreciation

ADVERTISEMENTS:

IBT – indirect business taxes

BTP = business transfer payments

National income (NI) may also be obtained by adding all earned in- comes, mat is,

NI = compensation of employees

+ proprietors’ income

+ rental income of persons

ADVERTISEMENTS:

+ corporate profits

+ net interest income (4)

Finally, personal income (PI) and disposable income (DI) are related to national income in the following way:

PI = NI

– corporate profits

– net interest income

ADVERTISEMENTS:

– contribution for social insurance + dividends

+ personal interest income

+ government transfer payments

+ business transfer payments (5)

DI = PI

– personal taxes (6)

ADVERTISEMENTS:

DI = personal consumption expenditures

+ personal saving (7)