The following points highlight the four important concepts of national income. The concepts are: 1. GDP and GNP 2. GDP at Market Price and GDP at Factor Cost 3. NNP 4. Personal Income.

National Income: Concept # 1. GDP and GNP:

GDP measures the aggregate money value of output produced by the economy over a year. In other words, GDP is obtained by valuing all final goods and services produced domestically in a year at market prices. GDP is also calculated by adding all the incomes generated by the act of production.

Since only domestically produced goods and services is estimated, we use the word ‘domestic’ to distinguish it from the gross national product. The word ‘gross’ means that no deduction for depreciation is allowed.

GNP includes GDP plus net property income from abroad. Thus, GNP includes income that nationals earn abroad, but it does not include the income earned by foreign nationals. On the other hand, GDP is concerned with incomes generated domestically even by the foreigners. GDP ignores incomes received from abroad.

ADVERTISEMENTS:

It is a measure of the goods and services produced within the country, regardless of who owns the assets. And, GNP is the total of incomes earned by the residents of a country, regardless of where the assets are located. India’s GNP includes profits from Indian- owned businesses located in other countries.

In other words,

GNP = market value of domestically produced goods and services + incomes earned by the nationals in foreign countries — incomes earned in the country by the foreigners.

GDP = market value of goods and services produced in the country + incomes earned in the country by the foreigners — incomes received by resident nationals from abroad.

ADVERTISEMENTS:

An example will help our understanding. Suppose, an Indian doctor goes to the USA temporarily to work there. The income he earns by rendering his service in the USA is included in the US GNP and not India’s GDP because it is earned in the USA.

But this income is not part of the US GDP because the Indian doctor is a foreign national there. Similarly, the income of a US ambassador in New Delhi is included in the US GNP, but it is a part of India’s GDP. Thus,

GNP = GDP + net property income from abroad

Thus GDP measures the aggregate money value of all goods and services produced by factors of production located and paid for in the domestic economy, even if these factors are owned abroad.

National Income: Concept # 2. GDP at Market Price and GDP at Factor Cost:

When national product is measured, it is measured at current market prices. Market prices always reflect taxes and subsidies on the commodities produced. If indirect taxes are imposed on commodities, market prices of the commodities go up. A 10 p.c. tax on a book on economics will raise its price.

ADVERTISEMENTS:

Tax is included in the price of a commodity and tax is not a production. Similarly, subsidies are provided to some commodities, as a result of which prices decline. If we do not make any adjustment for such taxes and subsidies, we obtain GDP at market price.

GDP at market prices does not reflect true incomes of factors of production. It includes taxes and subsidies but such are not production and, hence, they cannot be treated as incomes of productive inputs.

So, taxes and subsidies are to be excluded and included to obtain the true figure of production. Value of output can never be equal to the value of incomes paid to all productive inputs. By adjusting taxes and subsidies, we obtain GDP at factor cost, i.e.,

GDP at factor cost = GDP at market price – indirect taxes (T) + subsidies (SU)

An example may be given here. Suppose, an excise duty on Nano car has been imposed.

As a result of this, price of the car goes up to Rs. 1.75 lakh (Rs. 5 thousand being the excise duty). Value of the car output is, in fact, Rs. 1.70 lakh. This means different factor inputs have earned incomes in the form of rent, wages, etc., to the extent of Rs. 1.70 lakh. Value of output must equal the value of incomes generated. Thus, indirect taxes are to be excluded.

Subsidies have the opposite effect of taxes. A subsidy per unit of coarse cotton cloth has the effect of reducing its market price. As a result of, say, one rupee subsidy per meter, consumers get the cotton cloth at Rs. 20 per meter.

But incomes received by the input owners in this cloth mill are Rs. 21 per meter. Value of output must equal the value of all incomes. So, subsidies are to be added. Thus, by subtracting taxes and adding subsidies from GDP at market price, one obtains GDP at factor cost.

ADVERTISEMENTS:

GNP at market prices and GNP at factor cost are calculated in the same way as described above:

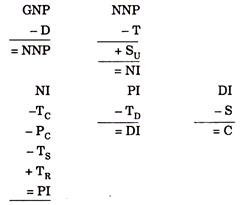

NI = NNP – T + SU

Or, NI = (GNP – D) – T + SU

National Income: Concept # 3. NNP:

If we deduct depreciation from gross product we obtain net product. GDP minus depreciation is called NNP. NNP is sometimes called national income.

ADVERTISEMENTS:

Anyway, to measure NNP, we must make a distinction between gross investment (IG) and net investment (IN). Gross investment refers to total expenditure for new plant, equipment, etc., plus the change in inventories. Net investment is equal to gross investment less depreciation.

That is,

IN = IG – depreciation

Since, GNP = C + IG + G + (X – M),

ADVERTISEMENTS:

NNP = C + IN + G + (X – M)

Or, NNP = GNP – depreciation

Although NNP gives us the better measure of an economy’s performance, we pay more attention to GNP. This is because estimation of NNP is difficult in practice, as one has to measure depreciation to obtain the net investment figure. In practice, GNP is the more commonly used indicator than NNP.

National Income: Concept # 4. Personal Income:

Although national income is the sum total of all individuals’ personal income, it is observed that received income is smaller than the earned income. This is because first a company has to pay corporate income tax (TC) to the government out of its earned income. Secondly, firms keep a portion of their profits for internal expansion.

This is called undistributed corporate profit (PC) or retained earnings. Thirdly, individuals pay social security taxes (TS), like provident fund, life insurance premium, etc. Finally, since government transfer payments (TR) do not reflect current earnings and, hence, are not included in national income, it increases received income.

To measure personal income (PI), we subtract TC, PC, and TS (i.e., all the components of income that is earned but not received) from NI and add TR (i.e., income received but not earned) from national income. Symbolically,

ADVERTISEMENTS:

PI = NI – (TC + PC + TS) + TR

We can summarize this discussion in the following form:

Here, TD refers to direct tax, DI to disposable income, S to saving, and C to consumption.