National income is the total money value of goods and services produced by a country in a particular period of time.

The duration of this period is usually one year. National income can be defined by taking three viewpoints, namely production viewpoint, income viewpoint, and expenditure viewpoint.

Based on these viewpoints, there are three different methods of estimating national income, which are shown in Figure-1:

For calculating national income-, an economy is looked upon from three different angles, which are as follows:

ADVERTISEMENTS:

1. Production units in an economy are classified into primary, secondary, and tertiary sectors. On the basis of this classification, value-added method is used to measure national income.

2. Economy is also viewed as a combination of individuals and households owing different kinds of factors of production. On the basis of this combination, income method is used for estimating national income.

3. Economy is viewed as a collection of units used for consumption, saving, and investment. On the basis of this collection, final expenditure method is used for calculating national income.

ADVERTISEMENTS:

Let us discuss the different methods of measuring national income (as shown in Figure-1).

1. Value-added Method:

Value added method, also called net output method, is used to measure the contribution of an economy’s production units to the GDPmp. In other words, value-added method measures value added by each industry in an economy. For calculating national income through value-added method, it is necessary to first calculate gross value added at market price (GVAmp), net value added at market price (NVAmp), and net value added at factor cost (NVAfc).

These can be calculated as follows:

ADVERTISEMENTS:

(i) GVAmp:

Refers to the value of output at market prices minus intermediate consumption. The value of output can be calculated by multiplying quantity of output produced by a production unit during a given time period with price per unit. For instance, if output produced by a production unit in a year is 10000 units at price Rs. 10 per unit, then the total value of output would be 100000.

The value of output is also calculated as:

Value of output = Total Sales + Closing Stock – Opening Stock

Where

Net change in stock = Closing Stock – Opening Stock

Glossing stock includes the value of unsold output in the previous year and forms the opening stock of the current year. Thus, by deducting the opening stock from the closing stock, unsold output of the current year can be calculated.

On the other hand, intermediate consumption refers to the value of non-durable goods and services purchased by a production unit from another production unit in particular period of time. These goods and services used up or resold during that particular period of time.

So, GVAmp can be calculated using the following formula:

ADVERTISEMENTS:

GVAmp = Value of Output Intermediate Consumption

The word gross in GVAmp indicates the inclusion of depreciation.

(ii) NVAmp:

Excludes depreciation from GVAmp. In other words, NVAmp is GVAmp minus depreciation.

ADVERTISEMENTS:

(iii) NVAfc:

Refers to another measure of value added.

It is calculated as:

NVAfc = NVAmp Indirect Taxes + Subsidies

ADVERTISEMENTS:

Or

NVAfc = GVAmp Depreciation Indirect Taxes + Subsidies

Now, using the value-added method, we aim to calculate national income (NNPfc).

The following are the steps to calculate national income using the value-added method:

1. Classifying the production units into primary, secondary, and tertiary sectors.

2. Estimating Net Value Added (NVAfc) of each sector.

ADVERTISEMENTS:

3. Taking the sum of NVAfc of all the industrial sectors of the economy. This will give NDPfc.

ΣNVAfc = NDPfc

4. Estimating NFIA and adding it to NDPfc, which gives NNPfc (national income).

NDPfc + NFIA = National Income (NNPfc)

The following are the precautions that should be taken into consideration while calculating national income using the value-added method:

i. Avoiding double counting of output as it leads to the overestimation of national income. For example, a farmer produces 5 kilograms of wheat worth Rs. 10000. He sells this wheat to a baker who uses it for making breads. The baker further sells these breads lo a grocer for Rs. 20000. Finally, the grocer sells these breads to consumers for Rs. 25000.

ADVERTISEMENTS:

Thus, the total output of the farmer, baker, and grocer would be Rs. 55000. However, this cannot be taken as the value of actual physical output. This is because it includes the value of wheal three times and value of bread two times. The double counting can be avoided by two measures. First is by taking the total value added instead of taking the total output.

In the above example, the value added by farmer is nil, by the baker is Rs. 10000, and by the grocer is Rs. 15000. Thus, the sum total of value added is Rs. 25000. Second is by taking the value of final products only. Final products are those which are purchased for consumption and investment. In the above example, the final product is bread sold to the consumers for Rs. 25000. Thus, the final output is Rs. 25000.

ii. Including output produced by production units for self-consumption in total output. All the production should be included whether u is sold in the market or not. In addition, the value of free services provided by government and non-profit institutions should also be taken into account. Non-inclusion of these will lead to underestimation of national income.

iii. Avoiding the inclusion of sales of pre-owned goods. This is because these goods are already counted when sold for the first time. The output of only newly produced goods is included in total output. However, the value of services provided by agents in selling pre-owned goods is fresh output and should be included in the total output.

2. Income Method:

Income method, also known as factor income method, is used to calculate all income accrued to the basic factors of production used in producing national product. Traditionally, there are four factors of production, namely land, labor, capital, and organization. Accordingly there are four factor payments, namely rent, compensation of employees, interest, and profit. There is another category of factor payment called mixed income.

ADVERTISEMENTS:

These factor payments are explained as follows:

(a) Rent:

Refers to the amount payable in cash or in kind by a tenant to the landlord for using land. In national income accounting, the term rent is restricted to land and not to other goods, such as machinery.

In addition to rent, royalty is also included in national income which is defined as the amount payable to landlord for granting the leasing rights of assets that can be extracted from land, for example, coal and natural gas.

(b) Compensation of Employees:

Refer to the remuneration paid to employees in exchange of services rendered by them for producing goods and services.

ADVERTISEMENTS:

Compensation of employees is divided into two parts, which are as follows:

(i) Wages and salaries:

Include remuneration given in the form of cash to employees on a daily, weekly, or monthly basis. It includes allowances, such as conveyance allowance, bonuses, commissions, rent-free accommodation, loans on low interest rates, and medical and educational expenses.

(ii) Social security contribution:

Includes remuneration provided to employers in the form of social security schemes such as insurance, pensions, and provident fund.

(c) Interest:

Refers to the amount payable by the production unit for using the borrowed money. Generally, production units borrow for making investment and households borrow for meeting consumption expenditure.

In national income accounting, interest is restricted to the payment by production units. If production units use their own savings, then the interest is payable to them in the form of imputed interest.

(d) Profits:

Refers to the amount of money earned by the owner of a production unit for his/her entrepreneurial abilities. The profits are distributed by the production unit under three heads. First is by paying income tax, called corporate profit tax.

Second is by paying dividend to shareholder. Third is the retained earnings called undistributed profits. Thus, profit Is the sum total of corporate profit tax, dividend, and retained earnings.

(e) Mixed Income:

Refers to earnings from farming enterprises, sole proprietorships, and other professions, such as medical and legal practices. In these professions, owners themselves assume the role of an entrepreneur, financier, worker and landlords. Mixed income also takes into account the income of those individuals who earn from different sources, such as wages rents on own property, and interests on own money.

Therefore,

National Income Rent + Wages + Interest + Profit + Mixed Income

Now, let us discuss steps involved in estimating national income using the income method.

These steps are as follows:

1. Classifying the production units into primary, secondary, and tertiary sectors.

2. Estimating Net Value Added (NVAfc) of each sector. The sum total of the factor payments equals NVAfc.

3. Taking the sum of NVAfc of all the industrial sectors of the economy. This will give NDPfc.

ΣNVAfc = NDPfc

4. Estimating NFIA and adding it to NDPfc, which gives NNPfc (national income).

NDPfc + NFIA = National Income (NNPfc)

The following are the precautions that should be taken into consideration while calculating national income using the income method:

a. Including the imputed value of factor services rendered by the owners of production units themselves. For example, if production units use their own savings for production, then the interest is payable to them in the form of imputed interest. This imputed interest should be added in the calculation of national income.

b. Avoiding the inclusion of transfer payments, such as gifts, donations and taxes.

c. Excluding the gains that arise from the sales of pre-owned goods. These gains are called capital gains.

d. Excluding the income arising from sale of financial assets, such as shares and debentures. This is not related to the production of goods and services. However, national income includes the value of services rendered by the agents in selling these financial assets.

3. Final Expenditure Method:

Final expenditure method, also known as final product method, is used to measure final expenditures incurred by production units for producing final goods and services within an economic territory during a given time period.

These expenditures are incurred on consumption and investment. This method is the opposite of the value-added method. This is because value-added method estimates national income from the sales side, whereas the expenditure method calculates national income from the purchase side.

Final expenditure of an economy is divided into consumption expenditure and investment expenditure, which are explained as follows:

(a) Consumption Expenditure:

Includes the following:

(i) Private Final Consumption Expenditure (PFCE):

Includes expenditure incurred by households and expenditure incurred by private non-profit institutions serving households (PNPISH). Thus, PFCE is divided into two parts, namely Household’s Final Consumption Expenditure (HFCE) and PNPISH Final Consumption Expenditure (PNPISH-FCE).

HFCE is defined as expenditures, both actual and imputed, incurred by a country’s households on final goods and services for satisfying their wants. In addition to actual money expenditure, HFCE includes imputed value of goods and services received without incurring money expenditure, for example, self-consumed output and gifts received in kind.

Expenditure by non-residents of a country is not included in HFCE. However, the expenditure incurred by the national residents in foreign countries is included in HFCE. Thus, imports are the part of HFCE. In addition, HFCE excludes the receipts from the sale of pre-owned goods, wastes, and scraps.

HFCE can be calculated with the help of the following formula:

HFCE = Money expenditure on consumption by residents + Imputed value of consumer goods and services received in kind by residents – Sale of pre-owned goods, wastes, and scraps

On the other hand, PNPISH includes expenditure incurred by private charitable institutions, trade unions, and religious societies, which produce goods and services to be supplied to consumers either free or at token prices.

PNPISH-FCE = Imputed value of goods and services produced Commodity and non-commodity sales

Commodity sales imply the sale at a price that covers cost, while non-commodity sales imply the sale at a price that does not cover cost.

(ii) Government Final Consumption Expenditure (GFCE):

Includes expenditure that is incurred by government for providing free goods and services to citizens. GFCE is equal to value of output minus sales (GFCE = Value of Output – Sales).

The value of output is calculated as:

Value of output generated by government = Compensation of government employees + purchases of commodities and services + consumption of fixed capital

Sales by government = Commodity Sales + Non- Commodity Sales

(b) Investment Expenditure:

Involves expenditure incurred on capital formation. This expenditure is known as Gross Domestic Capital Formation (GDCF).

There are three components of GDCF, which are as follows:

(i) Acquisition of fixed capital assets:

Implies purchasing assets, such as building and machinery.

(ii) Change in stocks:

Involves making addition to the stock of raw materials, semi-finished goods, and finished goods.

(iii) Net acquisition of valuables:

Involves acquisition of valuables minus disposal of valuables. These valuables include precious stones, metals, and jewellery.

GDCF becomes net when it is diminished by depreciation.

Net GDCF = GDCF – depreciation

GDCF is subdivided into Gross Domestic Fixed Capital Formation (GDFCF) and change in stocks.

Now, let us discuss steps involved in estimating national income using final expenditure method.

These steps are as follows:

1. Classifying the production units into primary, secondary, and tertiary sectors.

2. Estimating the final expenditures on goods and services by industrial sectors. These expenditures are PFCE, GFCE, and GDCF. The expenditure also includes net exports, which are equal to exports minus imports.

3. Taking the sum of the final expenditures which gives GDPmp.

GDPmp = PFCE + GFCE + GDCF + Net Exports

4. Estimating the consumption of fixed capital and net indirect taxes to calculate NDPfc.

NDPfc = GDPmp – Consumption of Fixed Capital- Net Indirect Taxes

5. Adding NFIA to get national income (NNPfc)

NDPfc +NFIA = NNPfc

The following are the precautions that should be taken into consideration while calculating national income using the final expenditure method:

a. Excluding the intermediate expenditure as it is already a part of final expenditure

b. Including the imputed expenditure incurred for producing goods for self-consumption

c. Excluding the expenditure incurred on transfer payments

d. Excluding expenditure incurred on financial assets, such as shares and debentures

e. Excluding the expenditure incurred on pre-owned goods

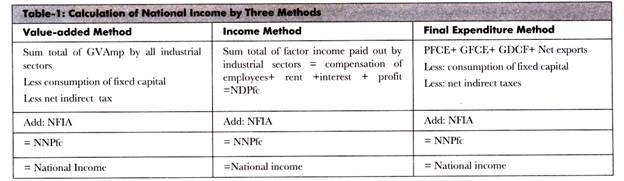

Table-1 shows the summarize calculation of national income by three methods: