Learn about the interrelationships among different concepts of national income.

1. Gross National Product (GNP) = Gross National Expenditure (GNE)

2. Gross Domestic Product (GDP) = GNP – Net Income from abroad

3. GNP at Market Prices = GNP at Factor Cost + Indirect Taxes – Subsidies

ADVERTISEMENTS:

4. NNP at Market Prices = GNP at Market Prices – Depreciation or Capital Consumption Allowance

5. Net Domestic Product = NNP at Market Prices – Net Factor

6. NNP at Factor Cost or National Income or National Product = NNP at Market Prices – Indirect Taxes Subsidies

7. NDP at Factor Cost or Domestic Income or Domestic Product = National Income – Net Factor Income from abroad

ADVERTISEMENTS:

8. Private Income = NNP at Factor Cost + Government and Business Transfer Payments + Current Transfers from abroad in the form of Gifts and Remittances + Windfall Gains + Net Factor Income from abroad + Interest on Public Debt and Consumer Interest – Social Security Contributions – Income from Government Departments and Property – Profits and Surpluses of Public Corporations (or Undertakings)

Or

= Income from Domestic Product accruing to Private Sector + Interest on Public Debt + Net Factor Income from abroad + Transfer Payments + Current Transfers from the rest of the world (or abroad)

9. Income from Domestic Product accruing to Private Sector = NDP at Factor Cost – Income from Domestic Product accruing to Government Departments – Saving of Non-Departmental Enterprises

ADVERTISEMENTS:

10. Personal Income = Private Income – Saving of Private Corporate Sector (or Undistributed Corporate Profits) – Corporation Tax (Or Profit Taxes)

11. Personal Disposable Income or Disposable Income = Personal Income – Direct Taxes paid by Households (or Direct Personal Taxes) and Miscellaneous Fees, Fines, etc.

Or

= NDP at Factor Cost + Transfer Payments + Payments + Net Factor Income from abroad – Corporation Tax – Undistributed Corporate Profits – Social Security Payments – Direct Personal Taxes

Or

= National Income at Factor Cost + Transfer Payments + Net Income from abroad – Corporate Tax – Undistributed Corporate Profits – Social Security Payments – Direct Personal Taxes – Indirect Taxes + Subsidies

Some solved problems:

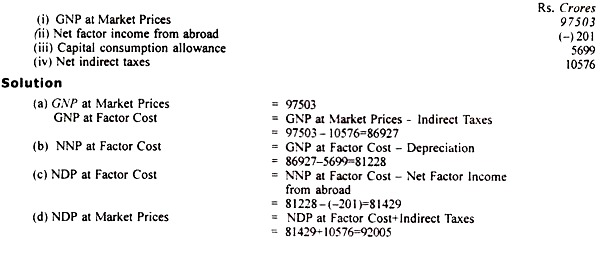

1. From the data pertaining to the Indian Economy given below, calculate (a) GNP at Factor Cost, (b) NNP at Factor Cost, (c) Net Domestic Product at Factor Cost, and (d) Net Domestic Product at Market Prices.

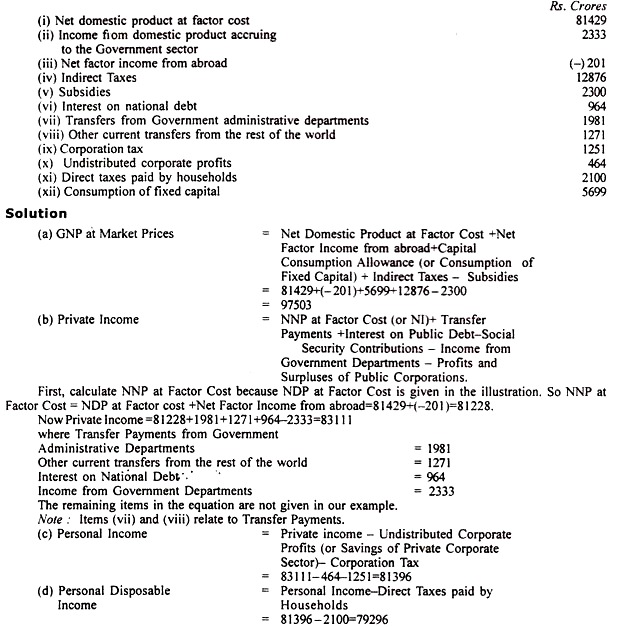

2. On the basis of the following information relating to the Indian Economy given below, estimate:

ADVERTISEMENTS:

(a) GNP at Market Prices,

(b) Private Income,

(c) Personal Income, and

ADVERTISEMENTS:

(d) Personal disposable Income.

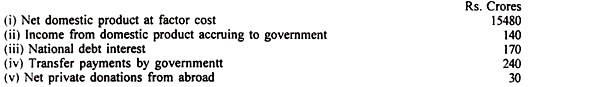

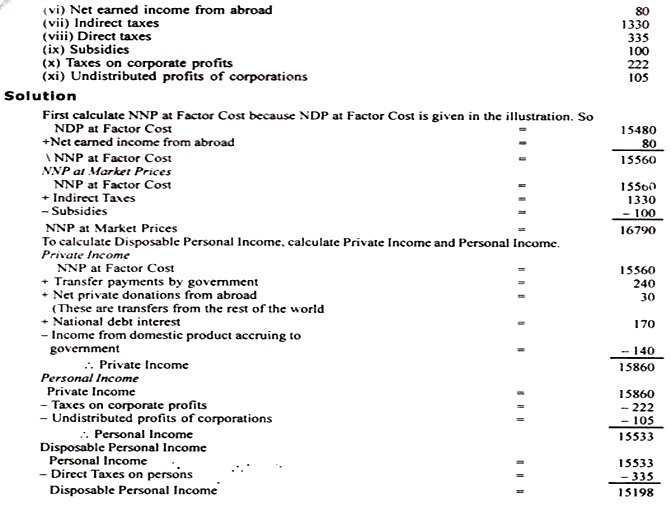

3. On the basis of the following information, calculate Net National Product at Market prices and Disposable Personal Income: