1. Introduction to Dividend Policy

Dividend refers to that part of net profits of a company which is distributed among shareholders as a return on their investment in the company. Dividend is paid on preference as well as equity shares of the company.

On preference shares, dividend is paid at a predetermined fixed rate. But the decision of dividend on equity shares is taken for each year separately. A company should adopt a consistent approach to the dividend decisions on equity shares rather than taking decisions each year on a purely adhoc basis. A settled approach for the payment of dividend is known as dividend policy.

Therefore, dividend policy means the broad approach according to which every year it is determined how much of the net profits are to be distributed as dividend and how much are to be retained in the business.

Thus, the dividend policy divides the net profits or earnings after taxes into two parts:

ADVERTISEMENTS:

(1) Earnings to be distributed as dividend

(2) Earnings retained in the business

Since dividends are distributed out of the profits, there exists an inverse relationship between dividends distributed and retained earnings in the business. If larger net profits are distributed as dividends, retained earnings would be less and on the contrary, if lesser profits are distributed as dividends, the retained earnings would be larger.

The retained earnings are the most easily accessible significant source of finance for the firm. A firm which declares larger dividends will have to use external sources of financing to finance its investment opportunities.

ADVERTISEMENTS:

Thus, a firm will have to choose between the portion of profits distributed as dividends and the portion ploughed back into the business. The choice is called the dividend policy and it will have its effect on both the long-term financing and the wealth of shareholders.

2. Types of Dividend

Dividends can be classified in various forms. Dividends paid in the ordinary course of business are known as Profit dividends, while dividends paid out of capital are known as Liquidation dividends.

Dividends may also be classified on the basis of medium in which they are paid:

A company may pay dividend in different forms as follows:

ADVERTISEMENTS:

1. Equity Dividend:

The dividend paid on equity shares is called Equity Dividend. The rate of equity dividend is set (recommended) by the board of directors of a business firm and approved by their shareholders.

2. Preference Dividend:

Preference dividend is paid on Preference Shares. At the time of issue of such shares, the rate of dividend is mentioned which remains fixed in nature. This dividend on preference shares is paid before equity dividend. The board of directors of a business firm does not put any recommendation towards preference dividend viz. rate, payment mode etc.

3. Interim Dividend:

Interim dividend is paid by a company for the current year before the accounts for that period have been closed. Such dividend is paid when the company has heavy earnings during the year.

4. Regular Dividend:

Payment of dividend at the usual rate is termed as regular dividend. The investors such as retired persons, widows and other economically weaker people prefer to get regular dividends.

5. Cash Dividend:

ADVERTISEMENTS:

A cash dividend is a usual method of paying dividends. Payment of dividend in cash results in outflow of funds and reduces the company’s net worth, though the shareholders get an opportunity to invest the cash in any manner they desire. This is why the ordinary shareholders prefer to receive dividends in cash.

But the firm must have adequate liquid resources at its disposal or provide for such resources so that its liquidity position is not adversely affected on account of cash dividends.

6. Stock Dividend:

Stock dividend means the issue of bonus shares to the existing shareholders. If a company does not have liquid resources it is better to declare stock dividend. Stock dividend amounts to capitalization of earnings and distribution of profits among the existing shareholders without affecting the cash position of the firm.

ADVERTISEMENTS:

7. Scrip or Bond Dividend:

A scrip dividend promises to pay the shareholders at a future specific date. In case a company does not have sufficient funds to pay dividends in cash, it may issue notes or bonds for amounts due to the shareholders. The objective of scrip dividend is to postpone the immediate payment of cash. A scrip dividend bears interest and is accepted as a collateral security.

8. Property Dividend:

Property dividends are paid in the form of some assets other than cash. They are distributed under exceptional circumstances and are not popular in India.

ADVERTISEMENTS:

9. Composite Dividend:

When dividend is paid partly in cash and partly in the form of property then it is known as composite dividend.

10. Optional Dividend:

Instead of paying a composite dividend, if the company gives option to its shareholders either for cash dividend or for property dividend then it is called option dividend.

11. Extra or Special Dividend:

Special dividend is an abnormal and non-recurring form of dividend, when the management of a company does not want to make frequent changes in the regular rate of dividend but company is having good amount of profits or undistributed reserves then they can declare extra or special dividend.

3. Types of Dividend Policies

ADVERTISEMENTS:

An organization considers many factors before deciding its dividend policy.

The explanation of various types of dividend policy is as follows:

1. Stable Dividend Policy:

Refers to the policy in which an organization pays regular dividends to its shareholders. The stable dividend policy is also known as constant-payout-ratio.

2. Long-Term Dividend Policy:

Refers to the policy in which dividend is paid to the shareholders in the long run. If an organization follows long-term dividend policy, then it would not distribute dividend among its shareholders regularly and consistently, even in case of huge profit.

ADVERTISEMENTS:

The organization retains the earnings to be used in future for its growth and expansion programs. Investors looking for short-term gains do not favor the long-term dividend policy. This policy is preferred by those shareholders who have interest in long-term capital gains.

3. Regular and Extra Dividend Policy:

Refers to the dividend policy, which pays a fixed amount of dividend on a regular basis, and an additional amount of dividend, if the organization earns abnormal profit. This policy encourages the prospective investors to invest in the organization and helps in raising capital in the future.

4. Irregular Dividend Policy:

Refers to the policy in which the dividend payout ratio keeps on fluctuating. In the irregular dividend policy, dividend per share depends on profit of the organization. If the profit is high, the organization would pay a high dividend per share.

However, if the profit is low, the organization would pay less or no dividend to the shareholders. The irregular dividend policy is favorable for an organization, which has unstable income. Although, shareholders do not approve this policy very much, as it does not provide any certain income.

ADVERTISEMENTS:

5. Regular Stock Dividend Policy:

Refers to the policy in which an organization gives dividend in the form of stock instead of cash. If an organization needs liquidity then it may adopt regular stock dividend policy and issue bonus shares to its shareholders.

However, regular stock dividend policy is not considered a very good strategy because it adversely affects share prices and credit standing of the organization. Moreover, shareholders are more interested in getting cash instead of shares.

4. Essentials of a Sound Dividend Policy

Following are the essentials of a sound dividend policy of a company:

1. Stability:

Stability in dividend distribution implies regularity in payment of dividend. If a company pays a high dividend in a year but fails to pay any dividend next year, then it cannot be said as good. On the other hand, if a company pays a dividend each year even though at a medium rate, its shareholders will remain satisfied and its shares will not be subjected to high speculation.

ADVERTISEMENTS:

2. Gradually Rising Dividends:

The management of the company should always try to make some increase in the dividend rate each year, though this increase will depend on the increase in income of the company. If there are huge profits in any year than in that year the company should distribute additional or special dividends.

3. Distribution of Cash Dividend:

Dividends should be paid in cash. But, if the amounts of reserves and funds in the company become very high, then stock dividend may also be declared. But the distribution of stock dividend should remain within reasonable limits otherwise the company may become victim of over-capitalization.

4. Moderate Start:

In the beginning years of a company’s incorporation, dividends should be declared at lower rates for some years so that the company’s financial position may become sound. Afterwards with the growth and progress of the company, dividend rates may be increased gradually.

5. Other Factors:

Dividends should be paid out of earned profits only. If there is carry forward of past losses, then dividend should not be declared till these are set off. Though, the dividend is usually paid only once in a year in order to keep the shareholders in high spirits, interim dividends should also be declared.

5. Dividend Theories

Theories of Dividend:

1. MM Theory:

According to MM approach, the dividend policy of a firm has no effect on the value of the firm.

This approach is based on certain assumptions which are as follows:

Assumptions:

(a) There are perfect capital markets and investors are rational.

(b) Information is freely available and there are numerous transactions.

(c) An investor cannot influence prices.

(d) Flotation costs are nil.

(e) There are no taxes.

(f) The firm has a fixed investment policy.

(g) Risk of uncertainty does not exist.

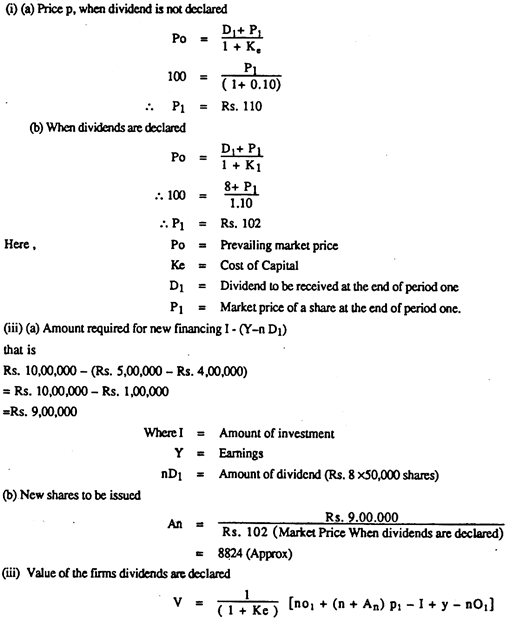

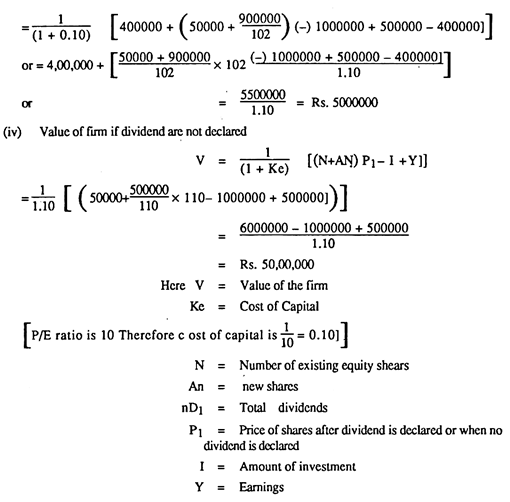

Mathematical Proof of MM Approach:

E.g., – A company has a P/E (Price/Earnings) ratio of 10. The amount of share Capital is Rs. 50,00,000 dividend into shares of Rs. 100 each. The company expects a declaration of dividend of Rs. 8 per share. On the assumption that the company pays dividend, its net income is Rs. 5,00,000 and it makes new investments of Rs. 10,00,000 during the period proven under the MM assumption that the value of the firm remains unchanged when.

(a) Dividends are paid; and

(b) Dividends are not paid

Solution:

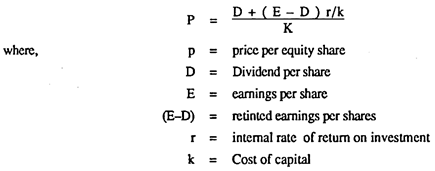

2. Walter’s Model:

Walter’s Dividend model measures the effect of dividend on common stock value by making a comparison of the actual and normal capitalisation rates i.e. –

As per Walter’s model the rate of return on investment and cost of capital determine the price of share. If r > k, the price per share increases as dividend payout ratio decreases. If r > k the price per share increases as dividend payout ratio increases. The dividend pay-out ratio has no effect on the price of the share if r = k.

Under the circumstance, the optimal pay-out ratio (i) for a growth firm (r > k) is nil (ii) declining firm (r > k) is 100 percent and (iii) for a normal firm (r = k) is irrelevant.

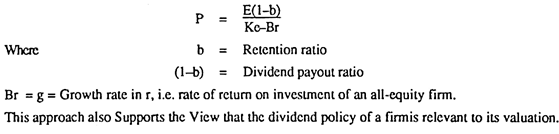

3. Gordon’s Model:

According to Gordon’s Model, the value of the share is given by the following equation:

6. Significance of Dividend Policy

Theoretically, the objective of the dividend policy should be to maximise the shareholder’s return so that the value of his investment is maximised. Shareholder’s return is composed of – the dividends and the capital gains. Dividend policy has a direct impact on these two components of return.

The term dividend policy involves two ratios namely the Payout ratio and the Retention ratio. The Payout ratio is the dividend which is calculated as the percentage of the earnings, for example, the total earnings are Rs. 1,00,000 and the company distributes or pays 20% of its earnings to the shareholders then the Payout ratio is 20% and the Retention ratio is calculated as 100% minus the payout ratio, i.e. in the above example the Retention ratio is 100% – 20% = 80%.

A company could adopt a high payout policy or a low payout policy. A high payout policy means more current dividends and less retained earnings, which may consequently result in slower growth and lower market price per share.

A low payout policy means less current dividends and more retained earnings, which may result in higher growth, higher capital gains and higher market price per share. Capital gains are future earnings while dividends are current earnings.

Paying dividends involves outflow of cash. The cash available for the payment of dividends is affected by the firm’s investment and financing decisions. If a company decides to incur large capital expenditure, it would have less cash available for the payment of dividends. Thus, the investment decision affects the dividend decision.

7. Factors Determining Dividend Policy

The major factors affecting the dividend policy of a firm are listed below:

1. Company’s Own Policy:

The Company’s own dividend policy regarding the stability of dividend affects the dividend decisions.

Where the earnings are more stable the company may decide to pay a constant dividend. Where the earnings are not stable i.e., fluctuating, then, the company may decide to pay a huge amount of dividend when earnings are more or no dividend in case of less earnings.

2. Availability of Divisible Profits:

The dividend policy of a concern depends upon the divisible profits available. If there are no divisible profits, there is no question of declaration of dividend. If there are large divisible profits, there can be more dividend distribution and more retention of funds.

3. Liquidity of the Company:

Liquidity of the company also affects the dividend decisions. Liquidity indicates the cash available to make the payment of dividend.

If a company has sufficient liquidity to pay a dividend, it can declare a higher dividend.

4. Effect of Current Market Prices:

Dividend decisions affect the market price of the shares. As per Walter’s model, dividend is relevant while determining the market price of a share.

5. Past Dividend Rates:

Every company takes past dividends as a base and takes decisions to enhance the dividend in the future. If a company pays 60% dividend in the last year, should maintain the same rate or enhance the rate during the current year.

6. Contractual Restrictions:

The term lending financial institutions impose restrictions on dividend decisions. They fix the maximum ceiling on the rate of dividend or the amount of dividend and also on the retained earnings.

7. Legal Restrictions:

The Companies Act specifies that every company is required to transfer a certain amount to general reserve based on the rate of dividend declared. If any shortage after declaration of dividend will impose restriction on their companies for declaration of dividend.

8. Equity Capitalisation Rate:

Cost of capital is an important factor to decide the dividend payment. If a company is raising capital at a cheaper rate of interest, then the company can declare a higher rate of dividend.

9. Composition of Shareholders:

The composition of shareholders also determines dividend policy. The shareholders of closely held company may be interested in capital gains rather than on dividends. Hence, a low dividend should be paid. But shareholders of widely held companies may be interested in higher dividends. Such companies may decide to pay a higher rate of dividend.

10. Availability of External Sources of Fund:

The availability of external sources of funds are needed for capitalisation purposes. The companies with greater accessibility to external sources may decide to pay higher dividends because they can retain less earnings for reinvestment. In case of new companies having less access to the external market may declare and pay lesser dividends and to retain more earnings.

11. Re-Investment Opportunities of the Company:

Availability of profitable investment opportunities to the company also decides the payment of dividend, if a company has more profitable reinvesting opportunity, then it can declare a lower rate of dividend. In other words, if a company cannot reinvest its earnings, then it can declare a higher rate of dividend.

12. Taxation:

The dividend tax has a greater impact on the dividend policy. If the dividend is taxable in the hands of individual shareholders, then the companies declare bonus issues, rather than cash dividend. At present the dividend distribution tax on a dividend is taxable in the hands of the company.

13. Bonus Issue:

The bonus issue in the past years increases the capital base in the current year, hence dividend policy determined on the basis of bonus issue. A company has to pay a dividend compulsorily in the year of bonus issue because a bonus issue cannot be in lieu of cash dividend.

14. Future Plan for Growth and Expansion:

A Company which will plan for future growth and expansion requires a huge fund. As merger and acquisition need a huge outflow of cash, a moderate dividend can be expected from such a company.

15. Effect of Inflation:

Inflation affects dividend decisions. During inflation the value of closing stock and the figures of net profits are overstated. During inflation, it is necessary to retain earnings so as to enable the company to have sufficient funds to replace capital assets. Hence, the companies pay lower cash dividends.