Financial management is such a managerial process which is concerned with the planning and control of financial resources. Financial management was started as a separate subject of study in the 20th century.

Till now it was used as a part of economics. As an educational subject, its scope has undergone some basic changes from time to time.

In the initial years of its development, financial management was concerned only with collection of funds for business. But according to the modern viewpoint, not only collection of funds but also their proper utilisation are the basic functions of financial management. In present times, financial management analyses all financial problems of a business.

Financial management refers to the functions involved in the management of financial resources. These functions are fund procurement, working capital management, capital budgeting, and capital structure designing of an organization.

ADVERTISEMENTS:

It includes controlling and maintaining the financial assets of an organization. In addition, it determines the future strategies related to expansion, diversification, joint venture, and mergers and acquisitions.

Financial management may be defined as planning, organising, directing and controlling the financial activities of an organisation. According to Guthman and Dougal, financial management means, “The activity concerned with the planning, raising, controlling and administering of funds used in the business.” It is concerned with the procurement and utilisation of funds in the proper manner.

Financial management involves the management of the finance function. It is concerned with the planning, organising, directing and controlling the financial activities of an enterprise.

Financial Management influences all segments of corporate activity, for both profit-oriented firms and non-profit firms. It is involved in a range of activities like acquisition of funds, the allocation of resources, and the tracking of financial performance. Therefore, it has acquired a vital role in every type 1of organization.

What is Financial Management: Introduction, Meaning, Definition, Objectives, Functions, Scope, Importance and Role Of Financial Manager

Introduction to Financial Management

1. Definitions of Finance

Finance is the soul of all economic activities. At present, we cannot imagine a world without Finance. The word finance was originally a French word. In the 18th century, it was adapted by English speaking communities to mean “the management of money.”

ADVERTISEMENTS:

Since then, it has found a permanent place in the English dictionary. When we say finance it generally means money for a layman but it is not only the money, it is a wider concept which is related to money and its flow.

According to Oxford dictionary, the word ‘finance’ means ‘management of money’.Finance is defined differently by different groups of people.

So it is very difficult to give a perfect definition of Finance but we can define finance from different point of view as given below –

ADVERTISEMENTS:

In General point of view – “Finance is the management of money and other valuables, which can be easily converted into cash.”

In Experts point of view – “Finance is a simple task of providing the necessary funds (money) required by the business of entities like companies, firms, individuals and others on the terms that are most favorable to achieve their economic objectives.”

In Entrepreneurs point of view – “Finance is concerned with cash. It is so, since, every business transaction involves cash directly or indirectly.”

In Academicians point of view – “Finance is the procurement (to get, obtain) of funds and effective (properly planned) utilization of funds. It also deals with profits that adequately compensate for the cost and risks borne by the business.”

All the business activities depend on finance so we can say that Finance is the life blood of every Business whether large scale, small scale or medium scale. Without adequate finance no business can survive.

So it is very important for business to have sufficient amount of finance (money) and not only having sufficient finance (money) it has to manage the finance because without good management of finance it is possible to not get success. Therefore, there is a need to understand the meaning of financial management.

2. Scope of Finance

Scope of finance simply explains its usefulness in all spheres of individual and organizational activities, without which no activity will begin nor will end. It is both means as well as an end like, Finance to Finance or money to money (F to F or M to M).

From this it is very clear that, there is no economic/financial activity which is out of the purview of/ involvement of finance. For accomplishment any sort of activity finance is an inevitable component/ element.

Experts Views on the Scope of Finance:

ADVERTISEMENTS:

Husband & Dockery observed that, in its overall sense; finance embraces many areas other than corporate finance, money, banking and credit of various types and classes. Centralized as a whole, finance may be said to be the circulatory system of the economic body, making possible the needed cooperation between many units of activity.

A brief description of scope of finance is narrated below:

Scope # 1. Finance and Economics:

Finance has been considered for a long time as a branch of economics, which makes use of available economic tools of demand, supply and consumption of money. No person can ever successfully dabble/experiment in finance unless he/she has a thorough knowledge of economics.

ADVERTISEMENTS:

The discipline of Economics deals with the basic theory of finance and its relevance in accomplishment of economic or financial activities. Hence there is a relevance of economic concepts with finance aspects is very much felt.

After the evolution of Financial Management, as an independent and a separate discipline, finance occupies an important place as an input of every economic activity. A financial input takes the form of money and near money assets or money equivalents like bank deposits, investment in shares and debentures and government securities.

Thomas L Greene has observed that, “the study of finance is an applied macro- economic theory and thus a subdivision of Economics”.

Scope # 2. Finance and Accounting:

ADVERTISEMENTS:

Modern business management is concerned with the process of converting information into actions and accounting is a source of most of the financial information that is used for this purpose of accomplishment of business objectives/goals.

Richard M Lynch and Robert W Williamson have described Accounting as ‘the measurement and communication of financial and economic data’. Accounting is the science of book-keeping and establishes the principles and concepts which should govern the collection and presentation of financial data.

It is a discipline which provides information essential for the efficient conduct and evaluation of the activities of the organization.

Accounting is an art of recording, classifying and summarizing, in terms of money, transactions and events of a financial character. Arising out of this close relationship of finance with accounting, a new branch of accounting has emerged under the title ‘Financial Accounting’.

Accounting has many branches, which deals with the varied functions of accounting financial information, which is transformed into functions of finance.

Such other areas of finance and accounting are:

ADVERTISEMENTS:

(a) Finance and Financial Accounting

(b) Finance and Management Accounting

(c) Finance and Cost Accounting

(d) Finance and Human Resource Accounting

(e) Finance and Inflation Accounting

(f) Finance and Responsibility Accounting, and

ADVERTISEMENTS:

(g) Finance and Transactional Accounting.

Brief explanation on each of the above sub-divisions of accounting are summarized below:

(a) Finance and Financial Accounting:

Financial accounting is concerned with the preparation of financial reports which provide financial information or data to all the stakeholders including outside users such as publics, creditors and the potential investors.

(b) Finance and Management Accounting:

Management accounting as a branch of accounting uses accounting information for reporting financial data to the top management for facilitating decision making.

ADVERTISEMENTS:

Thus Mary E Murphy defines Management accounting as ‘the presentation of accounting information in such a way as to assist management in the creation of policy and in the day to day operation of an undertaking’.

(c) Finance and Cost Accounting:

Cost accounting as a branch of Accounting, uses and expresses financial information to find out the cost of a product or service. Cost accounting helps not only in cost ascertainment for pricing purposes but also for cost control and cost reduction, with the aim of profit maximization.

Cost Accounting and finance are overlapping concepts since cost is the monetary measure of the value of economic service acquired by the firm.

(d) Finance and Human Resource Accounting:

Finance and Human Resource are inter-related aspects of business function. Human Resource Accounting is the process of identifying and measuring human resources and communicating this information to the interested parties.

ADVERTISEMENTS:

The economic value of human resources may be defined as ‘the present worth of the benefits or services in which employees are expected to render in the future’.

(e) Finance and Inflation Accounting:

Prices are subject to changes over time due to the operation of economic and social forces, which is regarded as inflation. Inflation accounting deals with incorporating a change in the general price level as measured by the general price index reflects changes in the general purchasing power of money.

(f) Finance and Responsibility Accounting:

Responsibility Accounting is the approach, whereby costs are planned and accumulated in accordance with the organizational responsibilities and communicated to and from the individuals responsible for incurring them. This system helps in accounting the cost of each element of a product/good to decide and to fix the appropriate price for the product.

(g) Finance and Transactional Accounting:

Accounting transactions are the transactions of finance on all spheres of activities, which are recorded in books of accounts.

Transactional accounting is concerned with recording, analyzing and accumulating evidence of dealings with outsiders made at the key exchange points between the business entity and the outside world of investors, suppliers and customers. These are equity rights/resources, right of payment and obligation to pay respectively.

Scope # 3. Finance and Corporate Finance:

Corporate finance deals with the finance problems of a corporate enterprise. Husband & Dockery have rightly said that, basically corporate finance serves two important functions; first it is a means of assembling the funds necessary to initiate any new business i.e. it deals with the procurement of required capital from various sources and secondly it provides the basis for continued operations i.e. the working capital required to meet the day-to-day operations of the organization.

Scope # 4. Finance and Business Finance:

Business Finance primarily deals with raising, administering and disbursing funds by privately owned business units operating in the non-financial fields of an industry. Business finance deals with functions of finance, which include banking, insurance, transport, mercantile agents and other service organizations and manufacturing sectors.

Business finance also deals with the capital input function for the economics of the acquisition of money /capital for the conduct of firms operations. The inter-relationship between finance and business states that, there is no business without finance, which is the life-blood of business.

Scope # 5. Finance and Production/Marketing/Quantitative Methods:

Finance has a close link with pre-production and post-production activities (input to output). New product development, product promotion, product designing, R&D, Storing, Distribution and other related activities are directly influenced by finance.

3. What is Financial Management?

Financial management is such a managerial process which is concerned with the planning and control of financial resources. Financial management was started as a separate subject of study in the 20th century.

Till now it was used as a part of economics. As an educational subject, its scope has undergone some basic changes from time to time.

In the initial years of its development, financial management was concerned only with collection of funds for business. But according to the modern viewpoint, not only collection of funds but also their proper utilisation are the basic functions of financial management. In present times, financial management analyses all financial problems of a business.

Financial manager has become an important constituent of business and he provides his significant contribution to all business activities. He estimates the requirement of funds, plans the different sources of funds and performs the functions of collection of funds and their effective utilisation.

As all the business activities like marketing, purchase, production, etc. include the creation and utilisation of funds, the financial manager must be clear about his duties and responsibilities in relation to these activities. Besides, he should also be clear about the financial objectives of the firm.

For the success of any business, it is necessary to procure adequate funds and to utilise them efficiently. The organisation of sole proprietorship and partnership businesses is personal. Moreover, due to limited needs of these businesses, it is easier to manage the finances. But to manage finances for the corporations, which are non-personal in character, is a complex job.

Finance is such a powerful source that it performs an important role to operate and co-ordinate the various economic activities of business.

Finance is of two types-

(1) Public Finance, and

(2) Private Finance.

Public finance means government finance under which the principles and practices relating to the procurement and management of funds for the central government. State government and local bodies are covered. In public finance, we observe which the sources of income of the public authorities are and how they spend them.

The Budgetary system of the government is considered as an important part of public finance. Public debt is also included under it. The growth of a nation depends upon the suitable principles of financial management.

Contrary to this, private finance means procurement and management of funds by individuals and private institutions. Under it, we observe how individuals and private institutions procure and utilise funds.

Private finance can be subdivided as-

(i) Personal Finance

(ii) Business Finance, and

(iii) Finance of Non-profit Organisations.

Personal Finance includes the analysis of principles and practices related to management of day to day funds of a person.

Business finance studies the financial problems, processes and practices of the profit making organisations including industry, trade, commerce and services.

Finance of non-profit organisations covers the study of transactions and events of charitable, religious, educational institutions, etc.

Business finance studies the management of finance for those organisations which operate with the objective of earning profit. It finds out how and from which sources these organisations raise finance and how they utilise these funds. The scope of business finance is quite wide.

It covers the financial arrangements for sole traders/partnership firms, companies and corporations. In present times, due to the increasing significance of the corporate sector, the study of Corporate Financial Management is undertaken as a separate subject.

The management of corporate finance is a wide subject which covers within its scope the management of funds for the day to day operations as well as for the future growth and expansion of business and the analysis of other financial problems.

Procurement of funds and their efficient utilisation are also given special attention. Although purchase, production and marketing are also associated with finance, their problems are kept outside the preview of finance.

In order to understand the term ‘Business Finance’ it is necessary to make clear the meaning of term ‘Business’ and ‘Finance’ separately. Business means those activities which are performed with the objective of earning profit. These activities include industrial production, agriculture, fisheries, banking, transport, mining, commercial activities, etc.

The services like those of doctors, lawyers, accounting, etc. are also included in business activities. Thus, the term business is a comprehensive term which includes, commerce, industry and services.

Finance in the common sense means money. But in actual practice, from the viewpoint of financial management, the term finance has been defined differently by different authors. Moreover, these viewpoints have undergone a great change in recent times.

Accordingly, the term finance is viewed as under:

(i) As per the traditional approach, finance means procurement of funds on appropriate terms. Accordingly, it studies financial institutions, sources of finance, necessary quantum of funds and the timing of these funds. But this is a narrow view of finance because it gives importance to one aspect but ignores the others.

(ii) Second approach to finance considers it as cash. Because all the transactions in an organisation can be expressed in finance, therefore, the finance manager is concerned with each activity of the institution. It means that the financial manager has to keep an eye on every transaction of the institution. But this meaning of finance is highly comprehensive.

(iii) Accordingly to another viewpoint, finance is concerned with procurement of funds and their efficient utilisation. Therefore, the duty of the financial manager is not only to procure adequate funds but also to see that these funds are also properly utilised. This meaning of finance is considered the most suitable.

From the above, it is now clear that the term ‘Business Finance’ deals with procuring funds from different sources on fair terms for the business and to utilise them efficiently for achieving business objectives.

According to Guthmann and Dougall, “Business finance can be broadly defined as the activity concerned with planning, raising, controlling and administering of funds used in the business.”

4. Meaning of Financial Management

Financial management refers to the functions involved in the management of financial resources. These functions are fund procurement, working capital management, capital budgeting, and capital structure designing of an organization.

Financial management includes controlling and maintaining the financial assets of an organization. In addition, it determines the future strategies related to expansion, diversification, joint venture, and mergers and acquisitions.

According to J. C. Van Home, “Financial Management is concerned with the acquisition, financing, and management of assets with some overall goal in mind.”

According to Weston and Brigham, “Financial Management is an area of financial decision making, harmonizing individual motives and enterprise goals.”

5. What is Financial Management?

Financial management may be defined as planning, organising, directing and controlling the financial activities of an organisation. According to Guthman and Dougal, financial management means, “The activity concerned with the planning, raising, controlling and administering of funds used in the business.” It is concerned with the procurement and utilisation of funds in the proper manner.

Financial management involves the management of the finance function. It is concerned with the planning, organising, directing and controlling the financial activities of an enterprise.

Ezra Solomon has described the nature of financial management as follows- “Financial management is properly viewed as an integral part of overall management rather than as a staff specially concerned with funds raising operations.

In this broader view, the central issue of financial policy is the wise use of funds and the central process involved is a rational matching of the advantage of potential uses against the cost of alternative potential sources so as to achieve the broad financial goals which an enterprise sets for itself.

In addition to raising funds, financial management is directly concerned with production, marketing and other functions within an enterprise whenever decisions are made about the acquisition or distribution of funds.”

6. Definitions of Financial Management

Financial Management influences all segments of corporate activity, for both profit-oriented firms and non-profit firms. It is involved in a range of activities like acquisition of funds, the allocation of resources, and the tracking of financial performance. Therefore, it has acquired a vital role in every type of organization.

Different authors have given different definitions, some are presented as below:

According to Harry Guthumann and Dougal, financial management means, “the activity concerned with the planning, raising, controlling and administering of funds used in the business.”

In the words of Weston and Brigham, “financial management is an area of financial decision-making, harmonizing individual motives and enterprise goals.”

According to Solomon and Ezra, “Financial management is to review and control decisions to commit or recommit funds to new or ongoing uses.”

Joseph and Massie define financial management as “the operational activity of a business that is responsible for obtaining and effectively utilizing the funds necessary for efficient operations.”

In the words of Phillippatus, “financial management is concerned with the managerial decisions that result in the acquisition and financing of long-term and short-term credits for the firm.

As such it deals with the situations that require selection of specific assets/combination of assets, the selection of specific liability/combination of liabilities as well as the problem of size and growth of an enterprise. The analysis of these decisions is based on the expected inflows and outflows of funds and their effects upon managerial objectives.”

Thus, financial management is mainly concerned with the effective management of funds in the business. The central issue is the wise use of funds and a rational matching of the advantage of potential uses against the cost of alternative potential sources so as to achieve the broad financial goals, which an enterprise sets for itself.

In addition to raising funds, financial management is directly concerned with production, marketing and other functions within an enterprise whenever decisions are made about the acquisition or distribution of funds.

7. Concept of Financial Management

Financial management entails planning for the future of a person or a business enterprise to ensure a positive cash flow. It includes the administration and maintenance of financial assets. Besides, financial management covers the process of identifying and managing risks.

The primary concern of financial management is the assessment rather than the techniques of financial quantification. A financial manager looks at the available data to judge the performance of enterprises. Managerial finance is an interdisciplinary approach that borrows from both managerial accounting and corporate finance.

Some experts refer to financial management as the science of money management. The primary usage of this term is in the world of financing business activities. However, financial management is important at all levels of human existence because every entity needs to look after its finances.

8. Evolution of Financial Management

The nature and scope of financial management has evolved and widened over time.

Its evolution may be divided broadly in three phases:

1. Traditional,

2. Transitional and

3. Modern phase.

In the words of Ezra Solomon – “Corporate finance has changed from a primary descriptive study to the one that includes rigorous analysis and normative theory, from a field that was concerned primarily with procurement of funds to one that includes management of assets, allocation of capital and valuation of firm in overall market, and from a field that emphasized external analysis of firm to one which emphasizes decision making within the firm”.

1. The Traditional Phase (Till Early 1940’s):

The Traditional phase lasted for about four decades till the early 1940’s. In this phase, the focus of financial management was mostly on events of episodic nature like procurement of capital, engagement with major lenders like banks, issuance of securities, debt servicing, expansion, merger and compliance with legal aspects. The approach was mainly descriptive.

Financial management was viewed mainly from the viewpoint of the investment bankers, lenders, and other outsiders.

In this traditional phase finance was a part of economics and no separate attention was paid to finance. Business owners were more concerned with operational activities.

a. Finance function was concerned with procuring of funds to finance the expansion or diversification activities. Finance function was not a part of regular managerial operations.

b. Finance function was viewed particularly from the point of supplier of funds i.e., the lenders, both individuals and institutions.

c. The focus of attention was on long term resources and only the long term finances was of concern.

d. The treatment of different aspects of finance was more of a descriptive nature rather than analytical.

e. Finance was concerned with procuring funds primarily by issue of securities such as equity shares, preference shares and debt instruments.

2. The Transitional Phase (1940 – Early 1950’s):

The Transitional phase began around the early 1940’s and continued till early 1950’s. Financial management had almost similar nature and scope during this phase as during the traditional phase.

However, there was an increasing emphasis on planning, procuring, managing and controlling funds to meet day to day financial needs of the business. Financial issues were begun to be analyzed in an analytical framework.

3. The Modern Phase (Since Mid-1950’s):

The mid 1950’s marked the beginning of the Modern phase in financial management owing to increasing competition, growth opportunities, globalization, breakthroughs in economic theories and development of quantitative methods of analysis.

This led to development of a more analytical and empirical approach to decision making. Management or insider’s view point became central to financial management.

Thus the modern approach views financial management in a broad sense and provides a conceptual and analytical framework for financial decision making. The finance function covers both acquisitions of funds as well as their allocations.

Development of Theory of Portfolio Management by Harry Markowitz in 1952, Theory of Leverage and Valuation of firm by Modigliani and Miller in 1958 and Option Valuation Model by Black and Scholes in 1973’s are regarded as milestones in the evolutionary journey of modern financial management.

Since then, the fields of capital budgeting, capital structure, efficient market hypothesis, option pricing theory, agency theory, financial derivatives and risk management, valuation model, dividend policy, working capital management, financial modelling, financial engineering, international finance and behavioural finance to name a few, have seen fascinating developments.

With the on-going endeavours of various academicians, researchers, practitioners and regulators, we are poised to see many more significant advancements in these and upcoming areas, which would add further dimensions to financial management.

9. Nature of Financial Management

Prof. S. C. Kuchhal has given three broad views on financial management simply providing the funds needed by the business or enterprise on terms that are most favorable in the light of its objectives.

The approach is concerned almost exclusively with the procurement of funds and could be widened to include instruments institutions and practices through which funds are raised. It also covers the legal and accounting relationship between a company and its sources of funds. Financial management is certainly broader than procurement of funds-these are other functions and decisions too.

At the other extreme there is a definition, which considers that finance is concerned with cash. Since every business transaction involves cash directly or indirectly finance may be assumed to be concerned with everything that takes place in the conduct of a business obviously it is too broad.

The third approach which is more appropriate consider financial management as procurement of funds and their effective utilization in the business – though there are other organizations like school, associations, government agencies etc. where funds are procured and used.

Financial management has to not only see that funds can be raised for installing plants and machinery at a cost but it has also to see that additional profits adequately compensate for the costs and risks born by the business while setting up the project.

Thus, from the point of view of a corporate unit financial management is related not only to ‘fund-raising’ but encompasses a wider perspective of managing the finances for the company efficiently.

In the developed state of a capital market raising funds is not a problem but the real problem is to put the capital resources to deal with tasks like ensuring the availability of funds allocating costs, forecasting financial requirements, doing profit- planning and assessment of return on investment and assessment of working capital etc.

Financial management to be more precise is concerned with investment financing and dividend decisions in relation to objectives of the company such relation to objectives of the interests of the shareholders.

They are upheld by maximization of shareholder’s wealth which depends upon increase in the net worth-capital invested in the business plus ploughed back profits for growth and prosperity of the company.

It is for such a reason that the market is prepared to pay a lower or higher price for the shares of some company or the other. Nature of financial management therefore can be judged by the study of the nature of investment decisions, nature of financing decisions and the nature of dividend decisions.

10. Objectives of Financial Management

The financial management is generally concerned with procurement, allocation and control of financial resources of a concern.

There can be several objectives of financial management such as:

(i) To ensure regular and adequate supply of funds.

(ii) To ensure adequate returns.

(iii) To ensure optimum funds utilization.

(iv) To ensure safety on investment.

(v) To plan a sound capital structure and so on.

11. Scope of Financial Management

Financing a business involves multiple short-term and long-term decisions which by itself widens the scope of financial management. Short-term financial decisions primarily relate to day-to-day capital needs of the business firm or managing working capital.

These decisions influence the liquidity and profitability of the firm. On the other hand, long-term financial decisions are concerned with financing the enterprise, investment of funds and administration of earnings.

Important decisions involved in financial management of a business unit may be summarized as:

1. Investment Decision:

A prospective investment to be made by any business unit must be evaluated in terms of risk involved, cost of capital involved and expected benefits from it. Hence, the two major components of investment decision are capital budgeting and liquidity.

Capital budgeting, in simple terms may be understood as the one related to capital allocation and commitment of funds in permanent assets which would yield earnings in future.

It also takes into account the decisions related to replacement and renovation of old assets. One of the major responsibilities of a finance manager is to strike a balance between fixed and current assets so as to maximize the profitability along with maintaining the desired degree of liquidity for the unit.

Taking these decisions is not a child’s play, it involves extensive estimation of costs and benefits which may not be ascertained with certainty and are unknown.

2. Financing Decisions:

Financing decisions of the firm deals with the financing mix or the financial structure of an organization. Financing a company requires important decisions related to methods and sources of finance, relative proportion and choice between alternative sources, time of floatation of securities, etc.

Investment needs of an organization can be met by various sources of funds. It is the job of the finance manager to devise the optimum combination of finance structure for an organization which involves minimum cost for raising the funds and maximizes the long term market prices of the company’s shares.

Also, a balance between debt and equity has to be maintained while financing so that an adequate return on equity is-generated with minimum risk involved. Both the returns and risk of equity capital is affected by the use of debt or financial leverage.

In order to maximize the per share value of a company’s capital, the financial manager is entrusted to take the best possible decisions related to the methods of issuing securities and the time to raise funds for the company.

3. Dividend Decision:

There has to be an appropriate, well thought dividend policy for a firm in case it wants to maximize on its wealth. One of the major decisions while formulating an appropriate dividend policy is to choose between the two alternatives – one, distribute all the profits among shareholders. Two, retain a part of profits and distribute the rest as dividends.

The finance manager is also expected to study various opportunities available for investing in order to have further growth and expansion while deciding upon the dividend payout ratio. The dividend payout ratio is the proportion of net profits to be paid out to shareholders as profits. Besides this, other considerations that are borne in mind of a finance manager are dividend stability; forms of dividends i.e., cash dividends or stock dividends, etc.

4. Working Capital Decisions:

These decisions relate to working capital needs of the firm i.e. current assets and current liabilities of the unit. While current assets comprise cash, receivables, inventory, short-term securities, etc.; current liabilities consist of creditors, bills payable, outstanding expenses, bank overdrafts, etc. When we talk of current assets and liabilities, we refer to all those assets and liabilities which have their maturity within an accounting year.

12. Importance of Financial Management

The importance of financial management cannot be overemphasized. In every organisation where the money is involved, Sound Financial management is necessary. Finance or money is the life blood of business. Every business organisation requires money to make more money But money will earn more money, only when it is managed properly.

It requires sound financial management.. As Collins Brooks has remarked “Bad production management and bad sales have slain in hundreds, but faculty financial management has slain in thousands”.

Finance managers must realise that when a firm makes a major decision, the effects of action will be felt throughout the enterprise. Sound financial management is essential for all types of organisation.

The financial management helps in monitoring the effective investment of funds in Fixed Assets and Working Capital. Hence the financial management has gained much importance over time.

The following are the importance of financial management:

1) Successful Promotion:

Efficient and effective financial management is essential to achieve the success in the promotion of business enterprise. It is found that one of the most important reasons for failures of business promotion is a defective plan. For this purpose a sound financial plan is very necessary for the success of business enterprise.

2) Smooth Running of an Enterprise:

Finance is essential for smooth running of the organisation. Finance to an enterprise is like oil to an engine. Finance is required at each stage such as promotion, incorporation, expansion, meeting day-to-day expenses, etc.

3) Coordination between Various Activities:

Financial management provides complete co-ordination between the various departments viz., production department, sales department, purchase department, marketing department, accounts department to achieve the organisational objectives. The finance manager is responsible to meet the financial needs of different departments timely.

For example, if the finance department fails in its obligations to the purchase department for purchase of raw materials, it will affect the production department, because of shortage of raw materials, consequently there is no supply and decreases in sales.

Consequently, the income of the concern will suffer. Thus financial management occupies a central place in the business organisation to control and coordinate all the activities of the enterprise.

4) Decision Making:

All the decisions are taken on the basis of profitability. Financial management supplies scientific analysis of all facts and figures, budget, financial statements, etc. These information help the financial management to calculate the profitability of the plan in given circumstances and guide them in taking proper decisions to minimise the risk.

5) Solution to Business Problems:

Financial management provides various solutions to the top management problems.

6) Measures of Performance:

Financial management provides the financial results. Therefore, financial results are the yardstick to measure the performance of an enterprise, its size of the earnings. Financial decisions which increase the risks will reduce the value of the firm whereas financial decisions which increase the profitability of the enterprise will increase value of the firm.

So risk and profitability are the two essential ingredients of the business enterprise. In this context, J.F. Weston and E.F. Brigham Express that “Financial decisions affect both the size of earnings stream of profitability and the riskiness of the firm. Policy decisions affect risk and profitability and these two factors jointly determine the value of the firm.”

13. Approaches of Financial Management

From theoretical point of view, financial management approach may be broadly divided into two major parts:

1. Traditional Approach

2. Modern Approach

1. Traditional Approach:

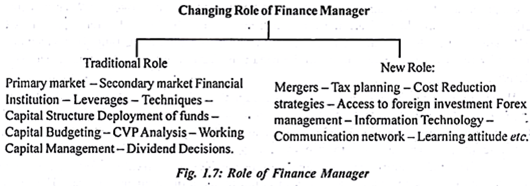

Traditional approach is concerned with the raising of funds only. Traditional approach is the initial stage of financial management, which was followed, during the year 1920 to 1950. This approach was very narrow because it was only related to the procurements of funds.

This approach has been criticized by the modern scholars on various grounds and they have given the modern approach to financial management.

2. Modern Approach:

According to the modern approach a financial manager is not only responsible for the arrangement of funds but at the same time he has to ensure wise application of funds. Finance manager is, therefore, concerned with all financial activities of planning, raising, allocating, and controlling finance. Thus modern approach has wide scope as compared to traditional approach.

According to modern approach the finance functions can be categorized into two broad groups- i. Executive/Primary Functions ii. Subsidiary Function.

i. Executive/Primary Functions:

a. Estimating Capital Requirements:

The first and the most important function is to estimate the capital requirements (needs) of the company very carefully. This must be done at the promotion stage. The company must estimate its fixed capital needs, working capital needs and for initial promotional expenses.

Promotional expenses include expenditure incurred in the process of company formation. Fixed capital needs depend upon the nature of the business enterprise-whether it is a manufacturing, non-manufacturing or merchandising enterprise.

Working capital is the amount which is required for day to day operating expenses of the business such as to pay wages, salary, rent etc. This depends upon the size of the enterprise.

For large organization higher amount of working capital is required as compared to a small level business. If there is any error in the computation of estimated requirements the company will become over-capitalized or under-capitalized.

b. Determination of Capital Composition:

Once the estimation of capital requirement has been made, the capital structure has to be decided. Capital structure is the ratio between owned capital and borrowed capital. There must be a balance between owned capital and borrowed capital. If the company has too much owned capital, then the shareholders will get fewer amounts of dividends.

Whereas, if the company has too much borrowed capital, it has to pay a lot of interest. It also has to repay the borrowed capital after some time. High amounts of borrowing can lead to the insolvency also. Every source of capital is having their own cost. This is to be also considered by the finance manager. So the finance managers must prepare a balanced capital structure.

c. Allocation of Funds:

The finance manager has to decide to allocate funds (investment of funds) into profitable ventures keeping in the mind the safety of funds and regular returns from the investment. Capital budgeting decisions are related to the investment of funds into the fixed assets; these decisions are very crucial because these are irreversible and for long term.

The alternative proposals are ranked on the basis of some criteria for example on the basis of urgency, liquidity, profitability etc. The financial manager has to take the decision by using the techniques such as payback period method, accounting rate of return, internal rate of return, and net present value methods.

d. Disposal of Surplus:

Surplus means profits earned by the company.

When the company has a surplus, it has two options which are given below:

i. Dividend Distribution – It includes the distribution of surplus among the shareholders in the form of dividends or other benefits like bonus.

ii. Retained Earnings – Retained earnings is that part of a company’s profit which is not distributed among the shareholders. The volume of retained profit has to be decided on the basis of expansion and diversification plans of the company.

e. Estimating Cash Flow:

Cash flow refers to the inflow and outflow of the cash. The cash comes in mostly from sales. The cash goes out for business expenses such as to pay wages, salaries, rent, insurance etc. So, the finance manager must estimate the future sales of the business.

This is called Sales forecasting, there are so many quantitative and qualitative methods for this. He also has to estimate the future business expenses.

f. Management of Cash:

Finance manager has to make decisions with regards to cash management. Cash is required for all the business activities like payment of wages and salaries, electricity and water bills, insurance, meeting current liabilities, purchase of raw materials, etc.

g. Interrelation with Other Departments:

Financial management is the most important functional area of management. All other functional areas such as production management, marketing management, personnel management, etc. depend on financial management.

Thus, the financial manager has to deal with all other departments, so the finance manager should have sound knowledge not only in finance related areas but also well in other areas. He must maintain a good relationship with all the functional departments of the business organization.

h. Financial Controls:

The finance manager has not only to plan, procure and utilize the funds but he also has to exercise control over finances. This will enable him to ensure that funds are being utilized as per the plan.

ii. Subsidiary Functions:

The subsidiary functions of financial management are as follows:

(a) Liquidity Function

(b) Profitability Function

(c) Evaluation of Financial Performance

(d) Valuation of Company at the time of merger or reorganization of the company.

(e) Financial readjustment at the time of illiquidity problems.

(f) Preparation of financial plan at the time of promotion of enterprise.

14. Elements of Financial Management

Financial management involves three elements:

1. Financial Planning:

It refers to scheduling the usage of financial resources, such as the raising of funds, deciding the amount of funds, and ensuring low cost and low risk in the raised finance. In the short term, funds may be required to meet operational and working capital requirements, such as paying for the use of current liabilities and sales made on credit. In the long term, finance is required to carry out mergers and acquisitions, expansion, and diversification of the organization.

2. Financial Control:

It refers to the process of supervising and monitoring the financial operations of the organization. Financial control is one of the most important activities, ensuring that a business is meeting its objectives by rectifying the error in the financial operations. It helps in efficient utilization of resources to accomplish the goal of the organization within the allotted time.

3. Financial Decision-Making:

Helps the organization in taking various decisions that involve the usage of funds. The important financial decisions include investing in a project, distributing dividend, and maintaining liquidity.

15. Functions of Financial Management

The functions of finance involve three important decisions, viz.:

1. Investment Decisions,

2. Financing Decisions, and

3. Dividend Decisions.

All these decisions directly contribute to the corporate goal of wealth maximisation. The subject financial management guides the management to have an optimal mix of these decisions. The joint contribution of these decisions increases the value of the shares. Let us discuss the above decisions separately.

1. Investment Decisions:

Investment decisions are referred to the activity of deciding the pattern of investment. It covers both short-term as well as long-term investment, in other words capital assets and the current assets. It is a long range financial decision and deals with allocation of capital.

It has to show how the funds can be invested in assets which would yield maximum return to the business concern.

This is a risky decision where the finance manager has to take maximum care in selecting the areas of investment. As the future is uncertain the returns expected must cover both risks as well as the uncertainties. The variability of each proposal must be examined costing technique, capital budgeting, CVP analysis has to be adopted before making a final decision on the investment avenues.

The popular technique adopted in the industry to evaluate the proposals is ‘Net present value’. The present economic scenario is pressurizing this decision to look more carefully than before.

As the competition for Multinational companies are dominating joint ventures, mergers and acquisition are taking place, each addition and deletion of products of the asset must significantly contribute to the concept of increasing the wealth of the organisation.

2. Financing Decisions:

It is another important decision where a business concern has to take maximum care in financing different proposals. The appropriate mix of finance with debt to equity- directly contributes to the profitability of a business unit. The instrument that is to be selected must aim at maximising the returns to the investors and to protect the interest of creditors.

The role of finance manager in taking decisions with regard to combination of the capital structure is vital.

He has an alternative of mobilising the funds through:

(i) equity,

(ii) equity plus debt,

(iii) equity plus debt plus preference shares and

(iv) equity plus debt plus preference shares plus public deposits with term loan.

Each opportunity must be evaluated with its benefits. If a company opts only for equity it loses its leverage benefits.

If it opts for both debt and equity, proper balance must be maintained between the two to reduce the financial risk. Supposing, a finance manager would like to have more debt and less equity. This may bring in more dividend to shareholders and results in increased price of the share in the market and may lead to wealth maximisation.

But the cost of borrowed funds may increase the risk of the business concern. Most of the earnings will be used only on the payment of interest on the borrowed funds which is also called as “Financing Risk”. Hence he should be intelligent and tactful in deciding the ratio between debts to equity.

In addition to the responsibility of having proper “Financing Mix”, he should also provide sufficient scope for gaining additional sources of funds for expansion, diversification etc. This can be achieved through issue of preference shares, public deposits and raising term loans. Therefore, capital structure should not be rigid and it should be flexible.

3. Dividend Decision:

The ultimate objective of a business concern is to fulfill the desires of equity shares namely-

(a) High Percentage of dividend and

(b) Maximum returns to shareholders in the form of capital gain.

(c) How much cash dividend should be paid to the shareholders?

(d) How much profit is to be flown back by capitalisation?

(e) Maintenance of stable dividend rate over the period.

He should always keep in view the psychology of investors who wish to get a better yield on their investment. Hence a sound decision on dividend should be taken. While taking such a decision, the finance manager should also care much for retained earnings, which will act as a solid component of equity capital.

The dividend payout ratio must be evaluated in the light of the objectives of maximising shareholders’ wealth. Thus the dividend decision has become a vital aspect of financing decisions.

Current Asset Management:

The finance manager should also manage the current assets/to have liquidity in the business involvement of reduction in dividend. But the finance manager should also equally look after the current financial needs of the firm to maintain optimum production through which he must achieve efficiency and increase the operating cycle to meet the short-term obligations.

Hence, it is also termed as ‘Working Capital Management’. It keeps business operations going with the proper management of cash, accounts receivables and inventory.

16. Areas of Decision Making in Financial Management

There are three major areas of decision making in financial management:

1. Investment Decisions:

Investment decisions are concerned with selecting the right type of assets in which funds will be invested by the firm. The assets, which can be acquired, fall into two groups –

(i) Long-term assets (fixed assets), which would yield a return over a period of time in future, and

(ii) Short-term assets (also known as current assets) which are in normal course of business operations convertible into cash usually within a year.

As such investment decisions of the firm are of two types—Long-term investment decisions popularly known as ‘Capital budgeting’ and Short-term investment decisions.

Long-term investment decision is the most crucial financial decision of an enterprise because the growth, productivity and success of the firm in the long run depend upon such decisions. Such decisions are related to the selection of an asset or project or course of action or proposal whose benefits are likely to be available in the future.

The process of selection involves the measurement of benefits, costs and risks of all alternative proposals.

Whether an asset or proposal should be accepted or not, will depend upon the relative benefits associated with it. Short-term investment decisions are also important because short-term survival is a prerequisite to long-term success.

2. Financing Decisions:

Financial manager has to take a decision regarding rising of finances (funds) i.e., he has to decide the financing mix or financial structure of the firm. There are different sources of finance like shares, debentures and loans.

But a proper mix of all these types of securities is essential. The combination of shares, loans and debentures constitute the capital structure of a company. The best financing mix or capital structure has to be decided which involves determining the proportion or ratio of shares and debentures in the capital structure.

3. Dividend Decisions:

The third major decision of financial management is the decision relating to declaration and payment of dividend. Financial manager has to advise the top management (Board of Directors) as to what portion of profits should be distributed as dividend to the shareholders and what portion should be retained in the business for further investment.

In this sense, dividend decision becomes a part of financing decision as well as part of investment decision. Ultimately the final decision will depend upon preference of shareholders and investment opportunities available within the enterprise.

All these three financial decisions as finance functions are interrelated because these have the same objective, i.e., maximization of wealth.

17. Goals of Financial Management

All businesses aim to minimize their expenses, maximize their profits and maximize their market share. Here is a look at each of these goals. Maximize Profits a company’s most important goal is to make money and keep it.

Broadly speaking, the financial management discipline has dual objectives, namely:

1. Profit Maximization, and

2. Wealth maximization.

But the fundamental objective of all modern organizations is Shareholders wealth maximization and the Profit maximization is used in the second sense.

Financial Management is concerned with the proper utilization of funds in such a manner that it will increase the value plus earnings of the firm. Wherever funds are involved, financial management is there.

There are two paramount objectives of the Financial Management, Profit Maximization and Wealth Maximization. Profit Maximization as its name signifies refers that the profit of the firm should be increased while Wealth Maximization aims at accelerating the worth of the entity.

1. Profit Maximisation:

Meaning:

Profit maximization is the main aim of any business and therefore it is also an objective of financial management. Profit maximization, in financial management, represents the process or the approach by which profits (EPS) of the business are increased.

In simple words, all the decisions whether investment, financing, or dividend etc. are focused on maximizing the profits to optimum levels. Profit maximization is the traditional approach and the primary objective of financial management. It implies that every decision relating to business is evaluated in the light of profits.

All the decisions with respect to new projects, acquisition of assets, raising capital, distributing dividends etc., are studied for their impact on profits and profitability. If the result of a decision is perceived to have a positive effect on the profits, the decision is taken further for implementation.

In economics, profit maximization is the short run or long run process by which a firm may determine the price, input, and output levels that lead to the greatest profit.

It has been traditionally recommended that the apparent motive of any business organisation is to earn a profit, it is essential for the success, survival, and growth of the company. Profit is a long term objective, but it has a short-term perspective i.e. one financial year.

Profit can be calculated by deducting total cost from total revenue. Through profit maximization, a firm can be able to ascertain the input-output levels, which gives the highest amount of profit. Therefore, the finance officer of an organisation should take his decision in the direction of maximizing profit although it is not the only objective of the company.

In this perspective, profit maximization would imply that a firm should be guided by financial decision making by one test that, ‘select those assets, projects and decisions which are profitable and reject those which are not’.

Significance of Profit Maximization Criterion:

The Profit maximization criterion serves as a basic criterion and the rationale behind this objective is-

a. It is a simple guide to financial decision making.

b. Profit is a test of economic efficiency.

c. It provides a yardstick by which economic performance can be judged.

d. It leads to efficient allocation and uses of the firm’s economic resources to make profits.

e. It ensures economic welfare of society, since an individual who searches for maximum profitability, provides the famous invisible hand (profit) by which total economic welfare is maximized.

Profit Maximization Criticized & Questioned:

In current financial literature, there is a general agreement that Profit maximization is used in the second sense; because it has been questioned and criticized on several grounds.

The main technical flaws of Profit maximization are:

a. The term Profit is Vague and Ambiguous concept

b. It ignores timing of benefits

c. It ignores the quality aspects of benefits, and

d. is not operationally feasible criterion.

a. Profit is Vague and Ambiguous Concept:

Profit has no precise connotation. It is amenable to different interpretations by different people. To illustrate, profit may be, short term or long term; total or rate of profit; Profit before tax or Profit after tax, return on investment or return on total assets or return on equity and so on.

If profit is taken to be the objective, the question arises, which of these variants of profits should a firm have to maximize? Obviously, a loose expression like profit cannot form the basis of operational criterion for financial management.

b. Profit Ignores Timing of Benefits:

This is another important technical objection to profit maximization, as a guide to financial decision making is that it ignores the differences in the time patterns of the benefits received over the working life of the asset, irrespective of when they were received.

Normally the basic dictum of financial planning is ‘the earlier is the better principle’ says that, ‘the benefits received sooner are more valuable than the benefits received later’. The reasons for the superiority of benefits received now, over the benefits received later lies in the fact that the former can be reinvested to earn a return.

Hence the profit maximization criterion does not consider the distinction between returns received in different time periods and treats all the benefits irrespective of the timing, as equally valuable. But in actual practice, the benefits received in early years should be valued more than equivalent benefits receivable in later years.

c. Profits Ignore Quality Aspect of Benefits:

Profits ignore the quality aspect of benefits associated with financial course of action. The term quality here refers to the degree of certainty with which benefits can be expected. As a rule, the more certain the expected return, the higher is the quality of the benefits. Conversely, the more uncertain/fluctuating is the expected benefits; the lower is the quality of the benefits.

An uncertain and fluctuating return implies risk to the investors. Risk is the chance that actual outcome may differ from those expected. Our investors are risk averters, who want to avoid or minimize risks.

Hence, this risk concept makes profit maximization objective as unsuitable as an operational criterion for financial management decisions, as it considers only size of benefits and gives no weightage to the degree of uncertainty of the future benefits.

The profit maximization is not an operationally feasible criterion:

The profit maximization concept does not specify clearly whether it means short or long- term profit, or profit before tax or after tax. In addition, in the free economy and perfect competition, businessmen pursue their own interests to maximize the profit by utilization of resources in an efficient and effective way.

Let us assume that maximizing the profit means maximizing profit after tax, i.e., net profit as reported by the income statement of the business firm. It should be understood that this would not maximize the welfare of the owners if some short-term actions were taken to improve profit.

For example, the manager may sell some of the assets and then invest funds in low yielding assets. The profit after taxes would go up in the short-term but the long-term profitability will suffer.

To conclude, Profit maximization criterion is inappropriate and unsuitable as an operational objective of investment, financing and dividend decisions of the firm. It is not only vague and ambiguous but also ignores two important dimensions of financial analysis, namely risk and time value of money.

To justify, as an appropriate decision criterion for financial management decisions, the basic criterion should incorporate the following features:

1. The Objective concept should be Precise and Exact.

2. The Objective should be based on the bigger the better principle.

3. The Objective should consider both quality and quantity dimensions of benefits.

4. The Objective should recognize the relevance of time value of money.

Hence, as an alternative to Profit maximization objective, another objective has derived is ‘Shareholders wealth Maximization’ (SWM).

2. Shareholders Wealth Maximization’ (SWM):

Meaning:

Shareholders Wealth Maximization is also known as Value Maximization or Net Present Value (NPV) maximization states that, the value of the Asset or the value of a course of action or the worth of the benefits associated with the precise estimation of the benefits actually derived and not expected.

Wealth maximization is the ability of a company to increase the market value of its common stock over time. The market value of the firm is based on many factors like their goodwill, sales, services, quality of products, etc.

It is the versatile goal of the company and a highly recommended criterion for evaluating the performance of a business organisation. This will help the firm to increase their share in the market, attain leadership, and maintain consumer satisfaction and many other benefits are also there.

It has been universally accepted that the fundamental goal of the business enterprise is to increase the wealth of its shareholders, as they are the owners of the undertaking, and they buy the shares of the company with the expectation that it will give some return after a period. This states that the financial decisions of the firm should be taken in such a manner that will increase the Net Present Worth of the company’s profit.

Shareholders Wealth Maximization concept is based on the concept of ‘cash-flows’ generated by the asset rather than accounting profit. SWM also considers the quality and quantity dimensions of the benefits measured in terms of time value of money using an appropriate discount rate or interest rate or time preference rate or capitalization rate.

The worth of the streams of cash-flows with the value maximization criterion is calculated by discounting its elements back to the present at a capitalization rate, that reflects both time and risk preferences of the owners or suppliers of capital. In applying the value maximization criterion, the term value is used in terms of worth to owners or shareholders.

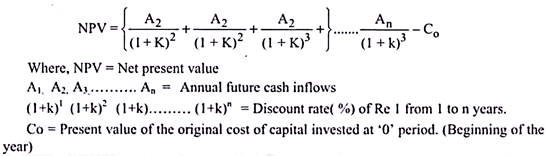

Using Ezra Solomon’s symbols & methods, NPV of a course of action is equal to-

W = V – C

Where,

W = Net present worth

V = Gross present value.

C = Capital required to acquire assets or to purchase a course of action (original investment).

Wealth/ NPV is the difference between gross present worth (V) and the original investment I required for achieving the benefits.

Gross present value (V) of a course of action is equal to the capitalized value of the flow of future expected benefits, discounted or capitalized at a rate which reflects their certainty/ uncertainty.

Alternatively NPV is also calculated as:

Advantages of Wealth Maximization:

Wealth maximization as an operational criterion for management is most important and rational from the following views:

1. Wealth maximization is a clear term since it takes into account the time value of future benefits to measure the future benefits of investment.

2. Wealth maximization takes into consideration the cash-flows instead of profit for measuring the magnitude of returns i.e. NPV

3. Wealth maximization considers risk and uncertainty associated with future benefits through discount rate.

4. Wealth is a visible concept by which the value of an organization is maximized.

5. Wealth maximization is a long term objective for long run survival.

6. Wealth maximization shows the true and fair picture of the organization.

Limitations of Wealth Maximization:

The sound and clear concept of Wealth maximization is not out of criticisms; which are listed below:

1. Wealth maximization objective is not descriptive, since this objective differs from one organization to organization in its narration of wealth.

2. Wealth maximization objective leads to conflicting situations between the yardsticks of management and stakeholders, since there are more possible areas of conflicts between them with regard to the policies and procedures of the organization.

3. An ambiguity exists between the primary objective of Profit maximization and the secondary objective of wealth maximization; since both the objectives are overlapping in nature.

4. There is a difficulty in the measurement of exact wealth, since it depends on anticipated future cash flow benefits.

Profit Maximization v/s Wealth Maximization:

Wealth maximization is Superior to Profit Maximization?

The wealth maximizing objective means maximizing the net present value, i.e., wealth of the owner. The net wealth of the owner is the difference between the present value of its benefits and the present value of its costs. Any action that has a positive NPV creates wealth for the owner.

The profit maximizing objective tries to maximize the profit after tax, i.e., net profit, which in the long term may reduce the net worth of the owner. The profit maximization concept basically ignores the time value of money and the risk involved in firm’s activities, which are very well taken care of by the wealth maximization concept.

Wealth/NPV maximization is superior to Profit maximization, as an operational objective of financial decision making has been narrated on the following grounds as below:

Profit Maximization:

1. Profit is a test of economic efficiency, which indicates the excess of output over input.

2. Profit is the basis for the measurement of benefits.

3. Profit maximization ignores the quality & quantity dimensions of benefits i.e. ignore time value of money of future benefits.

4. Profit maximization relies on EPS maximization.

5. It ignores risk and uncertainty associated with future benefits.

6. Profit is an economic concept, which theoretically sounds but practically weak.

7. Profit concept is vague and ambiguous.

8. Profit is an invisible hand by which the total economic welfare is maximized.

9. Profit maximization is a short term objective

10. Profit maximization does not show the true and fair picture of the organization.

Wealth Maximization:

1. Wealth is the test of value maximization, which is the difference between the present value of cash-inflows and outflows.

2. Present value of Cash-flows is the basis for the measurement of benefits.

3. Both quality & quantity dimensions of benefits through the capitalization rate have been considered i.e., it recognizes the time value of money or future benefits.

4. Wealth maximization relies on NPV maximization.

5. It considers risk and uncertainty associated with future benefits through a discount rate.

6. Wealth is a financial concept, which is both theoretically and practically sound.

7. Wealth is precise and clear.

8. Wealth is a visible concept by which the value of an organization is maximized.

9. Wealth maximization is a long term objective

10. Wealth maximization shows the true and fair picture of the organization.

Key Differences between Profit Maximization and Wealth Maximization are as follows:

The fundamental differences between profit maximization and wealth maximization are explained in points below:

1. The process through which the company is capable of increasing earning capacity known as Profit Maximization. On the other hand, the ability of the company in increasing the value of its stock in the market is known as wealth maximization.

2. Profit maximization is a short term objective of the firm while the long-term objective is Wealth Maximization.

3. Profit Maximization ignores risk and uncertainty. Unlike Wealth Maximization, which considers both.

4. Profit Maximization avoids time value of money, but Wealth Maximization recognises it.

5. Profit Maximization is necessary for the survival and growth of the enterprise. Conversely, Wealth Maximization accelerates the growth rate of the enterprise and aims at attaining the maximum market share of the economy.

Conclusion:

There is always a contradiction between Profit Maximization and Wealth Maximization. We cannot say which one is better, but we can discuss which is more important for a company. Profit is the basic requirement of any entity. Otherwise, it will lose its capital and cannot be able to survive in the long run.

But, as we all know, the risk is always associated with profit or in the simple language profit is directly proportional to risk and the higher the profit, the higher will be the risk involved with it. So, for gaining the larger amount of profit a finance manager has to take such decisions which will give a boost to the profitability of the enterprise.

In the short run, the risk factor can be neglected, but in the long-term, the entity cannot ignore the uncertainty. Shareholders are investing their money in the company with the hope of getting good returns and if they see that nothing is done to increase their wealth.

They will invest somewhere else. If the finance manager takes reckless decisions regarding risky investments, shareholders will lose their trust in that company and sell out the shares which will adversely affect the reputation of the company and ultimately the market value of the shares will fall.

Therefore, it can be said that for day to day decision making, Profit Maximization can be taken into consideration as a sole parameter but when it comes to decisions which will directly affect the interest of the shareholders, then Wealth Maximization should be exclusively considered.

18. Aims of Finance Function

All functions of finance are performed by all the responsible executives of the finance department aiming at solving the organizational problems both at micro and macro level, such aims and objectives are listed below-

1. Funds Rising:

Getting required amounts of funds from different forms and from both internal and external sources like shares, debentures, loans, retained earnings in the required proportion is the fundamental or prime function of the finance executives in the finance department.

2. Funds Allocation:

After the procurement of funds from various sources in required quantities, the next function of the finance executives is the allocation of these funds on profitable projects.

3. Project Selection & Risk-Return-Trade-Off:

While allocating the huge capital funds, choosing the best project or the asset for investment of funds using the different capital budgeting techniques, keeping in mind the risk patterns to manage projects to keep them at profitable levels is another key function of finance, which is regarded as Risk-return-trade-off.

4. Dividend Payout:

The Profit planning and allocation i.e. disposable profits is the third major function of finance. The rate of dividend declared and the stability of dividends i.e. Dividend payout is the most important function of finance. Retained earnings i.e. maintaining residual profits to meet future contingencies is also a key function along with the dividend function.

5. Maintaining Liquidity/Solvency:

Is the major responsibility of every organization for the smooth functioning of all its activities is the most important finance function? Every organization has to maintain sufficient amount of working capital to meet its day-to-day requirements.

6. Reporting & Auditing:

Information reporting of all audited documents to both internal and external users is also an important finance function in every organization, which is mandatory for all the organizations as per the companies’ act of 1956.

7. Budgeting and Controlling:

Through the preparation of various budget statements to estimate the financial requirements of a stipulated period to control the costs in the organization for long run survival is another finance function of the organization.

8. Understanding Capital Markets and EPS Maximization:

To meet these objectives, the organization has to keep a close touch with the developments which take place in the capital markets. Because it is the right place to procure the required capital funds in a required form.

This capital mix decision decides the size of benefits accrues to the owners of the company i.e. equity shareholders through the maximization of earnings per share.

9. Maintaining Stability and Sustainability:

Through the maximization of the value of the firm is possible only when all the finance functions are targeted towards this objective. Hence the company has to keep a strict vigilance at all its activities by maintaining sufficient liquidity, long-term solvency, efficiency and profitability.

19. Functions of Controller

The functions of controller are:

(1) Planning & Budgeting

It includes profit planning, capital expenditure planning, budgeting, inventory control, sales forecasting etc.

(2) Financial Accounting

He establishes a proper system of accounting, controls it and prepares financial statements such as Profit & Loss account and Balance Sheet etc.

(3) Cost Accounting

He establishes a cost accounting system suitable to the business and controls it.

(4) Data Processing

It includes the collection and analysis of business data.

(5) Internal Auditing

He manages internal audit and internal control.

(6) Annual Reports

He prepares annual reports and various other reports needed by the top management.

(7) Information to Government

He prepares various reports to be submitted to the Government under various laws.

20. Financial Management and its Relationship with Other Disciplines

Introduction:

The financial management provides oil to the life of a firm by providing the flow of funds. This helps the firm in achieving the ultimate objectives of the firm. Finance function is related to every other functional area of the business, wherever a policy decision is to be taken every policy decision involves some or other financial implications.

The knowledge of financial implications of their decisions is important for the non-finance managers i.e., production manager, marketing manager, human resources’ manager, etc. These non-finance managers also take investment decisions implicating the theories and principles of financial management.

Thus the functions like production, marketing, purchase, HR, etc., involve financial aspects also. Hence the functions of all departments imply a problem of finance in one form or other.

According to Hunt “Probably no other functional area of a business is so intimately interrelated with other areas of the business as is the finance function.”

The following are the relationship between financial management and other functional areas of business:

1) Financial Management and Production Departments

2) Financial Management and Marketing Department

3) Financial Management and Human Resources Management

4) Financial Management and Material Department

5) Financial Management and Top Management

6) Financial Management and Assets Management

7) Financial Management and Cost Accounting

8) Financial Management and Financial Accounting

1) Financial Management and Production Department: