1. Introduction to Capital Budgeting

Every business entity has to continuously incur expenses on certain resources or assets which help it not only to produce but also grow. This expenditure has to be made on raw materials, labour, fuel and power, spares and stores as well as certain essential maintenance expenses. These expenses are the routine and recurring expenses which help an enterprise to continuously produce at the current level of output.

However, enterprises also want to expand their productive capacities or to set up new ventures for which also they have to incur expenses which are not routine or regular. These expenses are occasional and are made when an enterprise sees a new opportunity and wants to exploit it in the foreseeable future. These expenses are on fixed assets like land, building, machinery, equipment etc. They are called ‘capital expenditure’.

Expenditure on fixed assets is entirely different from expenditure on current or variable assets. The implications of expenditure on fixed assets like plant, machinery, equipment, land, building or any such expenditure like research, brand building etc. extend into the future, whereas expenditure on variable inputs like raw material, labour, power or other current outlays belong to the same time period.

In this way, expenditure on fixed assets has inter temporal implications, i.e., expenditures are being done now but benefits will be received in future. That is why, they are treated as investment or capital expenditure decisions and the process of this decision making is called ‘capital budgeting’.

2. Meaning of Capital Budgeting

The investment decisions are commonly known as capital budgeting or capital expenditure decisions. Capital budgeting means planning for capital expenditure in acquisition of capital assets such as new building, new machinery or a new project as a whole. It refers to long term planning for proposed capital outlays and their financing.

ADVERTISEMENTS:

It includes mechanization of a process replacing and modernizing a process introduction of a new product and expansion of the business. It includes both raising of long-term funds as well as their utilization. It contains the preparation of Detailed Project Reports (DPR) and cost and revenue statements indicating the profitability.

3. Need for Capital Budgeting

The need for Capital budgeting arises due to the following reasons:

1. Capital budgeting is necessary because large sums of money are involved for acquiring fixed assets.

ADVERTISEMENTS:

2. Large sums of money involved on capital assets are permanently blocked. Capital investment decisions once taken cannot be reversed easily without heavy loss. This necessitates capital budgeting.

3. Funds invested in capital projects or fixed assets are recovered over a long period. Therefore, there is risk and uncertainty in the recovery of funds. So it necessitates capital budgeting.

4. Capital investment decisions require an assessment of future events, which are uncertain. This necessitates capital budgeting.

5. Excessive capital investment would increase the operating cost of the firm. So, careful planning of the capital budgeting is quite necessary.

4. Features of Capital Budgeting Decisions

Basic Features of Capital Budgeting decisions are:

(1) Current funds are exchanged for future benefits

ADVERTISEMENTS:

(2) There is an investment in long-term activities; and

(3) The future benefits will occur to the firm over a series of years.

5. Significance of Capital Budgeting

Capital budgeting decisions are of paramount importance in the financial decision-making process of an organization.

It provides the following benefits:

1. Capital budgeting decisions affect the profitability of a firm.

2. Capital budgeting decisions determine the destiny of the company. A few wrong decisions affect the survival of firms.

3. Capital budgeting decisions affect a company’s future cost structures.

4. Capital budgeting decisions provide a basis for long term financial planning.

ADVERTISEMENTS:

5. Capital budgeting is helpful for taking proper decisions on Capital expenditure.

6. Majority of the firms have scarce capital resources. Therefore, proper Capital budgeting decisions are helpful in allocating such scarce means in an economical way, keeping in mind the objective of the company.

6. Project Classification

Capital budgeting decisions involve more time and cost. The costs incurred in this process must be justifiable by the benefits from it. The capital budgeting process may be less or more, it depends on the type of the project. So firms normally classify the projects into different categories.

The categorisation may differ from one firm to another firm, but the following are the most important classification of projects:

ADVERTISEMENTS:

1. New Projects:

New manufacturing concerns require investing in fixed assets, without which there is no manufacturing process. For example – establishment of a paper manufacturing company requires machinery to produce paper, which may require investment of some crores of rupees. Purchase of long-term assets requires efficient decision-making.

2. Expansion Projects:

Expansion projects generally increase existing capacity, or addition of new features to the existing product or widen the distribution network. These types of investments call for an explicit forecast of growth.

ADVERTISEMENTS:

Project expansion generally requires more careful analysis than the other types of projects. For example – a paper manufacturing company which is currently producing 20,000 tonnes of paper per year may increase its plant capacity by 10,000 tonnes per year.

A Home Appliance Product Company that is producing semi-automatic washing machines now is planning to produce fully automatic washing machines.

3. Diversification Projects:

Diversification is the spread of risk across a number of assets of investments. Here it is necessary to recollect the proverb, “don’t put all eggs in one basket”. Diversification may be concentric or conglomerate. For example – a company producing toilet soaps is planning to enter into detergent soaps, is known as concentric diversification.

Conglomerate diversification is entering into a new business area. For example -Reliance, marketer of textiles, entering into petroleum business. Often diversification projects entail substantial risks, involve large initial cash outflows, and require considerable managerial effort and attention. They require more analysis not only in the form of quantitative but also in qualitative aspects.

4. Replacement and Modernisation Projects:

ADVERTISEMENTS:

In the competitive world, companies have to improve their operating efficiency and reduce costs, for which they are required to go for either modernisation of the existing machines or replacement of the obsolete and inefficient machinery, even though they may be in good condition. In other words, replacing or modernisation is to reduce costs, increase yield and improve quality of the product.

For example – a cement manufacturing concern is planning to go for modernisation where it is changing its drying process from semi-automatic to fully automatic drying equipment or replacement of manually operated machinery by fully automatic machinery.

5. Research and Development (R&D) Projects:

Nowadays, the majority of the large firms are setting up their own R&D departments. Organisations require more funds to set up R&D departments. R&D projects are characterised by numerous uncertainties and typically involve sequential decision-making. For this type of projects, discounted cash flow analysis is not applicable, but these projects are decided on the basis of managerial judgment.

6. Miscellaneous Projects:

Apart from the above-discussed types of projects, there are some other projects like interior decoration, recreational facilities, executive aircrafts, and landscaped gardens and so on. For evaluation of these projects there is no standard approach and the decisions with regard to such projects are based on the top management’s preferences and their judgement.

7. Capital Budgeting Techniques

The ultimate objective of the capital budgeting process is to achieve maximum benefit from the project.

ADVERTISEMENTS:

For this purpose, there are various techniques of capital budgeting which are as follows:

Technique # 1. Payback Period Method:

When one invests an amount in any type of investment, he/she always worries about the length of time for getting invested money back, same happens in a firm too. When a firm goes to invest an amount in purchasing any fixed asset, it explores the alternatives available which may provide cash back soon.

The payback period is the duration to recover the initial cost of the project. In this process, the payback period is the most identified and popular method of capital budgeting to evaluate the proposals for the purpose of capital expenditure. Payback period is that time period in which net cash inflow from investment recovers the cost of investment.

Under this method, the proposal is to be selected which is time conscious i.e. the project which will take least time to pay back the amount invested will be preferred. If numbers of proposals are available then these will be ranked on the basis of their estimated time consumption and selected accordingly.

ADVERTISEMENTS:

Advantages or Merits of Payback Method:

i. It is simple to calculate and easy to understand, apply and interpret.

ii. It is realistic in approach as businessmen want speedy recovery of their money in capital assets.

iii. It weights early returns heavily and ignores distant returns and thus a short payback period acts as a hedge against a boon decision.

iv. It is safe since it avoids incalculable risk and uncertainty in the long run.

Limitations or Demerits of Payback Method:

ADVERTISEMENTS:

Major shortcomings of this method are as follows:

i. This method is a ‘crude rule of thumb’ and over-emphasizes early recovery of invested funds of course, liquidity in itself is an important factor but ignoring ‘profitability of investment’ and concentrating, only on ‘liquidity of investment’ can in no way be justified in most of the situation.

ii. It concentrates only on the ‘recovery of the cost of investment’ and does not consider the earnings after the payback period.

iii. It considers only the payback period of the project and not its whole life. It doesn’t include the cash inflows which occur after the payback period.

iv. This method ignores the risk factor in investments. Hence, projects with higher risk but lower payback period will be accepted as compared to a project with lower risk and higher payback period.

v. This method does not consider the ‘cost of capital’ which is an important base of sound investment decisions.

vi. This method ignores the time value of money. It fails to consider varying cash flow patterns. All cash flows are treated and weighted equally, regardless of the time period of their occurrence.

vii. It focuses on recovery of capital only rather than measuring the profitability of a firm.

viii. This method ignores the salvage value of the asset.

ix. It is not possible to calculate the rate of return by this method.

Accept/Reject Criteria:

If the actual pay-back period is less than the predetermined pay-back period, the project would be accepted. If not, it would be rejected.

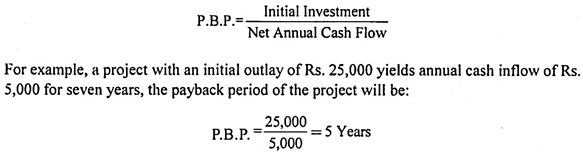

The payback period is calculated as follows:

i. In the Case of Even Cash Inflows:

If cash inflows from investment are uniform throughout the life of investment, payback period is calculated by dividing the cost of investment with the amount of annual cash inflow.

As per formula:

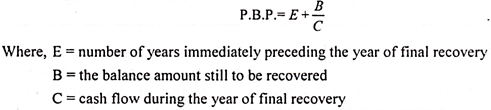

ii. In the Case of Uneven Cash Inflows:

If cash inflows from investment are not uniform each year, payback period will be calculated by taking cumulative total of each year’s cash inflows and the exact payback period will be calculated by interpolation.

Payback period will be calculated as:

Note – The Answer will be in years. If we will multiply B/C with 12 or 365 then this part will be converted into months or days respectively.

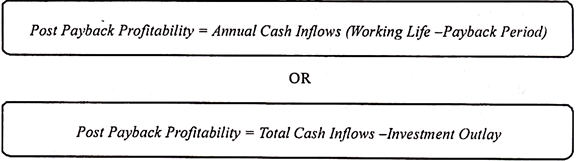

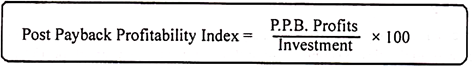

Technique # 2. Post Payback Profitability (P.P.B. Profit):

One of the major limitations of the pay-back period method is that it does not consider the cash inflows earned after pay-back period and if the real profitability of the project cannot be assessed. To improve over this method, it can be made by considering the receivable after the pay-back period. These returns are called post pay-back profits.

It is calculated as follows:

Note: Salvage value of assets will be included in the earnings of last year.

Accept/Reject Criteria:

Other things being equal, the project with the highest post-payback profitability will be the best. Higher the post-payback profitability, more attractive will be the project. If cost of various projects differs substantially, a post payback profitability index may be calculated to assess the relative profitability of the projects.

Technique # 3. Accounting Rate of Return Method (ARR Method):

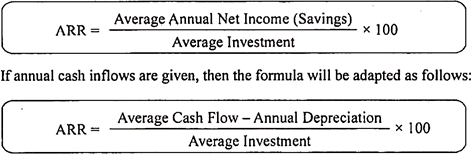

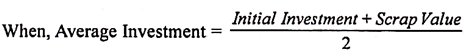

This method is also known as the unadjusted rate of return method or Financial Statement Method because the main figures used in the calculation are derived from accounting statements. Under this method, the percentage rate of return of the annual net profit on investment is calculated.

If it is calculated on initial investment, it is called Return on Investment (ROI) and if it is calculated on average investment, it is called as Average Rate of Return. Usually, it is calculated on average investment in the project. If annual net income fluctuates then average annual net income is used into the calculation.

Thus, the formula for calculating this return is as follows:

Note:

1. Average investment we can say average value of investment (opening value + closing value)/2

2. Average investment refers to the average funds that remain invested or blocked over its economical life.

Average investment = 1/2(Initial cost +installation exps. – salvage value) + salvage value.

Evaluation of Project under ARR Method:

Rate of return calculated as above is compared with the cutoff or the pre-specified rate of return. If the return is more than the cut-off rate, the project would be accepted, if not, it would be rejected.

In the evaluation of mutually exclusive projects, only such projects are considered, whose accounting rates of returns are more than the cut-off rate and the project with the highest rate is selected. The larger is the rate, better is the project.

Advantages or Merits of Unadjusted Rate of Return Method:

a. It is simple to compute and easy to understand and interpret.

b. It takes into consideration the total earnings from the project during the entire economic life.

c. This method gives due weight to the profitability of the project.

d. This method duly recognizes the concept of net earnings, i.e., earnings after providing for depreciation on capital assets. In fact, this is the correct way of income determination.

e. This method ignores the life of the project for determining the cost of investment. Hence, the amount of initial investment and average investment remain the same.

Limitations or Demerits of Unadjusted Rate of Return Method:

a. It is simply an averaging technique, which does not take into account the impact of various external factors on overall profits of the firm.

b. It ignores the life of the project and differentiates against the projects of lower economic life. Two projects can have the same ARR, A proposal with a longer life may have the same ARR with a shorter life proposal. On the basis of ARR both the projects are equally good, but the proposal with longer life would be preferred.

c. It ignores the time value of earnings. In other words, this method does not discount the future earnings to present value.

d. The method does not determine the fair rate of return on investments. It is left at the discretion of management.

e. This method does not give consideration to the risk factor in respect of each project. Risk analysis should be the integral part of a project evaluation technique.

f. This method is based on accounting profits rather than cash flows. We know that accounting profits are affected by different accounting policies.

Technique # 4. Present Value Method:

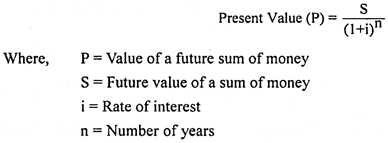

This is the method which follows the concept of real time factor. It involves the value of time in transactions. This method is popularly known as ‘discounted cash flow method’ because in this method all future cash flows (inflows and outflows both) of an investment project which occur at different times are discounted at a given rate to bring them at a common denominator and make them comparable.

Discounting is a procedure of bringing future inflows and outflows of cash to their present values. In general, money received today is valued more than money receivable tomorrow. “A bird in hand is worth more than the two in the bush” is rightly applicable to the management of capital.

Therefore, in this technique, all future inflows and outflows of cash of an investment project are brought to technique, all future inflows and outflows of cash of an investment project are brought to their present values by applying a discounting rate (i.e., cost of capital or interest rate).

What you have today is more worthy than what you will have in future.

Calculating Present Value:

The present value of future cash flows is found out with the help of the following algebraic formula:

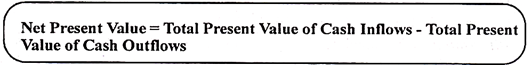

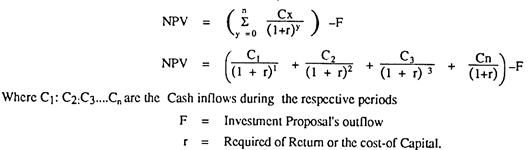

Net Present Value Method (NPV Method):

This is also known as Excess Present Value Method or Net Gain Method. This method is used when the management has prescribed a minimum (or target) rate of return or cut-off rate.

Following steps are involved in this method:

(i) Determine the present value of all cash inflows from investments at different periods at required earnings rate.

The formula is:

Note:

It should be remembered that salvage value and working capital released at the end of the project’s life are considered as cash inflows of the last year and are duly discounted to present values.

(ii) Determine the present value of all cash outflows at different periods at the same earnings rate. Cash outflows at zero period of time (initial investment including working capital needed, if any) are not discounted.

For this amount, the present value factor is taken as 1. However, cash outflows at subsequent periods are discounted by the relevant present value factor.

(iii) Find out the present value. For this, the total of present values of all cash inflows is compared with the total of present values of all cash outflows.

As per formula:

Accept/Reject Criteria:

(a) If NPV is positive, the project is accepted.

(b) If NPV is zero, the project is accepted or rejected on non-economic considerations.

(c) If NPV is negative, the project is rejected.

Higher the NPV, more attractive will be the project. Hence, in mutually exclusive projects, (if cost of investment is similar), the project which gives the higher positive NPV will be preferred.

Merits of NPV Method:

a. The NPV method recognizes the time value of money and takes into consideration the cost of capital.

b. It is very easy to calculate and simple to understand and interpret.

c. It takes care of the entire life of the project and its entire earnings including salvage of asset.

d. It can be applied to both types of cash inflow patterns – even and uneven cash inflows.

e. The economists generally prefer this method as it is consistent with the objective of maximizing owners’ wealth.

Limitations or Demerits of NPV Method:

a. Compared to the payback or accounting rate of return methods, NPV methods are difficult and complicated.

b. The greatest problem of this method is determination of desired rate of return. Due to the difference in the state of risk and uncertainty of different business, no uniform rate can be used.

c. Keeping in view the time-span of different projects and the difference of risk inherent in them, use of a common discounting rate is not correct.

d. It may also not give satisfactory results where the projects under competition have different lives. NPV method favours long-lived projects.

e. It assumes that intermediate cash inflows are reinvested at the firm’s cost of capital, which is always not true.

f. The results from this method may contradict those under the internal rate of return method, even in the case of alternative proposals, which are mutually exclusive.

g. Net present value is sensitive to discount rates. With a change in rate, a desirable project may turn into an undesirable one and vice-versa.

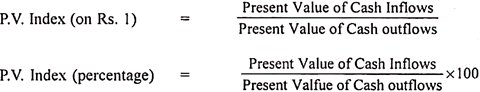

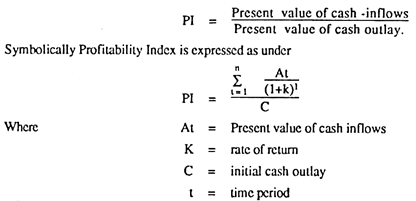

Profitability Index Method or Present Value Index Method:

The Profitability index method is a variant of NPV method and is called benefit-cost ratio. It is preferable to the NPV method where capital costs of mutually exclusive projects differ substantially. It expresses the relationship between present values of cash inflows and the present value of cash outflows (i.e., cost of investment).

The formula is:

The main object of the use of present value index is to provide ready comparability between investment proposals of different magnitude. A proposal can be accepted only if the profitability index is greater than or at least equal to unity. Higher the index, more desirable is the investment.

The proposal is rejected if its profitability index is less than one. But, it is to be noted that a profitability index of less than one does not indicate loss. It simply means that the firm’s cost of capital exceeds the rate of return making it imperative for the proposal to be rejected.

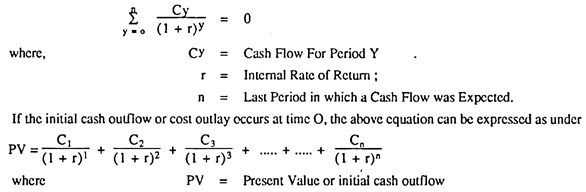

Technique # 5. Time Adjusted Rate of Return Method (TAR Method) or Internal Rate of Return Method (IRR Method):

This rate is also known as ‘Marginal Efficiency of Investment’, ‘Internal Rate of Project’ and ‘Breakeven Rate’. It follows the discounted cash flow technique, which takes into account the time value of money. This is why this rate is called a time adjusted rate. This method is used when the management does not prescribe a desirable rate of return.

Under this method, such a rate of return (or discounting rate) is derived at which the aggregate of the present values of all future cash inflows from investment equals the present value of cash outflows for the proposal (i.e., initial investment outlay). In other words, IRR is the maximum rate of interest that could be paid for the capital employed over the life of an investment without loss on the project.

It is the rate of discount at which net present value is zero. Higher the IRR, more attractive is the proposal. A proposal is accepted only when IRR is higher than the required rate of return (cut-off rate). If it is lower, the proposal is rejected; if it is just an equal decision is taken on the basis of other considerations. In case of mutually exclusive projects, the project with the highest IRR is selected.

Computation of IRR:

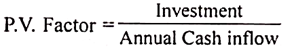

a) In The Case Of Even Cash Inflows:

If cash inflows are uniform each year, the computation of IRR involves the following two steps:

i) Calculate Present Value Factor (or Payback Reciprocal):

The following formula is applied for this purpose:

ii) Finding Rate of Return:

Locate the factor closest to the factor calculated above in the compound present value in the row of year corresponding the life span of investment in years. The interest rate of the column of that factor will be the required IRR.

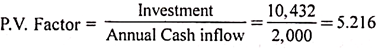

For example, if an investment outlay of Rs. 10,432 yields cash earnings of Rs. 2,000 each year for 10 years, IRR is calculated as follows:

Locating this factor in the compound P.V. Table in the row corresponding to the life span of investment in years (i.e., tenth year), the factor is an interest rate of 14%s. Hence, IRR in this case is 14%.

Note:

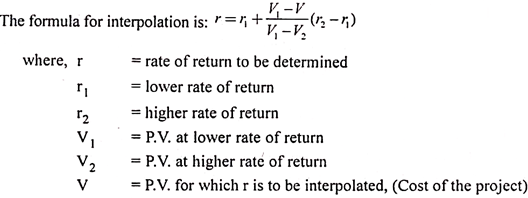

It is always not possible that the same factor as calculated in (i) above is there in the present value table. It may exist between any two factors in the table. In such a case, IRR is determined on the basis of the closest factor. The actual rate can, however, be calculated by applying interpolation technique, although such accuracy is usually not required in the appraisal of the projects.

b) In the Case of Uneven Cash Inflows:

The calculation of IRR under such circumstances is a little bit difficult. In this case, ‘trial and error’ procedure is followed to find out IRR. Here also the object is the same.

We have to determine the rate at which the total present value of irregular and uneven cash inflows equals the cost of investment (or total present value of cash outflows), i.e., where NPV is zero.

The following procedure may be followed in such a case:

i) Calculate the average annual cash inflows to get a fake annuity.

ii) Determine ‘fake payback factor’ by dividing the initial outlay with the average annual cash inflows.

iii) Locate the factor in compound P.V. Table closest to the fake present value factor in the same manner as in the case of annuity and determine the fake IRR.

iv) Calculate present value of cash inflows at the fake rate determined above and compare the total present value of cash inflows with the cost of investment. If NPV is positive, a higher rate should be tried to calculate NPV. Conversely, if NPV is negative, a lower rate should be tried. The procedure will go on till we find the rate at which NPV is zero.

Alternatively, two discounting rates may be selected in such a way that the NPV result of the lower rate of discount is a positive amount and the NPV result of the higher discounting rate is a negative amount. Then the interpolation technique should be applied to arrive at the correct IRR.

Criteria for Acceptance:

(1) Accept the project of IRR>k,

(2) Reject the project of IRR<k

(3) k is the cost of capital

Merits of TAR or IRR Method:

(a) Like NPV, IRR method takes into consideration time value of money and also the total cash inflows and outflows over the entire life of the project.

(b) The pre-determination of earnings rate is not a precondition for the use of this method.

(c) For a manager, it is easier to understand and interpret the ‘rate’ than an absolute amount.

Demerits of TAR or IRR Method:

(a) Its computation is difficult. IRR requires tedious calculations based on trial and error procedure or interpolation.

(b) The assumption that cash flows are reinvested for the remaining life of the project at the IRR is unrealistic. In some cases, it remains idle in the business.

(c) This method requires the determination of minimum required rate of return to know the acceptability of IRR, which is a difficult task.

(d) If cash inflows in any years are negative then it may give more than one solution.

(e) This method does not differentiate satisfactorily between projects of different lives.

Comparison between NPV and IRR (NPV vs. IRR):

Net Present value method and the Internal Rate of Return Method are similar in the sense that both are modern techniques of capital budgeting and both take into account the time value of money. In fact, both these methods are discounted cash flow techniques.

However, there are certain basic differences between these two methods of capital budgeting:

1) In the net present value method the present value is determined by discounting the future cash flows of a project at a predetermined or specified rate called the cut-off rate based on cost of capital.

But under the internal rate of return method, the cash flows are discounted at a suitable rate by hit and trial method which equates the present value so calculated to the amount of the investment. Under the IRR method, discount rate is not predetermined or known as is the case in NPV method.

2) The NPV method recognizes the importance of market rate of interest or cost of capital. It arrives at the amount to be invested in a given project so that its anticipated earnings would recover the amount invested in the project at market rate.

Contrary to this, the IRR method does not consider the market rate of interest and seeks to determine the maximum rate of interest at which funds invested in any project could be repaid with the earnings generated by the project.

3) The basic presumption of NPV method is that intermediate cash inflows are reinvested at the cut off rate, whereas, in the case of IRR method, intermediate cash flows are presumed to be reinvested at the internal rate of return.

4) The results shown by NPV method are similar to that of IRR method under certain situations, whereas, the two give contradictory results under some other circumstances. However, it must be remembered that NPV method using a predetermined cut-off rate is more reliable than the IRR method for ranking two or more capital investment proposals.

8. Factors Affecting Capital Budgeting Decisions

Capital budgeting decisions are affected by a number of factors.

Such factors are listed and explained briefly as follows:

1. Availability of funds

This is one of the important factors affecting capital budgeting decisions. If the firm has more funds, it may invest in many projects. At the same time, limited funds lead to choose between the available projects.

2. Amount of capital investment

This is another factor affecting capital budgeting decisions. Some of the project requires more capital investment and some of the project requires less capital investment.

3. Earnings of the project

Earnings of the project would affect the capital budgeting decisions. If the earnings of the projects are good that project would be taken for implementation, otherwise it may be rejected straightway.

4. Get investment early/Payback policy

This is also one of the factors affecting capital budgeting decisions. If a project helps a firm to get back its investment early, that project is selected and vice versa.

5. Day to day Capital/Working Capital requirement

Capital budgeting decisions are also affected by day-to-day capital. If the project requires more additional capital then do not select such project for implementation. If it requires less additional capital it may be selected for implementation.

9. Kinds of Capital Budgeting Decisions

Capital budgeting decisions are of three types:

(1) Accept-Reject Decisions

(2) Mutually Exclusive Investment Decisions

(3) Capital Rationing Decisions

(1) Accept-Reject Decisions:

This is a basic decision in capital budgeting. If a project is accepted, the firm will make investment in it. And if it is rejected, no investment will be made by the firm. Generally, all these proposals are accepted in which the available rate of return is more than the cost of capital or standard rate or predetermined rate.

On this basis all independent proposals are accepted or rejected. Independent proposals are those which are not competitive with each other and all proposals can be accepted simultaneously. Thus, under accept-reject yardstick, all those proposals are accepted which fulfil the minimum standards.

(2) Mutually Exclusive Investment Decisions:

Mutually exclusive investment decisions are those which compete with each other. In such a case to accept one project, others have to be rejected. Thus, out of certain projects only one has to be selected.

For example- to manufacture a product necessary equipment is available under different brand names of different companies.

But only one of such equipment will be selected. It may be observed here that only that equipment/project will be accepted which provides, atleast, a minimum predetermined rate of return as per accept-reject rule.

(3) Capital Rationing Decisions:

When the funds available with a firm are unlimited, all those independent projects can be accepted from which better rate of return is available as against predetermined rates. But in actual life, it is not so. Firms have limited funds. In such a situation, these funds should be utilised by way of maximum profitable investment.

Certain projects may not be mutually exclusive and all of them are giving more returns than the predetermined rates. In such a case, the limited capital budget will be allocated in a manner that the long-term returns of firm are maximised. The priority of these profitable projects will be determined on the basis of their rates of return.

Accordingly, only the maximum profitable projects as per limited availability of funds will be selected and all others will be rejected.

10. Steps Involved in Capital Budgeting Decisions

(1) Consideration of investment proposals including alternatives

(2) Application of a suitable evaluation technique for selecting the project

(3) Estimation of profits, cash flows and analysis of cost benefit of the project or scheme

(4) Estimation of available funds and their utilization

(5) The objective is to maximize the profits with the utilization of available funds.

11. Data Required for Capital Budgeting Decisions

While taking Capital budgeting decisions, the decision to invest capital on the acquisition of fixed assets, which suitable data, financial or accounting data/information has to be taken to frame the decision criterion and to follow all the stages to call it as a capital budgeting decision.

Among the various concepts, some of the prominent concepts are:

(a) Accounting Profit data or Cash flow data – which one is suitable aspect for CB Decisions?

(b) Techniques for analysis and ranking the projects – Traditional or Discounted techniques are suitable?

A brief description of the above two key aspects are given below:

(a) Accounting Profit or Cash Flows:

Any capital investment proposal is to be evaluated by taking the future benefits accruing from the investment proposal. There are two alternatives available for ascertaining future economic benefits of an investment proposal. They are accounting profit and cash flows.

Accounting profit – means profits earned during the year shown by the profit and loss account for the given accounting period.

Cash flow – refers to the cash profit after tax but before depreciation expected to be generated from the project in future years till the life of the asset. Such Cash flow patterns associated with capital investment projects can be classified as conventional or non-conventional and incremental cash flow.

(i) Conventional Cash flows:

The initial cash outlay (original investment made at the beginning of the year of investment) followed by a series of future cash inflows generated from the asset is called conventional cash flows.

(ii) Non-Conventional Cash Flows:

Non-conventional cash flows refer to the cash flow pattern in which an initial cash outlay is not followed by a series of future inflows.

(iii) Incremental/Differential Cash Flow:

The second aspect of the data required for capital budgeting relates to the basis on which the relevant cash outflows and cash inflows associated with proposed capital expenditure are to be estimated.

For the purposes of estimating cash flows in the analysis of investments we consider incremental cash flows. Incremental cash flows are those cash flows that are directly attributable to the investment. It is also known as differential cash flow because it is the difference in the cash flows of two acceptable alternatives.

12. Process of Capital Budgeting

A capital budgeting process may involve a number of steps depending upon the size of the concern, nature of projects, complexities and diversities.

Following steps are necessary for a comprehensive capital budgeting process:

1. Identification of Various Investments Proposals:

The capital budgeting may have various investment proposals. The proposal for the investment opportunities may be defined from the top management or may be even from the lower rank. The heads of various departments analyze the various investment decisions, and will select proposals submitted to the planning committee of competent authority.

2. Screening or Matching the Proposals:

The planning committee will analyze the various proposals and screenings. The selected proposals are considered with the available resources of the concern. Here resources are referred to as the financial part of the proposal. This reduces the gap between the resources and the investment cost.

3. Evaluation:

After screening, the proposals are evaluated with the help of various methods, such as payback period proposal, net discovered present value method, accounting rate of return and risk analysis.

The proposals are evaluated by:

(a) Independent proposals

(b) Contingent of dependent proposals

(c) Partially exclusive proposals.

Independent proposals are not compared with other proposals and the same may be accepted or rejected. Whereas higher proposals acceptance depends upon the other one or more proposals. For example, the expansion of plant machinery leads to constructing of new buildings, additional manpower etc.

Mutually exclusive projects are those which are compared with other proposals and to implement the proposals after considering the risk and return, market demand etc.

4. Fixing Property:

After the evolution, the planning committee will predict which proposals will give more profit or economic consideration. If the projects or proposals are not suitable for the concern’s financial condition, the projects are rejected without considering other nature of the proposals.

5. Final Approval:

The planning committee approves the final proposals, with the help of the following:

(a) Profitability

(b) Economic constituents

(c) Financial violability

(d) Market conditions.

The planning committee prepares the cost estimation and submits to the management.

6. Implementing:

The competent authority spends the money and implements the proposals. While implementing the proposals, assign responsibilities to the proposals, assign responsibilities for completing it, within the time allotted and reduce the cost for this purpose. The network techniques used are such as PERT and CPM. It helps the management for monitoring and containing the implementation of the proposals.

7. Performance Review of Feedback:

The final stage of capital budgeting is actual results compared with the standard results. The adverse or unfavorable results identified and removing the various difficulties of the project. This is helpful for the future of the proposals.

13. Capital Budgeting under Capital Rationing

Capital Rationing is a situation where the firm has limited funds available for new investment. Many profitable and financially able proposals may be available but all the proposals cannot be undertaken by the firm due to lack of finance.

Thus a firm has to drop some proposal so capital rationing means distributing the available scarce and limited capital funds among competitive proposals.

There can be two types of project:

(a) Divisible Projects

These can be taken full or can be taken in part also for example a building having five floors can be constructed at a cost of Rs.5core however if the fund is not adequate we can construct only two floors.

(b) Individuals Projects

These projects are not divisible. A firm has to take it full or not take it at all. For example a proposal to prepare the bridge of 10 km cannot be accepted in part.

Methods of Capital Rationing:

i. Aggregation of projects or feasible set approach (on the basis of NPV we will select the combination which has the maximum total NPV).

ii. Analysis based on IRR (Decision will be taken on the basis of IRR).

iii. Profitability index (Decision will be taken on the basis of Profitability index)

14. Suitability of Different Methods

1. Payback Method:

Though this method ignores profitability and hence its conclusions are not very accurate, even then use of this device is desirable in the following circumstances:

i. Where precision in estimates of profitability is not very significant.

ii. Where preliminary screening of several proposals is required.

iii. Where there is scarcity of cash in the firm or where the project is to be financed by borrowings.

iv. Where the project under consideration is very risky. For example, there is possibility of obsolescence of the project due to rapid technological developments.

v. Where investment is for short term or medium term. This method is always unsuitable for the evaluation of long-term investment proposals.

2. Unadjusted Rate of Return Method:

i. From a simplicity point of view use of this method is desirable for appraising the long- period projects, but due to ignoring the time factor of cost and earnings of investment, this method loss its utility.

ii. If reinvestment of earnings from investment is not possible then decision can be made on the basis of rate of return calculated by this method.

3. Present Value Method or Discounted Cash Flow Method:

This method gives due weights to the time value of money. Hence, it is considered to be the best method. If annual cash inflows are uneven then this is definitely the only method of objective and accurate appraisal of investment projects.

If the required earnings rate is not prescribed then the time-adjusted rate of return method should be applied and if the required earnings rate has been prescribed by the management then the net present value method should be applied. However, if the difference in the outlay of different proposals is very significant, then a decision should be made by calculating the present value index.

Consideration Other than Profitability in Managerial Decisions:

Managerial decisions on capital projects are very difficult and complicated problems. Though profitability of the proposal is the crucial factor that influences the capital expenditure decisions this cannot be the sole determinant for these decisions. In practice there are many other factors which make the profitability base subsidiary or less important.

These factors are as follows:

i. Urgency of the Project:

Sometimes an investment is made due to urgency to avoid heavy losses. For example, on breakdown of machinery, management may decide to replace it by any available machine suitable for the work without proper evaluation of its cost and benefits so as to avoid heavy losses due to the stoppage of production process. In such a case, the basis of managerial decision is urgency and not the profitability.

ii. Funds Available:

The availability of funds is an important factor that influences the capital budgeting decisions. Sometimes, a more profitable project is not taken up for want of sufficient funds and a lesser profitable project of lower payback period is approved, if the firm is short of funds.

iii. Available Technical Know-how and Managerial Capability:

Before approving a project, the management will have to consider whether their firm has got the necessary technical know-how and managerial capability to implement that project and if not, whether it could be acquired.

iv. Availability of Additional Funds:

If the management is capable of arranging additional funds in future, then all the funds available at present may be utilized for the capital projects; if not, working capital needs will have to be arranged out of the funds available with the firm.

v. Fuller Utilization of Funds:

The ultimate goal of managerial policy is to maximize the owner’s wealth. Hence, if the firm has ample funds for investment then a project yielding the highest rate of return and requiring lesser outlay may not be approved by the management if no other profitable investment of spare funds is possible. In such a situation, it may be better to select the next best project if total funds of the concern could be invested in the project, so that total profits of the firm are maximized.

vi. Future Expectations of Earnings:

Expected earnings on future investments may also influence current capital investment decisions. If more profitable investments are possible in future, then at present management would select the project of lower useful life so that the funds invested may be taken back early and could be invested in future in more profitable projects.

On the contrary, if there is possibility of rate of return on investment to go down then long economic life projects would be better even if rate of return on this project is lower to a short live project.

vii. Degree of Certainty of Net Income:

Certainty of income on the project also influences the selection of the project. Although future business operations are uncertain, even then the management may select a lower income project in place of a higher but uncertain income project.

viii. Risk of Obsolescence:

In case of rapid technological development, the project with a lesser payback period may be preferred in comparison to one which may have higher profitability but still longer payback period.

ix. Maintaining Market Share:

Sometimes, the management may take a decision in favor of a project though yielding a lower return but necessary to maintain earning capacity and existing market share of the firm.

Some Important Notes:

The following are few points to be considered in capital budgeting:

1. Working Capital Requirement of the Project:

If there is any requirement of additional working capital for the project in the beginning, the amount of working capital is added to the initial investment and of the requirement of working capital arise during the life of the machine say in the beginning of 3rd year, then calculate the present value of that and add in the initial investment.

In the last year of the project add the amount of working capital in the cash flow. It is because we assume that funds initially tied up in working capital at the time of investment would be released in the last year when the investment is terminated.

2. Treatment of Salvage Value:

a) Salvage value of new Assets – This will increase the cash flow of the last year.

b) Salvage value of existing Assets – This will reduce the initial investment of the new assets.

3. Treatment of Profit or Loss on Sale of Assets:

a) If there is gain on sale of old Assets we will charge tax and will be added in the initial investment

b) If there is loss on sale of old Assets we will get the benefit of tax and will deduct it from initial investment.

15. Risk and Uncertainty

Risk Meaning:

Risk is inevitable, more so in the field of Business. Risk is factored in from the trial stage of investment evaluation of a business right until the winding up of the business entity. Business in these days allocate large amounts of money from time to time in developing strategies to help manage risks associated with their business and investment dealings.

Their major role in the risk management process is assessing risk, which involves the determination of the risks both internal and external to their business or investment.

Risk occurs when the probability of future outcomes is unknown but there exists some basic information of past experience which helps predict future course of action like consumer’s preference, level of competition & so on.

Emmett J Vaughan, “Risk is a condition in which there is a possibility of adverse deviation from a desired outcome that is expected or hoped so far”.

Irving Fisher, “risk may be defined as a combination of hazards measured by probability”.

Warren Buffett, “Risk comes from not knowing what you’re doing.”

Uncertainty Meaning:

Uncertainty refers to those future events whose probability of occurrence cannot be accurately predicted. Uncertainty arises due to lack of information to accurately make future predictions. The lack of complete certainty like political factors, government policies, natural calamities & terrorists attack.

16. Discounted Cash Flow Techniques

1. Net Present Value Method (NPV):

The Net Present Value Method (NPV) is understood to be the best available method for evaluating the capital investment proposals. Under this method Cash outflows and inflows associated with each project are ascertained.

First Cash inflows are worked out by adding depreciation to profit after tax arising to each project. Since the cash outflows and inflows arise at different points of time and cannot be compared so both are reduced to the present values at the rate of return acceptable to the management. The rate of return is either cost of capital of the firm or the opportunity cost to be invested in the project.

The Net Present Value of expected inflows can be express as under-

Acceptance Rule:

If the NPV is positive or at least equal to zero the Project can be accepted. If it is negative the proposal can be rejected. Among the Various alternatives the project which gives the highest positive NPV should be selected.

NPV is positive = Cash inflows are generated at a rate higher than the minimum required by the firm.

NPV is zero = Cash inflows are generated at a rate equal to the minimum required

NPV is negative = Cash inflows are generated at a rate lower than the minimum required by the firm

The market value per share will increase if the project with positive NPV is selected.

Advantages:

i. Firstly the NPV method recognizes the time value of money. This is the most significant advantage since the payback method and the ARR method have ignored this factor.

ii. It considers all Cash-Flows over the entire life of the project.

iii. Selection of projects by this method results in achieving the financial objective i.e. maximization of profits and Net Worth.

iv. The changing discount rate can be built into the NPV calculations by altering the denominator. This method is used for the selection of mutually exclusive projects.

v. This method is consistent with the objective of maximizing the wealth of the shareholders of the company.

Limitations:

i. It is difficult to calculate

ii. It is difficult to work out the cost of capital especially the cost of equity capital

iii. This method may not provide satisfactory solutions when the projects compared involve different amounts of investment. For a project with a higher net present value may not be desirable since it may involve huge initial capital outlay.

iv. It may mislead when dealing with alternative projects or limited funds under the conditions of unequal lives.

v. This method favours long lived projects.

vi. It assumes that intermediate cash inflows are reinvested at the firm’s cost of capital which is not always true.

2. Internal Rate of Return Method (IRR):

The internal rate of return or yield for an investment project is the discount rate at which the present value of expected cash outflows are equal to the value of the expected cash inflow. In other words, it is the rate which gives the projects NPV as zero.

This method is also known as yield on investment, marginal productivity of capital rate of return time adjusted rate of return or trial and error method. The internal rate of return method like the present value method takes into consideration the time value of money by discounting the various cash flows.

The internal rate of return is represented by that rate such that –

The internal rate of return, so arrived at is compared with the predetermined rate of return known as required rate, cut-off rate, hurdle rate or expected rate. If the IRR exceeds such cut-off rate, the investment proposal is accepted; if not; the proposal shall be rejected. If the IRR and the required rate of return are equal it means that the unit is indifferent by either adopting or rejecting the proposal.

Advantages:

i. It takes into account the time value of money.

ii. It considers the cash flow stream over the entire investment horizon

iii. Business executives and non-technical people understand the concept of IRR much better than that of NPV. Even if they do not follow the definition of IRR in terms of the equation, they are well aware of the usual meaning in terms of the rate of return on investment.

iv. The calculation of the cost of capital is not a prerequisite for using the IRR method of evaluating investment projects unlike the HPV method.

v. This method is considered to be a sophisticated and more reliable technique of evaluating capital investment proposals.

Limitations:

i. The IRR method is difficult to understand as well as apply in practice as it involves tedious and complicated calculations

ii. The IRR method does not give unique answers in all situations. It yields negative rate or multiple rate under certain circumstances which is rather confusing

iii. It yields results inconsistent with the NPV method if projects differ in their expected life span, cash outlays or timing of cash flows.

iv. The assumption that all cash flows are reinvested at IRR is very unrealistic moreover, all cash flows are not normally invested. A share of it is paid out of dividend to shareholders etc. or a portion may be tied in current assets such as debtors or cash or unfold stock.

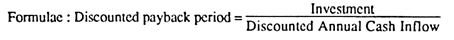

3. Discounted Pay- Back Period (DPP):

In This method the cash inflows are discounted at a rate which is equal to cost of capital and then the payback period is worked out. This is better than the ordinary payback period method as DPP considers the time value of money.

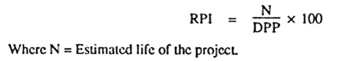

The discounted pay-back period is expressed in years and as long as the DPP is lesser than the estimated life of the project, the project is economically feasible and it can be accepted. Sometimes the two projects may have the same DPP although the estimated life of the project may be different.

In such a case it will better to calculate the relative payback index (RPI) as –

17. Profitability Index/Discounted Benefit Cost Ratio

Profitability Index is defined as the rate of present value of the future cash benefits at the required rate of return to the initial cash outflow of the investment. This is yet another method of evaluating the investment proposals. It is also known as the Benefit Cost Ratio (B/C).

The PI approach measures the present Value of returns per rupee invested. This is similar to the NPV approach. Where projects with different initial investments are to be evaluated the PI method proves to be the best technique.

Formula:

The above ratio is an indicator of the profitability of the Project. If the ratio is equal to or greater than one it shows that project has an expected yield equal to or greater than the discounted rate. If the index is less than one it indicates that the project has an expected yield less than the discount rate.

18. Limitations of Capital Budgeting

(i) Capital Budgeting helps in selection of profitable projects. In case the income, cost or lifetime of the project is wrongly estimated, it is possible that a less profitable project may be selected. For it management should be experienced.

(ii) There are some factors which affect profitability and productivity of the company, but it is difficult to measure them.

For example- a project may directly or indirectly affect the morale of employees. Project may also have an adverse effect on society. But while using capital budgeting techniques, these factors are ignored.

19. Difficulties in Capital Budgeting

Capital budgeting decisions are very important, but they pose difficulties, which shoot from three principal sources:

1. Measurement Problem:

Evaluation of a project requires identifying and measuring its costs and benefits of that project, which are difficult since they involve tedious calculations and lengthy processes. Majority of the replacement or expansion programmes have an impact on some other activities of the company (introduction of new products may result in decrease in sales of the other existing product) or have some intangible consequences (improving morale of workers).

2. Uncertainty:

Selection or rejection of a capital expenditure project depends on expected costs and benefits that involve into the future. Future is uncertain, if anybody tries to predict the future it will be childish or foolish. Hence, it is impossible to predict the future cash inflows.

3. Temporal Spread:The costs and benefits, which are expected to be associated with a particular capital expenditure project is spread out over a long period of time, which is 10-20 years for industrial projects and 20-50 years for infrastructure projects. The temporal spread creates some problems in estimating discount rates for conversation of the future cash inflows in present values and establishing equivalences.