Working capital indicates revolving a circular flow of cash starting with cash paid for purchase of material and ending with cash receipt after the sale of finished goods. This is how working capital is a circular cash flow from cash to inventories and back to cash.

According to Shubin, “working capital is the amount of funds necessary to cover the cost of operating the enterprise. Working capital in a going concern is a revolving fund, it consists of cash receipts from sales which are used to cover the cost of current operations”.

Working capital is the part of total capital. It is used for carrying out regular business operations. In other words, it is the amount of funds used for financing the day to day operations or activities.

C. W. Gerstenberg, “Working capital is the excess of current assets over current liabilities.”

ADVERTISEMENTS:

Annual survey of Industries (1961), Working capital is defined to include “stocks of materials, fuels, semi-finished goods including work- in-progress and finished goods and by-products; cash in hand and at bank and the algebraic sum of sundry creditors as represented by –

(a) outstanding factory payments i.e., rent, wages, interest and dividend;

(b) purchase of goods and services;

(c) short term loans and advances and sundry debtors comprising amounts due to the factory on account of sale of goods and services and advances towards tax payments.”

ADVERTISEMENTS:

Contents

- Introduction to Working Capital

- Meaning of Working Capital

- Definition of Working Capital

- Concepts of Working Capital

- Purposes of Working Capital

- Types of Working Capital

- Kinds of Working Capital

- Factors Determining the Amount of Working Capital

- Factors Affecting Working Capital

- Importance of Working Capital

- Significance of Working Capital

- Components of Working Capital

- Classification of Working Capital

- Cardinal Principles of Working Capital

- Gross and Net Working Capital

- Approaches to Working Capital in a Company

- Significance and Dangers of Excessive Working Capital

- Component Periods in Operating Cycle in a Manufacturing Company

- Methods for Estimating Working Capital Requirements

- Techniques of Forecasting Working Capital

- Methods for Calculations of Working Capital

- Determinants of Working Capital

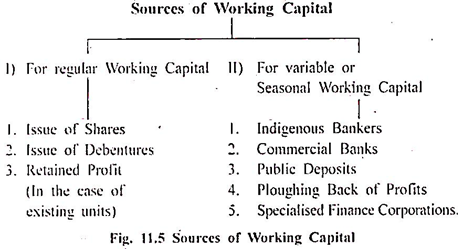

- Sources of Working Capital

- Adequacy of Working Capital

- Working Capital Policies

- Risk-Return Trade Off

- Difference between Fixed and Variable Working Capital

- Difference between Permanent and Temporary Working Capital

- Advantages of Working Capital

- Dangers of Inadequate Working Capital

- Multiple Choice Questions and Answers

What is Working Capital: Meaning, Definition, Formula, Management, Net working Capital, Concepts, Purposes, Types, Factors, Importance, Components, Gross Working Capital And Examples..

What is Working Capital – Introduction

Every industrial or commercial unit requires working capital along with fixed capital. It is that part of total capital which is required for purchased current assets, i.e., for meeting regular day to day needs of a business unit. Working capital or circulating capital is required for purchasing raw materials, spare parts, components, and payment of wages, rent and other recurring expenses of a business unit.

Working capital indicates revolving a circular flow of cash starting with cash paid for purchase of material and ending with cash receipt after the sale of finished goods. This is how working capital is a circular cash flow from cash to inventories and back to cash.

A business unit requires adequate working capital for its regular and smooth working. Adequate working capital creates goodwill and prestige for the company. It enables a company to make all payments on due dates. It also raises efficiency and general morale of employees. Working capital is required only for a short period as it is recovered from the purchasers out of the price paid.

ADVERTISEMENTS:

Thus, working capital is of short duration but is recurring in character. In addition, a part of the working capital is treated as regular as fixed working capital and the remaining part is known as variable or fluctuating working capital. Working capital is defined as excess of current asses over current liabilities. Distinction is also made between the gross and net working capital.

According to Shubin, “working capital is the amount of funds necessary to cover the cost of operating the enterprise. Working capital in a going concern is a revolving fund, it consists of cash receipts from sales which are used to cover the cost of current operations”.

The company promoters have to make an estimate of working capital requirements of the company and collect the same from convenient sources. It is treated as the controlling nerve centre of a business unit.

Working capital is also called circulating capital. In modern business, production is conducted in anticipation of demand and hence, payment has to be made in advance for purchasing raw materials, stores, etc.

Working capital is needed for meeting such financial needs in order to preserve the continuity of production. It is also needed in order to meet all normal as well as abnormal cash needs of the company.

What is Working Capital – Meaning

Working capital is the part of total capital. It is used for carrying out regular business operations. In other words, it is the amount of funds used for financing the day to day operations or activities.

The funds invested in current assets such as stock of materials, work-in- progress, investments, bills receivables, sundry debtors, bank balance, etc., are known as working capital or short term capital.

The success of any organisation depends upon the efficient management of working capital.

Working capital is known as revolving or circulating capital, because capital in all the forms mentioned above gets changed in the ordinary course of business from one form to another i.e., –

ADVERTISEMENTS:

i. From cash to investors,

ii. From investors to receivables and debtors,

iii. From book debts & receivables to cash again.

In simple terms all the current assets used in daily operations represent working capital.

ADVERTISEMENTS:

Current assets may be defined as assets which are usually converted into cash in the ordinary course of business, within a period of one year.

What is Working Capital – Definition

Definition of working capital

(i) ICAI:

Working capital means the funds available for day-to-day operations of an enterprise.

ADVERTISEMENTS:

(ii) Shubin:

Working capital is a part of capital which is required for purchase of raw materials and for meeting day-to-day expenditure on salaries, wages, rent and advertising etc.

(iii) J.M. Mill:

The sum of the current assets is the working capital of the business.

(iv) C. W. Gerstenberg:

Working capital is the excess of current assets over current liabilities.

ADVERTISEMENTS:

(v) Annual survey of Industries (1961):

Working capital is defined to include “stocks of materials, fuels, semi-finished goods including work- in-progress and finished goods and by-products; cash in hand and at bank and the algebraic sum of sundry creditors as represented by

(a) outstanding factory payments i.e., rent, wages, interest and dividend;

(b) purchase of goods and services;

(c) short term loans and advances and sundry debtors comprising amounts due to the factory on account of sale of goods and services and advances towards tax payments.

Concepts of Working Capital – Net Working and Gross Working Capital

There are two concepts of working capital:

ADVERTISEMENTS:

1. Net working.

2. Gross working.

Concept # 1. Net Working:

(This was supported by distinguished authorities like Lincolors, Boris, Stevens, Salaries). Working capital is the excess of current assets over current liabilities.

It is explained in the form of equation as follows:

Working Capital = Current Assets – Current Liabilities

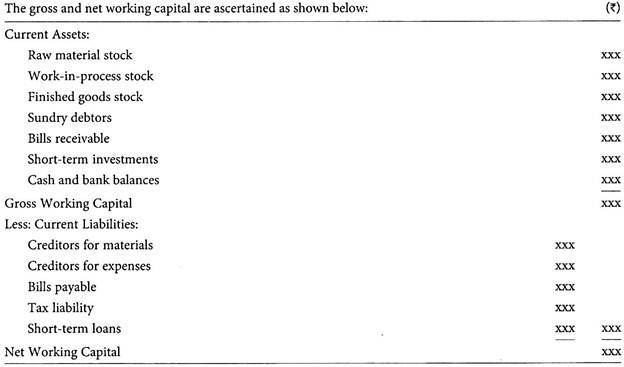

Components of Working Capital:

ADVERTISEMENTS:

According to net concept working capital has two components viz.,:

i) Current Assets.

ii) Current Liabilities.

i) Current Assets:

Those assets which are converted into cash within a period not exceeding one year normally, such assets are called Current Assets.

Examples of Current Assets:

ADVERTISEMENTS:

a. Cash in hand

b. Cash at Bank

c. Bills receivable

d. Sundry debtors

e. Prepaid expenses

f. Outstanding incomes.

ii) Current Liabilities:

Those liabilities are to be paid within a period of one year, such liabilities are called current liabilities. Generally current liabilities are paid out of current assets or the Income from the business.

So the Net Working capital is an accounting concept. Net working capital may be positive or negative.

Examples of Current Liabilities:

a. Trade creditors

b. Outstanding expenses

c. Short-term borrowings

d. Taxes and dividend payable

e. Bank Overdraft

f. Outstanding liability currently payable

g. Advance received from parties against goods to be sold.

Concept # 2. Gross Working Capital:

(This concept is supported by the authorities like Mean Banker, Mallot and Field)

According to them the working capital represents only current assets. So the gross working capital concept is a financial or going concern concept.

From the above two concepts, as per the general practice, Net working capital is preferred to simply as working capital.

What is Working Capital – Top 5 Purposes for Working Capital

Every business requires some amount of working capital. The necessity of working capital arises because of the time gap between the production and realisation of cash from sales.

Working capital is required for the following purposes:

1. For the purchase of raw materials, components and spares.

2. To pay wages and salaries.

3. To incur day-to-day expenses.

4. To provide credit facilities to the customers.

5. To maintain the inventories of raw materials work-in-progress and finished stock.

7 Important Types of Working Capital – Net, Gross, Permanent, Temporary or Variable, Balance Sheet, Cash and Negative Working Capital

The types of working capital are as follows:

Type # 1. Net Working Capital:

The net working capital is the difference between current assets and current liabilities. The concept of net working capital enables a firm to determine how much amount is left for operational requirements.

Type # 2. Gross Working Capital:

Gross working capital is the amount of funds invested in the various components of current assets.

This concept has the following advantages:

(a) Financial Managers are profoundly concerned with current assets;

(b) Gross working capital provides the correct amount of working capital at the right time;

(c) It enables a firm to realize the greatest return on its investment;

(d) It helps in the fixation of various areas of financial responsibility;

(e) It enables a firm to plan and control funds and to maximise the returns on investment.

For these advantages, gross working capital has become a more acceptable concept in financial management.

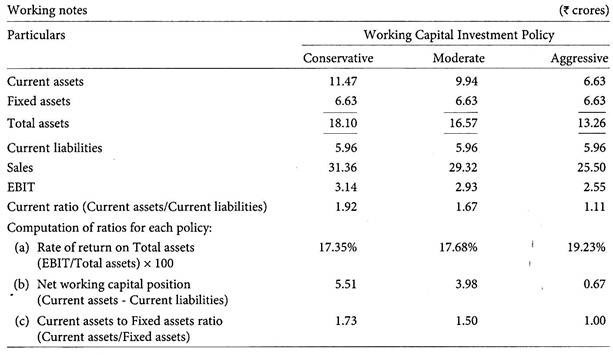

Type # 3. Permanent Working Capital:

Permanent working capital is the minimum amount of current assets which is needed to conduct a business even during the dullest season of the year. This amount varies from year to year, depending upon the growth of a company and the stage of the business cycle in which it operates. It is the amount of funds required to produce the goods and services which are necessary to satisfy demand at a particular point.

It represents the current assets which are required on a continuing basis over the entire year. It is maintained as the medium to carry on operations at any time.

Permanent working capital has the following characteristics:

(a) It is classified on the basis of the time factor;

(b) It constantly changes from one asset to another and continues to remain in the business process;

(c) Its size increases with the growth of business operations.

Type # 4. Temporary or Variable Working Capital:

It represents the additional assets which are required at different times during the operating year-additional inventory, extra cash etc., Seasonal working capital is the additional amount of current assets-particularly cash, receivables and inventory which are required during the more active business seasons of the year.

It is temporarily invested in current assets and possesses the following characteristics:

(a) It is not always gainfully employed, though it may change from one asset to another, as permanent working capital does and

(b) It is particularly suited to business of a seasonal or cyclical nature.

Type # 5. Balance Sheet Working Capital:

The balance sheet working capital is one which is calculated from the items appearing in the balance sheet. Gross working capital, which is represented by the excess of current assets, and net working capital, which is represented by the excess of current assets over current liabilities, are examples of the balance sheet working capital.

Type # 6. Cash Working Capital:

Cash working capital is one which is calculated from the items appearing in the profit and loss account. It shows the real flow of money or value at a particular time and is considered to be the most realistic approach in working capital management.

It is the basis of the operation cycle concept which has assumed a great importance in financial management in recent years. The reason is that the cash working capital indicates the adequacy of the cash flow, which is an essential prerequisite of a business.

Type # 7. Negative Working Capital:

Negative working capital emerges when current liabilities exceed current assets. Such a situation is not absolutely theoretical, and occurs when a firm is nearing a crisis of some magnitude.

2 Kinds of Working Capital – Fixed or Permanent Working Capital and Variable Working Capital

The need for Working Capital does not end once the operating cycle is completed. To carry on the business, a minimum stream of Working Capital is necessary for smooth production flow. This is the irreducible minimum amount necessary for maintaining the circulation of the current assets.

This is permanently locked up in the business and therefore, it is referred to as Core, Permanent or Fixed Working Capital. Depending upon the changes in production and sales volumes, the need for Working Capital over and above the core level will tend to fluctuate. The need for Working Capital will also vary on account of seasonal changes or abnormal and unpredictable conditions.

Variations in Working Capital requirements over and above the core level reflect seasonal variations and unpredictable day-to-day or month-to-month variations. This is referred to as variable or fluctuating Working Capital.

Kinds of working capital are as follow:

1. Fixed or Permanent Working Capital, and

2. Fluctuating or Variable or Seasonal or Temporary Working Capital.

Kind # 1. Fixed or Permanent Working Capital:

The need for current assets is associated with the operating cycle which is a continuous process. Although the need for current assets may be felt constantly, the volume of investments in current assets may not be the same all the time; it may increase or decrease over a period of time. But there is always a minimum level of current assets which must be kept in order to carry on the business.

This is the irreducible minimum amount needed for maintaining the operating cycle. It is the investment in current assets which is permanently locked up in the business and therefore it is known as Fixed or Permanent or Regular Working Capital.

Thus, Permanent Working Capital refers to the minimum level of investment in the form of current asset (gross or net) which is required permanently to operate at minimum level of activity.

Fixed Working Capital possesses the following characteristics:

(i) Fixed Working Capital constantly changes its form from one asset to another. It does not retain its form over the period as we find in the case of fixed assets.

(ii) It always remains in the business in one form or other.

(iii) Its size increases with the growth of business.

(iv) Fixed Working Capital is generally financed from long-term sources.

Kind # 2. Variable Working Capital:

Variable or Fluctuating Working Capital refers to that portion of total Working Capital which is needed over and above fixed Working Capital. Depending upon the changes in the volume of activity, the need for Working Capital over and above fixed Working Capital will always fluctuate.

Such need for Working Capital may also vary on account of seasonal changes or abnormal and unanticipated conditions. Therefore, Fluctuating Working Capital is also known as Seasonal Working Capital. Sometimes special factors may necessitate additional doses of Working Capital.

For example, additional doses of Working Capital may be needed to face tough competitions in the market or to meet other contingencies like strikes and lockouts. Special advertising campaigns or other promotional activities are to be financed by Additional Working Capital. In such a case, Fluctuating Working Capital may be termed as Special Working Capital.

What is Working Capital – Top 27 Factors Determining the Amount of Working Capital: Nature of Industry, Demand of Industry, Cash Requirements, Nature of Business, Time, Volume of Sales and More…

The following factors determine the amount of working capital:

Factor # 1. Nature of Industry:

The composition of an asset is a function of the size of a business and the industry to which it belongs. Small companies have smaller proportions of cash, receivables and inventory than large corporations.

This difference becomes more marked in large corporations. A public utility, for example, mostly employs fixed assets in its operations, while the merchandising department depends generally on inventory and receivables. Needs for working capital are thus determined by the nature of an enterprise.

Factor # 2. Demand of Industry:

Creditors are interested in the security of loans. They want their obligations to be sufficiently covered. They want the amount of security in assets which are greater than the liability.

Factor # 3. Cash Requirements:

Cash is one of the current assets which is essential for successful operations of the production cycle. Cash should be adequate and properly utilised. It would be wasteful to hold excessive cash.

A minimum level of cash is always required to keep the operations going. Adequate cash is also required to maintain good credit relations. Richards Osborn has pointed out that cash has universal liquidity and acceptability. Unlike illiquid assets, its value is clear-cut and definite.

Factor # 4. Nature of Business:

The nature of a business is an important determinant of the level of the working capital. Working capital requirements depend upon the general nature or type of business. They are relatively low in public utility concerns, in which inventories and receivables relatively low in public utility concerns, are rapidly converted into cash. Manufacturing organisations, however, face problems of slow turnovers of inventories and receivables, and invest large amounts in working capital.

Factor # 5. Time:

The level of working capital depends upon the time required to manufacture goods. If the time is longer, the size of working capital is great. Moreover, the amount of working capital depends upon inventory turnover and the unit cost of the goods that are sold. The greater this cost, the bigger is the amount of working capital.

Factor # 6. Volume of Sales:

This is the most important factor affecting the size and components of working capital. A firm maintains current assets because they are needed to support the operational activities which result in sales.

The volume of sales and size of the working capital are directly related to each other. As the volume of sales increases, there is an increase in the investment of working capital- in the cost of operations, in inventories and in receivables.

Factor # 7. Terms of Purchases and Sales:

If the credit terms of purchases are more favourable and those of sales less liberal, less cash will be invested in inventory. With more favourable credit terms, working capital requirements can be reduced. A firm gets more time for payment to creditors or suppliers. A firm which enjoys greater credit with banks needs less working capital.

Factor # 8. Inventory Turnover:

If the inventory turnover is high, the working capital requirements will be low. With a better inventory control, a firm is able to reduce its working capital requirements. While attempting this, it should determine the minimum level of stock which it will have to maintain throughout the period of its operations.

Factor # 9. Receivable Turnover:

It is necessary to have an effective control of receivables. A prompt collection of receivables and good facilities for settling payables result into low working capital requirements.

Factor # 10. Business Turnover:

The business turnover of the organisation directly calls for systematic planning for production. The exploitation of the available business can be achieved only when sufficient raw materials are stored and supplied. Hence business turnover will also influence the working capital.

Factor # 11. Business Cycle:

Business expands during periods of prosperity and declines during the period of depression. Consequently, more working capital is required during periods of prosperity and less during the periods of depression.

During marked upswings of activity, there is usually a need for larger amounts of capital to cover the lag between collection and increased sales and to finance purchases of additional materials to support growing business activity.

Moreover, during the recovery and prosperity phase of the business cycle, prices of raw materials and wages tend to rise and the business will require additional funds to carry even the same physical volume of business.

In the downswing of the cycle, there may be a brief period when collection difficulties and declining sales together cause embarrassment by the resulting means to replenish cash. Later, as the depression runs its course, the concern may find that it has a larger amount of working capital on hand that the current business volume may justify.

Factor # 12. Value of Current Assets:

A decrease in the real value of current assets as compared to their book value reduces the size of the working capital. If the real value of current assets increases, there is an increase in the working capital.

Factor # 13. Variations in Sales:

A seasonal business requires the maximum amount of working capital for a relatively short period of time.

Factor # 14. Production Cycle:

The time taken to convert raw materials into finished products is referred to as the production cycle or operating cycle. The longer the production cycle, the greater is the requirement of working capital. Utmost care should be taken to shorten the period of the production cycle in order to minimize working capital requirements.

Factor # 15. Credit Control:

Credit control includes such factors as the volume of credit sales, the terms of credit sales, the collection policy etc. With a sound credit control policy, it is possible for a firm to improve its cash inflow.

Factor # 16. Liquidity and Profitability:

If a firm desires to take a greater risk for bigger gains or losses, it reduces the size of its working capital in relation to its sales. If it is interested in improving its liquidity, it increases the level of its working capital.

However, this policy is likely to result in a reduction of the sale volume, and therefore, of profitability. A firm, therefore, should choose between liquidity and profitability and decide about its working capital requirements accordingly.

Factor # 17. Inflation:

As a result of inflation, the size of the working capital is increased in order to make it easier for a firm to achieve a better cash inflow. To some extent, this factor may be compensated by the rise in the selling price during inflation.

Factor # 18. Seasonal Fluctuations:

Seasonal fluctuations in sales affect the level of variable working capital. Often, the demand for products may be of a seasonal nature. Yet inventories have got to be purchased during certain seasons only. The size of the working capital in one period may, therefore, be bigger than that in another period.

Factor # 19. Profit Planning and Control:

The level of working capital is decided by the management in accordance with its policy of profit planning and control. Adequate profit assists in substantial generation of cash. It makes it possible for the management to plough back a part of its earnings in the business and substantially build up internal financial resources.

A firm has to plan for taxation payments, which are an important part of working capital management. Often the dividend policy of a corporation may depend upon the amount of cash available to it.

Factor # 20. Repayment Ability:

A firm’s repayment ability determines the level of its working capital. The usual practice of a firm is to prepare cash flow projections according to its plans of repayment and to fix working capital levels accordingly.

Factor # 21. Cash Reserves:

It would be necessary for a firm to maintain some cash reserves to enable it to meet contingent disbursements. This would provide a buffer against abrupt shortages in cash flows.

Factor # 22. Operational and Financial Efficiency:

Working capital turnover is improved with a better operational and financial efficiency of a firm. With a greater working capital turnover, it may be able to reduce its working capital requirements.

Factor # 23. Changes in Technology:

Technological developments related to the production process have a sharp impact on the need for working capital.

Factor # 24. Firm’s Policies:

These affect the levels of permanent and variable working capital. Changes in credit policy, production policy etc. are bound to affect the size of the working capital.

Factor # 25. Size of the Firm:

A firm’s size, either in terms of its assets or sales, affects its need for working capital. Bigger firms, with many sources of funds, may need less working capital as compared to their total assets or sales.

Factor # 26. Activities of the Firm:

A firm’s stocking on heavy inventory or selling on easy credit terms calls for a higher level of working capital than for selling services or making cash sales.

Factor # 27. Attitude of Risk:

The greater the amount of working capital, the lower is the risk of liquidity.

Whenever there is current strain, it has to be immediately diagnosed on the basis of the red signals which manifest themselves in the operations. The cause should be ascertained by making a thorough study of the components of current assets and current liabilities.

If stock is not moving fast, and if there is an excess inventory build-up, corrective steps should be taken to sell the stock or bring down its level. If the receivables have become sticky, effective recovery steps should be taken to reduce the debts and to increase the collections.

Sometimes, short-term funds have been used to finance fixed assets, and this creates the ‘current’ strain. This imbalance in the pattern of financing should be set right by raising long-term funds on the cover of fixed assets so that the current strain may be wiped out.

Similarly, if current funds are diverted outside when they are badly required within the firm itself, it would be very difficult to run the business. External diversion may be for the purpose of outside investment, advances to others or allied concerns may be in the form of drawings from the business or for various other purposes.

The situation can improve only if this external diversion is stopped. If the strain is allowed to continue because of involvement in any other business or industry, the consequences may be disastrous.

In such a situation, the ability to meet current demands deteriorates; short-term credits are not forthcoming; production is affected; sales decline; cash flow dwindles; income may disappear and the whole enterprise may get into the red over a period of time.

Only a concern which manages its assets and liabilities in a planned and projected way on the basis of its cash budgets and cash flow estimates to cover short-term as well as long-term situations can sustain a current strain.

The restrictions expressed as ratios of the elements of current assets and current liabilities are frequently referred to as current-position constraints and include the current ratio, the acid test ratio, and so called ‘compensating balance’ ratio (a minimum ratio of a borrower’s balance to the amount of the loan, as required by some banks). Contracts with fund suppliers frequently provide for current-position constraints.

7 Major Factors Affecting Working Capital – Nature of Business, Length of Production Cycle, Size and Growth of Business, Business/Trade Cycles, Terms of Purchase and Sales and More…

The factors affecting working capital are explained below:

Factor # (1) Nature of Business:

Some businesses are such, due to their very nature, that their requirement of fixed capital is more rather than working capital. These businesses sell services and not commodities and that too on a cash basis. As such, no funds are blocked in piling inventories and also no funds are blocked in receivables.

E.g. Public utility services like railways, electricity boards etc. Their working capital requirement is less. On the other hand, there are some business-like trading activities, where the requirement of fixed capital is less but more money is blocked in inventories and debtors. Their requirement of the working capital is obviously more.

Factor # (2) Length of Production Cycle:

In some businesses like the machine tool industry, the time gap between the acquisitions of raw material till the end of final production of finished products itself is quite high. As such more amounts may be blocked either in raw materials, or work in progress or finished goods or even in debtors. Naturally, their needs of working capital are higher. On the other hand, if the production cycle is shorter, the requirements of working capital are also less.

Factor # (3) Size and Growth of Business:

In very small companies the working capital requirements are quite high due to high overheads, higher buying and selling costs etc. As such, the medium sized companies positively have an edge over the small companies. But if the business starts growing after a certain limit, the working capital requirements may be adversely affected by the increasing size.

Factor # (4) Business/Trade Cycles:

If the company is operating in the period of boom, the working capital requirements may be more as the company may like to buy more raw material, may increase the production or sales to take the benefits of favourable markets, due to the increased sales, there may be more and more amount of funds blocked in stock and debtors etc.

Similarly, in case of depression also, the working capital requirements may be high as the sales in terms of value and quantity may be reducing, there may be unnecessary piling up of stocks without getting sold, the receivables may not be recovered in time etc.

As such, in both these two extreme situations of business/trade cycles, the working capital requirement may be high.

Factor # (5) Terms of Purchase and Sales:

Sometimes, due to competition or custom, it may be necessary for the company to extend mere and more credit to the customers, as a result of which more and more amount is locked up in debtors or bills receivables which increases working capital requirements.

On the other hand, in case of purchases, if credit is offered by the suppliers of goods and services, a part of working capital requirement may be financed by them, but if it is necessary to purchase these goods or services on cash basis, the working capital requirement will be higher.

Factor # (6) Profitability:

The profitability of the business may vary in each and every individual case, which in its turn may depend upon numerous factors. But high profitability will positively reduce the strain on working capital requirements of the company, because the profits to the extent that they are earned in cash may be used to meet the working capital requirements of the company.

However, profitability has to be considered from one more angle so that it can be considered as one of the ways in which strain on working capital requirements of the company may be relieved.

And these angles are:

(a) Taxation Policy:

How much is required to be paid by the company towards its tax liability? As the amount of cash profits only after payment of taxes will be available to the company for meeting its requirements of working capital.

(b) Dividend Policy:

How much of the profits earned by the company are distributed by way of dividend? As the amount of cash profits to the extent not distributed by way of dividend only will be available to the company for meeting its requirements of working capital.

Factor # (7) Operating Efficiency:

If the business is carried on more efficiently, it can operate in profits which may reduce the strain on working capital, it may ensure proper utilisation of existing resources by eliminating waste and improved coordination etc.

Top 8 Importance of Working Capital – Solvency of the business, Goodwill, Cash Discounts, Easy Loans, Regular payments and More…

Working capital is essential for smooth running of a business. No business can run successfully without an adequate amount of working capital.

Importance of working capital are as follows:

Importance # 1. Solvency of the business

Adequate working capital helps in maintaining the solvency of the business by providing regular supply of raw materials and continuous production.

Importance # 2. Goodwill

Adequate working capital helps in making prompt payments to suppliers and hence helps in creating and maintaining goodwill.

Importance # 3. Cash Discounts

Adequate working capital helps in making prompt payments to suppliers and hence, enables a firm to avail cash discounts on the purchases and reduce costs.

Importance # 4. Easy loans

A firm having adequate working capital, high solvency and good credit standing can help in availing loans on favourable terms.

Importance # 5. Regular payments

A firm having adequate working capital can make regular payments of salaries, wages and other regular expenses, which increases the morale of its employees, increases their efficiency, reduces wastages and costs and enhances production and profits.

Importance # 6. Ability to face crisis

A firm having adequate working capital is well equipped to face a business crisis like depression because during such a period, the firm relies heavily on working capital requirements.

Importance # 7. Favourable market conditions

Only firms with adequate working capital can take advantage of favourable market conditions such as purchase of raw materials in bulk when the prices are lower and by holding its stock for selling at higher prices.

Importance # 8. Quick and regular return on equity investments

Every investor wants a quick and regular return on his investments. Adequate / sufficient working capital enables a firm to pay quick and regular dividends to its investors as there may not be much pressure to plough back profits. This will create the confidence in the investors and create a favourable market to raise further funds in the future.

Advantages and Disadvantages of Working Capital – Adequate, Excessive And Inadequate Working Capital

Significance of working capital is summarized below:

Working capital is required for day to day smooth running of the business just as circulation of blood is essential in the human body for maintaining life. It is sometimes said that, “Inadequate working capital is disastrous; whereas redundant working capital is a criminal waste.” From the above statement it clearly indicates that there are three aspects of the significance of working capital.

They are:

(i) Adequate working capital

(ii) Excessive or redundant working capital

(iii) Inadequate working capital

Advantages of Adequate Working Capital:

Following are the various advantages of adequate working capital:

(i) Goodwill

Adequate working capital enables a business to pay its liabilities, whenever it becomes due which ultimately enhances goodwill of the firm.

(ii) Cash discount

Adequate working capital helps an organisation to avail cash discounts on the purchase of merchandise and raw materials. Timely payment of the cost of merchandise reduces the cost of production.

(iii) Easy loans from banks

Adequate working capital helps an organisation to avail banks loans on easy and favourable terms. A business having good credit standing and trade reputation avails loans easily.

(iv) Distribution of dividends

Adequate working capital helps a business to distribute dividends to its shareholders in the right time.

(v) High morale

Adequate working capital improves the morale of the executives. It brings an environment for certainty, security and confidence which are physiological factors for the improvement of efficiency.

(vi) Sense of security and confidence

Adequate working capital can build up a sense of security, confidence and loyalty among the stakeholders.

Disadvantages of Excessive or Redundant Working Capital:

Every business requires adequate working capital for the day to day management of the business. But a question always arises whether excess or redundant working capital is best for the business or shortage or inadequate working capital is best. Out of the above two alternatives, it can be concluded that both are bad for the business.

Following are the various disadvantages of excessive or redundant working capital:

(i) Loss of goodwill

Excess of working capital brings an opportunity to invest in low rate of interest bearing securities, which ultimately affect the return on investment of the shareholders. Their shareholders lose confidence in the company which ultimately reduces the good will.

(ii) Misuse of funds

Excess of working capital diverts the attention of the company to invest wisely in the most profitable investments. Due to the excess working capital it will be very much difficult to put control on the various purchases.

(iii) Inefficient management

Excessive working capital leads to the inefficiency of the business because the management is not interested in investing the funds in expanding the business.

(iv) Low rate of return on capital

Excess of working capital indicates the presence of idle funds available in the business. The idle funds do not carry any interest which ultimately leads to low rate of interest on the capital employed. The low rate of return on capital ultimately affects the earnings of the shareholders in terms of reduction of dividends.

Disadvantages of Inadequate Working Capital:

Following are few disadvantages of inadequate working capital:

(i) Loss of goodwill

A business facing inadequate working capital cannot pay its current liabilities in time. This will affect the reputation of the business and fails to avail good credit facilities.

(ii) Losing favourable opportunities

inadequate working capital fails to provide favourable opportunities to invest in profitable projects. It indicates a stagnant position because of the inadequate working capital.

(iii) Increase in business risks

Inadequate working capital leads to increased business risks because of the irregular payment of the business liabilities. It possesses a serious threat to the survival of the business.

(iv) Adverse effect on morale

Inadequate working capital discourages the morale of the business executives. It brings an environment for uncertainty and insecurity which losses the confidence of the executives and ultimately loses the morale of the stakeholders.

2 Major Components of Working Capital – Current Assets and Current Liabilities

Components of working capital can be listed as follows:

Component # a. Current Assets:

Current assets are those assets which are available either in the cash or which can be converted into cash within a short span of period, usually a year. These include cash and bank balances, short-term investments or advances, investment in raw material, work-in-progress, finished stock, receivables, prepaid expenses etc.

Component # b. Current Liabilities:

Current liabilities are those liabilities of the firm which are likely to be paid within a year. These may include payment to creditors, outstanding expenses, short-term borrowings, advance received against sales, taxes payable, dividend payable or any other liabilities payable within a year.

Top 2 Classification of Working Capital – Permanent or Fixed and Variable Working Capital

Classification of working capital are explained below:

Classification # 1. Permanent or Fixed Working Capital:

Permanent as the word depicts is that part of capital which is permanently locked up in the circulation of current assets and in keeping it moving. Every manufacturing concern has to maintain stock of raw materials, works-in-progress, finished products, loose tools and equipment. It also requires money for the payment of wages and salaries throughout the year.

It can again be sub-divided into:

(a) Regular Working Capital, and

(b) Reserve Margin or Cushion Working Capital.

a. Regular Working Capital:

It is the minimum amount of liquid capital needed to keep up the circulation of the capital from cash to inventories to receivables and back again to cash. This would include a sufficient cash balance in the bank to discount bills.

b. Reserve Margin or Cushion Working Capital:

It is the excess over the needs for regular working capital that should be provided for contingencies that arise at unstated periods.

The contingencies include:

(i) Rising price that may make it necessary to have more money to carry inventories and receivables or may make it advisable to increase inventories.

(ii) Business depressions which may raise the amount of cash required to ride out usually stagnant periods.

(iii) Strikes, fires and unexpectedly severe competition, which use up extra supplies of cash.

(iv) Special operations, such as experiments with products or with method of distribution, war contracts, contracts to supply new business and the like, which can be undertaken only if sufficient funds are available and which in many cases mean the survival of a business.

Classification # 2. Variable Working Capital:

The variable working capital changes with the volume of business.

It may be sub-divided into:

(a) Seasonal working capital

(b) Special working capital.

a. Seasonal Working Capital:

In some businesses, like sugarcane, operations are seasonal, so working Capital requirements change greatly during the year. The capital required to meet the seasonal needs of industry is termed as seasonal working capital.

b. Special Working Capital:

While special working capital is that variable capital which is needed to finance special operations like the inauguration of extensive marketing campaigns, experiments with products or with methods of distribution carrying out special jobs and similar other operations that are outside the usual business of buying, fabricating and setting.

Top 3 Cardinal Principles of Working Capital – Principle of Optimisation, Worthwhileness of Investment and Suitability

In managing working capital a finance manager must bear in mind certain fundamental principles which serve as useful guidelines.

These principles are spelt out as follows:

Principle # 1. Principle of Optimisation:

According to this principle, a finance manager must aim at selecting the level of working capital that optimises the firm’s rate of return. This level is defined as that point at which the incremental cost associated with a decline in working capital investment is equal to the incremental gain associated with it.

Finance manager is expected to determine the optimal level of working capital after analysing correctly the factors determining the amount of the various components of working capital as well as predicting the state of the economy.

Optimisation principle is based on the premise that a definite relation exists between the degree of risk that a firm assumes and the rate of return. Higher the risk that a firm assumes, the greater is the opportunity for gain or loss.

Principle # 2. Principle of Worthwhileness of Investment in Working Capital:

This principle was evolved by Professor Walker. According to this principle, capital should be invested in each component of working capital as long as the equity position of the enterprise increases. This will strengthen the financial position of the enterprise and reduce the risk involved in it.

Principle # 3. Principle of Suitability:

Principle of suitability should be followed while financing different components of working capital. This stipulates that each asset should be offset with a financing instrument of the same approximate maturity. Thus, temporary or seasonal working capital would be financed by short-term borrowings and permanent working capital with long-term sources.

Among long-term sources of financing, equity shares and debentures are the permanent sources. The issue of equity shares is more advantageous than the sales of debentures because it brings in permanent funds without any obligation of refunding the funds to its owners. Besides, it provides flexibility in financial planning and does not create the charge against the assets of the firm.

Besides, the firm is under no obligation to bear the interest cost. However, excessive reliance on equity financing deprives the firm of the benefits of trading on equity. This is why recourse to debt financing is advisable for satisfying a permanent portion of working capital. Debentures offer the advantage of higher return to the equity holders because of its being a relatively cheaper source of financing.

Furthermore, redemption of regular installments of debenture issue entails a constant financial discipline for the management.

Permanent working capital can also be financed by ploughing back of earnings. However, this source of financing is available only to enterprises having run their affairs successfully. Firms in their initial stages cannot make use of this source of financing.

Temporary or variable working capital needs of an enterprise are usually financed with short-term funds. Trade credit and bank loans are the permanent source of short- term funds.

In deciding about the pattern of financing, a finance manager usually faces the problem of precisely determining what part of current assets is temporary and what part is permanent. Even if amounts could be ascertained, the exact timing of asset liquidation is a difficult matter.

To compound the problem, the management is never quite sure how much short-term or long-term financing is available at a point of time. While the precise synchronization may be the most desirable and logical plan, there may be other alternatives of financing working capital.

Among these, the first such plan may be dependent on long-term financing even for meeting a part of temporary current assets. By borrowing long- term funds to cover short-term needs, the firm virtually assumes itself of having adequate capital all times and protects itself against the danger of not being able to provide adequate short-term financing in tight money periods. Generally, the conservative management follows this approach.

While this plan of financing involves less risk, it entails relatively more cost because long-term funds are more expensive than short-term funds. Further, long-term financing lacks flexibility.

In a sharper contrast to this, a firm may be aggressive in financing its working capital needs and may accordingly depend more on short-term sources to satisfy a part of its permanent current assets requirements. The relatively greater reliance on short-term financing involves more risk although short-term financing is less costly than long-term financing and contains the advantage of flexibility in financing.

Thus, there is a conflict between long-term and short-term financing. The choice between the two involves a tradeoff between risk and return. A finance manager should strike a satisfactory compromise between risk and return in the light of value maximisation goal, peculiar needs of the enterprise and degree of assets liquidity in the firm.

Thus, for instance, a firm with heavy risk exposure due to short-term financing may compensate, in part, by carrying highly liquid assets. Conversely, a firm with well- established long-term debt commitments may choose to carry a heavier component of less liquid but highly profitable needs.

Gross and Net Working Capital (With Reasons and Format)

Generally the working capital has its significance in two perspectives. These are gross working capital and net working capital are called ‘balance sheet approach’ of working capital.

Gross Working Capital:

The term ‘gross working capital’ refers to the firm’s investment in current assets. According to this concept working capital refers to a firm’s investment in current assets. The amount of current liabilities is not deducted from the total of current assets.

The concept of gross working capital is advocated for the following reasons:

I. Profits of the firm are earned by making investment of its funds in fixed and current assets. This suggests the part of the earnings relate to investment in current assets. Therefore, aggregate of current assets should be taken to mean the working capital.

II. The management is more concerned with the total current assets as they constitute the total funds available for operating purposes than with the sources from which the funds come.

III. An increase in the overall investment in the firm brings an increase in the working capital.

Net Working Capital:

The term ‘net working capital’ refers to the excess of current assets over current liabilities and it is the difference between current assets and current liabilities. The net working capital is a qualitative concept which indicates the liquidity position of a firm and the extent to which working capital needs may be financed by a permanent source of funds.

The concept looks into the angle of judicious mix of long-term and short-term funds for financing current assets. A portion of net working capital should be financed with permanent sources of funds.

Working Capital – Approaches to Working Capital in a Company: Hedging (Matching), Conservative and Aggressive Approach

A company may use any of the following approaches of working capital:

Approach # i. Hedging (Matching) Approach:

Under this approach, the life of the asset is matched with the life of the source of finance. That is, permanent current assets are financed using long-term funds and temporary current assets are financed using short-term funds. In this case net working capital will be equal to permanent current assets only. This is because temporary current assets have matching current liabilities.

Approach # ii. Conservative Approach:

A conservative approach is one where long- term financing is used to finance both permanent and temporary current assets. The net working capital in this approach is maximum and equal to total current assets because there are no current liabilities. This approach is less risky but more costly than a matching approach.

Approach # iii. Aggressive Approach:

In this approach, short-term financing is used to finance both permanent and temporary current assets. In this case Net working capital is zero because total current assets and current liabilities are equal. This approach is very risky but less costly for the firm. It can also lead to a liquidity crisis.

Significance and Dangers of Excessive Working Capital

Significance of Excessive Working Capital:

For maximisation of profits or minimisation of working capital cost or to maintain balance between liquidity and profitability, there is a need to maintain a balance in the working capital. It should not be excessive or inadequate. In other words, a firm should manage adequate working capital to run its business.

Both excess or inadequate working capital are dangerous from the firm’s point of view. Excessive working capital means idle funds, which can earn no profit but involve costs, and inadequate working capital disturbs production and impairs the firm’s profitability.

The Dangers of Excessive Working Capital:

The dangers of excessive working capital are as follows:

1. It results in unnecessary accumulation of inventories, which leads to mishandling of inventories (waste, theft and losses in increase).

2. It is an indication of defective credit policy and slack collection period. This leads to higher bad debt losses that reduce profits.

3. It makes management complacent which degenerates into managerial inefficiency.

Accumulations of inventories tend to make speculative profits grow. This type of speculation makes the firm to follow a liberal dividend policy and it is difficult to cope with in the future, because it is unable to make speculative profits.

Working Capital – 4 Component Periods in Operating Cycle in a Manufacturing Company: Raw Materials, Work-in-process, Finished Goods and Book Debt Conversion Period

The length of the operating cycle will depend on the nature of business. The length of the operating cycle of a manufacturing business is longer than the operating cycle of a trading concern.

A manufacturing company has 4 component periods in its operating cycle, namely-

1. Raw materials conversion period

It is the length of time required for purchase of raw materials and conversion of raw materials in to work-in-process.

2. Work-in-process conversion period

It is the length of time required for conversion of work-in-process into finished goods.

3. Finished goods conversion period

It is the time required for selling the finished goods to the customers. The total of the above period is called Inventory conversion period.

Inventory conversion period = RMCP + WIPCP + FGC

4. Book debt conversion period

It is the length of time needed for collecting cash from debtors for the credit sales made by the company.

Working Capital – 3 Widely Used Methods for Estimating Working Capital Requirements: Percentage of Sales Method, Regression Analysis Method and Operating Cycle Approach (With Formulas)

Three widely used methods for estimating working capital requirements of a firm are:

1. Percentage of sales Method

2. Regression Analysis Method

3. Operating Cycle Method

Method # 1. Percentage of Sales Method:

In this method, the level of working capital requirement is decided on the basis of past experience. The past relationship between sales and working capital is taken as a base for determining the size of working capital requirements for future.

It is, however, presumed that the relationship between sales and working capital that has existed in the past has been stable. Percentage of sales method is a simple and easily understood method and practically used for ascertaining short-term changes in working capital in future.

However, this method lacks reliability inasmuch as its basic assumption of linear relationship between sales and working capital does not hold true in all the cases. As such, this method cannot be recommended for universal application.

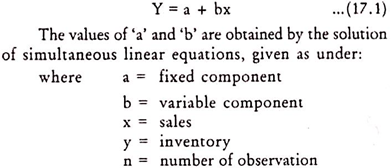

Method # 2. Regression Analysis Method:

This is a statistical method of determining working capital requirements by establishing the average relationship between sales and working capital and its various components in the past years.

In this regard the method of least squares is employed and the relationship between sales and working capital is expressed by the equation –

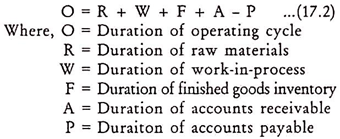

Method # 3. Operating Cycle Approach:

According to this approach, the size of working capital requirements of a firm is determined by multiplying the duration of the operating cycle by cost of operations.

The duration of the operating cycle may be found with the help of the following formula:

Duration of raw materials reflects the number of days for which raw materials remain in inventory before they are issued for production.

The following formula can be used to determine duration of raw materials:

Top 5 Techniques of Forecasting Working Capital – Operating Cycle, Estimation of Current Assets and Current Liabilities and Profit and Loss Adjustment Method of Working Capital (with Formula)

The following are the techniques or methods may be used in forecasting working capital for any future period:

1) Operating cycle method.

2) Estimating current assets and current liabilities method.

3) Profit and loss adjustment method.

Technique # 1) Operating Cycle Method:

Under this method working capital is determined by dividing total operating cost by the number of operating cycles during the year.

Total operating expenses includes all expenses on raw materials. Labour and overheads, while estimating operating expenses, non-cash items like depreciation is excluded. Because depreciation is non-operating expenses. Number of operating cycles is calculated dividing 365 days of the year by the duration of operating cycles.

The duration of operating cycle is the number of days involved in the various stages of the operating cycle i.e., cash – raw materials -finished goods – debtors – cash as reduced by the credit period allowed by the creditors.

Technique # 2) Assessment of Working Capital or Estimation of Current Assets and Current Liabilities:

It is the oldest and traditional method of estimating working capital requirements.

According to this method the working capital is the excess of current assets over the current liabilities. Thus its requirements can easily be forecasted by making the estimates of the amount of each component of current assets and current liabilities.

The procedures for estimating the components is as follows:

i) Stock of raw materials.

ii) Stock of work-in-progress.

iii) Stock of finished goods.

iv) Sundry debtors.

v) Cash and Bank Balance.

vi) Sundry Creditors.

vii) Outstanding expenses.

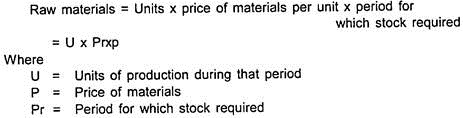

i) Stock of Raw Materials:

An industrial unit needs to maintain a certain stock of raw materials to ensure uninterrupted production. Stocking is necessary because of uncertainty of availability. Time lags between the placing of the order and actual delivery, sudden increase in demand etc.

Inadequate stocking could lend to being out of stock which would result in stoppage of production, inability to meet delivery schedules, cancellation of orders etc.

In short – For continuous and smooth production, raw materials are to be kept in the store.

The average amount of such stock of raw materials would depend on the quantity of raw materials required for production during a particular period as well as upon the average time taken in obtaining fresh delivery.

ii) Stock of Work-In-Progress:

It includes raw materials, wages and overheads. In order to determine the stock of work-in-progress, we must find out the time period for which the inputs will be in the process of production. This is also known as conversion period.

Note:

a) When wages and overheads acquire even during the period production is in process, then only half of the wages and overheads for that period shall be taken for determining the cost of work-in-progress.

b) When it is mentioned that raw materials are in process, the cost of work- in-progress will consist of any raw materials.

iii) Stock of Finished Goods:

The stocking of finished goods would depend on expected sales, seasonal nature of sales delivery schedules, length of the manufacturing process, expected sports in demand, and the like. Finished goods represent both materials cost and conversion charges.

Finished goods are to be kept in determining the amount to be locked cap in finished goods stock

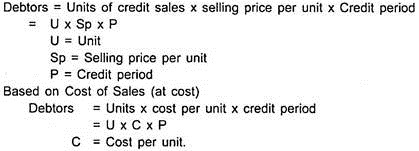

iv) Sundry Debtors:

It is computed based on credit sales, period of credit allowed or time lag in collecting the payments

Debtors may be calculated either at sales value or at cost.

Sales Value – In this case the amount of credit sales is taken into account.

At Cost – In this case the cost of credit sales is taken into account.

Note:

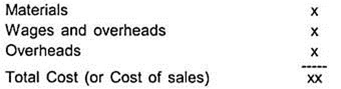

a) Calculation of cost of sales:

ii) While Calculating Debtors following points considered:

a) If sales value is given but profit is not given in such cases debtors should be calculated on the basis of sales values.

b) If sales value and profit are given, in such cases deduct the profit from sales. We will get cost of sales. So debtors should be calculated on cost of sales.

Formula for Debtors Based on Sales Value:

v) Cash and Bank balances

vi) Creditors:

It is estimated on the basis of credit purchases and the time day in payments to creditors or credit period allowed by suppliers of raw materials.

Creditors = Units of raw materials purchased on credit x Rate per unit x Credit Period

vii) Outstanding expenses such as wages, Salaries, overheads etc.

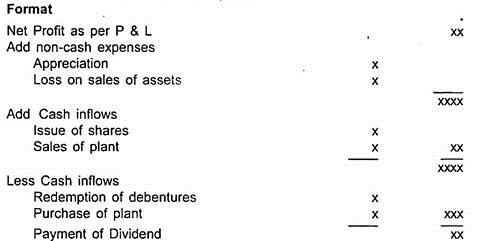

Technique # 3) Profit and Loss Adjustment Method:

Under this method profit is calculated on the basis of transactions. Afterwards working capital is determined by making necessary adjustments for cash inflow and outflow in the profit.

Format:

Determining the Working Capital Finance Mix:

There are two sources of financing of working capital requirements

(1) Long term sources and

(2) short term sources.

Out of these two sources a question arises as to what portion of working capital should be financed by long term sources and how much by short-term sources?

To answer the above question there are three basic approaches for determining an appropriate working capital financing mix viz.:

1. Hedging approach

2. Conservative approach

3. Aggressive approach.

1. Hedging Approach (Matching Approach):

Under this method, long term financing is used to finance long term assets and permanent assets.

Whereas short term financing is used to finance seasonal and variable current assets.

Advantages:

i. It reduces the cost of financing.

ii. It helps for proper utilisation of funds.

Cost of long term financing = Average long term x long term rate of interest.

Cost of Short term financing – Average short term funds x short term rate of interest.

2. Conservative Approach:

Under this method, long term funds are used to finance permanent as well as variable working capital requirements.

Only in case of emergency short-term financing is resorted to

Advantages:

i. It provides liquidity

ii. It protects the solvency of the firm.

Disadvantages:

i. Cost of raising funds is high, so it reduces the rate of return on investment.

3. Aggressive Approach:

Under this method short term funds are used to finance the working capital requirements.

Advantages:

i. It reduces the cost of funds.

ii. It increases the profitability of the firm.

Disadvantages:

i. It increases the risk resulting from lock of adequate liquidity.

Tradeoff between Hedging and Conservative Approaches:

Each approaches having its own merits and demerits. Hence both approaches are not suitable for efficient working capital management. So in order to balance these approaches a new approach is introduced. It is called trade-off-approach.

In this approach, average fund is ascertained by dividing minimum funds + maximum funds by the two

Thus the average fund is financed through long term source and excess amount over and above the average is financed from short-term funds.

Methods for Calculation of Working Capital

Methods for Calculation of Working Capital is summarized below:

Once the level of current assets is accepted by the banker and the customer, an advance limit is extended by the banker to finance the current assets. The essence of appraisal of the credit limit is to ensure that genuine production needs of the borrower are met and that there is no over-financing or under-financing.

For this reason, the appraisal system takes into account the levels of raw materials to be maintained, stock-in-process to be held, finished goods to be kept in store and credit to be allowed to buyers. It also takes into account the credit available from suppliers of raw materials, advance payments to be received against sales to be made, etc.

As regards quantum of the limit, the bank has also to examine the following, besides the level of current assets:

(i) The financial position, as revealed by the Balance Sheet. Profit and Loss Account and Funds flow Statement as on a recent date.

(ii) The estimated and projected levels of sales, profit and funds flow Position as also the estimated and projected Balance Sheet.

(iii) If the advance already exists and a renewal of the facility is sought, whether the loan account had been conducted satisfactorily in the past.

After examining the above and if these are found to be satisfactory, banks adopt anyone of the following methods to compute the working capital:

(i) MPBF Method (Maximum Permissible Bank Finance Method), popularly known as Tandon committee Method.

(ii) Projected Balance Sheet Method (PBS Method)

(iii) Turnover Method

1. Maximum Permissible Bank Finance (MPBF)

(a) Historical Background:

Earlier, in India, security-cum- -guarantee approach governed bank lending. So, borrowers with economic power had easy access to bank credit and bank lending was unrelated to the actual needs or activities.

With the abolishing of the Managing Agency System and higher demand for credit from priority and weaker sections of the society, increasing dependence on bank credit by medium and large-scale industries for meeting working capital needs came under criticism.

The inherent weakness of the cash credit system, viz., withdrawing funds and replenishing the account at the will and pleasure of the borrower, thwarted, to a great extent, the credit control measures as well as funds planning by banks.

A Study Group (Dehejia Study Group) was, therefore, set up by the National Credit Council to examine the entire gamut of bank lending to industry, which felt that the security-oriented approach led to over-financing of industry vis-a-vis the production needs and the bank finance was only short- term in name.

In practice, it was long-term in nature with an element of “hard core” borrowing, which represented a near permanent lock-up of bank funds in borrowers’ business. (“Hard Core” of working capital represents the minimum inventory required to be held for a given production).

The Study Group felt that financing of industry should be on the basis of the totality of the borrowers’ operations and that the “hard core” portion of the needs should be met out of long-term sources. Time was, therefore, opportune for considering reforms in the bank credit system, especially from the point of view of monitoring of the end-use of credit.

Accordingly, a Study Group (Tandon Study Group) was set up by the Reserve Bank of India in 1974 to frame guidelines for follow-up of bank credit and the terms of reference included prescription of norms for inventory and receivables.

The Group’s recommendations covered norms for inventory and receivables, method of lending, style of credit and financial follow-up. However, the principles governing MPBF, framed by the Tandon Committee, were later chiselled by the Core Committee.

According to the Tandon Study Group, bank finance should be provided to supplement a unit’s resources for carrying a reasonable level of current assets, based on production plan, lead time for supplies and economic ordering levels and a reasonable level of receivables and other current assets.

Holding of flabby inventory, profit making inventory, etc., should be discouraged. The Study Group prescribed norms for holding of inventories and receivables for 15 major industries. These norms represent the maximum levels. It is to be borne in mind that the norms are not entitlements.

If a borrower was managing with lower inventories or receivables in the past, he is expected to continue to do so in future also. No norms have been fixed for other current assets, which should bear a reasonable proportion to the total current assets.

Spares are not to exceed 9 months’ consumption, in case they are indigenous and 12 months’ consumption, in case they are imported. Further, consumption, cost of production, etc., are to be taken from the operating statement.

Deviations from norms are to be permitted only in exceptional circumstances such as bunched receipt of raw materials (including imports), power cuts, strikes, lock-outs, transport delays and bottlenecks, etc. Even sick units are not exempted from applicability of inventory norms.

(b) Lending Norms:

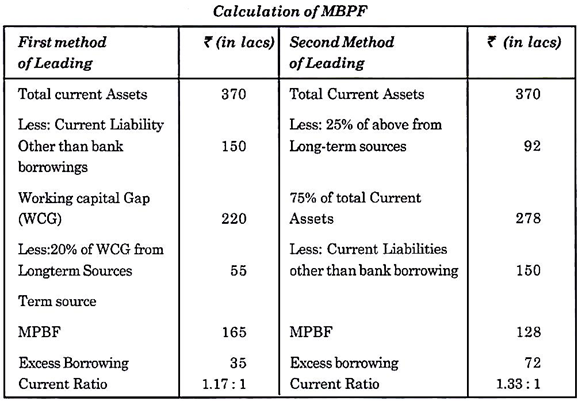

Tandon committee has recommended three methods for fixing the maximum permissible bank finance. However, only the first two methods have been accepted by the Reserve Bank of India. The methods provide for a progressive increase in the contributions from the borrower’s long-term sources for financing current assets.

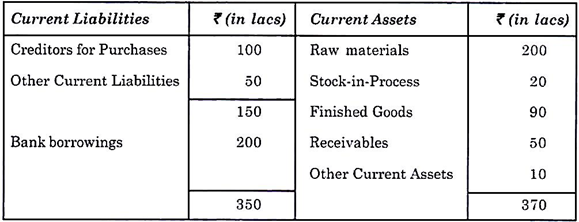

This would result in the Current Ratio to increase from 1 to 1.33. The basic assumption is that the role of the banker as a lender is to supplement the borrower’s resources in carrying a reasonable level of current assets in relation to his production requirements. The total current assets will be financed partly by creditors for purchases and other current liabilities.

The funds required for carrying the balance of current assets is called Working Capital Gap. This has to be bridged by Net Working Capital, which is the same as the difference between Long-term Sources and Long-term Uses of funds of the borrower, and bank finance.

Under the first method of lending, the banker first calculates the Working Capital Gap (WCG), i.e., the difference between the total current assets and the current liabilities other than bank borrowings.

The Maximum Permissible Bank finance (MPBF) can be worked out at 75% of this WCG. In other words, 25% of the WCG would have to be met out of long-term funds comprising owned funds and long-term borrowings.

Under the second method of lending, the borrower is required to bring from long-term sources 25% of total current assets. In other words, total current assets, inclusive of bank borrowings, would not provide more than 75% of total current assets.

These are being explained by way of illustrations as under:

Thus, the borrower will get lower quantum of bank finance under the first method than that under the second method.

As stated earlier, the third method was not accepted by the Reserve Bank of India for being implemented because, under this method, the “core assets” (i.e., those representing the absolute minimum level of raw materials, process stock, finished goods and stores, which are in the pipelines to ensure continuity of production) are to be deducted from the current assets, as commonly understood, for the purpose of arriving at the MPBF, which would unduly curtail bank finance and also because the identification of “core assets” could pose practical problems.

All borrowers have, therefore, been, since 1980, expected to conform to the second method. Although the mandatory prescription regarding the second method was withdrawn by the Reserve Bank in 1997, almost all the banks keep this method as the benchmark, while assessing credit limits for working capital to large industrial units.

Thus, all large borrowers of the banking system should conform to the second method, which postulates that minimum NWC should be 25% of current assets. In other words, the borrower should have a minimum Current Ratio of 1.33. The only exception is sick weak units, put under an approved rehabilitation scheme, which would be placed under the first method.

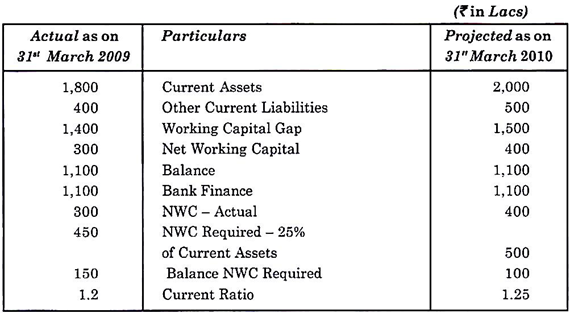

The question then arises as to how a bank should handle a case where the borrower is unable to conform to the second method and has a Current Ratio of say, 1.08. Normally, most borrowers with a weak current ratio tend to project a rosy picture for the coming year for which bank finance is sought and indicate that the current ratio would be 1.33 or above, as per projections. However, if a borrower, already enjoying a working capital limit, has a Current

Ratio of around 1.20 and seeks renewal and/ or enhancement in the limit, projecting a Current Ratio of around 1.25 for the next year, the bank could insist on the ratio going up to/1.33.

This could also be done by converting a part of the working capital limit (cash credit) into a working capital term loan, as indicated below:

In the above example, significant points to note are:

i. NWC increases by 33.33% as against the increase in current assets of 11.11 %. And yet, the company’s NWC falls short of 25% of current assets.

ii. Similarly, the Current Ratio increases from 1.20 to 1.25, but will not reach the minimum stipulated level of 1.33.

iii. The Company would not be seeking any enhancement, but only the renewal of limit.

The prescription of the Tandon Committee, which had been endorsed by the Reserve Bank for application by the banks, was to make the Company conform to the second method of lending as on 31st March 2009 while renewing the limit.

Thus, bank finance should only be Rs. 1,000 lacs as on 31st March 2009 if the Current Ratio were to be 1.33. Since it is already at Rs. 1,100 lacs, the difference of Rs. 100 lacs should be granted by way of working capital term loan, the balance Rs. 1,000 lacs being short-term working capital advance (cash credit).

By converting a portion into a working capital term loan, which is repayable over a period of 3-5 years or so, the long-term resources of the Company are shored up and NWC increased.

Working capital term loan has two attributes:

a. It is intended for working capital and secured primarily by a charge on current assets.

b. It is repayable over a medium term, say, 3-5 years from the profits of the borrower and, therefore, it is a term loan.

While the above policy regarding working capital term loan is sound in principle, in practice it is rarely, if ever applied by banks in India.

After an initial rigid posture on minimum current ratio of 1.33 (i.e., NWC being at least 25% of current assets) in early 1980s, the banking system had been adopting a flexible approach and accepting levels of Current Ratio below 1.33 also.

The only group to which working capital term loan is extended is sick units, out under rehabilitation scheme by the banking system.

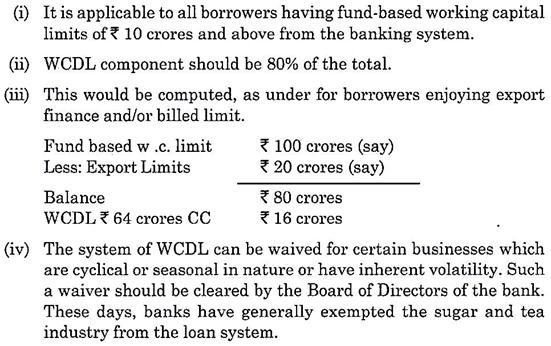

(c) Working Capital Demand Loan:

The Reserve Bank of India introduced the loan system “with a view to bringing about discipline in the utilisation of bank credit and gain better control over the flow of credit”. The system was evolved primarily to ensure that banks were not subjected to sudden shocks and surprises by borrowers making unanticipated demands for cash or dumping excess liquidity on an unsuspecting bank.

To start with, banks were asked to bifurcate the cash credit limit into a fixed portion styled Working Capital Demand Loan (WCDL) of 25% and the balance 75% as fluctuating portion or cash credit. This was to be applicable to all borrowers enjoying cash credit limits of Rs. 20 crores and above from the banking system.

WCDL would be for 12 months, excepting for seasonal industries, for which it would be 6 months. No prepayments (before the due date) were, in the initial stages, permitted in WCDL.

The salient features of the guidelines issued by the Reserve Bank in April 1977 on-the subject were: (this system is discontinued now and is replaced with Cash Budget System)

(v) Temporarily additional limits, such as for the payment of annual bonus to workers, can be granted only after the borrower has fully utilized /exhausted the existing limit’. This guideline is impracticable as at very, very rare occasions only, the cash credit limit will be fully utilised. Obviously, no bank strictly follows this guideline.

2. Projected Balance Sheet Method (PBS Method)

In 1997, the Reserve Bank of India (RBI) had withdrawn their earlier prescriptions on the assessment of working capital finance, based on the MPBF concept enunciated by Tandon Study Group.

RBI advised banks to evolve an appropriate system for assessing the working capital needs of borrowers and to lay down transparent policy and guidelines for credit dispensation in respect of each category of economic activities.