1. Introduction to Cash Management

Management of cash is one of the most important areas of overall working capital management due to the fact that cash is the most liquid type of current assets. As such it is the responsibility of the finance function to see that the various functional areas of the business have sufficient cash whenever they require the same.

At the same time, it has also to be ensured that the funds are not blocked in the form of idle cash, as the cash remaining idle also involves cost in the form of interest cost and opportunity cost. As such the management of cash has to find a mean between these two extremes of shortage of cash as well as idle cash.

2. Nature of Cash

Cash is the medium of exchange for purchase of goods and services and for discharging liabilities.

In cash management, the term has been used in two senses:

ADVERTISEMENTS:

(a) Narrow Sense – Under this cash covers currency and generally accepted equivalents of cash, viz., cheques, demand drafts and banks demand deposits.

(b) Broad Sense – Here, cash includes not only the above stated but also near cash assets. They are Bank time deposits and marketable securities.

3. Objectives of Cash Management

The prime objective of cash management is to channelize the flow of cash from the surplus to deficit units to maintain the appropriate liquidity position of the organization. In addition, the objectives of cash management can be broadly subdivided into two heads – maintaining the inflow and outflow of cash and sustaining the cash position held by the organization to meet the current obligations.

Other important objectives of cash management are discussed as follows:

ADVERTISEMENTS:

i. Planning of Cash Flows – Refers to scheduling the cash inflow and outflow of an organization over a period of time. The planning of cash flow helps in maintaining an adequate amount of capital to finance day-to-day- functions of the organization.

ii. Synchronizing Cash Flows – Refers to developing equilibrium between inflow and outflow of cash in the business. If the amount of cash receipts (inflow) is equal to the cash payment (outflow) then there would be no requirement of holding extra cash.

iii. Optimizing Cash Holding – Refers to determining the appropriate amount of cash to be kept in the business to meet the contingency needs. It is the duty of the finance manager to decide the optimal cash holding to avoid any excess or deficit of cash.

iv. Investing Idle Cash – Refers to utilizing the idle cash kept in the business for short-term investment purposes. An organization can invest the idle cash in marketable securities for a short duration to earn a reasonable rate of return. The marketable securities are highly liquid in nature and can be easily converted into cash at a short notice.

4. Importance of Cash Management

Cash management is one of the critical areas of working capital management and assumes greater significance because it is the most liquid asset used to satisfy the firm’s obligations but it is a sterile asset as it does not yield anything. Therefore, the finance manager has to manage cash so that the firm maintains its liquidity position without jeopardizing profitability.

ADVERTISEMENTS:

Problem of prognosticating cash flows accurately and absence of perfect coincidence between the inflows and outflows of cash add to the significance of cash management. In view of the above, at one time a firm may experience dearth of cash because payments of taxes, dividends, seasonal inventory, etc., build up while at other times, it may have surfeit of cash stemming out of large cash sales and quick collections of receivables.

It is interesting to observe that in real life a finance manager spends considerable time managing cash which constitutes relatively a small proportion of a firm’s current assets. This is why in recent years a number of new techniques have been evolved to minimize cash holding of the firm.

5. Scope of Cash Management

Cash management refers to a systematic way of handling cash inflows and outflows resulting from business operations. Understanding the basic concepts of cash management will help business enterprises to plan for the unforeseen eventualities that nearly every business faces.

1. Cash Planning:

Cash planning is a systematic way of forecasting the cash requirements for a given period with an objective to maintain adequate cash balance in hand, sufficient to meet the payments and obligations as and when they mature. Thus it includes forecasting of cash inflows and cash outflows. A business must generate a positive cash flow, meaning that long-term cash outflows must be less than long-term cash inflows.

2. Managing Cash Flows:

Cash planning is a systematic way of forecasting the cash requirements for a given period with an objective to maintain adequate cash balance in hand, sufficient to meet the payments and obligations as and when they mature.

Thus it includes forecasting of cash inflows and cash outflows. Managing cash inflows is the task of implementing policies and procedures regarding inflow and outflow of cash. It includes short term investment plans when cash in surplus and borrowing programmes during the days of cash deficit.

ADVERTISEMENTS:

3. Optimum Cash Level:

Cash optimization here signifies to make as perfect or effective as possible. Most enterprises focus on cash flows but find them hard to control. The problem is not so much predicting investments and payments to creditors and owners but rather being able to optimize and control cash flows related to the day-to-day operation of the enterprise. Effective cashflow is essential for survival, profit and sound business.

4. Investing Idle Cash:

If the business has surplus cash balances available during certain periods of time, then it should consider investing in short-term marketable securities. On the other hand if business is consistently generating a cash surplus, then it should consider longer-term and higher yield investments. However a business need to be cautious and maintain a certain level of cash on hand to cover any unforeseen circumstances, or to take advantage of prompt payment discounts, as mentioned above.

6. Factors Determining Level of Cash

ADVERTISEMENTS:

Factors Determining Cash Needs and Level of Cash:

The factors affecting or determining the cash requirements of a business are as follows:

(1) Timing of Cash Flows:

The need for maintaining cash balance arises because cash inflows and cash outflows take place at different times. If cash inflows perfectly match cash outflows, i.e., if they take place at same time, there would be no need for keeping cash balance. Need for keeping cash balance arises when cash outflows exceed cash inflows. Therefore, the need for cash can be determined by forecasting cash inflows and cash outflows. Forecast is done through a cash budget.

ADVERTISEMENTS:

(2) Cash Shortage Costs:

Cash budget would reveal the quantum as well as periods of cash shortages. Every shortage of cash involves a cost depending upon the quantum and duration of shortfall. Costs incurred as a result of shortfall of cash are called cash shortage costs.

Examples of cash shortage costs are:

(i) Transaction cost relating to raising cash to tide over the shortage such as brokerage etc. for sale of marketable securities.

(ii) Borrowing costs like interest etc. for borrowing to cover the shortage,

(iii) Penal interest charged by banks due to shortfall in compensating or minimum balances in the bank.

ADVERTISEMENTS:

(iv) Costs due to deterioration of credit rating like shortage in the supply of raw-material, less favourable terms offered by suppliers and so on.

(v) Loss of cash discount because of non-payment in time due to shortage of cash.

Cash shortage costs should also be considered along with cash shortage itself in determining cash needs.

(3) Cash Excess Costs:

If a firm keeps cash balance in excess of its requirements, it will miss opportunities to invest it elsewhere. As a result it will lose interest which it would otherwise have earned by investing excess cash elsewhere. This factor should also be considered in determining the level of cash and therefore the level of cash should not be determined in excess.

(4) Cash Management Costs:

ADVERTISEMENTS:

Cash management also involves some costs such as salary, clerical expenses etc. of cash management staff. Cash need should be determined after considering this factor also.

(5) Uncertainty:

Cash flows can never be predicted with complete accuracy and there is always some uncertainty in their forecast such as unexpected delay in collection from debtors. Firm must always keep some additional cash to meet these uncertainties.

(6) Firm’s Capacity to Borrow in Emergent Situations:

If a firm is able to borrow quickly in case of emergency, it can keep a low level of cash. Firm’s ability to borrow depends on many factors such as its credit standing, relation with the banks and so on.

(7) Attitude of Management:

ADVERTISEMENTS:

The attitude of management towards liquidity and profitability affects the level of cash. If the management attaches more significance to liquidity than profitability, the level of cash will be high. On the contrary, if it gives more importance to profitability instead of liquidity, the level of cash will be low.

(8) Efficiency of Management:

If the management can accelerate the collection of cash from customers and slow down the disbursement of cash, it can keep a low level of cash.

7. Motives for Holding Cash

A company may hold the cash with the various motives as stated below:

(1) Transaction Motive:

The company may be required to make various regular payments like purchases, wages/salaries, various expenses, interest, taxes, dividends etc. for which the company may hold the cash. Similarly, the company may receive the cash basically from its sales operations.

ADVERTISEMENTS:

However, receipts of the cash and the payments by cash may not always match with each other. In such situations, the company will like to hold the cash to honour the commitments whenever they become due. This requirement of cash balances to meet routine needs is known as transaction motive.

(2) Precautionary Motive:

In addition to the requirement of cash for routine transactions, the company may also require the cash for such purchases which cannot be estimated or foreseen. E.g. There may be a sudden decline in the collection from the customers, there may be a sharp increase in the prices of the raw materials etc. The company may like to hold the cash balance to take care of such contingencies and unforeseen circumstances. This need of cash is known as precautionary motive.

(3) Speculative Motive:

The company may like to hold some reserve kind of cash balance to take the benefit of favourable market conditions of some specific nature. E.g. Purchases of raw material available at low prices on the immediate payment of cash, purchase of securities if interest rates are expected to increase etc. This need to hold the cash for such purposes is known as speculative motive.

8. Compensating Balances

Compensating balances represent cash at Bank balances which are necessary to compensate for the services rendered by banks to the business concerns. For operating and maintaining a Current Account or- Savings Account in any bank, a minimum balance in the account has to be kept all the time. That is known as compensating balances to a business concern.

Ordinarily, the compensating balance is fixed by a bank after considering the income from an account and cost of operation of the same account. Bank offers a number of services to its clients for whom it compels its clients to leave a minimum balance in their accounts so that the banker may earn some interest and thus compensate to some extent its cost-free services to clients.

A.M. King has suggested a method for determining the compensating balance from the point of view of business concern- “Relate the cash balance to the amount needed to keep one’s banker happy. This brings to mind a simple procedure of trial and error to determine minimum cash level. Every three months reduce the average bank balance by 5 percent. Keep doing this until a bank officer calls to find out what has happened. At that point you know you have a working cash level which if not maintained, will cause you to be unpopular at the bank.”

9. Cash Management Models

Let us discuss very briefly some of these models:

(i) Cash Cycle Model:

Cash cycle is a term which is used to signify the entire process of cash flow through an enterprise’s accounts. Cash is used to purchase raw materials which are used to produce goods. Production of these goods also involves the use of cash for paying wages and meeting other expenses. Goods produced are sold both for cash as well as on credit.

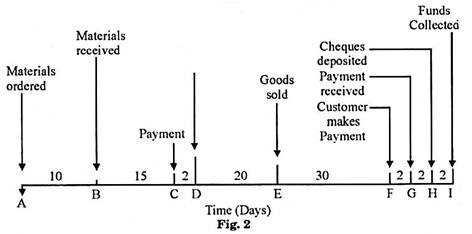

In the case of credit sales, the pending bills are realised at a later date. This cycle continues to be repeated in an accounting year several times. Thus, the flow of cash in a business passes through various channels. The magnitude of the flow in terms of time (days) may be depicted in the diagram ahead-

Let us summarise the information reflecting from the above diagram:

(i) Raw materials reach the factory 10 days after placement of order.

(ii) Conversion period including inventory holding period (from B to E) is 15 + 2 + 20 = 37 days.

(iii) Payment to suppliers for raw materials purchase may be deferred to 17 days. (Time distance between B to D assuming it takes 2 days C to D for collection of cheques by supplier’s banks).

(iv) The amount of bill for goods sold is released after 36 days (from E to I, i.e., 30 + 2 + 2 + 2) after the sale of goods.

(v) The recovery of cash spent till point D is made after 56 days (20 + 30 + 2 + 2 + 2).

Cash cycle = Conversion period (Inventory holding period) + Average Collection period – Average Payment period

In the above case,

Cash cycle = 37 + 36 – 17 = 56 days

Another term used in cash cycle model is cash turnover. It signifies the number of times enterprise’s cash is used during each year.

It is determined by the formula:

Cash Turnover = 365 or 360/ Cash Cycle period in days

The amount of cash required shall be ascertained by applying the cash turnover to total cash operating expenses (annual). Thus,

Minimum cash requirement = Total Cash outlay p.a. / Cash Turnover

(ii) Baumol Model:

This model is based on the Economic Order Quantity (EOQ) model used in inventory control and therefore, also known as Inventory Model. Application of EOQ model to the determination of Optimum Cash Balance was suggested by William J. Baumol.

Working cash balance on the basis of this model is determined under the following assumptions:

(i) All cash flows are certain.

(ii) Cash inflows are periodic and instantaneous.

(iii) Cash outflows occur at a constant rate.

Under this model, efforts are made to balance two types of costs—cost of holding the cash (i.e., loss of interest by not investing the cash in marketable securities, a kind of opportunity cost) and transaction cost [i.e., brokerage and other charges payable on converting (selling) the marketable securities into cash].

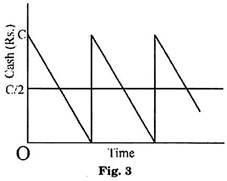

This can be explained through the graphical figure given below:

It is assumed in the annexed figure that demand for cash in the concern during a definite period is steady. During this period the concern collects cash by selling the marketable securities. Let us assume that in the beginning the cash balance with the concern is Rs.C.

The moment cash balance is spent, the same time the concern sells marketable securities of the amount equal to C. As such, when cash amounts to zero, funds invested in marketable securities are converted or transferred into cash. However, the concern may sell securities even before the cash balance becomes zero.

Now the financial manager has to determine the amount of C. Obviously, the amount of C should be such as to involve possible minimum cost in terms of charges on the sale of securities (transaction costs) and also the cost of holding cash, i.e., loss of interest on securities to be sold.

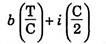

These costs can be expressed as under:

Here ‘b’ stands for transaction costs, i.e., fixed charges in the transactions (purchase and sale) of securities, T stands for total demand for cash during a particular period and ‘I’ stands for rate of interest on securities for a definite period. Interest rate is assumed to be fixed.

T/C in the formula suggests how many times the securities would be sold during a definite period and when it is multiplied by ‘b’, i.e., transaction costs, we find cost of sale of securities during a particular period. C/2 indicates the average cash balance and when it is multiplied by the rate of interest, we find the amount of loss of interest by holding the cash.

It is thus clear that higher the amount of C, the more will be the loss of interest, but transaction costs will be less.

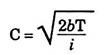

The optimum amount of C may be found by the following formula:

(iii) Miller-Orr Model:

The basic assumptions of this model are:

(i) Firm has minimum required cash balance.

(ii) Cash flows are normally distributed.

(iii) Expected cash flow is zero.

(iv) There is no auto-correlation in cash flows.

(v) The standard deviation of cash flows does not change over time.

Based on the above assumptions, Miller-Orr Cash Model is basically an application of control limits theory to the cash decision/investment decision. In other words, this model is based on control principles.

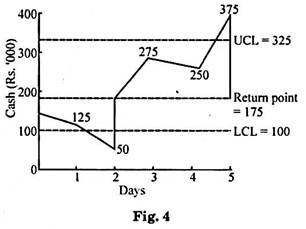

Two control limits (upper control limits and lower control limits) are determined.

When cash balance goes beyond (or outside) the upper control limit, some cash is invested in short-term securities just to bring the cash balance back to the return point. When the cash balance goes below the lower control limits, investments in short-term securities are being sold, so that cash balance may rise and reach a return point.

The formula developed by Miller and Or is:

Here ‘V’ is the variance of daily cash flow; T is the daily interest rate on investments in Govt. securities; and ‘a’ is the transaction cost of investing or disinvesting. If the lower control limit is taken to be ‘L’, then the optimum return point is (R + L). The lower limit ‘L’ is set by the firm itself and is not determined within the model. It may be a zero cash balance (so that the firm does not go for overdraft) or it may be a minimum compensating balance. The optimum upper control limit is (3R + L).

Lower control limits, return point, upper control limits and the effects of cash flows for a hypothetical case are shown in the figure 4-

It may be observed that the firm has a policy of keeping Rs.1,00,000 as minimum balance and thus it is set as Lower Control Limit (LCL). Also assume that the firm on the basis of historical data has calculated the value of R to be Rs.75,000 and therefore, return point is 1,00,000 + 75,000 = Rs.1,75,000. Using (3R + L), Upper Control Limit (UCL) comes to Rs.3,25,000.

The figure shows five days’ cash flows and their effects. It can be observed that on 2nd day the cash balance has reached below LCL necessitating the sale of securities as much as to bring cash balance equal to return point up to Rs.1,75,000.

On 3rd and 4th days cash balances are within control limits and hence no action is required. However, on the 5th day Cash balance exceeds UCL (Rs.3,25,000) and therefore, cash balance on this day over Return point (Rs.1,75,000) will be invested in securities leading 6th day to start with return point.

This model is intended to be used when the concern has no valid future information about day-to-day cash flows. However, concerns may have knowledge about part of their cash flows with considerable certainty (as in the case of cash disbursements) but may be uncertain about other parts of the cash flows.

Where the concerns have some knowledge of future cash flows (may not be error free), Miller-Orr Model may provide non-optimal results. Take for example; when the cash balance exceeds Upper Control Limit, the model suggests that the concern should invest in short-term securities.

But if the concern has knowledge that major cash outflows are imminent, the decision to investment may not be a fair strategy. It would be better for the concern to ignore the investment as signaled by the model, to keep the cash to cover the outflow and also to save transaction costs. This limiting aspect of Miller-Orr Model has been taken care for in another model, i.e., Stone model.

(iv) Stone Model:

This model is based on the assumptions given below:

(i) Firm has a minimum required cash balance.

(ii) Firm has some knowledge of future cash flows, although this knowledge contains an error component.

In fact, the last point of assumption has rendered Miller-Orr Model un-practicable. This model attempts to improve the decisions regarding investment and disinvestment on the basis of expected future cash flows particularly the outflows. This model also involves control limits.

But these control limits are of two sets-inner control limits (UCL1 and LCL1) and outer control limits (UCL2 and LCL2). The concern performs no evaluation (i.e., investment or disinvestment) until its cash balance falls outside the outer control limit.

But when such a situation comes, i.e., cash balance falls outside the outer limit the concern thinks ahead by adding the expected cash flows for the next few days to the current balance.

If the total sum falls outside the inner control limits, a transaction (investing or disinvesting) is made, otherwise the transaction is foregone. It is to be remembered that the transactions relating to investments and their volumes are the same as those in Miller-Orr model.

In other words, investments are made to bring the cash balance back to the return point if the upper control limit is crossed; corresponding investments are to be sold if the lower control point is crossed.

The outer control limits in Stone Model could be set by the Miller-Orr’s formula. Of course, internal control limits can be set at an amount slightly less than outer control limits.

The Stone model is flexible. The parameters of the model may be changed over time to accommodate concern’s needs. However, the model does not specify the optimum levels of the parameters.

10. Cash Management Techniques

Everything you need to know about cash management techniques.

Cash is the most fundamental need of an organization, and none of the organizational operations can be performed without it. Therefore, it is very important for an organization to manage cash in an efficient manner. There are various techniques of cash management used in an organization.

Some of the cash management techniques are:-

1. Accelerating Cash Inflows 2. Slowing Cash Outflows

1. Accelerating cash inflows includes: a.Prompting Customers for Timely Payment b.Quick Conversion of Payment into Cash c.Improving Average Collection Period

2. Slowing cash outflows includes: a.Paying on Last Date b.Paying by Draft c.Centralisation of Payments d.Adjusting Payroll Funds e.Use of Float

Additionally, also learn about more cash management techniques:-

1. Effective Inventory Management 2. Minimizing Operational Cost 3. Reducing the Time Span of Production Cycle 4. Fast Cash Transaction 5. Speedy Conversion of Securities into Cash 6. Effective Management of Account Receivable 7. Concentration Banking 8. Lock-Box System.

Cash Management Techniques – Accelerating Cash Inflows and Slowing Cash Outflows

Techniques of cash management are summarised below:

Cash management consists of taking the necessary actions to maintain adequate levels of cash to meet operational and capital requirements and to obtain the maximum yield on short- term investments of pooled, idle cash. A good cash management technique is very significant component of the overall financial management of a business.

Further a business enterprise should note that income and expenditure cash flows rarely occur together, with inflows often lagging behind. The main aim must be to do all that it can to speed up the inflows and slow down the outflows.

Technique # 1. Accelerating Cash Inflows:

Cash inflows refer to funds generated by an organization from its operating activities, investment activities, and financing activities. During the course of business operations the management needs to ensure that more money is flowing in than flowing out.This will allow it to build up cash reserves with which it can plug cashflow gaps, seek expansion and reassure lenders and investors about the health of business.

In order to ensure that income and expenditure cash flows rarely occur together, with inflows often lagging behind.

The main aim must be to speed up the inflows which can be initiated by following moves:

a. Prompting Customers for Timely Payment:

Prompt payment here indicates payment done without delay as per the schedule, one of the major challenges for a business enterprise is collecting the money from customers on time for sales or service provided to them. Sometimes customers will make an honest mistake and simply miss a payment.

Other times, they’ll actively avoid your requests for payments. Slow paying customers can have a devastating effect on business cash inflows but many business owners find this a difficult area to deal with.

b. Quick Conversion of Payment into Cash:

Payment and deposit is the final event in the cash conversion period. This step involves looking at the way a business enterprise receives payments from its customers and continues through to the deposit of their payments into its business bank account. After the completion of this step, the cash paid to you is finally available for use of business enterprise. One of the challenges in the collection process is that the customer waits until the payment due date before dropping the check in the mail.

From the perspective of business this can delay collection further because cheques can add one to three business days to convert cheque into cash. Finding ways to bypass the postal service for receiving customers’ payments is a key factor in accelerating and improving cash inflows. There are a number of techniques for quick conversion of payment into cash.

Techniques for Quick Conversation of Payment into Cash:

(a) A post office box commonly referred to as a P.O box is a numbered box in a post office assigned to an organization for mails. Some of the delay in the postal service may result in late delivery as result of this some extra sorting so that your mail gets into the hands of the correct mail carrier, not to mention the added time it takes the carrier to actually deliver it to your address.

Using a post office box is one way to accelerate the payment and deposit portion of the cash conversion period. It can reduce this delay by one to three days.

(b) Lockbox banking is a service offered to organizations by commercial banks in which the payments made by customers are directed to a special post office box, rather than going to the company. The bank will then go to the box, retrieve the payments, process them and deposit the funds directly into the company bank account.

The difference between this special post office box and a regular post office box is that only your customers’ payments are delivered to the box. Instead of you picking up the payments, your bank’s couriers have a key to the post office box, and they remove its contents and deliver your customers’ payments to your bank. Your bank opens the payments and then processes the payments for deposit directly into your bank account.

(c) A pre-authorised cheque or demand draft is guaranteed by a bank issued in exchange for a fee, in order to obtain a draft a customer must first deposit the required amount in the bank and then the bank gives the draft in the name who the customer intends to pay.

Pre authorized checks don’t even need your customers’ signatures. On the dates customers’ accounts are due, either a business enterprise or its bank will write the cheques for the amounts due, and then deposit them into the bank account.

(d) Pre Authorized Debits or ECS is an arrangement made with the bank by the customer for making payments as and when they are due. Pre-authorized debits are a convenient way to routinely pay down debt or automatically pay bills without the need for reminders.

In pre-authorized debit an automatic withdrawal is taken directly from the customer account by the business enterprise based on which customer bank is authorized by a customer to debit his or her account for a regular bill’s amount.

(e) Invoice discounting is the practice of selling a bill to a financial institute for or to the maturity date at a value less than the par value of the bill. The amount of the discount is subject to duration left before the bill matures and also the perceived risk attached to the bill. Discounting of bill allows the issuer of the bill to receive cash before the actual due date associated with the bill, while also allowing the buyer to make a modest profit on the cash advance extended to the bill’s originator.

(f) Use of debt factoring is an arrangement in which a business sells accounts receivable on a contract basis to an agency known as a factor in order to obtain cash payment before the accounts come due. The factor also undertakes exclusive responsibility for credit analysis of new accounts, payments collection, and credit losses. A factoring agreement normally states the exact conditions and procedures for the purchase of an account.

The factor, like a lender against a pledge of accounts receivable, chooses accounts for purchase, selecting only those that appear to be acceptable credit risks. Where factoring is to be on a continuing basis, the factor will actually make the firm’s credit decisions because this will guarantee the acceptability of accounts. Factoring is normally done on a notification basis, and the factor receives payment of the account directly from the customer.

c. Improving Average Collection Period:

Average Collection Period is the approximate amount of time that it takes for a business to receive payments owed, in terms of receivables, from its customers. A short collection period means prompt collection and better management of receivables. A longer collection period may negatively affect the short-term debt paying ability of the business.

The Average Collection Period calculation formula is as following:

Average Collection Period = No. of days x Average net receivables / Net credit sales

Technique # 2. Slowing Cash Outflows:

Cash outflows are movement of cash out of the business as a result of its operating activities, investment activities, and financing activities. Cash outflows include- payment to creditors; purchases of raw material; wages or salaries; various kinds of overheads; redemption of shares / debentures; loan installments; purchase of fixed assets; purchase of fixed assets; interest; taxes; dividends etc.

Good cash flow management is all about increasing the speed of cash inflow from customers and slowing the speed of cash outflow.

The aim is to slow down the cash payments as much as possible, following methods car be used to delay disbursements:

(a) Paying on Last Date:

This is used to describe the amount of time that passes in between the reception of a bill and the actual remittance of the payment that is due. One of the tactics in the payment process is to wait until the payment due date before dropping the cheque in the mail. From the perspective of business this can delay collection further because cheques can add one to three business days to convert cheque into cash.

By doing this a business enterprise gets 3 business days and this duration can be utilized to receive payments from customers that in turn can be used to pay suppliers, without creating a temporary cash flow issue.

(b) Paying by Draft:

A business makes use of draft as a payment method to delay outflow of cash as part of their usual strategy of doing business. A draft that is payable through a specific bank. Payable-through-draft instruments draw money from the account of the issuer. One of the reasons for using draft instead of cheque is after issuing a cheque a firm needs to lock in the amount in the account for clearance, whereas a draft is payable only on presentation to the issuer.

This means the receiver should hand over the draft to its bank for presenting it to the buyer’s bank which may consume a number of days before it is actually paid. This buffer time allows a business to use the cash for other important and needy purposes.

(c) Centralisation of Payments:

In this payments are brought under the control of a central authority. Centralised Payment System takes time for collection from firm’s accounts and enables a firm to pay on the date.

(d) Adjusting Payroll Funds:

Payroll is the total of all compensation that a business must pay to its business partners. Performing a good forecast over a period of 12-months is the best practice for a company to study the pattern of payments and receipts so that a proper planning can be done in respect of payment dates and amount.

(e) Use of Float:

Float is the difference between the day a cheque is written and the day the amount is actually deducted from the firm’s bank balance. Usually the process cheque clearance can take three business days.

Cash Management Techniques: Speedy Cash Collections and Slowing Disbursements.

After estimating the cash flows, efforts should be made to adhere to the estimates of receipts and payments of cash. Cash management can be successfully done only if collections are accelerated and disbursements are delayed, as far as possible.

Managing cash flow constitutes two important parts:

I. Speedy Cash Collections.

II. Slowing Disbursements.

Technique # 1. Speedy Cash Collections/Accelerating Cash Inflows:

Business concern must concentrate in the field of Speedy Cash Collections from customers. For that, the concern prepares systematic plan and refined techniques. These techniques aim at encouraging the customers to pay as quickly as possible and to receive the payment from customers without any delay.

For speedy cash collection business concern applies some of the important techniques as follows:

1. Prompt Payment by Customers:

To accelerate cash flows, collection from the customers must be fast. Business concern should encourage the customer to pay promptly by offering discounts, and other special offers which will create anxiety among customers to earn the discount and encourage them to pay at the earliest. It helps to reduce the delaying payment by the customers and the firm can avoid delays from the customers.

The firms may use some of the techniques for prompt payments like billing devices, self-address cover with stamp etc. The customers must be promptly informed about the amount payable and the time by which it should be paid. It will be better if self- addressed envelope is sent along with the bill and a quick reply is requested.

2. Early Conversion of Payments into Cash:

Business concerns should take careful action regarding the quick conversion of the payment into cash. Cash inflows can be accelerated by improving the cash collection process. There is a time gap between the cheque sent by the customer and the amount collected against it. This is due to many factors like mailing time i.e., time taken by the post office for transferring cheque from the customer to the firm i.e., postal float.

Time taken for processing the cheque within the organisation and sending it for collection, which is referred to as lethargy/ processing float. Collection time within the bank i.e., time taken by the bank in collecting the payment from the customer’s bank, which is called Bank float. The postal float, processing float and bank float are collectively called deposit float. The term deposit float refers to the cheques written by the customers but the amount not yet usable by the firm. Time taken in the deposit float must be reduced for enabling better cash management.

3. Decentralised Collection and Concentration Banking:

A big firm operating over a wide geographical area can accelerate collections by using the system of decentralised collections i.e., having collection centers in different areas or multiple locations. Concentration banking is a collection procedure in which payments are made to regionally dispersed collection centers, and deposited in local banks for quick clearing. It is a system of decentralized billing and multiple collection points. Decentralised collection system saves mailing and processing time and thus reduces the financial requirements.

4. Lock Box System:

It is a collection procedure in which payers send their payment or cheques to a nearby post box that is cleared by the firm’s bank. Several times that the bank also deposits the cheque in the firm’s account. Under the lock box system, business concerns hire a post office lock box at important collection centers where the Customers remit payments.

The local banks are authorized to open the box and pick up the remittances received from the customers. The bank will prepare a detailed account of cheques received which will be used by the firm for processing purposes. This system of collecting cheques expedites the collection process and avoids delays due to mailing and processing time at the accounting department.

Technique # 2. Slowing Disbursement/ Slow Cash Outflows:

An effective cash management is not only in the part of speedy collection of its cash and receivables but also it should concentrate on slowing their disbursement of cash to the customers or suppliers. Slowing disbursement of cash doesn’t mean delaying the payment or avoiding the payment.

Slowing disbursement of cash is possible with the help of the following methods:

1. Avoiding the Early Payment of Cash:

The firm should pay its payable only on the last day of the payment. If the firm avoids early payment of cash, the firm can retain the cash with it and that can be used for other purpose for short periods.

2. Centralised Disbursement System:

Decentralized collection systems will provide speedy cash collections. Hence centralized disbursement of the cash system takes time for collection from our accounts as well as we can pay on the date. When cheques are issued from the main office then it will take time for the cheques to be cleared. The benefit of cheque collecting time is availed.

3. Adjusting Payroll Funds:

Some economies can be exercised on payroll funds by reducing the frequency of payments i.e., if the payments are made weekly this period can be extended to a month. The finance manager can also take the advantage of time taken by the employees in encashing their pay cheques.

4. Payment through Draft:

The payments can be made through drafts instead of cheques. When a cheque is issued the company will have to keep a balance in the account so that the cheque is paid whenever it comes. On the other hand, a draft is payable only on presentation to the issuer. The receiver will give the draft to his bank for presenting it to the buyer’s bank. The company can economise large resources by using this method.

5. Making Use of Float:

Float is the difference between the balance shown in the company’s cash book i.e., bank column and the balance in the pass book. The period during which the cheques issued are expected to be presented for encashment is called Float Period. Once the cheque is issued the balance at the bank in the cash book is reduced but till the cheque is presented to the bank for the payment by the party the amount will be there in the account and will be reflected in the pass book. The company can make use of this float if it is able to estimate it correctly.

Electronic Funds Transfer limits the ability of a company to use float because the transaction takes place immediately and there is no time delay between the deposit and crediting of funds. While float is good for extending disbursements, Electronic Funds Transfer increases the speed of collections. The prices associated with Electronic Funds Transfer can be as much as 2 times cheaper than the fees associated with processing a cheque. However, both float and Electronic Funds Transfer can be applied to collections in order to maximize return.

Top 8 Cash Management Techniques – Effective Inventory Management, Minimizing Operational Cost, Reducing the Time Span of Production Cycle, Speedy Conversion of Securities into Cash and More…

Cash is the most fundamental need of an organization, and none of the organizational operations can be performed without it. Therefore, it is very important for an organization to manage cash in an efficient manner. There are various techniques of cash management used in an organization.

Following points explain the techniques of cash management:

1. Effective Inventory Management:

Involves increasing the turnover of raw material and finished goods. Inventory management helps in maintaining coordination between demand forecasting and production planning by keeping a sufficient stock of raw material and finished goods.

2. Minimizing Operational Cost:

Refers to decreasing the amount of cash involved in business operations. The demand of excess cash in the business can be minimized by maximizing the cash turnover of the business.

3. Reducing the Time Span of Production Cycle:

Refers to restructuring the production cycle of the business. If the production cycle is smaller than the organization requires to maintain less cash balances with itself. This happens because shorter production cycle would produce products in less time. In such a situation, the products can be sold early to generate cash inflow. This cash inflow can be further invested in the production of more goods. As a result of this, the organization does not need to maintain huge cash reserves.

4. Fast Cash Transaction:

Speeds up the inflow and outflow of cash. The cash transactions can take place frequently if the organization encourages cash sales and motivates the clients to settle trade credit quickly.

5. Speedy Conversion of Securities into Cash:

Implies that if the organization invests in demand deposits and marketable securities, which can be easily converted into cash at a very short notice, then it needs to maintain a small cash reserve.

6. Effective Management of Account Receivable:

Helps in the timely recovery of account receivables. The effective management of account receivable can be implemented by changing the credit policy, credit standards, and credit terms. The organization should extend credit facilities only to those clients that have good credit rating and goodwill in the market.

7. Concentration Banking:

Refers to establishing collection points to obtain payment of receivables from clients who may belong to different geographical regions. If the collection process is centralized in a large organization, then the clearance of bills, cheques, and other financial instruments would consume more time. Therefore, a large organization decentralizes its collection process to save time and inconvenience.

8. Lock-Box System:

Refers to a system that minimizes the internal processing of the collection of account receivable. Under this system, all the customers of the organization deposit their bills with the local post office lock box.

After that, the banks that have tie ups with the organization are given the authority to collect all the bills deposited in the lock box for clearance. In this way, the organization does not need to spend time on the processing of receivables.

Cash Management Techniques – Accelerating Cash Collections and Slowing Disbursements

The term cash management includes prompt collection and efficient disbursement of cash. If cash is collected promptly and liabilities are paid in time, the optimum cash balance requirement in the business also reduces. The task of managing the Cash Flow is two-fold.

It includes:

(a) Accelerating Cash Collections

(b) Slowing Disbursements

Technique # (a) Accelerating Cash Collections:

The customers should be encouraged to pay as quickly as possible and their payment should be converted into cash without any delay. Customers can be encouraged to pay quickly by applying certain techniques such as quick billing, offering cash discounts on early payments, enclosure of a self-addressed return envelope along with a sales bill in which customers can send their cheque or Bank Draft etc.

If the customer makes the payment by cheque or draft, the cheque or draft should be encashed promptly.

Cheques or drafts can be encashed promptly:

(i) By reducing the time gap between sending a cheque or draft by the customers by mail and its receipt by the firm.

(ii) By reducing the time gap between receipt of cheque or draft by the firm and their deposit in the bank after their processing in the firm, and

(iii) By reducing the time gap between sending the cheque or draft for collection by the bank and their actual payment from the customer’s bank.

The main objective of cash management is to reduce these time gaps so far as possible.

There are certain techniques to reduce these time gaps:

(1) Establishment of Collection Centres or Concentration Banking:

Under this technique, large firms which have large number of branches at different places, select some of these branches for receiving payments from the customers. These branches are called “collection centres”. The firm also opens its accounts in the local banks of collection centres.

Customers are advised to send their cheques to their nearest collection centre. The collection centres deposit these cheques in the firm’s local bank account. All the collections over a predetermined level are transferred daily to bank where the head office is situated. Head office can use these funds for disbursements.

This technique reduces the time gap between sending a cheque or draft by the customers by mail and its receipt by the collection centre. It also reduces the time in the collection of cheques because generally, cheques received by the collection centres are drawn on local banks.

(2) Lock-Box System:

Under this technique also, large firms select some branches as collection centres for receiving payments from the customers and open accounts in local banks of collection centres. Under this technique, firms also hire a post office lock-box at important collection centres. Customers are advised to send their cheque or draft to the post office lock-box.

The local banks of the firm are authorised to open the post office lock-box and collect the cheques received from the customers. The local banks withdraw the cheques from lock box several times a day and deposit them in firm’s accounts.

Local banks, then, send a deposit slip to the collection centre along with list of payments received from customers, on the basis of which, the collection centre makes a record of all the receipts in its books.

This technique is an improvement over the first technique because under the first technique, cheques or drafts are deposited in the local banks only after their recording by the collection centre but under lock-box system, cheques or drafts are first collected by the local banks and recording at the collection centre is done later on the basis of list of payments received from the local banks. Therefore, all three time gaps are reduced under this technique.

But under this technique, the firm has to bear additional expenses on hiring the post office lock-box. Therefore, this technique should be adopted only after cost-benefit analysis.

Technique # (b) Slowing Disbursements (Controlling Disbursements or Payables Management):

Payments should be made as late as possible without damaging the goodwill and credit rating of the firm. It should, however, take advantage of the cash discount available on prompt payment.

There are certain techniques to slow the disbursements:

(1) Avoidance of Early Payments:

One way to slow disbursements is to avoid early payments. The firm should make the payment on the due date only. Payment should not be made before or after the due date. Payment before the due date involves no special advantage and payment after the due date may adversely affect the credit rating of the firm and firm may find it difficult to secure trade credit later.

(2) Centralised Disbursements:

Another way to slow down disbursements is to make all the payments by the head office from the centralised account. This system increases the time gap between remittance from the head office and its actual receipt by the creditors.

On the contrary, if remittances are made locally by the branches, it will take lesser time to reach the creditors by post. Another advantage of centralised disbursement system is that the firm needs a relatively smaller total cash balance in centralised bank as against decentralised disbursement where each branch has to maintain some cash.

(3) Float:

Float is a very important way of slowing down disbursements. Float is the amount of money tied up in cheques that have been issued to creditors but which have not been presented in the bank for payment. There is always some time-gap between the issue of cheque by the firm and its presentation to its bank by the creditor’s bank for payment due to transit and processing delays by the creditor.

Therefore, a firm can send cheques to its creditors although it does not have adequate balance at its bank at the time of issuance of the cheque. Meanwhile, funds can be arranged to make payment when the cheques are presented for payment after a few days. To make use of the float, the firm may issue a cheque on the banks far away from the creditor’s bank.

In order to take advantage of the float it is necessary to analyse the time-lag in the issue of cheques and their presentation in the bank for payment. For example, if the cheque issued to a particular creditor is presented for payment normally after twenty days, the firm needs not to have that much cash in its bank account on the very first day of issuing the cheque to that particular creditor.

(4) Accruals:

Another way to slow down disbursements is Accruals. Certain kinds of expenses such as wages, rent etc. should be paid after the period when actual services have been rendered.

11. Management of Cash Flows

In order to manage cash properly a finance manager has to ensure that cash is flowing in and flowing out as per the plan.

This requires comparison of actual performance against predetermined plans and objectives, finding discrepancies, if any, analyzing their variations in order to pinpoint the underlying causes and finally, taking remedial steps to correct the anomaly. All this is possible with the help of a cash budget report.

Besides, efficient utilization of cash involves accelerating cash inflows and slowing disbursements. There are various methods of speeding cash collections and delaying payments.

We shall now discuss each of these methods below:

1. Methods of Accelerating the Cash Inflows:

(i) Quick Deposit of Customer’s Cheques:

One way of shortening the time lag between the date when a customer signs a cheque and the date when the funds are available for use is to make an arrangement for quick deposit of the cheques in the banks. Special attention should, therefore, be given to large remittances. For example, these may be deposited individually or air-mail service should be used for such remittances.

(ii) Establishing Collection Centres:

To accelerate the cash turnover a nationwide organisation may, instead of a single collection centre, establish collection centres in various marketing centres of the country. The customers are instructed to remit their payments to the collection centre of their region.

The collection centre deposits the cheques in the local bank. These cheques are collected quickly because many of them originate in the very city in which the bank is located. Surplus of money of the local bank can then be transferred to the company’s main bank.

Thus, with this decentralized system of collection the company stands to gain two main advantages. First, time required to mail bills of customers is reduced because bills are handed over to customers by the collection centre of the area.

Again, time the customer’s payments reach the company’s head office is also reduced because the collection centre will receive all the payments whether cash or cheques from the customers of its region.

Secondly, the decentralized system hastens the collection of cheques because most of the cheques deposited in the company’s regional bank are drawn on banks located in that area. Thus, the company can reduce the time a cheque takes to collect.

Thus, if a company could reduce, say for example, two days – One day in mailing bill and one day in collection of cheques by adopting the decentralized system and if the company’s average daily remittances amount to say Rs.20 lakhs, funds of about Rs.40 lakhs could be released for investment elsewhere.

This would increase the profits of the company. However, the company will have to incur additional cost to man these collection centres. An in depth cost- benefit analysis of each region, where the collection centre is to be set up, therefore, should be undertaken by the company.

(iii) Lock-Box Method:

Another device which has become popular in the recent past is lock-box method which will help reduce the time interval from the mailing of the cheque to the use of funds by the firm. Under this arrangement, the company rents lock-boxes from post offices through its service area.

The customers are instructed to mail cheques to the local box. The company’s bank branch picks up the mail from the lock several times a day and deposits them in the company’s account and on the same day sends the firm by airmail the deposit slip listing all the cheques deposited.

Thus, the company is free from the bother of receiving, processing, endorsing and depositing remittance cheques and accordingly, overhead cost of the company is reduced to that extent. It takes less time under the lock-box system in mailing cheques for deposit in banks and in their collection.

Instead of going to the regional collection office and then to the bank, cheques go directly to the company’s bank via the lock-box. Another advantage of this arrangement is that it reduces the exposure to credit losses by expediting the time at which data are posted to ledgers.

However, the basic limitation of the lock-box system lies in additional cost which the company’s bank will charge in lieu of additional services rendered. Since the cost for these services is directly in proportion to the number of cheques handled by the bank, obviously the lock-box arrangement will prove useful and economical too particularly when average remittance is large.

Before deciding to adopt the lock-box system a finance manager must compare the added income on funds released as a consequence of speedy collection of remittances with the increased cost entailed in the system. If the benefits are more than the cost, obviously the company should use the lock-box system otherwise the idea of employing the system should be dropped.

(iv) Other Methods:

Cash balances lying idle in the company’s name in several banks could be minimized without any loss in banking service. The most important measure that can be used in this respect is to eliminate many such bank accounts as were originally opened and subsequently maintained just for building up a strong image in the market.

Thus, with a few accounts in bigger banks having their branches scattered all over the country the company can handle customer’s cheques as effectively as earlier with several unnecessary accounts. By closing the superfluous accounts the company can release fund for investment in profitable channels.

Another device of improving the efficiency of cash utilization in the company is to set a maximum limit which each bank of the company will maintain at one time. The banks may be given instruction that any balance in excess of the stipulated limit should be immediately transferred by wire to the company’s principal bank.

The principal bank, in turn, may be instructed to invest funds in excess of the limit set for it in highly liquid assets. Thus, without jeopardizing liquidity the company manages to increase its profits under the above arrangement.

The firm should also tighten control over transfer of cash between its various units so that excessive funds are not tied in some units.

2. Methods of Slowing Cash Outflows:

In order to optimize cash availability in the firm a finance manager must employ some devices that could slow down the speed of payments outward in addition to accelerating collections.

We shall now discuss some of the important methods that may delay disbursements:

(i) Delaying Outward Payment:

By delaying the payment on bills until the last date of the no-cost period, finance managers can save cash resources. If purchases are made on terms of 1/10, n/30, this method suggests that payment should be made on the 10th day. In this way the firm hot only avails the benefits of discount but also releases funds for eight days for investment in short-term channels.

(ii) Slowing Disbursement by Use of Drafts:

A company can delay disbursement by the use of drafts on funds located elsewhere. Payments could be made through cheques but for that drawer of the cheque must have the funds in the bank. Contrary to this, draft is payable only on its presentation to the issuer for collection.

Thus funds have to be provided to meet a draft only when it is presented by the bank for payment. This arrangement will delay the time the company is required to deposit money in its bank to cover draft. If the term of trade is 2/10, n/30, a company can mail the draft to the supplier on the 10th day. The supplier will present the draft to his bank for its presentation to the buying company’s bank.

It will take several days for the draft to be actually paid by the company. Finance managers can thus economies large amounts of cash resources for at least a fortnight, the funds so saved could be invested in highly liquid low risk assets such as treasury bills to earn income thereon.

(iii) Making Payroll Periods Less Frequent:

This can also help a company to economies cash. If the company is currently disbursing pay to its employees weekly, it can affect substantial cash savings in case it is disbursed only once in a month.

(iv) Where Payroll is Monthly:

A finance manager should predict as to when employees will present cheques to the company’s bank for collection. Supposing if pay day falls on Saturday, not all cheques will be presented on that day. The company need not deposit funds to cover its entire payroll.

Even on Monday, some employees may not present cheques for payment. Thus, on the basis of the past experience, the finance manager could estimate on an average, the cheques presented on the pay day on the subsequent day for payment. Accordingly, a finance manager can assess fund requirements to cover payroll cheques on different days.

(v) Using Float:

Float is the difference between the company’s cheque book balance and the balance shown in the bank’s books of account. When a firm writes a cheque, it will reduce the balance in its books of account by the amount of the cheque. But the bank will debit the amount of its customers only after a week or so when the cheque is collected.

Thus, there is no strange if the firm’s books show a negative balance while the bank’s books show positive balance. The firm can make use of the float if the magnitude of the float can be accurately estimated.

In all these methods of delaying payments, the company’s reputation is likely to be damaged. The cost that would thus result must be taken into account.

(vi) Inter-Bank Transfer:

Another method of making efficient use of cash resources is to transfer funds quickly from one bank to another bank where disbursements are to be made. This would prevent building up of excess cash balances in one bank. This procedure could be adopted by a company having accounts with several banks.

12. Advantages of Ample Cash

As we know that without cash we cannot run the business. Cash is the backbone of every business. Without cash no firm can survive. So the planning of cash is one of the primary responsibilities of a financial manager.

A firm having sufficient cash balance can drive the several advantage some of them are listed below:

1. Increase in Goodwill:

The goodwill or reputation of a business firm depends to a large extent on this fact that the firm retires all the obligations and meets the payments as and when they mature. It can be possible only when the firm maintains a good cash balance.

2. Cash Discount:

Cash discount is received when we pay in cash and only a firm having the adequate cash balance can avail cash discounts offered by the suppliers. It will lower down the cost of raw material and the cost of production. Hence by decrease in cost of production the profit margin will automatically increase.

3. Good Bank Relations:

Commercial banks like to maintain good relations with such firms having high liquidity in funds. Such firms can avail credit facility from the banks at a reasonable rate of interest.

4. Encouragement to Investors:

Generally the dividends are paid in cash. Investors like to have dividends in cash form only. To pay a high cash dividend a firm requires adequate cash balance also. A firm having a good cash position can maintain a sound cash dividend policy. This encourages the investors to invest in the shares of such firms because shareholders are attracted towards cash dividend.

5. Exploitation of Favorable Market Conditions:

Only concerns with adequate cash can exploit favourable market conditions such as purchasing its requirements in bulk when the prices are lower and by holding its inventories for higher prices.

6. Ability to Face Crisis:

Adequate cash enables a concern to face business crisis such as depression because during such periods, generally, there is much pressure on working capital. So a firm having sufficient working capital can easily face the adverse conditions of the business.

7. High Efficiency and Morale:

Unless there is an adequate supply of cash, production cannot be carried out smoothly. Uninterrupted production process increases labour efficiency. Adequacy of cash increases the morale also.

Adequate cash balance with the firm creates an environment of security, confidence, and high morale and creates overall efficiency in a business. As earlier mentioned with ample cash we can pay the salary and wages on time that will increase the morale of employees also.

13. Cash Budget

Cash budget is an extremely important tool available in the hands of a finance manager for planning fund requirements and for controlling cash position in the firm. As a planning device, a cash budget helps the finance manager to know in advance the cash position of the firm in different time periods.

The cash budget indicates in which months there will be cash surfeit and in which months the firm will experience cash drain and by how much.

With the help of this information finance manager can draw up a programme for financing cash requirements. There will be two advantages if the finance manager knows in advance as to when additional funds will be required. First, funds will be available in hand when needed and there will be no idle funds.

In the absence of the cash budget it may be difficult to determine cash requirements in different months. If cash required is not available in time it will land the firm in a precarious position.

Importance of Cash Budget:

Cash budget is an important budget for any business concern.

The main advantages of preparing cash budget are as follows:

1. Estimate of Future Position of Cash:

It can be estimated with the help of a cash budget that how much cash will be needed and when and what will be the position of availability of cash during the budget period. If there is a position of shortage of cash, proper arrangement can be made by securing bank overdraft or short-term borrowings. On the contrary if there is a position of surpluses, a plan can be made for profitable investment of such funds.

2. Control over Cash Expenditure:

The cash expenses of various departments of an enterprise can easily be controlled with the help of a cash budget because it reveals the estimated expenditure of each department. These figures can be compared with reasonable expenditure and possible cash receipts and necessary corrective actions may be taken.

3. Formulation of Suitable Dividend Policy:

Cash budget enables the management to formulate a suitable dividend policy. If the business is not able to obtain sufficient inflow of cash then the business can restrict its cash dividends.

4. Helpful in Financial Planning:

Cash budget is extremely useful as a tool for financial planning because it may facilitate coordination between cash on the one hand and working capital, sales, investments or loan on the other hand.

5. Regulation of Other Budgets:

Cash budget regulates other budgets such as sales budget, capital budget, etc.

6. Helpful in Fulfillment of Seasonal Needs:

This budget is more helpful in those concerns where there are wide seasonal fluctuations.

7. Justification of Cash Requirements:

The system of preparing a cash budget helps to convince the bank and other financial institutions about the bona-fides of the cash requirement of the concern.Thus, it is clear that cash budget is an important tool of managerial control. In fact, it is like a mirror in which the pattern of future cash flow is reflected.