Every business enterprise whether new or already established would need finance for its various programmes like new project implementation, expansion, modernization etc.

At the same time, there are several sources of finance available to a business enterprise, which source of finance should be resorted for raising funds shall be decided by the type of requirements for which fund is needed by the business enterprise.

Sources of Finance

If financial requirements are expressed in terms of time/period, then requirements/needs for fund may be grouped into three categories:

(i) Long-term financial requirements, which are for a period exceeding five to ten years. All funds to be invested in various types of fixed assets plus in hard core working capital are to be considered as long-term financial needs.

ADVERTISEMENTS:

(ii) Medium-term financial requirements which are required for a period exceeding one year but not exceeding five years. All funds needed for meeting the defined revenue expenditures like expenses on heavy publicity and advertisement campaigns shall be considered as medium-term financial needs.

(iii) Short-term financial requirements which arise for a short period of time often not exceeding one year (i.e., accounting period). All funds needed for financing current assets/for meeting working capital requirements shall be considered as short-term financial needs.

A. Long Term Sources of Finance

The long term sources of finance are shown below:

Equity shares, also known as ordinary shares or common shares represent the owners’ capital in a company. The holders of these shares are the real owners of the company. They have control over the working of the company. The rate of dividend on these shares depends upon the profits of the company.

ADVERTISEMENTS:

They may be paid a higher rate of dividend if the profit of the company is high or they may not get anything if the profit of the company is not sufficient. Equity shareholders are paid dividend after paying dividend to the preference shareholders.

According to Section 85(1) of the Companies Act, 1956, “A preference share is a share which carries preferential rights as to the payment of dividend at a fixed rate either free or subject to income tax and as to the payment of capital at the time of liquidation prior to equity shareholders.”

In simple words we can say that preference shares have certain preferences as compared to other types of shares.

These preferences are given below:

ADVERTISEMENTS:

i) The first preference is for payment of dividend.

ii) The second preference for these shares is the repayment of capital at the time of liquidation of the company.

A company can issue preference shares of varying dividend rates at a time viz. 10% Preference Shares, 12% Preference Shares etc. these % are showing the fixed rate of dividend which is payable to the preference shareholders

3. Debenture:

According to section 2(12) of Indian Companies Act, 1956, “debenture includes debenture stock, bonds or any other securities of a company whether constituting a charge on the assets of the company or not.”

A debenture holder is a creditor of the company. A fixed rate of interest is paid on debentures. The interest due on debentures is a charge on the profit and loss account of the company. The debentures are generally given a floating charge over the assets of the company.

4. Loans from Financial Institutions:

This is also termed as ‘Term Loan’. Term loans refer to the borrowed capital of the companies, repayable in not less than one year and normally not more than ten years.

Financial institutions such as Commercial Banks, Life Insurance Corporation, Industrial Finance Corporation of India, State Financial Corporation, State Industrial Development Corporations, Industrial Development Bank of India, etc. provide this type of loan.

This source of finance is more suitable to meet the medium-term demands of working capital.

Features of Term Loan:

ADVERTISEMENTS:

i) The loan is given for a specific purpose or a particular project.

ii) All term loans have a first charge on the assets for which the loan is sanctioned.

iii) Rate of interest charged by the financial institutions may differ from project to project.

iv) In case of bigger projects one financial institute may not provide for full requirement of the project. A group of different institutions may be constituted to collectively sanction a term loan for the project.

5. Ploughing Back of Profits/Retained Earnings:

ADVERTISEMENTS:

A company generally doesn’t distribute all its earnings amongst the shareholders as dividend. A portion of the net earnings may be retained in the business for use in the future. This is known as retained earnings. It is a source of internal financing or self-financing or ploughing back of profits.

The profit available for ploughing back in an organization depends on many factors like net profit, dividend policy, and age of the organization etc. It means the reinvestments by concern of its surplus earnings in its business.

Advantages of Retained Earnings:

The followings are the advantages of retained earnings:

ADVERTISEMENTS:

i) Retained earnings are a permanent source of funds available to an organization.

ii) It enhances the capacity of the business to absorb unexpected losses.

iii) It may lead to increase in the market price of the equity share of the company.

iv) As the funds are generated internally, there is a greater degree of operational freedom and flexibility.

v) It doesn’t involve any explicit cost in the form of interest, dividend or floatation cost. Hence it is the cheapest source of finance.

vi) By raising the funds with retained earnings, there will be no dilution of control.

ADVERTISEMENTS:

Disadvantages of Retained Earnings:

There are several advantages associated with the retained earning but there are some disadvantages of the same.

The followings are some of them:

i) Excessive ploughing back may cause dissatisfaction amongst the shareholders as they would get lower dividends.

ii) It is an uncertain source of funds as the profits of business are fluctuating.

iii) The opportunity cost associated with these funds is not recognized by many firms. This may lead to suboptimal use of the funds.

ADVERTISEMENTS:

3. Term Loans

A term loan is a monetary loan that is repaid in regular payment over a set period of time. Term loan usually lasts between one and ten years but may last as long as 30 years in some cases. It usually involves an unfixed interest rate that will add additional balance to be paid.

They are the sources of long term debt for financing large expansions, diversification of projects etc., they are also referred as Project Financing.

Advantages of Term Loans:

Term Loans are beneficial for the borrower as well as for the lender, as is clear from the following:

A) Advantages to Borrowers:

ADVERTISEMENTS:

Borrowers have following advantages, if they choose for term loans rather than going for some other source:

i) From taxation point of view, raising finance through term loan is cheaper than those raised through equity capital or preference capital.

ii) Borrowing companies do not lose control over their management, as the lenders do not have rights to vote.

B) Advantages to Lenders:

Lenders find term loans very convenient and profitable because of the following advantages:

i) The first advantage of lender’s in term loans is getting a fixed rate of interest and a certain maturity period.

ADVERTISEMENTS:

ii) They are fully secured with the borrower’s assets (primary as well as collateral securities).

iii) Interest of lending institutions is protected by many restrictive clauses imposed on the borrowers.

Disadvantages of Term Loans:

Borrowers as well as lenders have following disadvantages in raising and lending term loans respectively:

A) Disadvantages to Borrowers:

The disadvantages of term loans from the borrowers view point are as follows:

i) Periodical repayment of installments representing interest and principal are obligatory in nature. Failure to fulfill the obligation may invite imposition of penalty from the lender in the form of liquidated damages.

ii) In terms of the contract relating to term loan, a lender has the right to appoint its nominees on the Board of a borrower. Managerial freedom of the borrower is thus compromised to a great extent. In addition to the above, there are other clauses also, which are not in favor of the borrower.

iii) Financial risk of the borrower increases many times after availing a term loan. This results in the increased cost of equity capital.

B) Disadvantages to Lenders:

The lenders are at a disadvantageous position in respect of following:

i) Although a lender can appoint its nominee on the borrowing company Board, no voting rights are available for him.

The securities equitable-mortgaged in favour of the lender are not negotiable. This problem, however, may be sorted out by the process of securitization.

3. Lease Financing

Initially, the concept of lease was limited to land only but for the past few years, lease financing is becoming operational in the industrial arena. Lease is a long-term source of business finance. Companies can take necessary business assets on lease rather than buying them.

If they purchase these fixed assets, they have to pay in full. Contrarily, under lease agreement the company gets the right to use the asset after making part payment for it. Under this arrangement, the owner of the asset (lessor) surrenders the right to use the asset in favour of another person (lessee) in consideration of predetermined rent.

After the lease period, whether the asset will be returned to the lessor or it will be retained by the lessee, depends on the terms of lease. Thus, the ownership and the use of assets, in case of lease, lie in different hands. In the industrial era, the use of lease financing started after 1980.

During this period, the financial needs of the industrial units also increased due to the rise in price level. Ranks and other financial institutions were unable to meet these requirements. Banks were overburdened with the credit to the priority sector.

With effect from 1987-88, the Government withdrew the investment allowance, which made the acquisition of equipment on lease to be more useful rather than purchasing them.

B. Short Term Sources of Finance

Sources of finance are the most explored area for the businessmen, a boost to start a new business. There are several sources of finance, i.e., Equity Share Capital, Preference Share Capital and Debentures, etc. These are long-term sources of finance.

Purpose of this finance is to finance fixed assets, construction projects on large scale, expansion of companies, etc. but business firms need to manage cash for operations, such as activities involved in the day-to-day functions of the business conducted for the purpose of generating profits.

For recurring activities, short-term finance also plays an important role. Time period of short-term finance is not exceeding one year. Basically it is related to the working capital requirement of the company.

The following are the short-term sources of finance:

(1) Trade Credit

(2) Accrued Expenses

(3) Advance from Customers

(4) Commercial Paper

(5) Factoring

(6) Leasing

The short-term sources of finance can be divided into two parts:

A. Bank Sources:

The bank sources of short term finance include:

(i) Line of Credit:

Under this source, the bank determines the maximum limit of credit for the customer. Customers can withdraw money from the bank within this limit. The maximum amount of credit is determined on the basis of goodwill of the customer, his size of business, financial position and allied factors. Interest has to be paid on the amount actually withdrawn.

(ii) Overdraft:

In this facility, the bank allows the customer to withdraw more than his actual deposit in his current account. The excess amount withdrawn is called overdraft. The amount of overdraft is also determined on the basis of financial position of business.

The quantum of overdraft is generally less than the line of credit. Bank honours the cheques of customers within a predetermined time frame. Interest is charged on the actual amount withdrawn.

(iii) Secured Loan:

Banks generally grant credit on the basis of security of the current assets like inventory. The assets held as security remain in control of the bank. As soon as a loan is paid by a customer, he is allowed to remove goods from the godown.

Under this source, banks grant loans after reserving a fair margin. The amount of loan is transferred to the account of the customer. Interest is charged on the whole amount of loan rather than the actual amount withdrawn.

(iv) Discounting of Bills:

Customers can discount the bills due on the future date from the bank. The amount of the bill after charging a discount is transferred to the account of the customer. On the date of maturity, the branch collects money from the drawee of the bill.

(v) Letter of Credit:

It is another form of credit purchase. In the letter of credit, the bank takes the guarantee of payment which is supposed to be paid by the buyers of the goods. In case of default, the bank is responsible for making these payments.

B. Non-Banking Sources:

The non-bank sources of short term finance are:

(i) Public Deposits:

Public deposits for a period of one year are a short term source of finance. The public deposits for more than one year are included in medium term sources of finance.

(ii) Short-Term Loans:

Short term loans, secured or unsecured can be taken from other parties accepting banks including merchant bankers, finance companies, co-operative societies, relatives, etc.

(iii) Trade Credit:

Trade credit is the credit extended by one trader to another for purchasing goods and services. Credit period starts on the receipt of goods and extends till the payment is made therefore. When the goods are delivered, the minimum time for this exercise is 30 days, 60 days and 90 days, but in jewellery business it is extended to 180 days.

Features:

(1) It is an internal arrangement between the buyer and seller.

(2) It is a self-generated source of financing.

(3) There are no formal legal instruments of debt.

(4) It is an expensive source of finance if payment is not made within the discount period.

Advantages of Trade Credit:

(1) It is easily accessible.

(2) It does not require any period of negotiation or formal agreement.

(3) It reduces the owner’s capital and borrowed capital.

(4) There is no need of creating any sort of charge against the firm’s assets for obtaining the trade credit.

Disadvantages of Trade Credit:

(1) It is very expensive, if payment is not made on maturity date.

(2) Trade credit is available only to those companies who have a good trade record of repayment in the past.

(3) If re-payments are not made within the time limit, the business will receive poor credibility, therefore, no loans, trade credit, leasing given to business in near future.

(4) If payments are not made within the prescribed period of Trade Credit, it will negatively affect working capital. It will spoil the relationship with the other business which will increase the cost of capital.

(iv) Promissory Notes and Hundies:

Under it, the buyer gives hundi or promissory note after purchasing the goods. On due date, payment is received from him.

(v) Advance from Customers:

This is the very cheapest source of finance, price of goods to be purchased are paid in advance before the receipt of a goods. It is really useful in those businesses where costly goods are to be produced. Long production cycles, like special types of machine manufacturing industrial products prefer to take advance from their customers.

The seller might require advance because the quantity of goods ordered is so large and cannot afford to tie up more funds in purchasing of raw material or work in progress. Goods are actually delivered after some time. No interest is paid on this advance.

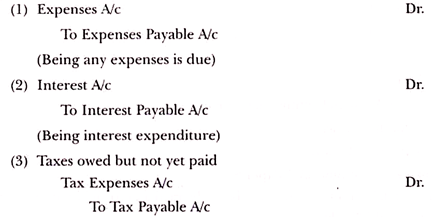

(vi) Accrued Expenses:

Accrued expenses are expenses which have been incurred but not yet paid. Accrued accounts become an important source of finance since with the increase in scope of the operation of the business along with increase in sales and costs. Usually with them, the amount of accrued wages also increases. To support this, we take an example.

Wages are paid in the first week of the month next to the month in which the services were rendered. Another example is a provision for tax is created out of the profits of the company at the end of the financial year but tax is paid only after the assessment is finalised.

Ultimately, time log between receipt of income and making for expenditure incurred increasing that income helps the business in meeting short-term financial requirements.

Some Examples of Accrued Expenses:

(vii) Provision and Reserves:

Provision may be made in the books, against some future liability like tax and bad debt provision, when the amount is not certain. From profit after tax, various future expenses are deducted as estimated expenses of the future like reserves for proposed dividends and for proposed bonus.

As these provisions and reserves are not immediate cash outflows, they provide cash to the firm for its current use. However, the firm is supposed to make payments of these provisions and reserves when they become due.

(viii) Commercial Paper:

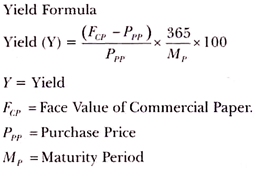

Commercial paper represents a short-term unsecured promissory note issued by firms that have a fairly high credit rating. It was first introduced in USA and it is an important money market instrument. They are issued in large denominations (minimum amount is Rs.0.5 million) in the market through banks or merchant bankers.

Commercial papers are usually issued to finance seasonal needs for funds. It is very popular in developed countries like USA, UK and France. In India, commercial papers were introduced on the suggestion of the working group on the money market in 1987.

In India, commercial papers are generally used by companies to manage their working capital like purchase of inventory. Generally, the mutual funds companies prefer investing in corporate commercial papers. In India, the maturity period of CP ranges between 3 to 6 months. C.P. are sold at discount and redeemed at its face value.

The RBI issued some guidelines on the issue of commercial paper on 01.01.2013.

Salient features are:

(1) As per latest audited balance sheet tangible net worth is not less than Rs.4 crore.

(2) Shares of the company are listed in recognised stock exchange.

(3) Current Ratio is at least 1.33:1.

(4) Working Capital is not less than Rs.4 crore.

(5) Company obtains credit rating from credit rating agencies which is approved by SEBI.

Advantages of Commercial Papers:

(1) The Cost of commercial papers is lower than the commercial bank loans.

(2) Commercial papers can be issued only when the money market is tight.

Disadvantages of Commercial Papers:

(1) Commercial paper can neither be redeemed before maturity date nor can be beyond maturity date.

(2) New and moderately rated firms are not issuing commercial papers but large firms who enjoy high credit rating and sound financial position.

(ix) Factoring:

In factoring, accounts receivables are generally sold to a financial institution (a subsidiary of commercial bank called “Factor”), who charges commission and bears the credit risks associated with the accounts receivables purchased by it. Factoring as a means of financing is comparatively costly source of finance. The cost of factoring is higher than normal lending rates.

Factoring in India is rendered by only a few financial institutions on a recourse basis. However, the report of the working group on money market (Vaghul Committee Constituted by the Reserve Bank of India) has recommended this just because of RBI involvement, banks should encourage to set up factoring division, to provide speedy finance to the corporate entities.

Advantages of Factoring:

(1) Factoring ensures a predetermined pattern by cash inflows.

(2) Due to continuous factoring, there is no need for credit department.

(3) Any business organisations can convert accounts receivables into cash without bothering repayment.

(4) Factorising business is required to be fulfilled under the supervision of RBI guidelines.

(x) Forfeiting:

A form of financing of receivables arising from international trade is known as forfeiting. Within this arrangement, a bank/financial institution undertakes the purchase of trade bills/promissory notes without recourse to the seller. Purchase is made through discounting of the documents covering the entire risk of non-payment at the time of collection.All risks become the full responsibility of the purchaser (forfeiture). Unlike factoring, which is firm based, forfeiting is transaction based. Through this exporters are able to avert risk for non-settlement of claims as it provides for a non-recourse facility. Moreover, exporters need not to assume any botheration of credit administration and collection problems.