1. Introduction to Receivables Management

The sale of goods on credit and the deferment of payment by customers create receivables in a firm. The receivables include both accounts receivable and bills receivables.

The customers who purchased the goods and services from the firm on credit basis and have not paid the amount till the end of accounting period are known as debtors or accounts receivables. The bills (or promissory notes) drawn by the seller and accepted by the customer in exchange of credit sales are known as bills receivables.

According to Hampton, “The receivables are asset accounts, representing the amount owed to the firm as a result of the sale of goods or services in the ordinary course of business.”

The receivables are part of current assets of the firm. The credit policy of the firm decides the amount of receivables in the firm. The amount of receivables in the firm affects its requirements for the working capital. Thus, the credit policy and management of receivables in the firm becomes significant.

ADVERTISEMENTS:

The finance manager of the firm should analyse costs and benefits associated with the receivables when deciding the investment in receivables.

2. Meaning of Receivables Management

The term ‘receivables’ refers to debt owed to the firm by the customers resulting from sale of goods or services in the ordinary course of business. These are the funds blocked due to credit sales. Receivables are also called as trade receivables, accounts receivables, book debts, sundry debtors and bills receivables etc. Management of receivables is also known as management of trade credit.

Motives or Purposes of Maintaining Receivables:

(i) Sales Growth Motive

ADVERTISEMENTS:

The main objective of credit sales is to increase the total sales of the business. On being given the facility of credit, customers who have shortage of cash may also purchase the goods. Therefore, the prime motive for investment in receivables is sales growth.

(ii) Increased Profits Motive

Due to credit sales, the total sales of business increase. This, in turn, results in increase in profits of the business.

(iii) Sales-Retention or Meeting Competition Motive

ADVERTISEMENTS:

In business, goods are sold on credit to protect the current sales against emerging competition. If goods are not sold on credit, the customers may shift to the competitors who allow credit facility to them.

3. Objectives of Receivable Management

The receivables management is also known as credit management. The objective of receivables management is to promote sales and profits of the firm up to the level where the return on investment in further receivables becomes less than cost of additional investment in receivables.

The objective of receivables management should be helpful in achieving the firm’s goal of maximising shareholders’ wealth. Thus, the finance manager has to decide the optimal credit policy of the firm which gives maximum return on investment in receivables.

To achieve this objective, the finance manager has:

1. To decide the optimal sale of goods and services,

2. To control the cost of receivable, cost of collections, bad debts and other administrative expenses.

4. Policy for Managing Receivables

The credit policy of any firm should be established in such a way that the benefits likely to accrue from it should outweigh costs; i.e. maximization of profits.

The following are the main aspects of receivables management:

1. Formulation of credit policy

ADVERTISEMENTS:

2. Credit evaluation

3. Credit granting decision

4. Monitoring Receivables.

1. Formulation of Credit Policy:

ADVERTISEMENTS:

The credit policy of a company can be regarded as a kind-of-tradeoff between increased credit sales leading to increase in profit and the cost of having larger amounts of cash locked up in the form of receivables and the loss due to incidence of bad debts.

The important credit policy variables are as follows:

(a) Credit Standards:

The term credit Standards represents the basic criteria for the extension of credit to any customer. This is done with the help of factors such as credit ratings, credit references and various financial ratios. The level of sales and the amount of account receivables should be higher when credit standards are fairly liberal as compared to sales under the restrictive or tight credit standards.

ADVERTISEMENTS:

The credit standards of any customer / firm are usually determined by five “C”s, namely:

(i) Capacity

(ii) Character

(iii) Collateral

(iv) Capital

(v) Conditions.

ADVERTISEMENTS:

(b) Credit Terms:

This refers to the stipulation under which goods are sold on credit, i.e., terms and conditions of trade credit relating to repayment. The credit terms have three Components –

(i) Credit period

(ii) Cash discount, and

(iii) Cash discount period. The credit term should be determined on the basis of the cost benefit trade-off in these three Components.

(c) Collection Procedure:

ADVERTISEMENTS:

The third decision area in the management of accounts receivables is the collection procedure. A stringent collection procedure has implications which involve the benefits as well as costs. Therefore a balance has to be stuck between them.

2. Credit Evaluation:

Credit evaluation of the customer involves the following 5 Stages:

(i) Gathering Credit information of the customer through

(a) Financial statement of the firm

(b) Bank references

ADVERTISEMENTS:

(c) References from trade and chamber of commerce

(d) Reports of credit rating agencies

(e) Credit bureau reports

(f) Firms own records

(g) Other sources such as trade journals, Income-tax returns, wealth tax returns, sales-tax returns, court cases, Gazette notifications, etc.

(ii) Credit analysis

ADVERTISEMENTS:

After gathering the above information about the customer, the credit-worthiness of the applicant is to be analyzed by a detailed study of 5 C’S of credit as mentioned above.

(iii) Credit decision

After the credit analysis the next step is the decision to extend the credit facility to potential customers or to reject it.

(iv) Credit limit

If the decision is to extend the credit facility to the potential customer a limit say Rs. 50,000 or Rs. 2,00,000 may be prescribed by the financial manager depending on credit analysis and credit worthiness of the customer.

(v) Collection Procedure

A suitable and clear-cut procedure is to be established by a firm and the same is to be intimated to every customer while grating credit facilities.

3. Credit Granting Decision:

The decision to grant credit or not depends upon the cost-benefit analysis. If the customer pays, the company will make profit on sale and if he fails to do so then the amount of cost gone into the product will be borne by the company.

An aster manager more often lost can form a subjective opinion based on credit evaluation about the chance of getting payment and the chance of not getting the payment. The relative chances of getting the payment and the chances of not getting payment is at the back of his mind while taking a decision.

The feeling can perhaps be translated into numerical figures such that there is a nine-in-ten chance that the payment will be made while the chance of the account turning into a bad debt is one-in-ten.

Once these relative chances are expressed in the above terms one can say that the probability of getting payment is 0.9 and not getting it is 0.1. It is then possible to obtain the financial consequences of granting credit as a weighted average of profit to be obtained and the loss to be sustained where the weights are the respective probabilities.

If the weighted average is positive it can be concluded that the weighted benefit exceeds weighted loss and hence it is a product to grant the credit, otherwise not. It should be noted that the probabilities are always non-negative and add up to equity.

4. Monitoring Receivables:

An import aspect of receivables management is to monitor the payment of receivables. Several measures can be employed by the credit manager for this purpose

(i) Days sales outstanding

(ii) agency schedule and

(iii) Collection matrix are some of the measures employed.

The average collection period is based on year-end balance of receivables. For the purpose of internal control monitoring has to be made more frequently. Further year-end balance can be misleading when the sales are subject to seasonality or have gone towards the end year. For this reason two approaches viz., ‘days sales outstanding’ and ‘aging schedule of receivables’ are followed for control purposes.

5. Credit Terms

The second decision criteria in receivables management is the credit terms. Credit terms means the stipulations under which goods or services are sold on credit. Once the credit terms have been established and the creditworthiness of the customers has been assessed, then the financial manager has to decide the terms and conditions on which the credit will be granted. The credit terms specify the length of time over which credit is extended to a customer and the discount, if any, given for early payment.

Credit terms have three components such as:

(i) Credit period, and

(ii) Cash discount, and

(iii) Cash discount period.

(i) Credit Period:

The period of time, for which credit is allowed to a customer to economic value of purchases. It is generally expressed in terms of a net data [i.e., if a firm’s credit terms are “net 60”], it is understandable that payment will be made within 60 days from the date to credit sales. Generally, the credit period is decided with the consideration of industry norms and depending on the firm’s ability to manage receivables.

A decision regarding lengthening of credit period increases sales by inducing existing customers to purchase more and attracting new customers. But it also increases investment in receivables and lowers the quality of trade credit. In other words, it increases investment in receivables and bad debt loss.

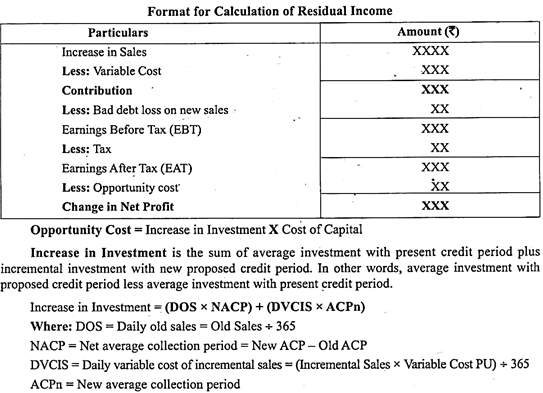

On the other hand, shortening of the credit period (existing) will lead to lower sales, decrease investment in debtors, and reduce the bad debt loss. A firm should finalise the decision relating to credit period [either lengthening or shortening credit period] only after cost-benefit analysis. If the change in net profit (residual income) is positive it is better to go with the proposed credit period and vice versa.

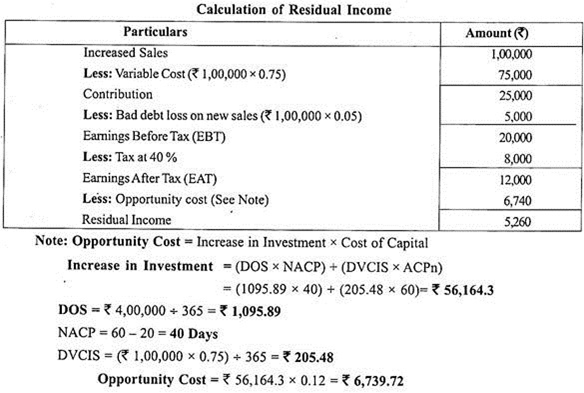

Illustration:

Long Lost Pvt. Ltd, currently provides 20 days of credit to its customers. Its current sales level is Rs.4,00,000. The company’s cost of capital is 12 per cent and the tax rate is 40 percent. The ratio of variable cost to sales is 75 per cent. Long Lost is considering extending its credit period by 40 days, such an extension is expected to increase sales by Rs.1,00,000, and also increase the bad debt portion on new sales would be 5 per cent. Determine the residual income and suggest whether the company should consider the relaxation of credit period or not.

Solution:

Suggestion – Extension of credit period is feasible, since the residual income is positive.

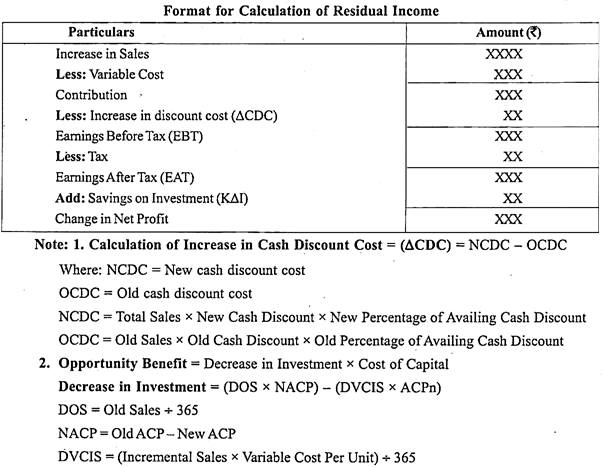

(ii) Cash Discount:

The second part of credit terms is cash discount. Cash discount represents a percent reduction in sales or purchase price allowed for early payment of invoices. It is an incentive for credit customers to pay invoices in a timely fashion.

In other words, it encourages the customers to pay credit obligations within a specified period of time, which will be less than the normal credit period. It is generally stated, as a percentage of sales. Cash discount terms specify the repayment terms required of all credit customers, which involve the rate of cash discount.

For example – ‘2/20 net 60’, which means that the creditor (sells) grants 2 per cent discount, if the debtor (buyer) pays his/her accounts within 20 days after beginning of the credit period. Financial managers before going to offer a cash discount, he/ she is supposed to estimate the residual income, if it is positive, then he/she can go for providing cash discount and vice versa.

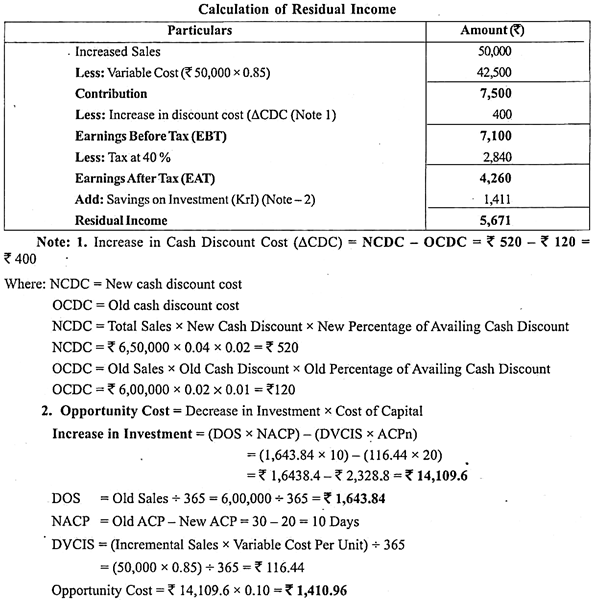

Illustration:

“2/10, net 30” is the present credit term of Well Do Company Ltd. Its present level of sales is Rs.6,00,000, with an average collection period of 30 days. The contribution margin ratio is 15 percent. The proportion of sales on which currently customers take discount is 1 percent. The Company’s cost of capital is 10 percent.

Now the Company is considering increasing the discount term to “4/10, net 30”, which is expected to push up sales to Rs.6,50,000 and reduce the average collection period by 10 days. Such relaxation increases the proportion of discount sales to 2 per cent. Determine the residual income with the assumption of 40 per cent tax rate.

Solution:

(iii) Cash Discount Period:

It refers to the duration during which the discount can be availed of, collection of receivable is influenced by the cash discount period. Extension of cash discount period may prompt some more customers to avail discount and more payments, which will release additional funds.

But extending the cash discount period will result in late collection of funds, because the customers who are able to pay less cash now may delay their payments. It will increase the collection period of the firm. Hence, the financial manager has to match the effect on collection period with the increased cost associated with additional customers availing the discount.

6. Factors Influencing Size of Receivables

The level of investment in receivables is affected by the following factors:

1. Volume of Credit Sales:

Size of credit sale is the prime factor that affects the level of investment in receivables. Investment in receivables increases when the firm sells a major portion of goods on credit base and vice versa. In other words, increase in credit sales increases the level of receivables and vice versa.

2. Credit Policy of the Firm:

There are two types of credit policies such as lenient and stringent credit policy. A firm that is following a lenient credit policy tends to sell on credit to customers very liberally, which will increase the size of receivables, on the other hand, a firm that follows a stringent credit policy will have a low size of receivables, because, the firm is very selective in providing stringent credit. A firm that provides stringent credit may be able to collect debts promptly, this will keep the level of receivables under control.

3. Trade Terms:

It is the most important factor (variable) in determining the level of investment in receivables. The important credit terms are credit period and cash discount. If credit period is more when compared to other companies/industry, then the investment in receivables will be more. Cash discount reduces the investment in receivables because it encourages early payments.

4. Seasonality of Business:

A firm doing seasonal business has to provide credit sales in off season. When the firm provides credit automatically the level of investment in receivables will increase in comparison with the level of receivables in the season; because in season firm will sell goods on cash basis only. For example – refrigerators, air-cooling products will be sold on credit in the winter season and on cash in the summer season.

5. Collection Policy:

Collection policy is needed because all customers do not pay the firm’s bills on time. A firm’s liberal collection policy will not be able to reduce investment in receivables, but in future sales may be increased. On the other hand, a firm that follows a stringent collection policy will definitely reduce receivables, but it may reduce future sales. Therefore, the collection policy should aim at accelerating collections from slow payers and reducing bad debt base.

6. Bill Discounting and Endorsement:

Bill discounting and endorsing the bill to the third party will reduce the size of investment in receivables. If the bills are dishonored on the due date, again the investment in receivables will increase because the discounted bills or endorsed bills have to be paid by the firm.

7. Professional Credit Rating

At the outset, it should be stated that professional credit rating is not applicable in the area of credit analysis for receivables management. A satisfactory credit rating doesn’t indicate that the purchasing company will be a good paying and regular customer for the company. However, a satisfactory credit rating may be a good indication about the overall financial strength of the customer.

It should be noted that at present, credit rating is obligatory only in respect of debt securities issued by the issuing company i.e. debentures/bonds, and commercial paper. Credit rating is also compulsory for the finance companies raising the deposits from the public. For the equity shares issued by the companies, credit rating is not compulsory.

Though the term credit rating is popular/ associated with the name Credit Rating and Information Services of India Limited (CRISIL), at present there are two more approved credit rating agencies in India viz. Investment Information and Credit Rating Agency (ICRA) and Credit and Research Limited (CARE).

The significance of the credit rating process lies in the fact that in the developing capital market situations, credit rating provides the investor with the reliable and superior information about the company from an independent agency at relatively lower cost. This instills confidence in investors whereby they can direct their savings into the investments.

From the issuing company’s point of view also, credit rating proves to be significant due to various reasons. First, in some cases, credit rating is compulsory. Hence, before the company issues such securities (viz. debentures and commercial paper), it has to get the credit rating done.

Second, for a company which obtains a higher credit rating, it is easy to raise the funds at lower cost because prospective investors may be happy with a low risk situation. Third, if a company obtains a higher credit rating, marketing the securities may be relatively easy for the company.

However, following propositions should always be remembered in case of credit rating:

(1) Credit rating is not a recommendation for buying, selling or holding a security. The actual investment may depend upon the other important factors also viz., expectation of returns, risk-taking capacity of the investor etc.

(2) During the process of credit rating, the credit rating agency may make a comprehensive study of the information about the company to be rated. This information may be obtained either from the company itself or from any other source. However, the credit rating agency does not perform the audit function. As such, the credit rating does not certify that the information available to it is true.

(3) Credit rating does not create any legal relationship between the credit rating agency and the investor. A high credit rating indicates that the probability of the issuing company fulfilling its obligations towards security is higher. The investor cannot hold the credit rating agency responsible for his investment decision based upon the credit rating done by the credit rating agency.(4) The credit rating once done cannot be a one-time phenomenon applicable during the entire tenure of the security. With the changing risk characteristics of the company, the credit rating should be reviewed and upgraded or downgraded accordingly.