1. Introduction to Cost of Capital

The various sources from which the long term requirement of the capital can be met. Each of these sources involves some cost. The cost of capital can be defined as ‘”the rate of which an organization must pay to the suppliers of capital for the use of their funds”.

In economic term, the cost of capital is viewed from two different angles:

(1) The cost of raising funds to finance a project. This cost may be in the form of the interest which the company may be required to pay to the suppliers of funds. This may be the explicit cost attached with the various sources of capital.

(2) The cost of capital may be in the form of opportunity cost of the funds of the company i.e., rate of return which the company would have earned if the funds are not invested. E.g. suppose that a company has an amount of Rs. 100,000 which may either be utilised for purchasing a machine or may be invested with a bank as fixed deposit carrying the interest 10% p.a.

ADVERTISEMENTS:

If the company decides to use the amount for purchasing the machine, obviously it will have to forgo the interest which it would have earned by investing the same in fixed deposit with the bank. Thus, the cost of capital of this capital of Rs. 1,00,000 is 10%.

2. Meaning of Cost of Capital

It is a rate of returns expected by the investors i.e., K = ro + b + f. i.e., the cost of capital includes the rate of return at zero risk + premium for business risk + premium for financial risk.

It is the minimum rate of return the firm earns as its investment in order to satisfy the expectations of investors, who provide funds to the firm.

Cost of capital is the measurement of the sacrifice made by the investors in order to the capital formation with a view to get a fair return on investment.

ADVERTISEMENTS:

For Investor:

Cost of capital is the measurement of disutility of funds in the present as compared to the return expected to future.

For Company:

Cost of capital is the required rate of return to justify the use of capital so that expected rate of return can be maintained on equity shares and the market value of share remains unchanged or should not be reduced at cost.

ADVERTISEMENTS:

When a company collects funds by issuing debentures, bonds and preference shares it has to earn at least a rate of return on investment which is equal to the cost of raising them. So that market value of equity shares remains unchanged.

The cost of capital is a minimum rate of return required to be earned on investment to keep the market value of the shares unchanged.

3. Definitions of Cost of Capital

The concept of the cost of capital plays an important role in corporate finance – theory and practice.

The term cost of capital is defined by various authors in different ways, some of which are stated below:

Milton H. Spencer says “cost of capital is the minimum required rate of return which a firm requires as a condition for undertaking an investment.”

According to Ezra Solomon, “the cost of capital is the minimum required rate of earnings or the cut-off rate of capital expenditure.”

L. J. Gitman defines the cost of capital as “the rate of return a firm must earn on its investment so the market value of the firm remains unchanged.”

The definition given by Keown refers to the cost of capital as “the minimum rate of return necessary to attract an investor to purchase or hold a security.”

According to the point of view of an enterprise, the cost of capital refers to the cost of obtaining funds—debt or equity—to finance an investment. The cost of capital is used to evaluate new projects of a company, as it is the minimum return that investors expect for providing capital to the company. Thus, the cost of capital is a benchmark that a new project has to meet.

ADVERTISEMENTS:

According to the point of view of an investor, the cost of capital is the required rate of return an investment must provide in order to be worth undertaking. When an investment is made, the investor has to forego the return available on the next best alternative investment.

This foregone return is the opportunity cost of undertaking the investment and consequently, is the investor’s required rate of return. This required rate of return is used as a discounting rate to determine the present value of the estimated future cash flows.

Thus, the cost of capital is also referred to as the discounting rate to determine the present value of the returns. It is used as the discount rate in the investment appraisal process while using techniques- such as net present value and internal rate of return.

Cost of capital is also known by a variety of rates- the break even rate, minimum rate, cut-off rate, target rate, hurdle rate, standard rate and so on.

ADVERTISEMENTS:

In other words, the cost of capital is the average rate of return required by the investors who provide long-term funds. It is the price that is paid for time and risk involved in obtaining the capital.

Therefore, cost of capital refers to the minimum rate of return a firm must earn on its investment so that the market value of equity shares remains unchanged. It serves as a guideline to determine the rate at which the firm shall borrow the funds.

A rational firm, using economic wisdom, always seeks to raise capital by the cheapest and most efficient methods, thereby minimizing its average cost of capital. This will have the effect of increasing the net present value of the firm’s projects and hence its market value.

In order to minimize its average cost of capital, a company needs to judiciously combine different sources of finance in order to reach its optimal capital structure.

4. Concepts of Cost of Capital

ADVERTISEMENTS:

Besides the general concept of cost of capital, the following concepts are also used frequently:

(a) Component Cost and Composite Cost:

Component cost refers to the cost of individual components of capital viz., equity shares, preference shares, debentures and so on. Composite cost of capital refers to the combined or weighted average cost of capital of the various individual components. For capital budgeting decisions, it is the composite cost of capital which is considered.

(b) Average Cost and Marginal Cost:

The average cost refers to the weighted average cost of capital. Marginal cost refers to the incremental cost attached with new funds raised by the company.

(c) Explicit Cost and Implicit Cost:

ADVERTISEMENTS:

Explicit cost is the one which is attached with the source of capital explicit or apparently. Implicit cost is the hidden cost which is not incurred directly. E.g. In case of the debt capital, the interest which the company is required to pay on the same is explicit cost of capital.

However, if the company introduces more and more doses of debt capital in the overall capital structure, it makes the investment in the company a risky proposition. As such, the expectations of the investors in terms of return on their investment may increase and share prices of the company may decrease.

These increased expectations of the investors or the decreased share prices may be considered to be an implicit cost of debt capital.

5. Importance of Cost of Capital

The term cost of capital is important for a company basically for following purposes:

(1) The concept of cost of capital is used as a tool for screening the investment proposals. E.g. In case of the net present value method, the cost of capital is used as the discounting rate for discounting the future inflow of funds. Any project resulting into positive net present value only will be accepted.

All other projects will be rejected. Similarly, in case of Internal Rate of Return Method (IRR), the resultant IRR is compared with the cost of capital. It is expected that if a project is to be accepted, IRR resulting from the same should be more than cost of capital. If a project generates ERR which is less than cost of capital, the project will be rejected.

ADVERTISEMENTS:

(2) The cost of capital is used as the capitalisation rate to decide the amount of capitalisation in case of a new concern.

(3) The concept of cost of capital provides useful guidelines for determining the optimal capital structure. Optimal capital structure is the one where overall cost of capital is minimum and the overall valuation of the firm is maximum.

6. Classification of Cost of Capital

Some of the classification of cost of capital are as follows:

1) Marginal cost of capital & Average cost

2) Explicit cost and Implicit cost

3) Future cost and Historical cost

ADVERTISEMENTS:

4) Specific cost and Inclusive of combined cost

5) Spot cost or normal cost.

1) Marginal Cost and Average Cost:

Marginal Cost

It is the additional cost of manufacturing an additional unit. Marginal cost is the average cost of a new fund required to be raised by the company. So the current rate of interest on long term debt is treated as the marginal cost of capital.

Average cost of Capital

ADVERTISEMENTS:

Average cost is the combined cost of various sources of capital such as debentures, preference shares and equity shares. It is the weighted average cost of the costs of various sources of finance.

So the average cost is the cost per unit. It is calculated by dividing total cost by the number of units produced.

2) Explicit Cost and Implicit Cost:

Explicit cost arises when funds are raised, whereas the implicit cost arises when funds are used.

Explicit cost involves the payment of fixed charges in the form of interest or dividend.

Generally, companies issue equity shares, preference shares and debentures. Debentures carry a fixed rate of interest yearly or half yearly. Implicitly is the opportunity cost. It is the cost of one investment opportunity which is sacrificed for getting another investment opportunity. So implicit cost arises when the firm thinks in terms of different alternative opportunities of investment with the available funds at its disposal.

Distinction between Explicit Cost and Implicit Cost:

Explicit Cost:

a) Arises – It arises when the funds are raised

b) Base – It is based on the concept of net present value

c) Effect – Cash outflows in the form of payment for fixed charges

Implicit Cost:

a) Arises – It arises when the funds are used.

b) Base – It is an opportunity cost.

c) Effect – It will not affect the outflows and inflows of cash.

The explicit cost may be defined as the discount rate that equates the present value of cash inflows that is incremental to the taking of the financing opportunity with the present value of its incremental cash outflows.

So it is the internal rate of return of cash flows of financing opportunities.

3) Future Cost and Historical Cost:

Future Cost (Estimated Cost):

It refers to the cost of funds intended to finance the expected project. All financial decision making expected rate of return and expected (Future) cost of capital are considered. Future cost are widely used in capital budgeting and capital structure designing decisions.

Historical Cost (Book Value):

It is the cost which has already been incurred for financing a particular project. Historical costs are useful in analysing the existing capital structure, in projecting the future costs and providing an appraisal of the post-performance, when compared with standard or predetermined cost. So historical costs are the basis of existing capital structure.

Difference between Future Cost and Historical Cost:

Future Cost:

1. Nature of cost – These costs are expected cost to be incurred in financing a particular project or Estimated cost.

2. Base – These costs are calculated on the basis of post records.

3. Use – These costs are useful for decision making and designing capital structure of the firm.

Historical Cost:

1. Nature of cost – These costs are already incurred.

2. Base – These costs are actual costs that are recorded.

3. Use – These costs are useful for controlling future costs and evaluating the past performance.

4) Specific Cost and Combined Cost (Composite Cost):

Specific cost (individual cost e.g., cost of equity)

It is a component of capital structure e.g., debentures, preference shares & equity shares, etc. It implies the cost of a specific source of funds. It is the individual cost of a specific source of funds.

Combined cost or composite cost (Weighted average cost)

It is the aggregate of the cost of capital from all sources of funds i.e., debt equity and preference capital and other loans. It is also called weighted cost of capital or composite cost of capital or over all capital mix.

Distinction between Specific Cost and Composite Cost:

Specific Cost:

1. Name – It is the component of total capital

2. Cost – It is the cost of source of finance

3. Use – It is not useful for decision making

4. Type of cost – It is a part of weighted average cost of capital

Composite Cost:

1. Name – It is the combined cost of different sources of capital.

2. Cost – It is the average cost of all sources of finance

3. Use – It is useful for decision making

4. Type of cost – It is the aggregate of specific cost of capital

5) Spot Costs and Normalised Costs:

Spot costs – Spot costs are those costs prevailing in the market at a certain times.

Normalised costs – These are long term costs. It is an estimate of costs by some averaging process from which a cyclical element is removed. These are normally used for taking overall investment decisions.

7. Significance of Cost of Capital

The following are the significance of cost of capital:

1. It Helps in Capital Budgeting

Cost of capital helps the organisation for different alternatives in respect of the purchase of major fixed assets, i.e., investment decisions. The organisation will choose the project which gives a satisfactory return on investment, while preparing capital budgeting the various alternatives are available, out of them cost of capital is the key factor in deciding the project out of various proposals pending before management.

The cost of capital has an important bearing on decisions to be taken with respect to the rejection or acceptance of a particular capital expenditure budget.

According to the Net Present Value method (NPV) of capital budgeting, if the present value of expected returns from investment is greater than or equal to the cost of investment, such project may be accepted.

If the expected returns from investment is less than investment in such a case project may be rejected.

The Net present value of expected return is calculated by discounting the expected cash inflows at cut-off rate. Therefore cost of capital is useful in capital budgeting decisions.

2. It Helps in Designing the Capital Structure Decisions (i.e., Capital Mix Decisions):

The cost of capital is an important factor in designing the firm’s capital structure. The cost of capital is influenced by the changes in the capital structure.

While designing the capital structure, the main objective is to maximise the value of the firm (i.e., profit maximisation) and minimising the cost of capital.

3. It Helps in Selecting the Sources of Finance (i.e., Method of Financing):

Financial executive must have the knowledge of fluctuations in the capital market. So a financial executive analyses the rate of interest of loans and normal dividend rates in the market from time to time, whenever a company requires additional finance he may have a better choice of the sources of finance which bears the minimum cost of capital.

4. It Helps for Optimum Mobilisation of Resources:

It can be used as a medium of optimum resources mobilisation on national scale.

5. It Helps to Evaluate the Financial Performance of the Top Management:

Evaluation of the financial performance will involve a comparison of actual profitabilities of the project undertaken with the projected overall cost of capital. Similarly the actual cost of raising the funds can be analysed with the estimated figures and an appraisal of the actual costs incurred in raising the required funds.

8. Factors Affecting Cost of Capital

The cost of capital is largely dependent on the sources of finance. It is important to understand the factors that affect the cost of capital in order to minimize the overall cost of capital. There are several factors that may be controlled by the firm and many more that may be beyond the control of the business enterprise.

The former may be referred to as internal factors and later as external factors. The internal factors include composition of capital structure, dividend policy, and amount of financing and operating conditions.

These factors have been discussed in the following paragraphs:

(a) Capital Structure Composition:

The composition of capital structure, that is, debt- equity mix affects the cost of capital of a firm. As the debt proportion increases, the average cost of capital decreases because debt funds are cheaper as they also offer tax advantages. However, this happens only up to a certain point (called optimum level).

Thereafter, the cost of the capital starts increasing. This is because when a higher proportion of debt is chosen, the cost of debt must factor in the risk that the firm may fail to meet its payment obligations.

In case of large investment projects, due to cost and time overruns, the costs of servicing debt may become more than the revenues, thus, making it difficult for the firm to pay interest and principal amount of debt.

Also, higher levels of debt can cause a wider variation in earnings due to higher fixed obligations that must be paid (interest to debt holders). This is referred to as financial risk. The equity owners may also require higher returns to compensate for increased risk, thereby causing the cost of equity fund to increase.

(b) Dividend Policy:

The cost of equity is also influenced by a company’s dividend policy. When a company makes profits, it can distribute them to the shareholders as dividends or reinvest them into the company as retained earnings or it can do both by deciding the dividend pay-out ratio.

The firm may use retained earnings to retire costly debts, hence changing its overall cost of capital and debt equity ratio. Although retained earnings have an implicit cost, yet they are considered to be a cheaper source of finance.

(c) Amount of Financing:

The cost of funds also depends on the level of financing that the firm requires. As the financing requirements of the firm become larger, the weighted cost of capital increases for several reasons. For instance, as more securities are issued, additional floatation costs are incurred, which in turn tend to cause a rise in the cost of capital.

Also, as management approaches the market for large amounts of capital relative to the firm’s size, the investors require a higher rate of return. This is because the suppliers of capital become hesitant to grant relatively large sums without evidence of management’s capability to absorb this capital into the business.

Also, as the size of the issue increases, there is greater difficulty in placing it in the market without reducing the price of the security, which also increases the firm’s cost of capital.

(d) Business Risk:

Business risk occurs from operating activity of a firm. It is influenced largely by the amount of fixed costs that are incurred by a firm. The higher the fixed costs, the greater will be the business risk and vice versa. For example, higher fixed costs tend to result in wider variations to operating income from numerous factors- increased competition, slower economic growth and so on.

It is one of the important factors that influence the determination of cost of capital. The more the business risk, the higher will be the cost of capital because the providers of funds raise their required rate of return by charging risk premium to compensate for increase in risk.

Besides the above, there are external factors- economic conditions, tax considerations, market conditions and marketability of securities that affect the cost of capital.

These have been discussed in the following paragraphs:

(a) Economic Conditions:

The economic conditions in the form of demand and supply of capital as well as expectations with respect to inflation also affect the cost of capital. If the demand for funds in the economy increases, lenders will automatically increase the required rate of return and vice versa.

Supply of funds has an inverse relation to cost of capital- If supply of fund increases then the cost of capital decreases; and if the supply of funds decreases, the cost of capital increases.

Similarly, inflation is expected to deteriorate the purchasing power, investors require a higher rate of return to compensate for this anticipated loss. As a result, the cost of capital tends to register an increase.

In other words, the market forces of demand and supply of funds determine the risk free interest rate on government securities which consists of the actual interest rate paid to the supplier of the funds and the purchasing power risk premium. This risk free interest rate is important in calculating cost of capital.

(b) Tax Considerations:

Corporate taxes as well as value added tax also exert an influence in determining the cost of capital in a firm. A higher rate of corporate tax makes the debt funds cheaper because of the tax shield enjoyed by interest.

The tax rates affect the after-tax cost of debt. As tax rates increase, the cost of debt decreases, thereby causing overall cost of capital to decline. A higher value added tax increases the indirect tax burden and increases the amount of funds that are tied up with credit customers.

(c) Market Conditions:

The market conditions of the product produced by the project for which funds are required is an important factor in determining the cost of capital. When the funds required for risky projects, the cost of capital is expected to register an increase, as lenders demand a higher rate to compensate for the risk they embrace.

On the other hand, if the market conditions are such that it is expected to get a high and secured return, then the risk will be lower and obviously the cost of capital is expected to be less.

(d) Marketability of Securities:

When an investor purchases a security with significant risk, an opportunity for additional returns is necessary to make the investment attractive. Essentially, as risk increases, the investor requires a higher rate of return.

If the security is not readily marketable when the investor wants to sell, or even if a continuous demand for the security exists but the price varies significantly, an investor will require a relatively high rate of return. Conversely, if a security is readily marketable and its price is reasonably stable, the investor will require a lower rate of return and the firm’s cost of capital will be lower.

9. Measurement of Specific Cost of Capital

(a) Cost of Debt:

The debts may be either short term debts or long term debts. Very naturally, the cost of capital in the form of debt is the interest which the company has to pay. But this is not the real cost attached with debt capital. The real cost is something less than the rate of interest which the company has to pay.

This is due to the fact that the interest on debt is a tax deductible expenditure. If the amount of interest is considered as a part of expenses, the tax liability of the company reduces proportionally. As such, while computing the cost of debt, adjustments are required to be made for its tax impact. E.g. Suppose a company issues the debentures having the face value of Rs. 100 and bearing the rate of interest of 10% p.a.

If the tax rate applicable to the company is 50%, the cost of debentures is not 10% which is the rate of interest, but it is to be duly reduced by the tax benefit available for this interest. The tax benefit is 50% of 10%, hence the cost of debentures is only 5%. Further, the interest payable on the debentures has to be viewed from the angle of the amount actually received on their issue.

E.g. A company issues 1000 debentures of Rs. 100, each bearing interest @ 8% p.a. Company incurred the expenses in connection with the issue of debentures to the extent of Rs. 10,000 (These expenses may be in the form of discount allowed, underwriting commission, advertisement etc.) Thus, the company will have to pay the annual interest of Rs. 8,000 on the net amount received to the extent of only Rs. 90,000 (i.e. Rs. 1,00,000 minus Rs. 10,000).

Cost of debentures in this case works out to around 8.89% and assuming that the tax rate applicable is 50%, the tax benefit makes the cost of debentures equal to 4.45%. However, the debt capital has a hidden cost also.

If the debt content in the capital structure of a company exceeds the optimum level, the investors start considering the company as too risky and their expectations from equity shares increase. This is the hidden cost of debt.

(b) Cost of Preference Shares:

The cost of capital preference shares is the dividend rate payable on them. As in case of debentures, the cost of capital is adjusted for the amount excess or less received on the issue of preference shares. E.g. Suppose, a company issues 1,000 preference shares of Rs. 100 each at the value of Rs. 105 each.

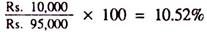

Rate of dividend is 10% and the expenses involved with the issue of preference shares amount to Rs. 10,000. Thus the net amount received works out to Rs. 95,000 whereas the amount of the dividend is Rs. 10,000. Here, the cost of capital works out to-

As the amount of dividend payable on preference shares is not a tax- deductible expenditure, there is no question of further adjustment for tax benefit.

(c) Cost of Equity Shares:

Computation of cost of equity shares is the most complex procedure. It is due to the fact that unlike preference shares or debentures, equity shares do not have either the interest or dividend to be paid at a fixed rate. The cost of equity shares basically depends upon the expectations of the equity shareholders.

There are following approaches to compute the cost of equity shares:

(1) D/P Approach:

According to this approach, before an investor pays a certain price for purchasing equity shares of the company, he expects a certain return on the investment which is in the form of the dividend. This expected rate of dividend is the cost of equity shares.

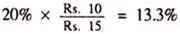

This means that the investor calculates the market price of the shares by capitalising the present dividend rate which is expected to be the same for all times to come at a given level. E.g. If the market price of Equity shares of a company (Face value Rs. 10) is Rs. 15 and if the company at present is paying the dividend @ 20% which is expected to be continued in future also, the cost of equity shares will be –

However, it can also be argued that the cost of equity shares may be 20%, because on the expectation of a rate of dividend at 20%, market price of the shares is Rs. 15.

This approach is objected to on certain grounds. Firstly, this presupposes that an investor looks forward only to receiving a dividend on equity shares. This may not always be correct. He may also look forward to capital appreciation in the value of his shares.

Secondly, this approach assumes that the company will not earn on its retained earnings and that the retained earnings will not result in either appreciation of the market price or increase in dividends. This assumption can be a wrong assumption which may lead to wrong conclusions.

(2) E/P Approach:

According to this approach, the cost of equity shares is based upon the stream of unchanged earnings earned by a company. This approach holds that each investor expects a certain amount of earnings whether distributed by way of dividend or not, from the company in whose shares he invests.

Thus, if an investor expects that the company in which he is investing should have at least a 20% rate of earnings, cost of equity shares will be calculated on that basis. If a company is expected to earn 30%, he will be prepared to pay Rs. 150 for one share of Rs. 100 each.

This approach can be objected to on the following grounds. Firstly, it wrongly assumes that the earnings per share will remain constant in future. Secondly, the market prices of the shares will not remain constant as the shareholders will expect capital gains as a result of reinvestment of retained earnings. Thirdly, all the earnings may not be distributed among the shareholders by way of dividend.

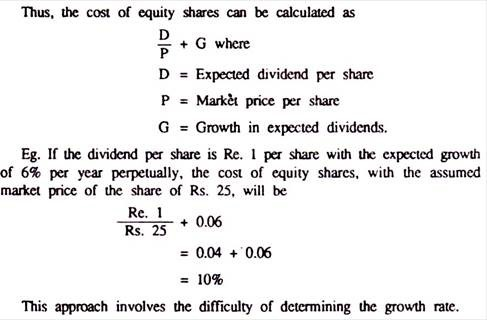

(3) D/P + G Approach:

According to this approach, the investor is prepared to pay the market price of the shares as he expects not only the payment of the dividend but also expects a growth in the dividend rate at a uniform rate perpetually.

(4) Realised Yield Approach:

According to this approach, the cost of equity shares may be decided on the basis of yields actually realised over the period of past few years which may be expected to be continued in future also. This approach basically considers the D/P + G approach, but instead of considering the future expectations of dividends and growth factor, the actual yields in the past are considered.

(d) Cost of Retained Earnings:

Many times, it is argued that the retained earnings do not cost anything to the company. This is argued like this as there is no obligation, either formal or implied, to pay return on retained earnings even though they constitute one of the major sources of funds for the company. In case of debt, the company has a fixed obligation to pay interest on it.

Almost similar obligation exists in case of preference shares also. In case of equity shares, though there is no legal obligation, the expectations of the shareholders at least provides a starting point for computing the cost of equity shares. The retained earnings do not involve any of such obligations, either, formal or implied.

As such, it may be felt that retained earnings involve no cost as they are not raised from outside source. But this contention is not correct. Retained earnings involve cost and this cost is in the form of the opportunity cost in terms of dividends foregone by or withheld from the equity shareholders.

E.g. Assuming that the profits earned by the company are not retained but are distributed among shareholders by way of dividend. These amounts of dividends which would have been received by the shareholders, after due adjustments for tax deducted at source, could have been invested by the shareholders elsewhere to earn some return.

The company, by retaining the profits, prohibits the shareholder from earnings these returns. As such, the company is required to earn on the retained earnings at least equal to the rate which would have been earned by the shareholders if they were distributed to them. This is the cost of retained earnings.

10. Computation of Cost of Capital

Computation of cost of capital consists of two important parts:

1. Measurement of specific costs/individual capital cost

2. Measurement of overall cost of capital

1. Computation of Cost of Individual Capital Components:

A company has a capital structure with the different components. Each component carries its own importance as well as burden over the firm. In order to compute the overall cost of the firm, the finance manager must determine the cost of each type of funds needed in the capital structure of the firm.

Each firm has an ideal capital mix of various sources of funds – external sources (debt, preference share and equity share) and internal sources (reserves and surplus).

The followings are the different sources of capital:

i) Cost of Debt Capital:

In debt generally we include term loans, bonds and debentures. The debts always carry a fixed rate of interest as a charge for the users which a firm is ready to pay to maximize its profitability and wealth.

The rate adjoined with the debt as generally shown (as 10% or 12%. Debenture) is the rate of interest to be paid over the Debenture/debt but this is not only the cost for the issue of debt, the actual cost may differ from this rate.

To find the actual charge (real cost of debt), it is required to know the relation of interest over the actual amount realized (Net Proceed).

The Net Proceed is that amount which is actually realized after adjusting discount or premium on the face value of loan or debentures after charging floatation costs.

Net Proceeds will be calculated as follows –

Face value of Debenture + Premium on issue (if any) – discount on issue (if any) – floatation cost.

Floatation costs include all types of charges or expenses incurred to obtain such loan like – Advertisements Charges, Postage Stationery & Printing, Stamp duty, Brokerage Underwriting commission etc.

Debt-capital can be classified into the following two types:

a) Perpetual or Irredeemable Debt:

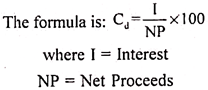

These are the debts which are not repayable during the life of the company. They are repayable only on the liquidation of the company. For calculating the cost of this type of debt-capital, the amount of interest payable on it is divided by the net proceeds from its issue.

b) Redeemable Debt:

Mostly debentures are repayable within a stipulated time period. In the calculation of cost of such debts, the time period of their redemption is very important.

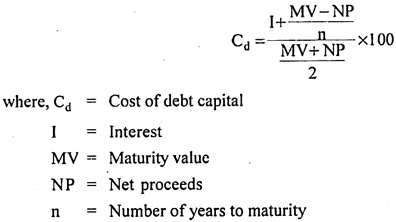

The formula for calculating the cost of debenture-capital can be adapted as follows:

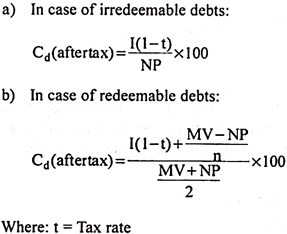

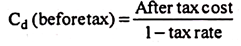

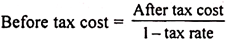

For calculating after tax cost of debt capital, the amount of interest is to be adjusted as follows:

ii) Cost of Preference Share Capital:

Preference shares are also fixed cost bearing securities like debentures. The rate of dividend payable on these shares is fixed. Since dividend is not an admissible deduction in the computation of taxable income, unlike debentures, cost of preference share capital is ‘after tax cost’ of capital which may be converted into before tax cost by applying the following formula –

Preference Share can be classified into the following two types:

(a) Perpetual or Irredeemable Preference share

(b) Redeemable Preference share

(a) Cost of Irredeemable Preference Share Capital:

Cost of such preference shares is the ratio of annual dividend burden on each such share to its net proceeds.

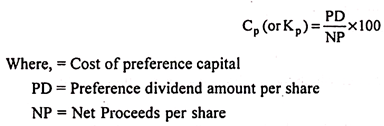

As per formula:

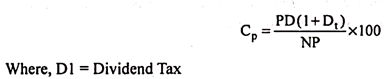

If dividend tax is paid, the formula will be as follows:

Note:

The only difference between the cost of debt and preference share is that in preference share we will take preference dividend instead of interest, as we paid dividend on preference share and in preference share first we will get after tax cost and then we will convert it to before tax.

(b) Cost of Redeemable Preference Share Capital:

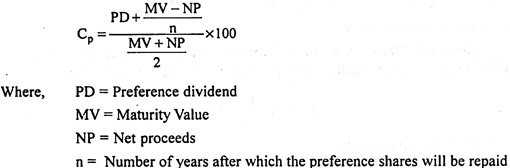

Such shares are redeemed after a specified period. Cost of such shares is calculated in the same way as discussed in the case redeemable debentures. Necessary adjustments will have to be made for terms of issue, terms of redemption and floatation charges.

The following formula may be used for this purpose:

iii) Cost of Equity Share Capital:

The calculation of cost of equity share capital is a relatively difficult task because like preference share capital there is neither any prefixed rate of dividend payable on these shares nor there is any legal obligation to pay dividend on them. But it does not mean that equity share capital is cost-free.

The cost of such capital is equal to that expectation of equity shareholders, which they expect to be fulfilled by the management to maintain their company.

Following are the three approaches of estimating the cost equity share capital:

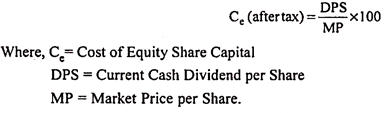

(a) Dividend Yield Method:

This is also called the Dividend/Price Ratio Method or D/P Ratio Method. This Method is based on the thinking that when an investor invests his savings in a company, he expects a dividend at least at the current rate of return. As such cost of equity capital is calculated on the basis of the future stream of dividends which the shareholders expect to receive from a company.

The formula is:

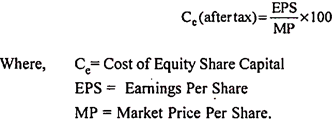

(b) Earnings Yield Method:

This is also known as Earnings/Price Ratio Method or E/P Ratio Method. This method is based on the assumption that the market price of the shares is based on earning per share and so shareholders capitalize the expected future earnings (as distinguished from dividends) in order to evaluate their shareholders.

Hence, cost of equity capital is found by relating earnings per share with its market price.

The formula is as follows:

(c) Dividend Yield + Growth in Dividend Method:

This method is also known as Dividend/ Price + Growth in Dividend Method or D/P + G Method. This method is based on the thinking that each equity shareholder is not satisfied with the present rate of dividend only, he wants an increase in it each year based on his expectations of increase in future earnings of the company.

In this method, cost of equity share capital is found by making appropriate adjustments in the current rate of dividend on the basis of probable rate of increase in future earnings of the company.

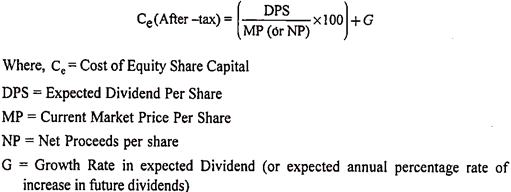

This rate of increase is termed as growth rate:

1) When dividends are expected to grow at a uniform rate perpetually:

In this case, the yearly growth rate in dividend is added to the cost of equity capital as ascertained in accordance with the D/P ratio method.

The formula is:

2) When dividends grow at different rates:

In such a case, the constant growth equation mentioned above is to be modified to take into account two or more growth rates.

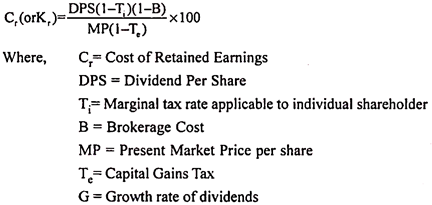

iv) Cost of Retained Earnings:

That part of earnings of a company which remains with it after distribution on dividend among the shareholders is called ‘retained earnings’. They are commonly known as internal equity of the concern. There is no explicit cost of this type of profits because there is no formal or implied obligation on the company to pay any return on this amount. But it is not correct to treat them as cost free.

In fact, cost of this source of finance is its opportunity cost. If retained earnings were not retained, they would have been paid out to the shareholders as dividend and the shareholders should have invested it in some alternative investments and should have earned return.

When earnings are retained, the shareholders are forced to forego such return. Hence, the expected return foregone by the shareholders on forgone dividends may be treated as the cost of retained earnings.

The following formula will be applied for calculating cost of retained earnings:

Notes:

Cost of retained earnings calculated by the above formula is after tax cost.

It can, however, be converted into before tax cost by applying the following formula –

2. Overall Cost of Capital:

A company finances its projects by different sources, although the specific cost of each source of finance is different. Some are cheaper and some are dearer. There are two objectives of this policy – firstly, to balance the capital structure, and secondly to increase the return of equity shareholders.

These objectives can be achieved only when the firm’s average cost of financing is lower than its return on investment. This requires the computation of overall or average cost of capital. Overall cost of capital may be defined as the average cost of the specific costs of different sources of financing. This is used as acceptance/ rejection criterion in capital expenditure decisions.

The average can be a simple average or weighted average. However, a weighted average is more reasonable and appropriate as it gives due emphasis to different sources of capital in the capital structure of a firm.

Computation of Weighted Average Cost of Capital:

In involves the following four steps:

i) The computation of specific costs of various sources.

ii) Assignment of weights to each type of funds.

iii) Each specific cost is multiplied by the corresponding weight and in this way the weighted cost of each source is determined.

Assignment of Weights:

This involves the determination of share of each source of capital in the total capital structure of the company.

There are three approaches of assigning weights:

i) Historical Weights Approach:

According to this approach, the relative proportions of various sources of capital to the existing capital structure are used to assign weights. The assumption of this approach is that the company’s present capital structure is optimum and it will raise additional funds from various sources in proportion to their share in the existing capital structure.

Historical weights can be given on the basis of face or book value of securities or on the basis of their market value.

a. Book Value Weights:

This is the most convenient to be used. In this method proportion of each source in total capital structure is determined on the basis of the book value of securities.

b. Market Value Weights:

In this method, market value of invested capital funds of each type of security is calculated on the basis of their prevailing market values and proportion of each type of security to the total of market values of all securities is used as weight.

This is theoretically a more sound and appealing approach since market values of the securities closely approximate the actual rupees to be received from their sale. However, it is more difficult to calculate the market values.

ii) Target Weights Approach:

If a firm has determined the capital structure which it believes most consistent with its goal of owner’s wealth maximization and it is directing its financing policies toward achievement of this ”optimal” capital structure, then the use of these target capital structure weights may be appropriate.

iii) Marginal Weights Approach:

According to this approach, specific costs are assigned weights in proportion to funds to be raised from each source to the total funds to be raised. This approach presumes that the new project is to be financed wholly by raising fresh capital.

11. Weighted Average Cost of Capital

After calculating the cost of capital of different sources of financing, we need to know the overall cost of capital, which will serve as the discount rate for investment decisions. Since, in a project, we have to use a variety of sources to meet our entire capital requirement, the overall cost of capital for the entire project would be the weighted average cost of capital (WACC).

The WACC depends upon two factors – one, the cost of capital of each individual source and two, the share of each source in the total. If the cost of capital of an individual source is high, but its share in the total is low, it will have little impact on the total and if its share is high it will increase the WACC quite substantially.

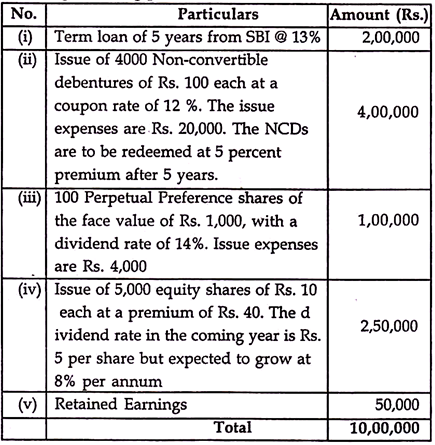

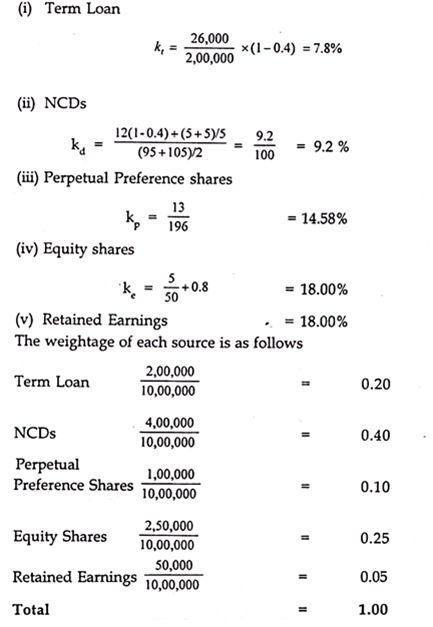

Illustration:

A company is planning an investment of Rs. 10, 00,000 in a project.

They are planning to raise this amount through the following financing plan:

The tax rate is 40%. Calculate the weighted average cost of capital.

Solution:

We first calculate the cost of capital of each source:

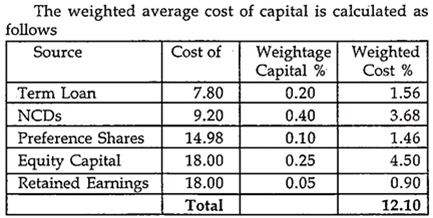

If we are using the IRR method, then the WACC, calculated above, should be compared with the IRR of the project. If the project IRR is greater than the WACC, the project should be accepted. If the IRR is less than this rate, then it implies that the cost is higher than the return and the project is not acceptable. For example, if the IRR is 12 percent only, then the project may not be accepted.

12. Limitations of Cost of Capital

Some of the limitations of cost of capital are as follows:

1) For ascertaining cost capital, use of mathematical calculations and their results cannot be accurate for practical use.

2) The decision maker should not put too much dependence or reliance on these financial calculations.

3) From the calculations indicates that debt capital is cheaper than preference and equity shares capital in case most of the enterprises.

Problems in Determining Cost of Capital:

1) Problems in Computation of Cost of Equity:

Calculation of exact cost of capital is difficult, because it depends upon the expected rate of return by its investors. The results also differ with the method adopted for its calculation.

2) Problem in Computation of Cost of Retained Earnings:

While calculating the cost of equity capital, the problems arise whether cost of retained earnings should be included.

Some people argue that, cost of retained earnings does not involve any cost. But in reality, the cost of retained earnings is the opportunity cost of dividends foregone by its shareholder because different shareholders may have different opportunities for investing their funds. So, this creates a problem in calculating precise cost of capital.

3) Future Cost and Historical Cost:

While calculating the cost of equity capital, another problem arises, whether future cost or historical cost is included. Some people argue that for decision making, historical cost or book cost are included and they are related to the past.

Hence historical costs are not relevant. Some people argue that future costs are more relevant for decision making. Even some arguments are given in favour of marginal cost, specific cost and composite cost.

4) Problems in Assigning Weights:

While computing weighted average cost of capital, weights have to be assigned to the specific cost of individual sources of finance. But the computation of weights to be assigned to each type of funds which is a complex issue. There are two options in this respect whether – book value weights or Market value weights to be assigned, both have their own merits as well as weaknesses or demerits.

5) Conceptual Controversy – (i.e., Relationship between the Cost of Capital and the Capital Structure):

For explaining the relationship between the capital structure, cost of capital and the value for the firm, It has created the conceptual controversy.

According to the traditional approach and the net income approach, a firm can change its overall cost of capital by changing debt-equity mix. It means that both cost of capital as well as the value of the firm have direct relationship with the method and level of financing.

On the other hand, the M.M. Approach and the Net operating income approach reject the traditional view and holds that cost of capital is independent of the method and level of financing. It means that M.M. approach prove that cost of capital is not affected by changes in the capital structure or any debt equity mix (i.e., No relationship between cost of capital and value of the firms is not relevant while calculating cost of capital and value of the firm.)