Learn about types of cost of capital: 1. Opportunity Cost of Capital 2. Explicit and Implicit Cost of Capital 3. Specific and Overall Cost of Capital 4. Marginal Cost of Capital.

1. Opportunity cost of capital is the rate of return foregone on the next best alternative investment opportunity.

2. Explicit cost of capital to a company involves a payment i.e. cash outflow by the company to the suppliers of the funds. Implicit cost on the other hand, is a kind of opportunity cost as it does not require any explicit payment or cash outflow by the company.

3. Cost of a specific source of fund is termed as specific cost of capital Cost of debt, cost of preference capital, cost of equity and cost of retained earnings are all examples of specific cost of capital. Overall cost of capital is the weighted average cost of specific costs of capital.

ADVERTISEMENTS:

4. Marginal cost of capital is the average cost of incremental funds raised by the company. It must be noted that as the amount of debt capital increases in a company, the cost of debt and cost of equity does not remain the same, rather increase.

Also learn about some more types of cost of capital: 1. Future Cost and Historical Cost 2. Component Cost and Composite Cost 3. Average Cost of Capital 4. Before Tax and After Tax Cost of Capital.

Types of Cost of Capital: Opportunity, Explicit and Implicit, Specific and Overall, Marginal Cost of Capital and More…

Types of Cost of Capital – Opportunity, Explicit and Implicit, Specific and Overall and Marginal Cost of Capital (With Calculation)

Types of cost of capital are as follows:

Type # 1. Opportunity Cost of Capital:

Opportunity cost of capital is the rate of return foregone on the next best alternative investment opportunity. For instance, suppose you have Rs.1,000 to invest and there are two alternative investment options available before you.

ADVERTISEMENTS:

First option is investment in a nationalized bank Fixed deposit that will fetch 8% p.a. rate of interest, and the second option is to invest in Government bonds offering 8.5% p.a. rate of interest.

Now, if you select a second option i.e. investment in government bonds, you are foregoing the opportunity of investing in fixed deposits. Hence the opportunity cost for Govt., bonds is 8%.

Type # 2. Explicit and Implicit Cost of Capital:

The cost of capital can also be classified as explicit and implicit cost of capital. Explicit cost of capital to a company involves a payment i.e. cash outflow by the company to the suppliers of the funds. Cost of debt is an explicit cost because it involves payment of interest by the company to the debt holders.

Implicit cost on the other hand, is a kind of opportunity cost as it does not require any explicit payment or cash outflow by the company. Cost of retained earnings is implicit cost because when a company retains its earnings it does not distribute dividends by that amount.

ADVERTISEMENTS:

This amount of earnings actually belongs to equity shareholders and therefore the company is obliged to earn at least that much rate of return which the shareholders could have earned had it been distributed to them. Thus implicit cost of capital does not involve any cash outflow to the providers of funds.

Type # 3. Specific and Overall Cost of Capital:

Cost of a specific source of fund is termed as specific cost of capital Cost of debt, cost of preference capital, cost of equity and cost of retained earnings are all examples of specific cost of capital. Thus specific cost of capital is the cost that a company incurs for the funds raised through a specific source.

Overall cost of capital is the weighted average cost of specific costs of capital. Hence the overall cost of capital is also termed as ‘Weighted average cost of capital (WACC)’ or simply ‘Average cost of capital’. Thus overall cost of capital is cost which the company incurs for its total financing.

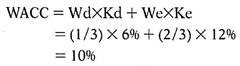

The weights may be assigned either on the basis of book values or on the basis of market values. For example let us assume that a company has Rs.1,00,000 market value of debt capital and Rs.2,00,000 market value of equity capital.

So the total amount of capital is Rs.3,00,000. Cost of debt (Kd) is 6% while cost of equity (Ke) is 12%. In this case the weight of debt capital is 1 / 3 i.e. 1,00,000/ Rs.3,00,000 and weight for equity capital is 2/3 i.e. Rs.2,00,000/3,00,000.

Hence weighted average cost of capital (WACC) or overall cost of capital is calculated as below:

Type # 4. Marginal Cost of Capital:

Marginal cost of capital is the average cost of incremental funds raised by the company. It must be noted that as the amount of debt capital increases in a company, the cost of debt and cost of equity does not remain the same, rather increase.

Hence marginal cost of capital does take into account any increase in such specific cost of capital. The weights for marginal cost of capital are generally based on market values.

Types of Cost of Capital – Historical Cost vs. Future Cost, Average Cost vs. Incremental/Marginal Cost, Actual Cost vs. Opportunity Cost, Before Tax and After Tax Cost of Capital

The important types of cost of capital are as follows:

1. Historical Cost vs. Future Cost:

ADVERTISEMENTS:

When the cost of capital pertains to the funds which were obtained in the past, it is called the historical cost. However, when we are planning for the future, this historical cost may be of little use. We will have to estimate the cost of funds for the future, which may be higher or lower than the historical cost.

2. Average Cost vs. Incremental/Marginal Cost:

When we collect funds from several sources, we can calculate its average cost of capital. However, for financing some extra amount, the cost of capital may be different. This cost needed for additional funding will be called incremental cost. The cost of capital of the last unit of capital will be called the marginal cost of capital.

3. Actual Cost vs. Opportunity Cost:

When we pay interest on any capital, it is known as the actual cost of capital. However, many times we use funds for which we do not expressly pay any interest, like the retained earnings or some unutilized cash. But this should not be treated as free of cost. In such a case, we will use the opportunity cost of these funds and that will represent the cost of capital of that source.

4. Before Tax and After Tax Cost of Capital:

The interest and other expenses incurred for raising finance are allowed as an expense under the Income Tax rules and thus the burden of this cost is reduced to a great extent, depending upon the tax rate.

ADVERTISEMENTS:

Thus, we can find both – the before tax cost of capital and after tax cost of capital. Since, in an investment decision, we use ‘Cash-Flows after Tax’ (CFATs), it is very logical that we use the cost of capital also on an after tax basis.

Types of Cost of Capital – Explicit and Implicit Cost, Specific and Combined Cost, Average and Marginal Cost, Historical and Future Cost

Cost of capital is defined in several ways—the minimum required rate of return that a project must earn, the cost of using funds in the firm, the cut-off rates for capital expenditure or the target rate of return on investment.

Cost of capital may be classified into the following types on the basis of its nature and usage:

1. Explicit and Implicit Cost

ADVERTISEMENTS:

2. Specific and Combined Cost

3. Average and Marginal Cost

4. Historical and Future Cost

Type # 1. Explicit Cost and Implicit Cost:

The cost of capital may be explicit or implicit cost on the basis of the computation of the cost of capital.

i. Explicit Cost of Capital:

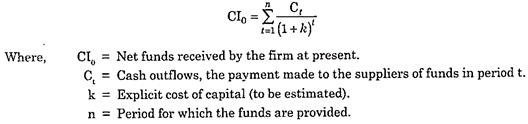

It is the rate that the firm pays towards the procurement of funds. The cost of raising funds involves both cash inflows (receipt of funds raised) and the cash outflows (repayment of principal and the interest thereon).

ADVERTISEMENTS:

Explicit cost of any source may be defined as the discount rate that equates the present value of the funds raised by a firm with the present value of expected cash outflows.

It is the internal rate of return and is calculated with the following formula:

To illustrate, let us assume that a firm accepts a loan of Rs.5,00,000. This firm also promises to pay Rs.50,000 per year to the lender. The company’s total inflow will be Rs.5,00,000 and total outflow of cash will be Rs.50,000 per year and if there is no cost of capital, then this loan can be repaid within 10 years.

But it is not possible that firms would receive loans without paying interest. The rate of interest which the firm pays so as to equate the present value of Rs.5,00,000 with the stream of payments of Rs.50,000 per year for a number of years is the explicit cost of capital.

Explicit cost of retained earnings is zero, as there is no cash outflow associated with its use in the firm, though such funds do have an implicit cost of capital.

Similarly, the cost of interest free loan shall also be zero because the outflow of cash in terms of principal amount shall exactly be equal to the inflows. Apart from these, interest paid on capital, dividend paid on preference shares, interest on debentures and so on are examples of explicit cost.

ADVERTISEMENTS:

ii. Implicit Cost of Capital:

This cost arises because of an ability of a firm to have an alternative use of funds. It is defined as the rate of return associated with the best investment opportunity for the firm (and its shareholders) that shall be foregone, if the projects presently under consideration by the firm are accepted.

Implicit cost is also known as the opportunity cost as it is the cost of the opportunity foregone in order to take up a particular project. For example, the implicit cost of retained earnings is the rate of return available to shareholders by investing the funds elsewhere.

To illustrate, let us assume that shareholders can earn an interest of 10% by investing the funds that will be distributed as dividend to them. However, if the firm decides to retain the profits and does not distribute dividends, this is the return foregone by the shareholders and can be referred to as implicit cost.

Difference between Explicit Cost and Implicit Cost:

The following are the major differences between explicit cost and implicit cost:

ADVERTISEMENTS:

(a) Explicit costs involve cash outflows in terms of interest, dividend and so on whereas implicit costs do not involve any cash outflows.

(b) Explicit cost is also known as out-of-pocket cost while implicit costs are known as imputed cost.

(c) Explicit cost can be easily ascertained, but it is just opposite in the case of implicit cost as it does not have any paper trail.

(d) The measurement of explicit cost is objective in nature because it is actually incurred whereas implicit cost occurs indirectly and that is why its measurement is subjective.

(e) Explicit cost helps in the calculation of both accounting profit and economic profit. Conversely, implicit cost helps in the calculation of only economic profit.

(f) Explicit Cost is recorded and reported to the management. On the other hand implicit cost is neither recorded nor reported to the management of the firm.

Type # 2. Specific Cost and Composite Cost:

ADVERTISEMENTS:

i. Specific Cost of Capital:

The cost of each component of capital is known as the specific cost of capital. A firm raises capital from different sources- such as equity, preference, debentures, and so on. The cost of equity, the cost of debt, cost of preference capital and cost of retained earnings are examples of the specific costs of capital.

The cost of capital of each component, when appropriately averaged becomes a representative measure of the cost of capital. The specific costs are used to appraise the profitability of a project when it is financed from a specific source of finance.

ii. Composite Cost:

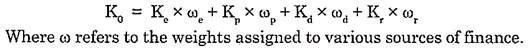

When the specific cost of each source of finance is combined together using an appropriate average, it is called combined or composite cost. It can be computed as-

K0 is the composite cost.

Ke, Kp, Kd, Kr are the cost of equity, preference shares, debt and retained earnings respectively. Composite cost is also known as the weighted average cost of capital. It is a useful measure while choosing a capital structure and also while taking capital budgeting decisions.

As it combines the cost of all sources of capital, it is also called overall cost of capital. It is used to understand the overall cost associated with the aggregate of finance raised in a firm. This overall cost of capital is used to appraise the profitability of a project that is funded from more than one source of finance.

Type # 3. Average Cost and Marginal Cost:

i. Average Cost of Capital:

The capital structure includes inter-alia the debt capital that carries fixed interest charge; equity capital that carries variable return to the shareholders; preference capital that carries fixed dividend rate and the retained earnings on which a firm does not incur any explicit cost.

The average cost of capital is computed by measuring the specific cost of each component of capital and then finding out their average by applying weights to each component as per its contribution to the capital structure. It considers weighted average cost of all kinds of financing such as equity, debt, retained earnings and so on.

Normally, the weighted average is used to measure the overall cost of capital so that various components of costs are accorded due importance in accordance with their contribution in the formation of capital structure.

ii. Marginal Cost of Capital:

Marginal cost of capital (MCC) refers to the change in the overall cost of capital that results from the raising of one more rupee of fund. It is also called the incremental or differential cost of capital. It can be computed on the basis of the difference between the new cost of capital and existing cost of capital after additional financing.

In other words, it is described as the weighted average cost of capital of new or additional funds required by a firm. It is the marginal cost which should be taken into consideration in investment decisions.

Type # 4. Historical Cost and Future Cost:

i. Historical Cost:

It is the cost which has already been incurred for financing a particular project. It is based on the actual cost incurred in the previous project. These are book costs relating to financing in the past.

ii. Future Cost:

It is the expected cost of financing the proposed project. Expected cost is calculated on the basis of previous experience. It is an important cost in project planning and deciding the future financial commitments.

These are useful in comparing the projected future cost of capital and current overall cost of capital for financial decision-making.

4 Main Types of Cost of Capital

Types of cost of capital are explained below:

(1) Historical Cost and Future Cost:

Historical cost is the cost which has already been incurred for financing a project. It is computed on the basis of past data. Future costs are estimated costs of funds to be raised for financing a project. Historical cost is an appraisal of past performance and helps in the estimation of future costs. For all decision making purposes, the relevant cost is future cost and not the historical cost.

(2) Specific Cost and Composite (Combined) Cost:

Capital can be raised from various sources and the cost of each source is known as specific cost. Composite cost refers to the combined cost of various sources of finance. In other words, composite cost is the weighted average cost of capital from all sources, i.e. equity shares, preference shares, long term debt etc. It may also be called overall cost of capital.

The concept of specific cost is used when the profitability of a project is decided on the basis of a particular source from which the funds for the project will be raised. For example, if the cost of debt is 10% and the funds for the project are raised by debts, the project will be accepted only when the rate of return accruing from it is, at least 10%.

However, since the capital funds are obtained from a pool of different sources, it is the composite cost of capital which is considered for decision making and not the specific cost.

(3) Average Cost and Marginal Cost:

The average cost of capital is the weighted average cost computed on the basis of various sources of finance and weights assigned to them in proportion to their share in the total capital structure. Marginal cost refers to the cost of raising additional funds.

In other words, marginal cost is the weighted average cost of new capital raised by the company. In investment decisions, it is the marginal cost which is taken into consideration.

(4) Explicit and Implicit Cost:

The explicit cost may be defined in terms of interest and dividend that the firm has to pay to the suppliers of funds. For example, the firm is required to pay interest on debt, dividend at fixed rate on preference share capital and also dividend at expected rate on equity share capital. All such payments are the explicit cost of capital.

The implicit cost, also known as opportunity cost, is the cost of retained earnings. Retained earnings are the profits earned by the firm but not distributed among the equity shareholders. Had these profits been distributed to equity shareholders, they could have invested these funds elsewhere and would have earned some return.

This return is foregone by the equity shareholders when the profits are not distributed to them. As such, the firm has an implicit cost of these retained earnings. In other words, implicit cost is the rate of return at which shareholders could have invested these funds, had these been distributed to them as dividends.

Types of Cost of Capital – Future Cost and Historical Cost, Component Cost and Composite Cost, Average Cost and Marginal Cost and More…

Types of cost of capital are as follows:

Type # 1. Future Cost and Historical Cost

Future cost of capital refers to the expected cost of funds to be raised to finance a project. In contrast, historical cost represents cost incurred in the past in acquiring funds. In financial decisions, the future cost of capital is relatively more relevant and significant.

While evaluating viability of a project, the finance manager compares expected earnings from the project with expected cost of funds to finance the project. Likewise, in taking financing decisions, the attempt of the finance manager is to minimise future cost of capital and not the costs already defrayed.

This does not imply that historical cost is not relevant at all. In fact, it may serve as a guideline in predicting future costs and in evaluating the past performance of the company.

Type # 2. Component Cost and Composite Cost

A company may contemplate raising the desired amount of funds by means of different sources including debentures, preferred stock, and common stocks. These sources constitute components of funds. Each of these components of funds involves cost to the company.

Cost of each component of funds is designated as a component or specific cost of capital. When these component costs are combined to determine the overall cost of capital, it is regarded as composite cost of capital, combined cost of capital, or weighted cost of capital. The composite cost of capital, thus, represents the average of the costs of each source of funds employed by the company.

For capital budgeting decisions, composite cost of capital is relatively more relevant even though the firm may finance one proposal with only one source of funds and another proposal with another source. This is, for the fact that it is the overall mix of financing over time which is materially significant in valuing firms as an ongoing overall entity.

Type # 3. Average Cost and Marginal Cost

Average cost represents the weighted average of the costs of each source of funds employed by the enterprise, the weights being the relative share of each source of funds in the capital structure. Marginal cost of capital, by contrast, refers to incremental cost associated with new funds raised by the firm.

Average cost is the average of the component marginal costs, while the marginal cost is the specific concept used to comprise additional cost of raising new funds. In financial decisions the marginal cost concept is most significant.

Type # 4. Explicit Cost and Implicit Cost

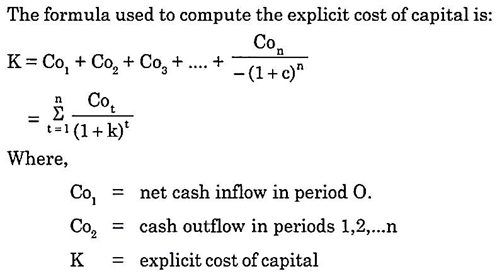

Cost of capital can be either explicit cost or implicit. The explicit cost of any source of capital is the discount rate that equates the present value of the cash inflows that are incremental to the taking of the financing opportunity with the present value of its incremental cash outlay. Thus, the explicit cost of capital is the internal rate of return of the cash flows of financing opportunity.

A series of each flows are associated with a method of financing. At the time of acquisition of capital, cash inflow occurs followed by the subsequent cash outflows in the form of interest payment, repayment of principal money or payment of dividends.

Thus, if a company issues 10 per cent perpetual debentures worth Rs. 10,00,000, there will be cash inflow to the firm of the order of 1,00,000. This will be followed by the annual cash outflow of Rs. 1,00,000. The rate of discount, that equates the present value of cash inflows with the present value of cash outflows, would be the explicit cost of capital.

The technique of determination of the explicit cost of capital is similar to the one used to ascertain IRR, with one difference, in the case of computation of the IRR, the cash outflows occur at the beginning followed by subsequent cash inflows, while in the computation of explicit cost of capital, cash inflow takes place at the beginning followed by a series of cash inflow subsequently.

The explicit cost of an interest bearing debt will be the discount rate that equates the present value of the contractual future payments of interest and principal with the net amount of cash received today. The explicit cost of capital of a gift is minus 100 percent, since no cash outflow will occur in future.

Similarly, explicit cost of retained earnings which involve no future flows to or from the firm is minus 100 percent. This should not tempt one to infer that the retained earnings is cost free.

The cost of retained earnings is the opportunity cost of earning on investment elsewhere or in the company itself. Opportunity cost is technically termed as implicit cost of capital. It is the rate of return on other investments available to the firm or the shareholders in addition to that currently being considered.

Thus, the implicit cost of capital may be defined as the rate of return associated with the best investment opportunity for the firm and its shareholders that will be foregone if the project presently under consideration by the firm were accepted.

In this connection it may be mentioned that explicit costs arise when the firm raises funds for financing the project. It is in this sense that retained earnings have implicit cost. Other forms of capital also have implicit costs once they are invested.Thus in a sense, explicit costs may also be viewed as opportunity costs. This implies that a project should be rejected if it has a negative present value when its cash flows are discounted by the explicit cost of capital.