Everything you need to know about the Objectives of Financial Management. Financial Management is an important functional area of business. The objectives of financial management should, therefore, be consistent with the overall objectives of the business.

It is the duty of the top management to lay down the objectives or goals which are to be achieved by the business. In order to make wise financial decisions a clear understanding of the objectives of the business is necessary. Objectives provide a framework within which various decisions relating to investment, financing and dividend are to be taken.

Financing decisions help the management measure which activities should be undertaken and which policies should be followed. The main objective of any firm should be to maximise the economic welfare of its shareholders.

Learn about the objectives of financial management: 1. Profit Maximization 2. Wealth Maximization/Shareholders’ Value Maximization (SVM) 3. Value Maximization

ADVERTISEMENTS:

1. Profit maximisation is used as a standard of financing decisions. According to this approach, a firm should undertake all those activities which add to its profits and eliminate all others which reduce its profits. This objective highlights the fact that all the decisions—financing, dividend and investment, should result in profit maximisation.

2. The wealth maximisation approach has been recognised for the evaluation of performance of a business undertaking. It is also known as value maximisation or maximisation of net present worth. According to this approach, financial management should take such decisions which increase the net present value of the firm.

3. Value maximization may be defined as the managerial function involved in the appreciation of the long-term market value of an organization. The total value of an organization is comprised of all the financial assets, such as equity, debt, preference shares, and warrants. The total value of an organization increases when the value of its shares increases in the market.

Objectives of Financial Management: Profit Maximization, Wealth Maximization, Value Maximization, Cost Minimization, Sources of Funds and Wealth in the Long-Run

Top 2 Objectives of Financial Management – Profit and Wealth Maximization

It is the duty of the top management to lay down the objectives or goals which are to be achieved by the business. In order to make wise financial decisions a clear understanding of the objectives of the business is necessary. Objectives provide a framework within which various decisions relating to investment, financing and dividend are to be taken.

ADVERTISEMENTS:

In other words, objectives lay down a criterion by which the efficiency and profitability of a particular decision is evaluated. The choice of such a criterion lies between profit maximization and wealth maximization.

Hence, there are two objectives in this regard:

(1) Profit Maximization, and

(2) Wealth Maximization

Objective # (1) Profit Maximization:

ADVERTISEMENTS:

According to this approach, all activities which increase profits should be undertaken and which decrease profits should be avoided. Profit maximization implies that the financial decision making should be guided by only one test, which is, select those assets, projects and decisions which are profitable and reject those which are not.

The following arguments are advanced in favour of this approach:

(i) Measurement of Performance

Profit is a test of economic efficiency of a business. It is a yardstick by which the economic performance of a business can be judged.

(ii) Efficient Allocation and Utilisation of Resources

Profit maximization leads to efficient allocation and utilisation of scarce resources of the business because sources tend to be directed to uses from less profitable projects to more profitable projects.

(iii) Maximisation of Social Welfare

Profitability is essential for fulfilling the goal of social welfare also. Maximization of profits leads to the maximization of social welfare.

(iv) Source of Incentive

ADVERTISEMENTS:

Profit acts as a motivator or incentive which induces a business organisation to work more efficiently. If profit motive is withdrawn the pace of development will be reduced.

(v) Helpful in Facing Adverse Business Conditions

Economic and business conditions go on changing from time to time. There may be adverse business conditions like recession, severe competition etc. Under adverse circumstances a business will be able to survive only if it has some past earnings to rely upon. Hence, a business should maximize its profits when the circumstances are favourable.

(vi) Helpful in the Growth of the Firm

ADVERTISEMENTS:

Profits are the major source of finance for the growth of a firm.

However, the profit maximization approach has been criticised on several grounds:

(i) Ambiguous:

One practical difficulty with this approach is that the term profit is vague and ambiguous. Different people take different meanings of term profit. For example, profit may be short-term or long-term, it may be before tax or after tax, and it may be total profit or rate of profit. Similarly, it may be returned on total capital employed or total assets or shareholders’ funds and so on.

ADVERTISEMENTS:

(ii) Ignores the Time Value of Money:

This approach ignores the time value of money, i.e., it does not make a distinction between profits earned over the different years. It ignores the fact that the value of one rupee at present is greater than the value of the same rupees received after one year. Similarly, the value of profit earned in the first year will be more in comparison to the equivalent profits earned in later years.

(iii) Ignores Risk Factor:

This approach ignores the risk associated with the earnings. If the two firms have the same total expected earnings, but if earnings of one firm fluctuate considerably as compared to the other, it will be more risky.

Investors in general, have a preference for a lower income with less risk in comparison to high income with greater risk. But this approach does not pay any attention to the risk factor.

(iv) Ignores Future Profits:

ADVERTISEMENTS:

The business is not solely run with the objective of maximising immediate profits. Some firms place more importance on growth of sales. They are willing to accept lower profits to achieve stability provided by a large volume of sales.

(v) Ignores Social Obligations of Business:

This approach ignores the social obligations of business to various social groups like workers, consumers, society, Government etc. A firm cannot exist for long when interests of social groups are ignored because these groups contribute to its smooth run.

(vi) Neglects the Effects of Dividend Policy on Market Price of the Shares:

Under this approach the firm may not think of paying dividends because retaining profit in the business may satisfy the goal of maximising the earning per share.

It is, thus, clear that profit maximization criterion is inappropriate and unsuitable. It is not only ambiguous but fails to solve the problems of time value of money and the risk. An alternative to profit maximization, which solves these problems, is the criterion of wealth maximization.

Objective # (2) Wealth Maximization:

ADVERTISEMENTS:

This approach is now universally accepted as an appropriate criterion for making financial decisions as it removes all the limitations of profit maximization approach. It is also known as net present value (NPV) maximization approach. According to this approach the worth of an asset is measured in terms of benefits received from its use less the cost of its acquisition.

Benefits are measured in terms of cash flows received from its use rather than accounting profit which was the basis of measurement of benefits in profit maximization approach. Measuring benefits in terms of cash flow avoids the ambiguity in respect of the meaning of the term profit.

Another important feature of this approach is that it also incorporates the time value of money. While measuring the value of future cash flows an allowance is made for time and risk factors by discounting or reducing the cash flows by a certain percentage. This percentage is known as discount rate.

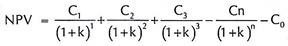

The difference between the present value of future cash inflows generated by an asset and its cost is known as net present value (NPV). A financial action (or an asset or a project) which has a positive NPV creates wealth for shareholders and, therefore, is undertaken.

On the other hand, a financial action resulting in negative NPV should be rejected since it would reduce shareholder’s wealth. If one out of various projects is to be chosen, the one with the highest NPV is adopted. Hence, the shareholder’s wealth will be maximized if this criterion is followed in making financial decisions.

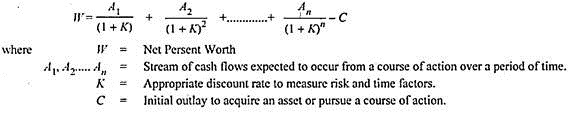

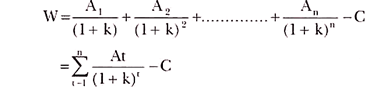

The NPV can be calculated with the help of the following formula:

If W or NPV is positive, the firm should acquire the asset or pursue a particular course of action. On the contrary, if W is negative the asset should not be acquired or that particular course of action should not be taken.

ADVERTISEMENTS:

Profit Maximization versus Wealth Maximization:

The wealth maximization approach is superior to the profit maximization approach.

It has the following advantages in its favour:

(1) It uses cash flows instead of accounting profits which avoids the ambiguity regarding the exact meaning of the term profit.

(2) It gives due importance to the time value of money by reducing the future cash flows by an appropriate discount or interest rate. If higher risk and longer time period are involved, higher rate of discount or interest will be used to find out the present value of future cash benefits. The discount or interest rate will be lower for the projects which involve low risk.

ADVERTISEMENTS:

(3) It gives due importance to payment of regular dividends – In this approach financial decisions are taken in such a way that the shareholders receive the highest combination of dividends and increase in the market price of the shares.

(4) It gives due importance to risk factor and analyses risk and uncertainty so that the best course of action can be selected out of different alternatives.

(5) It gives due importance to social responsibilities of the business.

(6) It takes into consideration long-run survival and growth of the firm.

2 Main Long Run Objectives of Financial Management – Profit and Wealth Maximisation (With Favourable and Unfavourable Arguments)

But the ultimate long run objectives of the financial management can be categorized into the following two parts:

1. Profit maximization

2. Wealth maximization

Objective # 1. Profit Maximization:

No business can survive in the long run without earning profit. It is rightly said that profit is the biggest motivator for an entrepreneur, so we can say that profit maximization is the main objective of financial management.

All the economic activities are also done for the purpose of earning profit. Profit is the techniques to measure the efficiency of the business concern.Profit is an important component of any business. Without profit earning ability it is very difficult to stay alive in the market.

If a firm continues to earn large amounts of profits then only it can manage to serve the society in the long run. So, profit maximization is considered as the main objective of the business.

Favorable Arguments for Profit Maximization:

The following important points are in support of the profit maximization objectives of the business concern:

(i) Everyone is working to get reward and the reward of the entrepreneur is profit so the main aim of the entrepreneur should be to earn maximum profit, there is nothing wrong in this.

(ii) Profit is the barometer of the business operation efficiency. Today we give the ranking to the business concerns on the basis of profit they have earned, and everyone wants to be in the number one position. So, profit maximization is justified on the grounds of rationality.

(iii) Profit reduces risk of the business concern. A business will be able to survive in an unfavorable situation, only if it has some past earnings to rely upon. Therefore, a business should try to earn more and more when the situation is favorable.

(iv) Profit is the main source of finance for the growth and development of business concern. So profit maximization should be the ultimate objective of the concern.

(v) Profitability meets the social needs also. According to Adam Smith – business men in order to fulfill their profit motive in turn benefits the society as well. It is seen that when a firm tends to increase profit it eventually makes use of its resources in a more effective manner.

(vi) Firms which tend to earn continuous profit in the long run make up their products according to the demand of the consumers.

Unfavorable Arguments for Profit Maximization:

The following important points are against the objectives of profit maximization:

(1) It leads to exploiting the consumers by charging high prices to get more profits.

(2) It leads to exploitation of the workers also by creating pressure on them for more production to earn more profit.

(3) For achieving the Profit maximization objective sometimes businessmen uses immoral practices such as corrupt practice, unfair trade practice, etc.

(4) Profit maximization objectives lead to increase in the inequalities in the society.

Drawbacks of Profit Maximization:

Profit maximization objective consists of certain drawback also:

(a) It is vague

In this objective, profit is not defined precisely or correctly. It creates some unnecessary opinions regarding earning habits of the business concern. Does it mean short- term profits or long-term profits? Does it mean total profits or earnings per share? Should we take profit before tax or after tax?

(b) It ignores the time value of money

Profit maximization ignores the timings of costs, and returns and thereby ignores the time value of money. In this method only monetary benefits and costs are considered the absolute value terms without adjusting for time value.

(c) It ignores risk

Profit maximization does not consider risk of the business concern. Risks may be internal or external which will affect the overall operation of the business concern. Risk and profit are directly and positively related. But management would welcome higher profit but not the higher risks.

Hence, financial management should aim at maximizing profits with minimum risk. But this approach gives no guide on the level of risk and uncertainty that might appropriately be accepted along with a profit forecast.

(d) It ignores the society

The profit maximization concept doesn’t consider the benefit of society; it is only related to the profit. It ignores the workers, shareholders, consumers and growth of the society.

(e) It is incomplete concept

As the profit maximization is only related with the businessmen. So it is an incomplete concept because it considers only businessmen.

Objective # 2. Wealth Maximization/Shareholders’ Value Maximization (SVM):

There are so many drawbacks of profit maximization objectives and that is not accepted universally. Wealth maximization is one of the modern approaches which try to overcome the drawbacks of profit maximization.

The term wealth means shareholder wealth or the wealth of the persons who are involved in the business concern. Wealth maximization is also known as value maximization or net present worth maximization. This objective is a universally accepted concept in the field of business.

According to Prof. Solomon Ezra, the ultimate goal of financial management should be the maximization of the owner’s wealth. According to him, the maximization of profit is half and unreal motive.

The proper goal of financial management is wealth maximization of equity shareholders as it is expressly concerned with the relationship of profitability and the volume of capital being used in the enterprise. In other words, the finance manager should attempt to maximize the value of the enterprise to its shareholders.

Hence, the ultimate goal of financial management should be to maximize the market price of the shares of the company. However, the maximization of market price of the share should be in the long-run. This price takes into account the present and prospective future earnings per share, the timing and the risk of these earnings, the dividend policy of the enterprise and many other factors.

Thus, we can conclude that Wealth maximization is the most appropriate objective of a firm because, in addition to the shareholders, it serves the interest of all the people which are directly or indirectly linked with the organization. It takes care of the consumers, employees, management as well as society also.

Favorable Arguments for Wealth Maximization:

(i) It considers maximizing the stockholder wealth instead of profit of the firm.

(ii) It considers the time value of money.

(iii) It considers the risk of the business concern.

(iv) It provides efficient allocation of resources.

(v) It ensures the economic interest of the society.

Comparative Analysis of Profit Maximization and Wealth Maximization:

We compare both these as follows:

1. Profit Maximization:

i. It is only for short term

ii. It emphasis on profit only

iii. It ignores society

iv. It has a narrow scope

v. It is a traditional approach

vi. It ignores the risk factor

vii. It ignores the time value of money

viii. It is secondary objective

ix. It does not consider the effect of earnings per share, dividends paid or any other return to shareholders on the wealth of the shareholders

2. Wealth Maximization:

i. It is for long term

ii. It emphasis on shareholders wealth

iii. It considers society

iv. It has a wider scope

v. It is a modern approach

vi. It considers the risk factor

vii. It considers time value of money

viii. It is primary objective

ix. It considers the effect of earnings per share, dividends paid or any other return to shareholders on the wealth of the shareholders.

We can say that wealth maximization should be the primary objective and profit maximization should be the secondary objective of the firms.

What are the Objectives of Financial Management? (With Arguments, Criticism and Equation)

It is the duty of management to clarify the objectives of business so that the departmental objectives could be determined accordingly. Financial objectives of a firm provide a concrete framework within which optimum financial decisions can be made.

The objectives should be such that they enable the evaluation of efficiency and effectiveness of funds management decisions, investment and dividend decisions, etc.

Financing decisions help the management measure which activities should be undertaken and which policies should be followed. The main objective of any firm should be to maximise the economic welfare of its shareholders.

Accordingly, there are two major objectives in this regard:

(1) Profit Maximisation

(2) Wealth Maximisation

(1) Profit Maximisation:

Profit maximisation is used as a standard of financing decisions. According to this approach, a firm should undertake all those activities which add to its profits and eliminate all others which reduce its profits. This objective highlights the fact that all the decisions—financing, dividend and investment, should result in profit maximisation.

Following arguments are given in favour of profit maximisation approach:

(i) Profit is a yardstick of efficiency on the basis of which economic efficiency of a business can be evaluated.

(ii) It helps in efficient allocation and utilisation of the scarce means because resources are applied to such uses only which maximise the profits.

(iii) The rate of return on capital employed is considered the best measurement of the profits.

(iv) Profit acts as a motivator which helps the business organisation in becoming more efficient through hard work.

(v) By maximising profits, social and economic welfare is also maximised.

(vi) Every business has limited capital, therefore, its efficient use is measured in terms of maximum profits.

However, the profit maximisation approach has been criticised on various counts:

(i) Ambiguity:

One of the major limitations of the profit maximisation approach in actual practice is that it is ambiguous. Profit can be expressed in various forms. Different people have different meanings of the term ‘profit’ e.g., it can be short-term or long-term. It can be total profit or rate of profit. Similarly, profit can be before tax profit or after tax profit.

It can be gross profit or net profit. In the same manner, it can be a rate of return on capital employed or total assets or shareholders’ funds. Now the question arises, which profits be maximised under the profit maximisation approach. Sometimes, firms increase their profits by reducing expenditure on machinery but it reduces the productivity of business in the long run.

(ii) Time Value of Money:

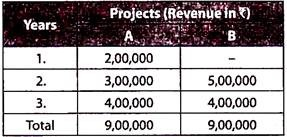

Profit maximisation approach is also criticised because it ignores the time value of money i.e., under this approach income of different years gets equal weight. But, in fact, the value of rupee today will be greater as compared to the value of rupee receivable after one year. In the same manner, the value of income received in the first year will be greater from that which will be received in the later year’s e.g.-

The profits of two different projects are:

Both the projects have a total earning of Rs.20, 000 in 3 years. And according to the profit maximisation approach, both will be considered equally profitable. But Project I has greater profits in the initial years of the project and therefore, is more profitable in terms of value of income. The profits earned in the initial years can be reinvested and more profits can be earned.

(iii) Risk Factor:

Another important reason for criticising the profit maximisation approach is that it ignores risk factors. The certainty or uncertainty of income receivable in future can be high or low. High uncertainty increases risk and low uncertainty reduces the risk. Less income with more certainty is considered better as compared to high income with greater uncertainty. But the profit maximisation approach does not pay any attention to this certainty.

Thus, the profit maximisation approach was more significant for sole traders and partnership firms because at the time when personal capital is invested in business, they want to increase their assets by maximising profits. But today ownership and management have separated due to the establishment of more and more corporations.

Companies are now managed by professional managers. Capital in companies is provided by shareholders, debenture holders, financial institutions, etc.

Besides these parties, creditors, customers, government employees, etc. are also interested in the operation of the business. One of the major responsibilities of business management is to co-ordinate the conflicting interests of all these parties. In such a situation, profit maximisation approach does not appear proper and practicable for financial decisions.

(2) Wealth Maximisation:

The wealth maximisation approach has been recognised for the evaluation of performance of a business undertaking. It is also known as value maximisation or maximisation of net present worth. According to this approach, financial management should take such decisions which increase the net present value of the firm.

And it should not undertake any activity which decreases net present value. This approach eliminates all the three basic criticisms of the profit maximisation approach. As the value of an asset is considered from the viewpoint of the profits accruing from it, in the same manner, the evaluation of an activity depends on the profits arising from it.

Therefore, all the three main decisions of a financial manager financing decision, investment decision and dividend decision affect net present value of the firm. Net present worth, gross present worth and the initial capital investment are different from each other. If the gross present worth is more than the initial investment, the value of the firm will increase and if the gross present worth is less than the amount of capital invested, the value of the firm will decrease.

In other words, the greater the amount of the net present value, the greater will be the value of the firm and more it will be in the interests of shareholders. When the value of a firm increases, the market price of equity shares also increases.

Therefore, an increase in the market price of shares is considered a sign of increase in the value of a firm. Thus, the maximisation of net present worth means the maximisation of the market price of shares.

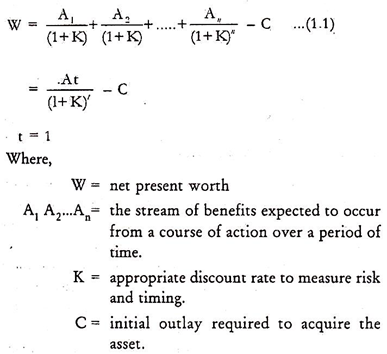

Net present worth can be calculated with the help of following equation:

where, W = Net present worth

A1, A2…………… An = Stream of expected cash benefits from a course of action over a period of time.

K = Appropriate discount rate to measure risk and timing.

C = Initial outlay to acquire that asset or pursue the course of action.

If W is positive, the decision or the course of action should be taken. On the other hand, if W is negative, the decision or course of action should not be taken.

If W is zero, it would mean that it does not add or reduce the present value of the asset.

The wealth maximisation approach is considered good for the companies in present situation. This approach gives due consideration to the time value of expected income receivable over different periods of time. Under this approach, risk or uncertainty is analysed with the help of interest rate.

If uncertainty and time period are greater, a higher rate of interest/discount will be used to calculate present value of the expected future cash benefits, whereas the interest/discount rate will be lower for the projects with low risk and uncertainty. Besides, this approach uses cash flows instead of accounting profits which removes the ambiguity associated with the term ‘profit’.

On the basis of the above explanation, we can conclude that wealth maximisation approach is better than profit maximisation approach.

Explain the Basic Objectives of Financial Management – Profit, Wealth and Value Maximization (With Figure of Risk-Return Trade off)

Financial management involves the effective utilization of all the financial resources to achieve the financial objectives of an organization. The objective of financial management may be broadly categorized as profit maximization, wealth maximization, and value maximization.

The primary objective of financial management is to maximize the profit of the organization. However, the organization also seeks to maximize the wealth and value by maximizing the returns to shareholders.

The profit maximization approach focuses on the high rate of return on investment by using the organizational resources effectively. The wealth maximization approach focuses on increasing Earning per Share (EPS) to increase the wealth of the shareholders.

However, the objective of the value maximization approach is to increase the turnover of the organization by effective utilization of the long-term resources.

Objective # 1. Profit Maximization:

In today’s highly competitive environment, every organization tries to maximize its profit.

Profit maximization is the one of the basic objectives of all organizations because of the following reasons:

i. Required for Organization’s Survival

Implies that in the long run only those organizations can survive, which have the capacity to make profit, cope up with changes, and meet the level of competition. Thus, making profit is an essential condition to survive for an organization.

ii. Meeting the other Organizational Objectives

Requires finance, which an organization can obtain if it earns sufficient profit. Therefore, an organization needs to maximize its profit to finance its various activities on a regular basis.

iii. Measuring Growth

Refers to estimating the development of the organization. Profit is an indicator of growth of an organization. Therefore, if an organization wishes to grow then it strives to maximize its profit.

iv. Measuring Efficiency

Refers to estimating the capability of an organization to use its funds rationally. If an organization is earning high profit then it is said to be efficient. Therefore, profit maximization is an indicator of efficiency of the organization. In addition, it is the most important element to judge the credibility of an organization.

The profit maximization approach has been criticized on the following points:

i. Different Objectives of an Organization

Refers to the fact that organizations may have objectives other than the profit maximization. For example, some organizations may pursue goals of sales maximization or greater stability.

ii. Ignoring Social Aspect

Refers to the fact that the objective of profit maximization does not take into consideration the welfare of the society. If an organization wishes to survive in the long run then it must take into account the effects of its operations on the society.

iii. Adopting Narrow Approach

Means that the profit maximization approach does not take into account the past performance and the future aspects of a business. It is merely concerned with the profit maximization of its organization.

iv. Ignoring the long-term objectives

Means that the profit maximizing approach does not take into consideration the long-term objectives, such as wealth maximization. This approach focuses only on profit maximization, which is short-term in nature.

Objective # 2. Wealth Maximization:

The wealth maximization approach has been recommended by several economists to overcome the limitations of profit maximization approach. The objective of wealth maximization approach is to increase the wealth of the shareholders. The wealth maximization approach aims at maximizing the wealth of the shareholders by increasing EPS.

The benefits of the wealth maximization approach are as follows:

i. Superior to Profit Maximization

Implies that the wealth maximization approach is considered better than profit maximization because wealth maximization approach focuses on the long-term growth and development of an organization.

ii. Fulfilling the Goals of Different Departments

Refers to achieving the goals of different departments, such as production, marketing, and human resource, of an organization. If the organization has enough wealth then it can easily fulfill the requirements of all its departments.

iii. Increase in EPS

Refers to the increase in the value of shares due to increase in overall wealth of the organization. The wealth maximization approach focuses on the appreciation of EPS by increasing the profitability and productivity of the organization.

iv. Efficient Allocation of Resources

Indicates the growth in productivity and fall in the cost of production. The wealth maximization approach ensures that the resources of an organization have been used effectively to accomplish the objectives of the organization.

v. Ensuring Social Interest

Refers to the fact that the wealth maximization approach takes into consideration the impact of its operations on the society. The wealth maximization approach also promotes the usage of eco-friendly techniques of production to ensure the social interest of the organization.

Although, wealth maximization approach is a very successful approach and widely accepted by the organizations; yet it suffers from some limitations.

The limitations of the wealth maximization approach are as follows:

i. Useful for Large Organizations Only

Refers to the fact that the wealth maximization approach is applied successfully only in large organizations. The small organizations have limited financial resources; therefore, they prefer to maximize their profit first.

ii. Does not distribute dividend regularly

Refers to the fact that the dividends are not awarded regularly to the shareholders. The organization retains profit with itself to invest in further profitable projects for increasing its wealth.

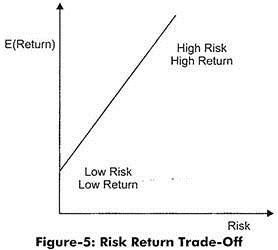

An organization adopts the wealth maximization approach, if it wants to survive in the long run. In the wealth maximization approach, the organization needs to understand the risk return trade-off because the estimation of risk would help in predicting the returns for long-term investments. Let us discuss the concept of risk-return trade-off to better understand the implication of the wealth maximization approach.

Different investment decisions involve different degrees of risks. If an investment decision does not carry high risk then the return on that investment would not be higher. For example, the government securities are considered to be one of the safest modes of investments and they carry very moderate returns. Therefore, higher the risk in an investment, higher would be the returns.

The relationship between risk and return is explained with the help of risk return trade-off, which is shown in Figure-5:

The relationship between risk and return (as shown in Figure-5) can be simply expressed as follows:

Return = Risk-free Rate + Risk Premium

Where;

Risk-free rate is that rate that does not involve the risk of loss.

A risk premium is provided to investors, if they invest in risky securities. It is an additional amount that is provided over the risk-free rate to the investors.

A proper balance between risk return should be maintained to maximize the market value of an organization.

Difference between Profit Maximization and Wealth Maximization:

The difference between the profit maximization and wealth maximization approach are as follows:

Profit Maximization Approach:

i. Strives to increase the profit of the organization.

ii. Measures the effectiveness of the organization.

iii. Fulfills the short-term objectives of an organization.

iv. Does not involve descriptive approach as it is intended to accomplish the short-term objectives.

v. Does not provide clarity on whether the earnings would be distributed or retained in the organization.

vi. Does not involve directly in increasing the EPS of the organization. The profitability of the organization indirectly increases EPS.

vii. Does not take into account the time value of money

Wealth Maximization Approach:

i. Strives to increase the wealth of the shareholders.

ii. Measures the financial stability of the organization.

iii. Fulfills the long-term objectives of an organization.

iv. Involves a descriptive approach as it accomplishes the long- term objectives.

v. Distributes the earnings among shareholders as dividend.

vi. Involves directly in increasing EPS of the organization. The growth in the value of the shares increases the wealth of the shareholders.

vii. Takes into consideration the time value of money

Objective # 3. Value Maximization:

Value maximization may be defined as the managerial function involved in the appreciation of the long-term market value of an organization. The total value of an organization is comprised of all the financial assets, such as equity, debt, preference shares, and warrants. The total value of an organization increases when the value of its shares increases in the market.

The prime goal of an organization is to maximize the market value of its equity shares. The value of these shares acts as a benchmark to measure the performance of the organization. Value maximization is similar to wealth maximization, which focuses on increasing the value of shares that in turn means increasing the wealth of shareholders.

However, value maximization is a broader concept than wealth maximization as value maximization seeks to maximize not only the value of its equity shares but also the value of all its financial assets. If an organization is able to maximize its value then it can generate sufficient returns to pay dividend to the shareholders and finance all its activities, operations, and projects.

Primary Objectives of Financial Management for Maximising Owner’s Welfare

Financial Management is an important functional area of business. The primary objective of financial management should, therefore, be consistent with the overall objectives of the business.

The financial management of an organisation seeks to achieve the following objectives:

(i) To ensure regular and adequate supply of funds at reasonable cost.

(ii) To ensure optimum utilisation of funds, they should not be wasted in unprofitable projects.

(iii) To ensure safety on investment, so that adequate rate of return can be achieved.

(iv) To ensure adequate returns to the shareholders.

(v) To minimise the cost of capital by developing a sound capital structure.

(vi) To create reserves for the future growth and expansion.

(vii)To maintain proper coordination between the finance department and other departments of the company.

Profit Maximisation vs. Wealth Maximisation:

The overall objective of financial management is to maximise owners’ welfare, i.e., to provide maximum return to the owners on their investment.

There are two widely discussed objectives for maximising owner’s welfare:

(i) Profit Maximisation; and

(ii) Wealth Maximisation.

Traditionally, the primary objective of a business is to earn profit. The finance manager has to take decisions in a manner that the profits of the concern are maximised. Profit is the parameter to measure the efficiency of a business concern.

Profit maximisation is also the narrow approach which aims at maximising the profit of the concern and hence reducing the risk of the business.

However, profit maximisation cannot be the sole objective of a company because of the following difficulties:

(a) The concept is vague. It does not clarify between the short-run and long-run profits.

(b) It ignores the timing of returns. The time value of money is not taken into account. The value of returns today cannot be equated with those received five years hence.

(c) It overlooks the uncertainty of future earnings. The more certain the expected return, the higher the quality of benefits.

(d) It does not take into consideration the interests of consumers, workers, government and society.

(e) It does not consider the effect of dividend policy on the market price of shares.

Wealth maximisation is a modern approach in financial management involving improvements in a business concern. It simply implies maximisation of shareholder’s wealth or net present worth of a company. This objective helps in increasing the market value of shares. Wealth maximisation has been accepted as an appropriate criterion for financial management as it overcomes the limitations of profit maximisation.

Firstly, it considers the time value of money, by discounting the future cash flows at an appropriate rate. Secondly, wealth maximisation is based on cash flows and not profits. Cash flows are more exact and definite than profits, leaving no scope for any ambiguity.

Thirdly, profit maximisation presents a short term view in comparison to wealth maximisation. Short term profit maximisation compromises with the long term sustainability of business.

Lastly, wealth maximisation takes into account the risk and uncertainty factor. Higher the uncertainty, greater is the discounting rate and vice-versa.

To conclude, wealth maximisation as an objective of financial management enables the shareholders to achieve their objectives and is, therefore, superior to the profit maximisation objective. It not only serves the interests of the owners by increasing the value of their shares but ensures security to other lenders as well.

The interests of the society are also taken care of when the resources are used economically and efficiently. Wealth maximisation objective views profits from the point of long-run perspective. It takes into account the long term profitability along with other objectives of business.

State the Objectives of Financial Management (With Criticism)

Financial management is concerned with raising financial resources and their effective utilisation towards achieving the organisation’s goals. The functions of finance, namely, investment, financing and dividend policy decisions, should help to achieve the stated objectives of the firm. Since business firms are profit seeking organisations, their objectives are frequently expressed in terms of money.

The objectives of financial management can be divided into two:

1. Profit – Maximisation, and

2. Wealth – Maximisation.

Objective # 1. Profit – Maximisation:

This is the frequently stated goal of the firm. This has the benefit of being a simple and straightforward statement of purpose. This objective is easily understood as a rational goal for a business unit and focuses the firm’s efforts towards making money.

According to this approach, actions that increase profits should be undertaken and those that decrease profits are to be avoided. In other words, the profit maximisation objective implies that the functions of finance of a firm should be oriented to the maximisation of profits.

Profit is a test of economic efficiency. It provides the yardstick by which economic performance can be judged. In other words, profit maximisation aims at efficient allocation of resources, in order to increase the profitability.

But this objectives is criticised on the following grounds:

(1) Ambiguity:

One practical difficulty with profit maximisation criterion for financial decision making, is that the term profit is a vague and ambiguous concept. The term profit has no precise connotation, therefore it is amenable to different interpretations by different people and it conveys different meanings to different people.

For example- whether it is short term or long term, profit, profit before tax, or profit after tax, return on capital employed, return on shareholders’ net worth, etc.

Profit in the short run may be quite different from profits in the long run. If a firm continues to operate a piece of machinery, vehicle, or building, without proper maintenance, it may be possible to increase short term profits.

But the firm will pay the price for these short term savings in future years, when the machine, vehicle, or building, is no longer capable of operating, because of prior neglect. It is clear that maximisation of profits does not mean, neglecting the long term picture in favour of short term benefits.

(2) Timing of Benefits:

A technical objection to profit maximisation as a guide to financial decision making is that, it ignores the differences in the time pattern of benefits received, from investment proposals, or courses of action.

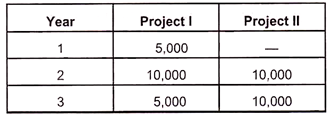

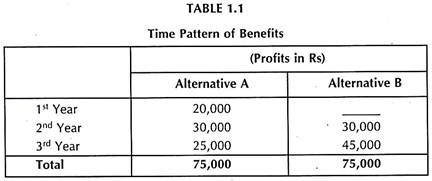

As per this objective, while working out profitability the bigger the better principle is adopted, as the decision is based on the total benefits received, over the working life of the asset, irrespective of when they were received. This can be made clear with the help of an example, given in Table 1.1.

It is clear from Table 1.1, that total profits from both the alternatives are the same and if profit maximisation is the criterion, both the alternatives would be ranked equally. But the returns from alternative A are higher in the earlier years, as compared to alternative B, where the returns are larger in later years.

Therefore, both these alternatives are not identical, because in financial planning the basic rule is that, ‘the earlier the better’. As benefits received sooner, are more valuable than benefits received later. The reason is that the benefits received in the earlier years can be reinvested to earn a return. This is known as the time value of money.

The limitation of profit maximisation objective is that it does not consider the distinction between returns received in different time periods and treats all benefits irrespective of the timing, as equally valuable. This is not true in actual practice, as the benefits received in earlier years should be valued more profitable than equivalent benefits, in later years.

Since money received earlier has a higher value than money received later, therefore the profit maximisation objective must consider the timing of cash flows and profits. So the assumption of equal value for benefits irrespective of timing, is inconsistent with the real world situation.

(3) It Overlooks Quality Aspects of Future Activities:

Apart from earning profits, business firms have to fulfill certain social objectives, such as the upliftment of the poor, environment protection, helping the weaker sections of the society, etc. Some business firms are interested in the growth of sales, even if they have to accept less profits to attain this objective.

For example- new firms, are interested in capturing the market, rather than maximising profits. Similarly when new products are introduced, free samples are distributed, or the selling price will be less, in order to promote the product.

Some business firms are interested in diversifying their activities into different products, even though it may result in short term decline in profits. For example- Godrej, Bajaj, Tata, Reliance, etc., are interested in diversifying into different products, rather than profit maximisation. Similarly, some firms utilise a portion of profits for social objectives, like running hospitals, schools, charitable services, etc.

Infosys Limited, is spending a major portion of its profits for charitable services and Tata, Bajaj, the Manipal group, etc. run hospitals and educational institutions, for social welfare. Now it is an accepted fact that business firms must also try to fulfill social objectives, rather than just maximise the profits.

(4) Quality Aspect of Benefits:

Another technical limitation of profit maximisation is that it ignores the quality aspect of benefits, associated with a financial course of action – that is, profit received in normal, boom, or in a depression state of economy, are different. The term quality, refers to the degree of certainty with which benefits can be expected. The more certain the expected return, the higher the quality of benefits.

Or the more uncertain or fluctuating the expected benefits, the lower the quality of benefits, the Investors expect steady returns and they want to minimise risk. The profit maximisation objective considers only the size of profits, the degree of uncertainty associated with it, is completely ignored.

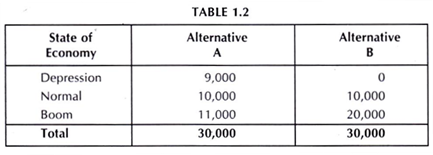

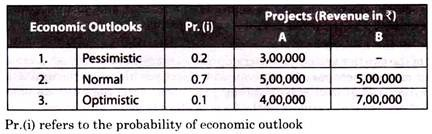

This can be made clear with the help of the example given in Table 1.2.

It is clear from Table 1.2, that under normal conditions, both the alternatives are giving the same profit (that is Rs. 10,000 each). Under depression, alternative A can provide Rs. 9,000, compared to zero profits from Alternative B and under boom condition, alternative A is giving Rs. 11,000, compared to Rs. 20,000 by B.

In other words, the earnings associated with alternative B, are more uncertain or risky, as they fluctuate widely depending on the state of the economy. Obviously alternative A is better from the point of risk and uncertainty. The profit maximisation objective fails to reveal this.

It is clear from the limitations, that the profit maximisation concept is vague and not clearly defined.

It also ignores three important aspects of financial analysis, namely-

(a) Risk,

(b) Time value of money, and

(c) State of economy.

Therefore, an appropriate operational decision criterion for financial management, should:

(a) Be precise and exact,

(b) Be based on bigger the better principle,

(c) Consider both quantity and quality aspects of benefits, and

(d) Recognise the time value of money.

The other objective of financial management, that is, wealth maximisation removes these technical limitations. It is explained below.

Objective # 2. Wealth Maximisation:

This is also known as Value Maximisation or Net Present Worth Maximisation. This objective is universally accepted, as an operational decision criterion for financial management, because it satisfies all the three requirements of a suitable operational objective, of financial courses of action, namely, exactness, quality of benefits and the time value of money.

As per this objective, the value of an asset should be viewed in terms of the benefits it can produce. The networth of a course of action can be calculated by total cash inflows, minus the investment. This calculation is the precise estimation of the benefits associated with the course of action.

Thus the wealth maximisation criterion is based on the concept of cash flows, generated by the decision, rather than the accounting profit, which is the basis of measurement for profit maximisation.

It is worth pointing out that cash flow is a precise concept with a definite meaning, compared to the accounting profit which is vague, and can be interpreted in different meanings by different people. This is the first operational feature of the wealth maximisation objective.

The second important feature of the wealth maximisation objectives is that it considers both the quantity and quality dimensions of benefits. At the same time, it also incorporates the time value of money. This is done by discounting the cash flows.

This is made clear with the help of the following example:

Problem:

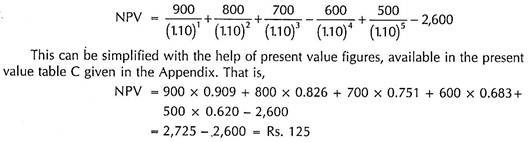

Assume that project X costs Rs. 2,600 and is expected to generate cash inflows of Rs. 900, Rs. 800, Rs. 700, Rs. 600 and Rs. 500 for five years. The cost of capital is 10%.

Where, C1, C2, C3 – Cn are the expected cash flows and Co = the investment.

(1 + k)1, (1 + k)2, (1 + k)3,……………….. (1 + k)n etc. are the present value for the 1st, 2nd, 3rd years respectively.

Putting the values in the equation, we get –

Here the Net Present Value is Rs. 125, so the financial plan is accepted. Thus as per the wealth maximisation objective, a financial plan which has a positive Net Present Value creates wealth, therefore it is accepted. At the same time, a financial plan with a negative Net Present Value is rejected. For mutually exclusive projects, the one with the highest Net Present Value should be adopted.

For example- in the above illustration, if there are two projects X and Y with initial investment of Rs. 2,600 and Rs. 2,500 respectively, and X has NPV of Rs. 125 and Y has NPV of Rs. 225. Then, project Y is accepted, because it has a higher NPV. It is an accepted principle that the wealth or net present value of the firm will be maximised, if this criterion is followed in making financial decisions.

Thus Net Present Value Maximisation, is superior to the profit maximisation as an operational objective. It compares values and cost of the financial decision. It is moreover, a precise and unambiguous concept. It is thus a feasible decision criterion for financial management decisions.

Moreover, the wealth maximisation objective is consistent with objective of maximising owner’s economic welfare. If wealth is maximised, the owners can adjust their cash flows in such a way, so as to optimise their investment.

From the shareholders’ point of view, the wealth created by the company through its actions, is reflected in the market value of the company’s shares. Therefore the wealth maximisation principle implies that, the fundamental objective of the firm should be to maximise the market value of its shares, which inturn is a reflection of the firm’s financial decision and is the firm’s performance indicator.

Financial management is one of the functional areas of business. Therefore, its objectives must be consistent with the overall objectives of business. The overall objective of financial management is to provide maximum return to the owners on their investment in the long term.

This is known as wealth maximisation. Maximisation of owners’ wealth is possible when the capital invested initially increases over a period of time. Wealth maximisation means maximising the market value of investment in shares of the company.

Wealth of shareholders = Number of shares held x Market price per share.

In order to maximise wealth, financial management must achieve the following specific objectives:

(a) To ensure availability of sufficient funds at a reasonable cost, (liquidity)

(b) To ensure effective utilisation of funds, (financial control)

(c) To ensure safety of funds by creating reserves, reinvesting profits, etc. (minimisation of risk)

(d) To ensure adequate return on investment, (profitability)

(e) To generate and build up surplus for expansion and growth (growth)

(f) To minimise cost of capital by developing a sound and economical combination of corporate securities, (economy)

(g) To coordinate the activities of the finance department with the activities of other departments of the firm.

A. Profit Maximisation:

Very often maximisation of profits is considered to be the main objective of financial management. Profitability if an operational concept that signifies economic efficiency. Some writers on finance believe that it leads to efficient allocation of resources and optimum use of capital.

Profit is a test of economic efficiency and contributes to social welfare through optimum use of service resources. It is said that profit maximisation is a simple and straightforward objective. It also ensures the survival and growth of a business firm. But modern authors on financial management have criticised the goal of profit maximisation.

Ezra Solomon has raised the following objections against the profit maximisation objective:

(i) The concept is ambiguous or vague. It is amenable to different interpretations, e.g. long run profits, short run profits, volume of profits, rate of profit, etc.

(ii) It ignores the timing of returns. It is based on the assumption of bigger the better and does not take into account the time value of money. The values of benefits received today and those received a year after are not the same.

(iii) It ignores the quality of the expected benefits or the risk involved in the prospective earnings stream. The streams of benefits may have varying degrees of uncertainty. Two projects may offer the same total expected earnings but if the earnings of one fluctuate less widely than those of the other it will be less risky and more preferable. More uncertain or fluctuating the expected earnings, lower is their quality.

(iv) It does not consider the effect of dividend policy on the market price of the share. The goal of profit and maximisation implies maximising earnings per share which is not necessarily the same as maximising market-price share. According to Solomon, “to the extent payment of dividends can affect the market price of the stock (or share), the maximisation of earnings per share will not be a satisfactory objective by itself.”

(v) Profit maximisation objective does not take into consideration the social responsibilities of business. It ignores the interests of workers, consumers, government and the public in general. The exclusive attention on profit maximisation may misguide managers to the point where they may endanger the survival of the firm by ignoring research, executive development and other intangible investments.

B. Wealth Maximisation:

Prof. Ezra Solomon has advocated wealth maximisation as the goal of financial decision-making.

Wealth maximisation or net present worth maximisation is defined as follows- “The gross present worth of a course of action is equal to the capitalised value of the flow of future expected benefits, discounted (or as capitalised) at a rate which reflects their certainty, or uncertainty.

Wealth or net present worth is the difference between gross present worth and the amount of capital investment required to achieve the benefits being discussed. Any financial action which creates wealth or which has a net present worth above zero is a desirable one and should be undertaken. Any financial action which does not meet this test should be rejected.

If two or more desirable courses of action are mutually exclusive (i.e. if only one can be undertaken), then the decision should be to do that which creates the most wealth or shows the greatest amount of net present worth. In short, the operating objective for financial management is to maximise wealth or net present worth.”

Wealth maximisation is more operationally viable and valid criterion because of the following reasons:

(a) It is a precise and unambiguous concept. The wealth maximisation means maximising the market value of shares.

(b) It takes into account both the quantity and quality of the expected stream of future benefits. Adjustments are made for risk (uncertainty of expected returns) and timing (time value of money) by discounting the cash flows.

(c) As a decision criterion, wealth maximisation involves a comparison of value to cost. It is a long-term strategy emphasising the use of resources to yield economic values higher than joint values of inputs.

(d) Wealth maximisation is not in conflict with the other motives like maximisation of sales or market share. It rather helps in the achievement of these other objectives. In fact, achievement of wealth maximisation also maximises the achievement of the other objectives. Therefore, maximisation of wealth is the operating objective by which financial decisions should be guided.

The above description reveals that wealth maximisation is more useful objective than profit maximisation. It views profits from the long-term perspective. The true index of the value of a firm is the market price of its shares as it reflects the influence of all such factors as earnings per share, timing of earnings, risk involved, etc.

Thus, the wealth maximisation objective implies that the objective of financial management should be to maximise the market price of the company’s shares in the long-term. It is a true indicator of the company’s progress and the shareholders’ wealth.

However, “profit maximisation can be part of a wealth maximisation strategy. Quite often the two objectives can be pursued simultaneously but the maximisation of profits should never be permitted to overshadow the broader objective of wealth maximisation.”

Objectives of Financial Management – Profit Maximization and Wealth Maximization (With Arguments)

Considering financial management belongs to the functional areas of business, its objectives must be in line with the overall objectives of business. A financial manager works so as to maximize his returns on long-term investments; this is known as wealth maximization. The process of maximizing wealth implies an increase in the market value of investments in shares of the company.

Wealth of shareholders = Number of shares held x Market price per share

Financial management ought to achieve the following objectives in order to maximize wealth:

(i) To provide funds to the company in an adequate amount at least cost (liquidity).

(ii) To ensure that the available funds are used efficiently (financial control).

(iii) To create reserves for the company for unforeseen contingencies or expected expenses in the future (minimization of risk).

(iv) To ensure adequate returns on the investments undertaken by the firm (profitability).

(v) To ensure that adequate funds are available for company’s growth and expansion (growth).

(vi) It also works to chart out the optimum combination of firm’s securities in order to minimize the cost of capital involved (economy).

(vii) It ensures the coordination and integration between the finance department will all the other departments of the organization (cooperation).

Objective # 1. Profit Maximization:

A lot of managers assume profit maximization as its main objective of financial management. Profitability is an operational concept that signifies economic efficiency. Some of the financial managers and writers are of the view that it leads to efficient allocation of resources and optimum utilization of capital invested.

It is well evident that profit maximization is quite simple, clear and straightforward. Maximizing profit level gets the survival and growth of business firms along. However, the goal of profit maximization has been criticized by modern authors.

Ezra Solomon has raised the following arguments against the objective of profit maximization:

(i) The concept is ambiguous or vague. It is amenable to different interpretations, e.g., long run profits, short run profits, volume of profits, rate of profits, etc.

(ii) It ignores the timing of returns. It is based on the assumption of bigger the better and does not take into account the time value of money. The value of benefits received today and those received a year later are not the same.

(iii) It ignores the quality of the expected benefits or the risk involved in the prospective earnings stream. The streams of benefits may have varying degrees of uncertainty. Two projects may have the same total expected earnings but if the earning of one fluctuates less widely than those of other it will be less risky and more preferable. More uncertain or fluctuating the expected earnings, lower is their quality.

(iv) It does not consider the effect of dividend policy on the market price of the share. The goal of profit maximization implies maximizing earnings per share which is not necessarily the same as maximizing market-price share. According to Solomon, “to the extent payment of dividends can affect the market price of the stock (or share), the maximization of earnings per share will not be a satisfactory objective by itself.”

(v) Profit maximization objective does not take into consideration the social responsibilities of business. It ignores the interests of workers, consumers, government and the public in general. The exclusive attention on profit maximization may misguide managers to the point where they may endanger the survival of the firm by ignoring research, executive development and other intangible investments.

Objective # 2. Wealth Maximization:

While presenting his views against focusing on profit maximization as its objective, Solomon advocated wealth maximization as a goal of financial decision-making. Wealth maximization or net present worth maximization may be defined as – The gross present worth of a course of action, is equal to the capitalized value of the flow of future expected benefits, discounted (or as capitalized) at a rate which reflects their certainty or uncertainty.

Wealth or net present worth is the difference between gross present worth and the amount of capital investment required to achieve the benefits being discussed. Any financial action which creates wealth or which has a net present worth above zero is a desirable one and should be undertaken.

Any financial action which does not meet this test should be rejected. If two or more desirable courses of action are mutually exclusive (i.e., if only one can be undertaken), then the decision should be based on what creates the most wealth or shows the greatest amount of net present worth. In short, the operating objective for financial management is to “maximize wealth or net present worth.”

Following arguments have been presented in favour of assuming wealth maximization as an important objective:

(i) Wealth maximization implies maximizing the market value of shares. Hence, it’s a clear, to the point, unambiguous concept.

(ii) The concept focuses both on quality and quantity of the expected stream of future benefits. All the adjustments related to the same are made in regard to the risks involved (uncertainty of expected returns) and timing (time value of money) by discounting the cash flows.

(iii) Wealth maximization helps in the decision making process of a business unit while undertaking cost analysis. It is a long-term strategy emphasizing the use of resources to yield economic values higher than joint values of inputs.

(iv) The objective of wealth maximization does not conflict with any other motives of an enterprise like that of sales maximization or capturing market share. Rather, it supports the strategies for achieving these objectives.

In fact, achievement of wealth maximization creates inter-linkages so as to achieve other objectives of the enterprise. Therefore, maximization of wealth is the operating objective by which financial decisions should be guided.

The arguments presented above make it clear that wealth maximization is a better objective than that of profit maximization. The former takes profit into account from the long-term perspective. The true reflector of market standing or reputation of a firm is the market price of its shares.

The market price of shares takes into account the influence of all such factors as earnings per share, timing of earnings, risk involved, etc. Hence, the long term implications of wealth maximization is to maximize the value of the market price of company’s shares. It is an actual indicator revealing a company’s progress and the shareholder’s wealth.

However, profit maximization can be a part of wealth maximization strategy. Quite often the two objectives can be pursued simultaneously but the maximization of profits should never be permitted to overshadow the broader objectives of wealth maximization.

2 Major Objectives of Financial Management – Profit Maximization and Wealth Maximization (With Reasons)

Finance managers are expected to put funds to best use and maximize returns to owners. To survive and flourish in a competitive environment, every firm must earn profits. How much to earn is a matter of debate and discussion. Without profits, of course, business would collapse under its own weight. When a firm is able to generate sufficient profits, it is able to please its shareholders.

Modern writers, however, insist on a firm trying to maximize shareholder’s wealth in place of profit maximization. Owner’s wealth, simply stated, would improve when the capital invested initially would increase steadily over a period of time. Wealth maximization means maximization of the market price per share of a company. (Number of shares held multiplied with market price of share).

Let’s examine the controversy between profit maximization and wealth maximization more closely:

How to Maximize Shareholders’ Wealth?

i. Ensure adequate and regular flow of funds (liquidity).

ii. Raise funds at lowest possible cost; plan for an optimal capital structure for the firm (cost).

iii. Put funds to economical use (effective utilization).

iv. Get the best returns out of invested money (adequate returns).

v. Ensure safety of funds through creation of reserves, reinvestment (reduce risk).

vi. Utilize retained money for further expansion (growth).

vii. Keep track of overall corporate goals and run the show along with other departments in a coordinated manner (coordination).

1. Profit Maximization:

Many writers believe that profitability is the real test of how funds are put to use. It indicates economic efficiency. You make profits only when funds are put to excellent use. Without making profits, a business cannot grow and expand its operations. The prospect of making money excites people to give their best to business.

It will spur people to put in extra effort while running the race. In a way, profit has the benefit of being a simple and straightforward statement of purpose. It makes sense to talk about profit as a rational economic goal.

When a firm makes money, it can give something to society as well and fulfill its social obligations. More importantly, when every firm makes money, it indicates efficient allocation of scarce resources of an economy.

A firm which seeks to make profits, thus, is able to maximize social economic welfare as well. The problem, according to modern writers, is not about making money. It is about maximization of profits. If firms try to maximize returns for themselves, they become easy targets for public criticism.

The concept of profit maximization has become the focal point of attack for a variety of reasons:

i. The Concept of is a Vague One: It is put to loose interpretation in many cases. Are we talking about short run profits or long run profits? In fact, it is ambiguous in its computation. We are not very clear about what profit figure would appease the hungry owners. At what point firms would stop looking at profit as the ultimate goal of business? (Rs. 1 crore or 100 crore or 1000 crore 10 per cent, 20 percent or 30 percent?) Are we talking about total profit, operating profit, profit before tax or after tax?

ii. The Time Value of Money is put to Rest Here: It assumes that bigger is better and ignores the time value of money. The fact that money received today has a higher value than money received next year is discounted.

iii. The amount of risk and uncertainty associated with a course of action is ignored The profit maximization objective considers only the quantity of profits realized by following a course of action without looking at the degree of risk and uncertainty associated with the proposal closely. If returns from a proposal look uncertain (or even fluctuating from time to time) it should be put to close scrutiny. In the name of making money a firm should not blindly embark on a journey that would put its future at risk.

It does not consider the effect of dividend policy on the market price of the share. To improve the earnings per share, the firm should retain profits rather than distribute them. If the intent is to maximize earning per share, the firm should never pay dividends. It should reinvest the money and generate additional returns. According to Van Horne, “to the extent payment of dividends can affect the market price of the share, the maximization of earnings per share will not be a satisfactory objective by itself”.

iv. The interests of society at large (including workers, consumers, government and the general public) are completely ignored when firms try to maximize profits for themselves. Profit maximization policies might compel firms to discount the worth of research and development totally.

2. Wealth Maximization:

Wealth maximization implies the maximization of the market price of shares. It is also known as value maximization of net present worth maximization. The net present value criterion involves a comparison of value to cost. Any action that has a discounted value—taking both time and risk into account—that exceeds its cost is said to create value (Solomon). Such actions should be pursued.

Actions with less value than cost reduce wealth and should, therefore, be rejected. If two or more desirable courses of action are mutually exclusive (i.e., only one can be undertaken) then the decision should be to do that which creates the most wealth or shows the greatest amount of net present worth. The goal of wealth maximization is not to put focus on profits but on the current value of firm’s securities—that is, equity shares.

The wealth of owners improves when the market price of shares improves. The share price would improve when the long run prospects of a company look pretty good (in terms of growth prospects, amount of risk that is inherent in a firm’s actions, the dividend it offers to shareholders etc.)

Wealth maximization, therefore, is a viable alternative due to the following reasons:

i. Wealth maximization objective is unambiguous. It reduces the whole rhetoric surrounding financial goals to just one thing. If you want to get ahead, a firm should try everything possible to improve the market value of its shares.

ii. The market price of a share adequately discounts the quantity and quality of expected returns from a company. The prospects of a company in terms of future cash flows, quality of earnings, quantity of profits, growth prospects—all get evaluated and judged by investing community from time to time.

iii. Wealth maximization strikes a happy balance between value and cost. Only those proposals that bring in value should be favoured—as a rule. If a proposal looks shaky and risky, and returns look uncertain—it should be rejected. As a long term strategy, wealth maximization criterion compels firms to put competing proposals to close scrutiny. Proposals that impact the net worth of a company negatively, as a result, are pushed to a corner.

iv. Wealth maximization does not come in the way of pursuing other corporate rate goals such as maximizing sales or conquering market share. Wealth maximization serves as a benchmark, a measuring rod to assess the mood and sentiment of the investing public toward a company—whether a company is able to run the show in sync with other corporate goals or not is automatically put to close scrutiny.

v. Wealth maximization serves as a true indicator of the progress achieved by a company. If the investing community is impressed with the track record of a company it will get a good rating and its share price would improve over time consistently.

As rightly pointed by Solomon, value maximization is simply an extension of profit maximization to a world that is uncertain and multi-period in nature.

Where the time period is short and the degree of uncertainty is not great, value maximization and profit maximization amount to essentially the same thing. Profit maximization can be part of a wealth maximization strategy.

Quite often the two objectives can be pursued simultaneously. Of course, care should be taken to see that profit maximization does not overshadow the broader objective of wealth maximization.

4 Main Objectives of Financial Management

The main purpose of financial management is to maximise the wealth of owners of the business.

However, the objectives of financial management are:

1. To ensure availability of sufficient funds at a reasonable cost.

2. To ensure effective utilisation of funds.

3. To ensure safety of funds through creation of reserves, reinvestment of profits, etc.

4. To ensure higher, quicker and stable returns to the investors of capital by most suitable employment of funds.

Objectives of Financial Management – Basic Objectives and Other Objectives

The basic objectives of financial management can be broadly classified into two categories, namely:

(a) Basic Objectives

(b) Other Objectives

(a) Basic Objectives:

The basic objectives of financial management have been-

(i) Profit Maximization, and

(ii) Wealth Maximization.

(i) Profit Maximization:

Profit earning is the main aim of every economic activity. A business being an economic institution must earn profit to cover its costs and provide funds for growth. No business can survive without earning profit.

Profit maximization refers to increasing the profit of a business organization to the maximum extent possible. In other words, it denotes the maximum profit to be earned by an organization in a given time period.

The following arguments are advanced in favor of Profit Maximization:

a) When profit earning is the main aim of the business then, profit maximization should be its main objective.

b) Profitability is a barometer for measuring efficiency and economic prosperity of a business enterprise.

c) Profits are the main sources of finance for the growth and development of a business.

d) A business will be able to survive under unfavorable situations like recession, depression, severe competition, etc. only if it has some past earnings.

e) Profitability is essential for fulfilling social needs also.

f) Profit maximization attracts the investors to invest their savings in securities of the firm.

g) Profit indicates the efficient use of funds of the business concern.

h) The goodwill of the firm is based on profitability.

i) Profit maximization ensures maximum returns to the proprietor, fair remuneration to employees and prompt payment to creditors of the company.

j) Profit maximization ensures confidence to the management in undertaking expansion and modernization programs of the company.

The following arguments are advanced against Profit Maximization:

a) The term profit is vague and it cannot be precisely defined. It means different things for different people i.e., it is not clear whether it is accounting profit or economic profit or profit before tax or profit after tax.

b) Profit maximization objective ignores the time value of money and does not consider the magnitude and timing of earnings. It treats all earnings as equal though they occur in different periods.

c) It does not take into consideration the risk of the prospective earnings stream.

d) Profit maximization encourages corrupt practices to increase the profit.

e) The effect of dividend policy on the market price of shares is also not considered in the objective of profit maximization.

f) Profit maximization attracts cutthroat competition.

g) Huge amounts of profit may invite government intervention.

h) If a company is making more profits, labourers expect more wages, more bonus, good working environment and so on. If the company fails to provide more wages, bonus and better working environment, they become unrest. It may also lead to labour turnover.

i) It does not consider the element of risks.

j) The true and fair view of an organization cannot be reflected through profit maximization.

(ii) Wealth Maximization: