Everything you need to know about the short-term sources of finance for a firm. Short-term financing may be defined as the credit or loan facility extended to an enterprise for a period of less than one year.

It is a credit arrangement provided to an enterprise to bridge the gap between income and expenses in the short run. It helps the enterprise to manage its current liabilities, such as payment of salaries and wages to labors and procurement of raw materials and inventory.

The availability of short-term funds ensures the sufficient liquidity in the enterprise. It facilitates the smooth functioning of the enterprise’s day-to-day activities.

Any delay in the procurement of the short-term fund may hinder the operational activities of the enterprise. An enterprise always strives to manage its short-term financing in the most efficient manner. The prime objective of the short-term finance is to maintain the liquidity of the enterprise.

ADVERTISEMENTS:

The short-term sources of finance for a firm are:-

1. Trade Credit 2. Commercial Paper 3. Unsecured Short-Term Bank Loans 4. Secured Forms of Credit 5. Customer Advances 6. Installment Credit

7. Bank Loan 8. Cash Credit 9. Certificates of Deposit 10. Bill of Exchange 11. Factoring 12. Bank Overdraft.

Sources of Short-Term Finance for a Firm: Trade Credit, Commercial Paper, Bank Loan, Cash Credit and a Few Others

Short-Term Sources of Finance – Trade Credit, Commercial Papers, Unsecured Short-Term Bank Loans and Secured Forms of Credit

Here the emphasis is on short-term financing such as trade credit, commercial paper, and other forms of instruments with a maturity structure of one year or less.

ADVERTISEMENTS:

An accepted rule is that short- term needs should be financed by short-term sources and long-term needs by long-term sources. This is why inventories and accounts receivable generally are financed by accounts payable and short- term bank lines of credit.

One source of short-term financing is accrued expenses, which frequently are referred to as spontaneous sources of financing. Accrued wages, taxes, and other expenses do provide a short breathing space for many firms, but because of the contractual nature of the obligation there is not a large degree of flexibility in adjusting the payment pattern. Though it is a major part of the current liability picture it is not a viable decision variable.

1. Trade Credit:

Trade credit has become one of the most common forms of short-term financing available to business today. For business establishments, it is the form most often used. When a firm buys supplies or merchandise, the supplier will generally grant a period of time for the firm to pay for the goods even after it has already received them. At no explicit interest cost, this is a very attractive means of obtaining goods.

Today suppliers are much more liberal than financial institutions in the granting of credit. For small firms that have limits as to the amount of borrowing that can be obtained from a financial institution, trade credit is not only attractive but is a vital form of financing.

ADVERTISEMENTS:

Trade credit can assume three different forms- open account, notes payable, and trade acceptances. The most common is the open account, whereby a customer receives shipment of the goods and an invoice which details the price, quantity, and description of the goods, along with a specified time for payment.

The term open account comes from the fact that no written agreement other than verification of receipt of shipment is required. Such credit is extended after the supplier has checked the credit worthiness of the customer.

The second form of trade credit is notes payable. If a customer has slipped behind on payments or if a supplier simply wants formal recognition of the obligation, it may ask the buyer to sign a note which officially recognizes the debt obligation of the buyer. The note will specify when the payment is due. Promissory notes are frequently used in lieu of open accounts in the fur and jewelry industries.

The third form of trade credit is trade acceptances. In this situation, the seller draws a document calling for the payment for goods at some future date. The seller will not release the goods until the buyer has formally accepted the draft, and has designated a bank to be the recipient of the payment when it becomes due.

At that point it becomes a trade acceptance and, if the buyer has a good credit reputation, may have a degree of marketability. If it is marketable, the seller can discount the trade acceptance and receive immediate funds in payment of the goods. When the trade acceptance finally matures, the holder of the acceptance presents it to the designated bank for collection.

Because trade credit is one form that does not have an explicit rate of interest attached, many businessmen feel that it is free credit. This is true in terms of not having to pay any additional interest above the face value of the goods. However, in terms of maximizing the value of the firm, there is a definite cost associated with trade credit.

If cash discounts are offered and not taken, there is a definite opportunity cost or implicit rate of interest associated with the face amount of credit.

By not taking the cash discount, the firm foregoes the opportunity of getting a reduction on the face value of the purchased merchandise. It then foregoes the opportunity of profitability utilizing this savings elsewhere.

ADVERTISEMENTS:

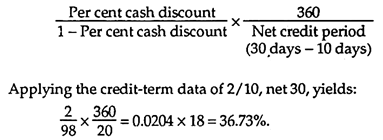

This situation can be illustrated by an example of a firm that is offered credit terms of 2/10, net 30 and does not utilize the cash discount.

The formula utilized to calculate the implicit interest cost is:

Thus the annual interest cost of not taking cash discounts amounts to 36.73 per cent.

ADVERTISEMENTS:

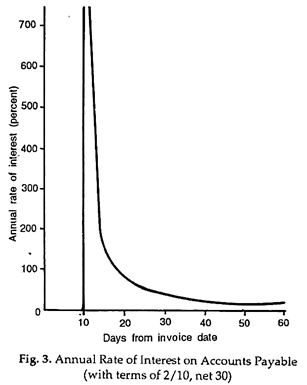

As the net credit period lengthens, the annual cost of not taking the cash discount declines. If the net credit period were 30 in the above example, the number of times this period occurs during a year would decline in Equation.

When multiplied by the discount period, this would reduce the annual interest cost to:

Continuing with the assumption of 2/10 discount terms, the relationship between the annual interest cost and the net credit period can be shown in Figure 3. This illustrates the fact that as the net period increases, the cost of interest decreases.

ADVERTISEMENTS:

By the same token, if the cash discount is not taken, it is imperative that the firm efficiently manages the cash position and does not pay the bill until the net period elapses. If the bill is paid before the net period elapses, the effective interest rate increases.

To illustrate this last point, assume that the credit terms are 2/10, net 30. The firm does not take the cash discount, but instead of waiting until the 30 days elapses to pay the bill it historically pays by the 15th day.

The annual opportunity cost is substantially increased:

The reason why the interest cost or opportunity cost has increased to such a large degree is that the customer, by choice, has decreased the net 30-day period to a net of 15 days. Thus the net credit period after the cash discount period of 10 days has been reduced from 20 to 5 days.

ADVERTISEMENTS:

It is clear that there is a considerable opportunity cost associated with a decision not to take cash discounts offered by suppliers.

Advantages and Disadvantages of Trade Credit:

There are-several advantages associated with the use of trade credit. The greatest is that this source of credit is readily available for most firms. No formal credit application is required each time it is utilized. Only in the initial application does a buyer go through a credit check by the supplier.

If a firm has been taking cash discounts and a liquidity problem arises, additional credit is available by allowing the payables to lapse until the end of the net period. Generally, there are no restrictions associated with trade credit such as those that are common with other forms of short- term lending. The only specific restriction pertains to the amount of trade credit that will be extended at any particular time.

Trade credit is particularly important to small firms which have difficulty receiving loans from financial institutions due to their lack of credit worthiness as viewed by these institutions. In a period of tight money where the availability of loanable funds becomes limited, trade credit is an even greater source of financing for the small firm.

Associated with the use of trade credit are two distinct disadvantages which can become costly for a firm. The first relates to stretching the accounts payable beyond the credit period.

ADVERTISEMENTS:

Frequently firms feel that since they regard trade credit as a free source of financing, they can stretch the accounts payable and no harm will be done. This is a very dangerous assumption. Most firms have an accounts payable aging schedule in which accounts payable are due within 30 days, 60 days, 90 days, and beyond.

The longer the aging schedule, the more difficult it is for a firm to pay off overdue bills. If they go to banks for financing, banks will require that payables be current within 60 days. If there is a significant percentage which goes beyond this period, the bank will require that part of the loan proceeds be used to bring the payable current.

A firm’s response to a liquidity crisis is often to lengthen its payables. If this continues, however, its suppliers will no doubt cut the line of credit.

The second disadvantage of trade credit concerns firms that extend this form of credit and thereby record accounts receivables. If it does not receive immediate cash, a firm extending trade credit may have to look to other sources of financing to underwrite the production cycle.

The longer customers take to pay their accounts payable, which are the suppliers’ receivables, the more critical the cash shortage becomes.

Frequently, a firm extending trade credit will have to slow down on the payment of its own accounts payable when there is a significant lengthening in its accounts receivable aging schedule. This in turn can jeopardize the firm’s credit relationship with its suppliers.

2. Commercial Paper:

ADVERTISEMENTS:

Commercial paper is a form of financing which consists of short-term promissory notes which are unsecured and are sold in the money market. They are issued by large companies and primarily sold to other business firms, insurance companies, pension funds, and banks. Because they are unsecured and are sold in the money market, they are restricted in use to the most credit-worthy of the large companies.

Though the commercial paper market has a long history, much of its tremendous growth has occurred in recent years with increases in the installment financing of automobiles and other consumer durable goods.

As credit tightens in terms of the banks’ ability to make loans, the commercial paper market increases. Many of the companies that issue these notes now look at this market as an alternative source of financing.

The commercial paper market includes a dealer distribution system and a system of direct placement. Most industrial firms, utilities, and medium-size finance companies utilize the dealer market to place their commercial paper.

Five major dealers comprise the market, which purchases the paper from firms and then sells it to investors. Denominations of commercial paper range from Rs.25,000 to several rupees, and maturity runs from about two to six months, with an average of five months.

ADVERTISEMENTS:

The cost of this paper is from 0.5 to 1 per cent below the prime lending rate. Considering that there are no compensating balance requirements, the rate differential is still more significant. The commission on the sale of paper runs from 0.125 of 1 per cent. Many firms are looking at this source of financing more in terms of a permanent source than as the traditional seasonal instrument.

Appraisal of the Commercial Paper Market:

Commercial paper is a much cheaper source of financing than short-term bank financing, as we have noted. Many companies are considering commercial paper as a supplement to bank credit. A company could make use of the paper market when the interest rate differential was large and borrow from the bank when the gap narrowed. This would result in the lowest borrowing cost to the firm in the short term.

Evidence has indicated that it is imperative for a firm not to impair its relations with a bank by using its services only during periods of extremely tight money, however. It is often suggested that a firm should have a backup line of credit with a bank to cover its borrowing position in the commercial paper market.

One factor which has helped the growth of the commercial paper market is a regulation that the maximum loan a national bank can make to a single borrower is 10 per cent of the bank’s capital and surplus. It is the perpetual need of short-term capital that has helped the commercial paper market to boom.

3. Unsecured Short-Term Bank Loans:

Short-term bank financing plays a key role in the growth of a firm. Frequently during the course of a year there is a period in which cash inflows are not sufficient to meet cash outflow demands. Short-term bank financing is one important vehicle by which a firm can be carried through such periods.

This form of financing appears as a note payable on the balance sheet at a specific rate of interest. It is second only to trade credit in importance.

Types of Unsecured Bank Loans:

Unsecured bank loans usually take the form of a line of credit, a revolving credit agreement, or a transaction loan.

i. Cash Credit Limit:

A limit of credit usually sets an upper limit as to the amount a firm can borrow on an unsecured basis. It is usually set for one year and is subject not only to an annual cleanup but also to an annual review before renewal. This review consists of an examination of an audited annual report. The line of credit is established after the bank has evaluated the credit worthiness and financial needs of the borrower.

Usually this form of financing is considered to be a temporary source which carries a firm through a seasonal low in terms of cash inflows. A cash budget is frequently drawn up to show the estimated cash inflow and outflow pattern over the next year. It may be that in 3 of the 12 months a negative cash flow pattern emerges; this can be handled by a line of credit.

The required clean-up period usually extends for 30 days out of the year. When a firm is unable to clean up its line of credit, it is an indication to the bank that a more permanent source of financing may be needed.

ii. Revolving Credit Arrangement:

Unlike the line of credit, which does not involve a legal commitment on the part of the bank, the revolving credit agreement is a formal commitment by the bank to lend up to a specified amount at the wishes of the borrower. In essence, this is a guaranteed line of credit issued by the banks. Negotiations between bank and borrower will determine the maximum amount of commitment.

If, for example, the firm borrowed Rs.1.3 million four months ago from a Rs.2 million revolving credit agreement, it can borrow the remaining amount at any time. For this privilege of having a guaranteed line of credit, the firm must pay a commitment fee on the unused portion of the revolving credit.

iii. Transaction Loans:

Certain types of business firms do not need a line of credit or a revolving credit agreement but may need short-term capital for a specific use. A good example is in the construction industry, in which firms often need funds to complete jobs.

After the contractor receives payment for a job it can repay the bank. Banks examine each request on an individual basis. The ability of the borrower to repay the loan through projected cash flows is quite important in this type of arrangement.

Compensating Balance Requirements:

Banks will not only charge interest on a short-term line of credit; in addition, they will require the borrower to maintain a demand deposit balance. This balance is calculated in direct proportion to the amount of the borrowed funds.

Demand-deposit requirements are called compensating balances and will usually run from between 10 to 20 percent of the loan balance. If the loan is for Rs.100,000 and there is a 20 percent compensating balance requirement. Rs.20,000 must be kept in deposits at the bank.

If this required balance is above the balance that the firm normally maintains at the bank for operation needs, the effect is to raise the effective rate of interest on the loan.

The bank usually views the compensating balance requirement as a means of increasing the general liquidity of the borrower. In addition, it provides the bank with a margin of safety in case the firm defaults on its repayment.

4. Secured Forms of Credit:

Borrowing on an unsecured basis would always be the best method for a firm to use in obtaining bank financing. This provides a wide latitude of operation, for at a later date the existing collateral can be utilized for more debt financing. In addition, record keeping for collateralized loans is costly and time-consuming.

However, banks often require a form of security to be put up as collateral to protect the lender in the case of default. This requirement means the firm can obtain capital when it would otherwise be impossible. Sometimes the collateralization of a loan will lead the lending institution to quote a lower interest rate, which over time can be of considerable advantage to the borrower.

Security to collateralize a loan can take many forms. Marketable securities, land, buildings, equipment, and inventory are all possible sources of collateral. Marketable securities, which appears to be the best form of collateral, are usually in short supply for firms needing capital. Land, buildings, and equipment are usually used as security devices for long-term forms of lending.

Most of the collateral used for short-term financing needs, therefore, is supplied by accounts receivable and inventories.

(a) Bills Receivable Financing:

One of the more liquid assets on a firm’s balance sheet that is assignable for collateral is its accounts receivable. As such, they are a prime lending vehicle. There are two methods by which a firm can utilize the accounts receivable in obtaining short- term financing. It can either pledge its receivables as collateral against a loan, or it can sell its receivables, which is called factoring.

i. Pledging Bills Receivable:

When a firm pledges its accounts receivable, the lending institution has a lien on them. If any receivables default, the firm which pledged them is responsible and must take the loss. When a firm utilizes this form of collateral, the organization that originally purchased the goods on credit is not notified. Commercial banks and the larger sales finance companies are the organizations that typically lend on this form of collateral.

In establishing this form of financing, the lender and the borrower sign legally binding documents which set forth the obligations of each party. Once this is done, whenever the borrower obtains a large enough amount of receivables they are taken to the lending institution for evaluation.

The lender screens the receivables, weeding out those that are unacceptable. Usually the lending institution will advance funds up to 75 to 80 per cent of the face value of the receivables.

This provides a margin of safety for the lending institution in case of default on the payment of any receivables. This also forces the borrower to take a so-called equity position in the receivables.

The lender will always try to get as wide a margin of safety as possible on the collateral. Many times the lending institution will demand recourse to the borrowing firm if the customer defaults on receivables.

The interest rate on this type of financing usually runs about 3 percentage points above the prime lending rate. If the receivables do not meet the quality requirements of traditional lending institutions, such as banks and large finance companies, there are other companies which lend on receivables that are perceived to have higher risk. The interest rates charged are usually quite high compared to the traditional lender’s rates, however.

ii. Factoring Accounts Receivable:

When a firm factors its account receivable, it actually sells them to a factor who actually buys the receivables. This may be done with or without recourse. With recourse, the factor can look to the seller of receivables for payment if there is a default on the payment of the receivable. Without recourse, the factor cannot look to the seller of the receivables for collection in case of default.

The factor maintains a credit department which can undertake a credit check of a customer. If a firm sells without recourse, utilization of this service can allow it to forego the cost of maintaining a credit department of its own.

In this case, the factor assumes risk and bad-debt losses and all expenses associated with collecting slow accounts. The customer of the firm who is factoring the receivables may or may not be told of the factor agreement; this decision is made between the lender and the seller of the receivables.

Associated with the assumption of risk and servicing of the receivables is an added cost to the seller. Usually a fee is attached which runs from 1 to 3 per cent of the face value of the receivables. In addition, there will be interest charges for funds that are advanced before collection by the factor.

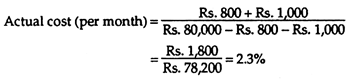

The cost of using a factor can be illustrated with the following example. A firm factors on the average Rs.100,000 per month for a year. The factor will lend 80 per cent of the face value of the receivables and will charge a factoring fee of 1 per cent of that face value.

In addition, the factor charges 1 per cent interest per month on the amount borrowed. The interest cost and the factoring fee are taken out in advance of all funds given to the firm. Assume that the firm borrows the full amount each month.

We can calculate the annual cost to the firm of utilizing the factoring service as shown in following equation:

In this example, the factor fee of 1 per cent of Rs.100,000 amounts to Rs.1,000. If the firm borrowed Rs.80,000 per month at 1 per cent, the monthly interest would be Rs.800.

If the interest and factoring cost are deducted before the firm receives any funds, the actual cost would be:

On an annual basis, this would amount to 27.6 per cent (2.3 per cent times 12).

Inventory is another asset that has considerable merit as collateral for short-term financing. The lender usually will advance only a specified percentage against the face value of the inventory. This loanable value is based on the type of inventory being considered and the ability of the lender to dispose of it in case of default.

The more specialized the inventory and the market for the product, the more unwilling is the lender to advance a large percentage of the face value.

The more standard and salable the inventory, the higher the loan percentage. Frequently lenders will loan 90 per cent of the face value when they feel the inventory is standard and has a ready market, apart from the marketing organization of the borrower.

Lenders usually consider such items as marketability, perishability, market price stability, and difficulty in liquidating the inventory in determining the percentage value that they are willing to advance on an inventory loan.

The most important aspect of a lender’s analysis is to substantiate that there is enough liquidating value in the inventory to cover the loan and accrued interest in case of default on the part of the borrower.

In addition, the lender must determine the ability of the borrower to service the debt by examining the cash flow structure of the firm. There are several ways in which inventory can be collateralized.

These methods are discussed below:

i. Floating Lien:

A feature of the Uniform Commercial Code permits a borrower to pledge inventory “in general” as collateral against a loan, without specifying the inventory involved. This allows the lender to obtain a floating lien or claim against all of the borrower’s inventory. This type of arrangement is very difficult to police, and in general it is made only to provide extra security for a loan.

A floating lien can cover both receivables and inventory; thus it allows a lender to obtain a lien on the major part of the current assets of a firm. The floating lien also can cover both present and future inventory.

A chattel mortgage provides for the borrower’s inventory to be identified specifically by a serial number or some other means. The borrower still holds title to the goods, but the lender has a lien or claim on the inventory. Under this arrangement, the lender has to give his consent before the inventory can be sold.

Any inventory that has a rapid turnover or is not readily identifiable would not be suited for this type of lien arrangement. Capital asset items such as machine tools and other heavy equipment are well suited for a chattel mortgage.

iii. Trust Receptions:

With a trust receipt loan, the borrower holds both the inventory and the proceeds from the sale of inventory in trust for the lender. Consumer durable goods, automobiles, and equipment are good examples of the types of inventory that are well suited to serve as this form of collateral.

The automobile dealership system is an excellent example of how a trust receipt collateral system works. When automobiles are shipped to the dealer from the manufacturer, the lending institution will pay the manufacturer under an arrangement made with the dealer. The dealer in turn signs a trust receipt agreement which specifies the handling of the inventory.

The dealer is allowed to sell the cars and must turn the proceeds over to the lender. Under the trust receipt arrangement, the inventory is serialized and is periodically audited by the lender. The purpose of the audit is to determine if any cars have been sold without the proceeds of the sale being remitted to the lender.

Each time a new batch of cars is acquired from the manufacturer, a new trust receipt agreement is signed to take account of the new inventory. Though this method provides a wider margin of safety than a floating lien arrangement, there is always the possibility that a dealer will sell cars and not remit the proceeds to the lender in payment of the funds advanced.

iv. Terminal Warehouse Receipt Loans:

Under another arrangement for using inventory as collateral for a loan, the borrower’s inventory is housed in a public, or terminal, Warehouse Company. A warehouse receipt which specifies the inventory located there provides the lender with a security interest in the inventory.

Because the goods in inventory can only be released on authorization by the lender, it can maintain strict control over the inflow and outflow of inventory. In addition, an insurance policy is usually issued which contains a loss-payable clause for the benefit of the lender.

The warehouse receipt can be in a negotiable or nonnegotiable form. If it is negotiable, the receipt can be transferred from one party to another by endorsement, but before the goods can be released the receipt must be presented to the warehouse man.

A nonnegotiable warehouse receipt is issued in favour of the lender, which has title to the goods and is the only one that can release them. The nonnegotiable receipt arrangement provides that the release of goods must be authorized in writing. Most arrangements are of the nonnegotiable form.

v. Field Warehouse Receipt Loans:

With the form of collateralization known as the field warehouse receipt loan, the inventory remains on the property of the borrower. A field warehouse company sets off a specific part of the borrower’s storage area in which to locate the inventory being used as collateral. Often this area is physically fenced off and only the field warehouse company has access to it.

Once the collateral value of the inventory is verified by the field warehouse company, the lender advances the funds. This arrangement is desirable when there is great expense involved in locating the inventory elsewhere, especially true when the borrower has a high inventory turnover ratio.

There is no question that the cost of this form of collateral financing is very high. This is primarily due to the cost of the warehouse company which acts as a third party in this arrangement.

The evidence of collateral is only as good as the warehouse company issuing the receipt. Historically there has been evidence indicating fraud in terms of the validity of the inventory actually being stored in a particular spot.

Short-Term Sources of Finance – Trade Credit, Customer Advances, Installment Credit, Bank Loan and a Few Others (With Advantages and Disadvantages)

Short-term financing may be defined as the credit or loan facility extended to an enterprise for a period of less than one year. It is a credit arrangement provided to an enterprise to bridge the gap between income and expenses in the short run. It helps the enterprise to manage its current liabilities, such as payment of salaries and wages to labors and procurement of raw materials and inventory.

The availability of short-term funds ensures the sufficient liquidity in the enterprise. It facilitates the smooth functioning of the enterprise’s day-to-day activities. Any delay in the procurement of the short-term fund may hinder the operational activities of the enterprise. An enterprise always strives to manage its short-term financing in the most efficient manner. The prime objective of the short-term finance is to maintain the liquidity of the enterprise.

Other important objectives of short-term financing are mentioned in the following points:

i. Fulfillment of Operational Demand – It refers to the fulfillment of working capital need to carry out the operations of the enterprise. Short-term financing helps in purchasing raw material, making payment to labor, and maintaining inventory, and cash reserves.

ii. Smooth Running of Business – It refers to the continuity in the operations of the enterprise. The short-term fund helps in fulfilling day-to-day financial needs of the enterprise.

iii. Fulfillment of Emergency Needs – It implies that short-term finance is needed to meet any urgent or emergency requirement of funds.

iv. Increase in Productivity – It refers to the use of short-term fund to enhance the production level of the enterprise. The proper utilization of fund for the procurement of labor, material, and machine can increase the productivity of the enterprise.

v. Efficient Allocation of Resources – It refers to the rational use of the short-term resources to meet the working capital requirement. The enterprise should make the judicial use of short-term financial resources to meet the short-term objectives.

The short-term financing is an ultimate source to manage the working capital requirements of an enterprise. The need of short-term funds varies from enterprise to enterprise and depends on the nature of business and production cycle.

An enterprise needs short-term financing because of the following reasons:

i. Business Cycle – Business cycle brings fluctuations in the demand and supply of products and services. If there is boom in the market, the demand of the product increases. In such a situation, the enterprise needs to raise the short-term funds to increase the supply of the product. Therefore, the enterprise requires short-term funds to cope up with the temporary rise in the demand of the product.

ii. Liquidity Position – Liquidity position refers to the capability of an enterprise to meet the immediate cash need for managing the current liabilities. The short-term financing helps in maintaining the liquidity position of an enterprise by providing excess cash to an enterprise.

iii. Operational Efficiency – It requires the replacement of old machines and equipment by new ones and employment of skilled labor and application of latest technology to improve the efficiency of the enterprise. The short-term financing helps in fulfilling these requirements of an enterprise.

iv. Nature of Business – It refers to the different types of business operations carried out by enterprises. The requirement of short-term financing varies as per the nature of business of the enterprise. For example, a manufacturing enterprise requires more short-term capital because it needs to procure raw material on a regular basis.

v. Selling goods on Credit – Selling goods on credit reduces the cash balance of the enterprise. Therefore, if an enterprise decides to sell goods on credit, it needs to retain sufficient amount of short-term fund to carry out its day-to-day operations smoothly.

Short-term financing is aimed to meet the demand of current assets and pay the current liabilities of the enterprise. In other words, it helps in minimizing the gap between current assets and current liabilities. There are different means to raise capital from the market for small duration.

The short term sources of financing are explained in detail as follows:

i. Trade Credit:

Trade credit is one of the traditional and common methods of raising short-term capital from the market. It is an arrangement in which the supplier allows the buyer to pay for goods and services at a later date in future. The decision to provide trade credit depends on the mutual understanding of both the buyer and supplier.

The supplier takes the decision to extend trade credit after taking into consideration creditworthiness, goodwill, and record of previous transactions of the buyer. The trade credit transactions are not always done in terms of cash but also in terms of kinds, such as finished goods. For example, the supplier may provide raw material, machines, finished goods, and services to the buyer instead of cash.

The advantages of trade credit are as follows:

a. Improved Cash Inflows – It refers to the increased amount of cash inflows in an enterprise. Trade credit enhances the cash inflows of the enterprise, which, in turn, facilitates the smooth flow of business operations.

b. Reduced Capital Requirement – It specifies that if an enterprise has trade credit arrangements with its suppliers, it would require less short-term capital to operate the business. In this case, the payments to the suppliers can be made within the pre-decided credit terms, after the receipt of payment from customers. Thus, the business would continue to operate with lower capital requirements. In addition, the enterprise can effectively use the short-term capital for other activities, such as maintaining inventory.

c. Increased Focus on Other Business Activities – It refers to the fact that trade credit facilitates an enterprise to focus on other business activities, which require immediate funds. The examples of such activities are procurement of raw materials and payment of salaries and wages.

The disadvantages of trade credit are as follows:

a. Increased Borrowing – Increased borrowing refers to the fact that the ease in availability of trade credit often induces the borrower to raise more credit than required. This results in accumulation of debt, which may hamper the growth of the enterprise in future.

b. Delay or Default in the Payment of Trade Credit – It affects the goodwill of the enterprise. Consequently, the enterprise may face a problem of poor credit rating, which further reduces its creditworthiness.

ii. Customer Advances:

Customer advances may be defined as the part of payment made in advance by the customer to the enterprise for the procurement of goods and services in the future. It is also called Cash before Delivery (CBD). The customers pay the amount of advance, when they place the order of goods and services required by them. The method of procuring goods and services depends on the characteristic and value of the product. Customer advances allow customers to defer their payment for some time and fulfill their other obligation on priority.

The advantages of customer advances are as follows:

a. Free from Interest Burden – It implies that the enterprise does not require paying any interest on customer advances

b. No Security Required – It implies that the enterprise does not need to keep any security to raise customer advances.

c. No Repayment Obligation – It refers to the fact that the enterprise is free to decide whether to refund money, if the order is cancelled by customers.

The disadvantages of customer advances are as follows:

a. Limited to Selected Enterprise – It refers to the fact that the benefits of customer advances can be availed only by those enterprises, which have goodwill in the market.

b. Limited Period Offer – Limited period offer implies that the customer advances can be availed only for limited period of time. The allotted time for the advances and delivery of goods and services is fixed and cannot be extended.

c. Limited Amount of Advance – It refers to the fact that customers made only a part of payment, which may not fulfill the fund requirement of the enterprise. In addition, the amount of advance is proportional to the value of the product; therefore, it may vary from product to product.

iii. Installment Credit:

Installment credit is another source of short-term financing, in which the borrowed amount is paid in equal installments with interest. It is also called installment plan or hire-purchase plan. Installment credit is granted to the enterprise by the suppliers on the assurance that the repayment would be done in fixed installment at regular intervals of time. It is mostly used to acquire long-term assets used in production processes.

The advantages of installment credit are as follows:

a. Convenient Mode of Payment – It implies that installment credit is an easy mode of payment as it divides the burden of payment in easy installments paid at regular intervals.

b. Protecting Blockage of Funds – It refers to the fact that installment credit helps the enterprise in saving capital, which can be used for other productive activities. In helps the enterprise in purchasing goods and services by making a part of payment.

c. Facilitating Modernization – It implies that installment credit helps the enterprise in acquiring new machines and technology even in the absence of sufficient funds for the time being.

d. Quick Possession of Assets – It requires very little paperwork to transfer the ownership of assets from one party to another.

The disadvantages of installment credit are as follows:

a. Influence on Liquidity Position – It refers to the impact of installments on the liquidity position of the enterprise. The payment of installments is considered as an additional burden on the short-term capital of the enterprise.

b. Extra Cost – It refers to the extra amount to be paid by the enterprise in the procurement of goods through installment credit. If an enterprise buys goods on installment credit then it needs to pay higher amount as compared to one-time payment. This happens because the installments include the amount of borrowing and the interest.

c. Extra Liability – It refers to the extra burden imposed on the enterprise in case of default. If the enterprise fails to pay the installment amount in the allotted time, it may seriously affect the image of the enterprise. Therefore, it becomes the liability of the enterprise to pay installment on time.

iv. Bank Loan:

Bank loan may be defined as the amount of money granted by the bank at a specified rate of interest for a fixed period of time. The commercial bank needs to follow certain guidelines to extend bank loans to a client. For example, the bank requires the copy of identity and income proofs of the client and a guarantor to sanction bank loan.

The banks grant loan to a client against the security of assets so that, in case of default, they can recover the loan amount. The securities used against the bank loan may be tangible or intangible, such as goodwill, assets, inventory, and documents of title of goods.

The advantages of the bank loan are as follows:

a. Grants loan at a low rate of interest

b. Follows a simple procedure for granting loan

c. Requires minimum document and legal formalities to pass the loan

d. Involves good customer relationship management

e. Consumes less time because of modern techniques and computerization

f. Provides door-to-door facilities.

In addition to advantages, the bank loan suffers from various limitations, which are as follows:

a. Imposes heavy penalty and legal action in case of default of loan

b. Charges high rate of interest, if the party fails to pay the loan amount in the allotted time

c. Adds extra burden on the borrower, who needs to incur cost in preparing legal documents for procuring loans

d. Affects the goodwill of the enterprise, in case of delay in payment.

v. Cash Credit:

Cash credit can be defined as an arrangement made by the bank for the clients to withdraw cash exceeding their account limit. The cash credit facility is generally sanctioned for one year, but it may extend up to three years in some cases. In case of special request by the client, the time limit can be further extended by the bank. The extension of the allotted time depends on the consent of the bank and past performance of the client. The rate of interest charged by the bank on cash credit depends on the time duration for which the cash has been withdrawn and the amount of cash.

The advantages of the cash credit are as follows:

a. Involves less time in the approval of credit.

b. Involves flexibility as the cash credit can be extended for more time according to the need of customers.

c. Helps in fulfilling the current liabilities of the enterprise.

d. Charges interest only on the amount withdrawn by the customer. The interest on cash credit is charged only on the amount of cash withdrawn from the bank, not on the total amount of credit sanctioned.

The cash credit is one of the most important instruments of short-term financing, but it has some limitations.

These limitations are mentioned in the following points:

a. Requires more security for the approval of cash

b. Imposes high rate of interest

c. Depends on the consent of the bank to extend the credit amount and the time limit.

vi. Commercial Papers:

Commercial paper is a short-term financing instrument used by the enterprise with high credit rating to raise money from the market. It is an unsecured promissory note, which the enterprise offers to the investors either directly or indirectly through the dealers. Commercial papers are generally sold by large enterprises, which have strong goodwill in the market.

The important features of commercial papers are as follows:

a. Does not allow the enterprise to trade the commercial papers in the secondary market

b. Encloses maturity period ranging from 90 to 180 days, since the day of issuing

c. Allows the enterprise to issue commercial paper at face value.

RBI has issued guidelines to ensure security of the investors investing in commercial papers offered by the enterprise.

These guidelines are mentioned in the following points:

a. Allows the issuing enterprise to keep at least Rs. 50 million as its net worth

b. Allows the bank to finance at least Rs. 100 million

c. Prohibits the enterprise to issue notes more than 30% of its working capital

d. Makes it mandatory to list the enterprise’s equity in the stock market

e. Sets the minimum current ratio at 1.33

f. Accepts the credit rating of only top institutions, such as Credit Rating Information Services of India Limited (CRISIL) and Credit Analysis & Research Ltd.

vii. Certificates of Deposit:

Certificate of deposit is a type of promissory note issued by the bank to the investors for depositing funds in the bank for a fixed period of time. The maturity period of certificates of deposit is designed in accordance with the necessity of investors. For example, if an investor needs to deposit funds for three months, then the maturity period of certificates of deposit would be three months. The maturity period of certificates of deposit can range from three months to one year.

The important features of certificates of deposit are listed as follows:

a. Deposit cash in the bank for a fixed maturity period.

b. Include maturity period ranging from 90 days to 365 days. The maturity period are tailor-made and intended to fulfill the needs of the investors.

c. Pays interest on the principle at the time of maturity. Certificates of deposit are issued at face value and traded in the secondary market.

d. Assures high security and reliability. Certificates of deposit can have default risk only in case of failure of bank, which is a rare case.

e. Depends on the prevailing financial market conditions.

viii. Bill of Exchange:

A bill of exchange is a document in which an individual asks the recipient to make payment for goods and services received to a third party at a future date. The individual who writes the bill is known as drawer and the individual who receives the bill is known as drawee. The individual who pays the bill is known as payee. One of the popular forms of bills of exchange is check, which is widely used in the market.

The important features of bills of exchange are as follows:

a. Produces in written format, such as draft or check.

b. It includes an order made by one party to second party to pay the amount to a third party.

c. The bills of exchange makes it mandatory for the drawer and drawee to sign the bill. If the bill does not contain the signs of drawer and drawee, it cannot be considered as a legal document.

d. It mentions the time at which the payment is to be made.

ix. Factoring:

The concept of factoring is new to the Indian financial market. The factoring services were introduced in India by the State Bank of India Factoring and Commercial Services Ltd. (SBIFACS) on 11th April 1991 for financing short-term projects. Over the time, other financial institutions, such as Canara Bank Factors Limited, incorporated in September 1991, have also started providing the factoring services. In the later stage, Punjab National Bank and Allahabad Bank have also entered in the factoring business but they limited their services to northern and eastern parts of India.

Factoring comprises complementary financial services, which is provided to the borrowers. The borrower has freedom to select the set of services provided by the factoring enterprise. Factoring is a transaction whereby a business sells its statement of receivable to a factor at a discount rate, to raise fund for financing short-term projects.

The advantages of factoring are as follows:

a. Flexibility – Flexibility helps in ensuring that an enterprise can relax certain procedures for extending better services to clients.

b. Cope up with Uncertainties – It refers to the fact that factoring enables the enterprise to meet seasonal demands for cash whenever required.

c. Better Fund Usage – It refers to the efficient utilization of funds because the enterprise takes decision with the help of advice provided by the factor.

The disadvantages of factoring are as follows:

a. Discounted Value – Discounting value refers to the fact that factoring enterprise does not pay the face value of the account receivable to the client enterprise. The factoring enterprise pays discounted value of the account receivable to the client enterprise.

b. Failure in maintaining Customer Relation – It refers to the fact that if the factor is not able to satisfy the client enterprise, he/she would not get business from the enterprise in future.

x. Bank Overdraft:

Bank overdraft is a temporary arrangement with the bank that allows the organization to overdraw from its current deposit account with the bank up to a certain limit. The overdraft facility is granted against securities, such as promissory notes, goods in stock, or marketable securities. The rate of interest charged on overdraft and cash credit is comparatively much higher than the rate of interest on bank deposits.