National income is the aggregate money value of all incomes earned by individuals and enterprises.

National income may also be defined as the money measure of the net aggregates of all commodities and services accruing to the inhabitants of an economy during a year.

Thus, the concept national income has different meanings. It may be described as the ‘national product’ or ‘national income’ or ‘national dividend’.

I. Different Views on National Income by Different Economists:

Here we present different views on national income suggested by different economists at different times:

1. Marshall’s Definition:

ADVERTISEMENTS:

Marshall defines national income or national dividend in the following way: “The labour and capital of a country, acting on its natural resources, produce annually a certain net aggregate of commodities, material and immaterial including services of all kinds… This is the true net annual income or revenue of the country or national dividend.”

The term net refers to deductions from total gross produce in respect of depreciation and wearing out of the plant and equipments plus additions of net income from abroad. This may be construed as national dividend as a flow of goods and services but not a fund. In Marshall’s words, “the national dividend is at once the aggregate net product of and the sole source of payment for all agents of production within the country.” Thus, what is produced in an economy is distributed among the various factors of production.

2. Pigou’s Definition:

According to A.C. Pigou; “National income is that part of the objective income of the community, including, of course, income derived from abroad which can be measured in money.” This definition is rather narrow as it does not include unmarketed goods and services for which no money payment is involved. This definition involves certain paradoxes. He argues that if a man marries his maid-servant the national income is reduced since he is not supposed to pay any remuneration or wages to his housewife who was paid before marriage. Anyway, Pigou’s definition is narrow.

Prof. Cairncross says; “The national income is, in fact, simply the output upside down. What we produce flows into a reservoir; what are consumed is drawn from the same reservoir, from the joint output of the community.”

ADVERTISEMENTS:

What is clear from the above discussion is that Marshall’s definition seems to be more comprehensive.

3. Modern Definition:

National income is a money measure of the value of all goods and services produced in a year by a nation. The National Sample Survey defines national income as “money measures of the net aggregates of all commodities and services accruing to the inhabitants of a community during a specific period.” According to the National Income Committee of India” A national income estimate measures the volume of commodities and services turned out- during a given period, counted with duplication.”

Profs Lipsey and Chrystral say that national income, in general, is “the value of the nation’s total output and the value of the income generated by the production of that output.”

According to Froyen; “National income is the sum of all factor earnings from current production of goods and services. Factor earnings are incomes of factors of production.” In the same vein, Gardner Ackley defines “National income is the sum of all (a) wages, salaries, commissions, bonuses and other form of incomes, (b) net income from rentals and royalties, (c) interest, (d) profit.”

ADVERTISEMENTS:

The concept ‘national income’ has been interpreted by economists usually in three ways. These are:

(i) National product,

(ii) National expenditure, and

(iii) National dividend. It is to be kept in mind that these are not different concepts.

As these three imply the same thing, these will be used interchangeably in the following pages. Using these three concepts we will show that national income is “the total flow of wealth produced, distributed and consumed.”

II. National Income Accounts:

Economic growth of any country is measured by its growth of national and per capita incomes. In other words, national income is the yardstick of measuring the growth performance of any economy. Increase in national income is tantamount to economic growth. In view of this, every country prepares statistics on national income as well as its various facets.

The method through which national income statistics is prepared and compiled is called national income accounting. Thus, national income accounts can be defined as a set of systematic statements which reflect the aggregate money value of all goods and services produced in different sectors of an economy (primary, secondary and tertiary sectors) together with the records of distribution of factor incomes among different groups and final expenditures (either gross or net) of the economy.

In national income accounts, all types of transactions conducted, say, in a year, are recorded. These are systematically classified and entered into national income accounts by the statisticians. Thus, national income accounts reflect how millions of transactions that are conducted are interrelated. Above all, by reading these accounts one gains clear knowledge about the working of the economy.

Economists, planners, government, businessmen, international agencies (IMF, World Bank, etc.,) use national income data and analyse them for variety of purposes. Firstly, while formulating national economic plans and policies, national income statistics are taken into account. Secondly, national income data help in measuring changes in the standard of living over time. Level of development is also measured by using national income figures. Such figures are also of importance for making international comparisons. There are other uses too. Above all, national income figures enable us to compare standards of living of different countries.

III. Circular Flow of Income:

The national income and national product accounts of a country describe the economic performance or production performance of a country. Various measures of the nation’s income and product exist the most frequently cited summary measures of an economy’s performance is the gross national product (GNP) or gross domestic product (GDP). However, there is a subtle distinction between GNP and GDP since both move closely together. Anyway, the distinction between the two will be presented in due time.

ADVERTISEMENTS:

The national product is the value of final goods and services produced in a country. Since all the value produced must belong to someone in the form of a claim on the value, national product is equal to national income. Each transaction in an economy involves a buyer and a seller. Households spend money for buying goods and services produced.

Thus, from the buyers’ side comes the flow of money demand. In other words, we have expenditure- side transaction. On the sellers’ side, money payments go to factor owners in the form of rent, wages, etc. Firms spend money for buying input services. Thus, we have income-side transaction from the seller’s side. These two are obverse and reverse of the same coin. This is called circular flow of income and expenditure.

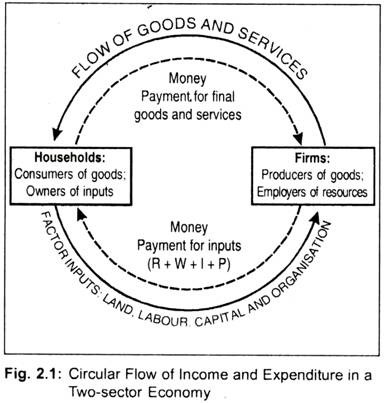

Graphically, we can present the circular flow of income. We are assuming that we are living in a market-oriented economy or a capitalistic economy where there are two decision-makers: firms and households. Firms make production decision. Households are consuming units which absorb output produced in the business firms. Again, firms coordinate and employ different factor units which are owned by households.

ADVERTISEMENTS:

In Fig. 2.1, goods and services flow from firms to households via the product market in return for the money payment for these goods and services by firms. Arrowhead indicates such goods flow and money flow between firms and households. It is clear that the flow of monetary payment on goods and services by buyers must be identical to the money value of all goods and services that firms produce and sell to households.

But wherefrom do the households get money? The diagram answers this question. Households supply factor inputs to firms via the factor markets. In return, households receive money from firms in the form of rent, wages, etc. These income payments to households on hiring input services must be identical to the firms’ income. This is the essence of the circular flow of income in a two-sector economy where there is no governmental activity and the economy is a closed one. Adding these, we have

Y = C + I

ADVERTISEMENTS:

where Y stands for national income, C for private consumption spending, and 1 for private investment spending.

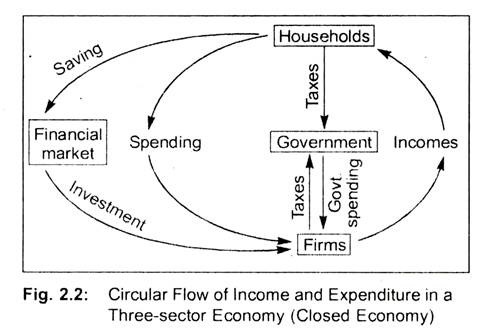

In a three-sector (closed) economy, the government intervenes. It spends not only for the benefits of the general people and firms but also imposes taxes on them to finance its spending. If we add government activities (levying of taxes, T and incurring expenditures, G), we have

Y = C + I + G

The relationships between households, firms and government have been presented in a circular flow diagram (Fig. 2.2).

Households receive money income from firms and government by selling input services. Part of this income is used to pay taxes to the government. Government receives taxes from both households and firms. Government spends by utilising its tax revenues. Households save in the financial market. These two—saving and taxes— constitute leakages in the circular flow. It is, thus, clear from Fig. 2.2 that the circular flow of money income depends upon consumption spending of households, investment spending of business firm and government’s plans to tax and spend.

ADVERTISEMENTS:

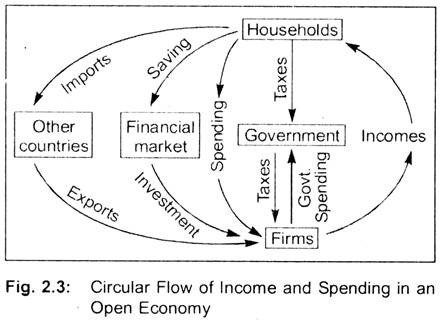

A four-sector economy is called an open economy in the sense that the country gets money by sending its goods outside i.e., exports (X), and spends money by buying foreign-made goods and services i.e., imports (M). In other words, in an open economy, there occurs a trading relationship between nations. Adding (X-M) in the above equation, we get

Y = C + I + G + (X-M)

The circular flow model in a four-sector open economy has been shown in Fig. 2.3.

The only difference in the circular flow of income between a closed economy and an open economy is that, in a four-sector economy, households purchase foreign-made goods and services (i.e., imports). Likewise, people of other countries purchase goods and services not produced domestically (i.e., exports). Imports constitute leakage from the circular flow while exports constitute injection in the circular flow. For simplicity’s sake, we have not shown in the diagram that firms and governments also sell export goods and purchase import goods.

Note that (I + G + X) constitute ‘injections’ into the circular flow and (S + T + M) constitute ‘leakages’ from circular flow. Injections increase national income while withdrawal or leakages reduce national income.

ADVERTISEMENTS:

The national product or national income measures the overall economic performance of a nation. To measure the national product, we add up the value of all final goods and services produced in a country in a year. Thus, we focus on firms or sellers which receive payment for the production. This is the product method of calculating national income.

IV. Concepts of National Income:

Some Important Concepts of National Income:

1. GDP and GNP:

GDP measures the aggregate money value of output produced by the economy over a year. In other words, GDP is obtained by valuing all final goods and services produced domestically in a year at market prices. GDP is also calculated by adding all the incomes generated by the act of production. Since only domestically produced goods and services is estimated, we use the word ‘domestic’ to distinguish it from the gross national product. The word ‘gross’ means that no deduction for depreciation is allowed.

GNP includes GDP plus net property income from abroad. Thus, GNP includes incomes that nationals earn abroad, but it does not include the incomes earned by foreign nationals. On the other hand, GDP is concerned with incomes generated domestically even by the foreigners. GDP ignores incomes received from abroad.

It is a measure of the goods and services produced within the country, regardless of who owns the assets. And GNP is the total of incomes earned by the residents of a country, regardless of where the assets are located. India’s GNP includes profits from Indian- owned businesses located in other countries. In other words,

GNP = market value of domestically produced goods and services + incomes earned by the nationals in foreign countries – incomes earned in the country by foreigners.

ADVERTISEMENTS:

GDP = market value of goods and services produced in the country + incomes earned in the country by foreigners – incomes received by resident nationals from abroad.

An example will help our understanding. Suppose, an Indian doctor goes to the USA temporarily to work there. The income he earns by rendering his service in the USA is included in the US GNP and not India’s GDP because it is earned in the USA. But this income is not part of the US GDP because the Indian doctor is a foreign national there. Similarly, the income of a US ambassador in New Delhi is not included in the US GNP, but it is a part of India’s GDP. Thus,

GNP = GDP + net property income from abroad.

Thus, GDP measures the aggregate money value of all goods and services produced by factors of production located and paid for in the domestic economy, even if these factors are owned abroad.

2. GDP at Market Price and GDP at Factor Cost:

When national product is measured, it is measured at current market prices. Market prices always reflect taxes and subsidies on the commodities produced. If indirect taxes are imposed on commodities, market prices of the commodities go up. A 10 p.c. tax on a book on economics will raise its price. Tax is included in the price of a commodity and tax is not a production. Similarly, subsidies are provided to some commodities, as a result of which prices decline. If we do not make any adjustment for such taxes and subsidies, we obtain GDP at market prices.

GDP at market prices do not reflect true incomes of factors of production. It includes taxes and subsidies but such are not production and, hence, they cannot be treated as incomes of productive inputs.

ADVERTISEMENTS:

So, taxes and subsidies are to be excluded and included respectively to obtain the true figure of production. Value of output can never be equal to the value of incomes paid to all productive inputs. By adjusting taxes and subsidies, we obtain GDP at factor cost, i.e.,

GDP at factor cost = GDP at market prices – indirect taxes (T) + subsidies (SU )

An example may be given here. Suppose, an excise duty on Indica car has been imposed. As a result of this, price of the car goes up to Rs. 2.75 lakh (Rs. 5 lakh being the excise duty). Value of the car output is, in fact, Rs. 2.70 lakh. This means different factor inputs have earned incomes in the form of rent, wages, etc. to the extent of Rs. 2.70 lakh. Value of output must equal value of incomes generated. Thus, indirect taxes are to be excluded.

Subsidies have the opposite effect of taxes. A subsidy per unit of coarse cotton cloth has the effect of reducing its market price. As a result of, say, one rupee subsidy per meter, consumers get the cotton cloth at Rs. 20 per meter. But incomes received by input owners in this cloth mill are Rs. 21 per meter. Value of output must equal the value of all incomes. So, subsidies are to be added. Thus, by subtracting taxes and adding subsidies from GDP at market prices, one obtains GDP at factor cost.

GNP at market prices and GNP at factor cost are calculated in the same way as described above:

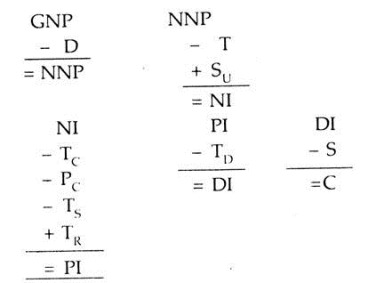

NI = NNP -T + SU

or NI = (GNP – D) – T + SU

3. NNP:

If we deduct depreciation from gross product we obtain net product. GDP minus depreciation is called NNP. NNP is sometimes called national income.

Anyway, to measure NNP, we must make a distinction between gross investment (Ic) and net investment (IN). Gross investment refers to total expenditure for new plant, equipment, etc., plus the change in inventories. Net investment is equal to gross investment less depreciation. That is,

I = IG – depreciation

Since GNP =C + Ic + G + (X- M),

or NNP = GNP – depreciation

Although NNP gives us the better measure of an economy’s performance, we pay more attention to GNP. This is because estimation of NNP is difficult in practice, as one has to measure depreciation to obtain the net investment figure. In practice, GNP is the more commonly used indicator than NNP.

4. Personal Income:

Although national income is the sumtotal of all individuals’ personal income, it is observed that received income is smaller than the earned income. This is because first a company has to pay corporate income tax (Tc) to the government out of its earned income. Secondly, firms keep a portion of their profits for internal expansion.

This is called undistributed corporate profit (Pc) or retained earnings. Thirdly, individuals pay social security taxes (Ts), like provident fund, life insurance premium, etc. Finally, since government transfer payments (TR) do not reflect current earnings and, hence, are not included in national income, it increases received income.

To measure personal income (PI), we subtract Tc, Pc and Ts (i.e., all the components of income that is earned but not received) from NI and add TR (i.e., income received but not earned) from national income. Symbolically,

PI = NI – (Tc + Pc + Ts) + TR

We can summarise this discussion in the following form:

Here, Tp refers to direct tax, DI to disposable income, S to saving and C to consumption.