Four models (Forms) of circular flow of national income and its significance are:

(a) Circular Flow of Income in a Two Sector Economy (b) Introduction of Capital Market (Financial system) (c) Introduction of Government Sector (Circular Flow of income in a three sector economy) (d) Introduction of External Sector (Circular flow of income in a four sector economy).

The structure of macro economy is given by the circular flows of income and output. National income accounting has its foundation in the model of circular flow.

Circular flow of income can be depicted in two sectors (Households and Firm), three sectors (Households, Firm and Government) and four sectors (Households, Firm, Government and Rest of the World) models. Let us first start with two sector model.

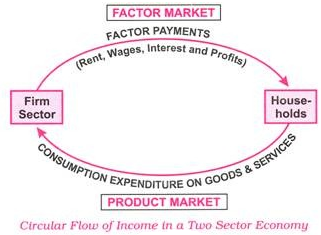

(a) Circular Flow of Income in a Two Sector Economy:

ADVERTISEMENTS:

Let us start with a simplified model involving two sectors, namely, household sector and firm sector, assuming that there is no government. We further assume that the economy is a closed one having no exports or Imports. Similarly, there is no saving by the households, who spend all what they earn; and no investment by the firms.

Such an economy has two types of markets—Product Market and Factor Market. Under these presumptions, the firm sector hires factor services from households who are owners of factors of production (land, labour, capital and enterprise) for producing goods and services and pays them remuneration (or compensation) in the form of money for rendering the productive services.

For the factors of production, these are factor incomes known as rent, wages, interest and profit which have been generated in the production process. Thus, money income flows from firm sector to the households. With this money, the households purchase from the firms, manufactured goods and services to satisfy their wants with the result that the same money flows back from households to the firm sector.

Thus, the entire income of the economy comes back to firms in the form of sale revenue. The counter flow of money from households to the firms leading to the circular flow of money between the two sectors is represented in the following diagram.

(b) Introduction of Capital Market (Financial system):

We now drop the above- mentioned assumptions one by one and move a step further by bringing in the role of capital market consisting of financial institutions. Financial institutions are primary intermediaries between savers and investors (or lenders and borrowers). All lendings and borrowings are channeled through capital market. In practical life, whatever is earned by the households is not spent on consumption goods.

A part of earning is saved and deposited in the capital market leading to money flow from households to the capital market. Similarly, firm also saves with the aim of meeting cost of depreciation and expanding its production capacity. Firms also borrow to finance their investment in plant and equipment. Thus, savings of the firms going to the capital market and borrowing by the former from the latter also create money flows as shown in the following diagram.

Leakage and Injections:

ADVERTISEMENTS:

A leakage is the amount of money which is withdrawn from the now of income whereas injections are the amount of money that is added to the flow of income in the economy Thus, (i) savings, (ii) taxes by households and firms and (iii) import spending constitute a leakage from the circular flow of income (money).

On the other hand, (i) investment spending, (ii) government spending and (iii) export earnings become injection into the circular flow of income (money). For equilibrium at macro level leakage must be equal to Injections as equilibrium condition C + S = C + I Indicates S = I or Leakage = Injections For instance. In a two sector economy when a part of income earned by households from firms is held back (i.e., saved), unsold stocks of output will accumulate leading to depression. Therefore, pluming of leakage is must if production is to be sustained.

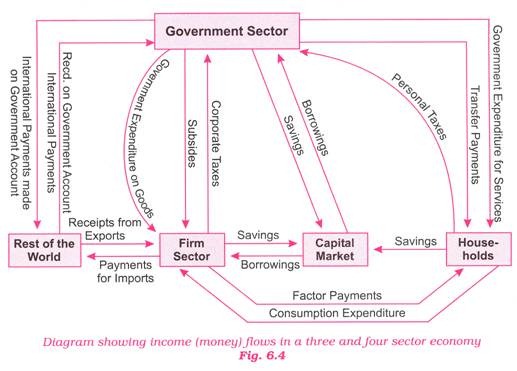

(c) Introduction of Government Sector (Circular Flow of income in a three sector economy):

We move further by introducing Government Sector which purchases goods from firms and labour services from households. Between households and the government, money flows from government to the households when the government makes transfer payments (like old-age pension, scholarships, etc.) and factor payments (for hiring services of factors of production) to the households. Money flows back to the government when it collects direct taxes (income tax, wealth tax) from the households.

Similarly, there are flows of money between the government sector and the firm sector when government realises corporate taxes from the firms, grants them subsidies (like land and electricity at cheap rates) and makes payment for the goods purchased by it. These flows have been shown in the Fig. 6.4

Remember, from macroeconomic point of view, there are four sectors, namely,

(i) Households,

(ii) Firms

(iii) Government and

ADVERTISEMENTS:

(iv) External sector.

(d) Introduction of External Sector (Circular flow of income in a four sector economy):

Our model will remain incomplete without converting the closed economy into an open economy where imports and exports are made. One country’s exports are another country’s imports. With the increase of a country’s imports, money flows to the rest of world (ROW) whereas in the case of exports, money flows in from ROW.

There is a Trade Surplus for an economy when its exports exceed imports but the economy suffers Trade Deficit when imports exceed exports. Mind, imports are leakages and exports are injections into the circular flow of income in the economy.

Significance of circular flow in income:

(i) It reflects structure of an economy.

ADVERTISEMENTS:

(ii) It shows interdependence among different sectors.

(iii) It gives information about injections and leakages from flow of money.

(iv) It helps in estimation of national income and related aggregates.