1. Introduction to Working Capital

Working capital management is significant in Financial Management due to the fact that it plays a pivotal role in keeping the wheels of a business enterprise running. Working capital management is concerned with short-term financial decisions.

Shortage of funds for working capital has caused many businesses to fail and in many cases, has retarded their growth. Lack of efficient and effective utilization of working capital leads to earn low rate of return on capital employed or even compels to sustain losses.

The need for skilled working capital management has thus become greater in recent years. A firm invests a part of its permanent capital in fixed assets and keeps a part of it for working capital i.e., for meeting the day to day requirements. We will hardly find a firm which does not require any amount of working capital for its normal operations.

The requirement of working capital varies from firm to firm depending upon the nature of business, production policy, market conditions, seasonality of operations, conditions of supply etc. Working capital to a company is like the blood to human body. It is the most vital ingredient of a business.

ADVERTISEMENTS:

Working capital management if carried out effectively, efficiently and consistently, will ensure the health of an organization. A company invests its funds for long-term purposes and for short-term operations. That portion of a company’s capital, invested in short-term or current assets to carry on its day to day operations smoothly, is called the ‘working capital’.

Working capital refers to a firm’s investment in short-term assets viz., cash, short-term securities, amounts receivables and inventories of raw materials, work-in-process and finished goods.

It refers to all aspects of current assets and current liabilities. The management of working capital is no less important than the management of long-term financial investment. Sufficient liquidity is necessary and must be achieved and maintained to provide that funds to payoff obligation as they arise or mature. The adequacy of cash and other current assets together with their efficient handling virtually determine the survival of the company.

The efficient working capital management is necessary to maintain a balance of liquidity and profitability. If the funds are tied- up in idle current assets represent poor and inefficient working capital management which affects the firm’s liquidity as well as profitability.

2. Meaning of Working Capital

Working capital is defined as ‘the excess of current assets over current liabilities’. All elements of working capital are quick moving in nature and therefore, require constant monitoring for proper management.

ADVERTISEMENTS:

For proper management of working capital, it is required that a proper assessment of its requirement is made. Working capital is also known as ‘circulating capital, fluctuating capital and revolving capital’.

The magnitude and composition keep on changing continuously in the course of business. If the working capital level is not properly maintained and managed, then it may result in unnecessary blockage of scarce resources of the company. Therefore, the Finance managers should give utmost care in management of working capital.

3. Definition of Working Capital

Gerestenburg defines, “Circulating capital means current assets of a company that are changed in the ordinary course of business from one form to another, as for example, from cash to inventories, inventories to receivables, receivables into cash”.

ADVERTISEMENTS:

Shubin defines, “Working capital is the amount of funds necessary to cover the cost of operating the enterprise.”

Weston and Brigham defines, “Working capital refers to a firm’s investment in short term assets – cash, short term securities accounts receivables and inventories.”

Hoagland defines, “Working capital is descriptive of that capital which is not fixed. But the more common use of the working capital is to consider it as the difference between the book value of current assets and the current liabilities.”

Mead, malott and Field defines, “Working capital means current assets.”

Bonneville defines, “Any acquisition of funds which increases the current assets, and which increases the working capital for they are one and the same.”

J.S. Mill defines, “The sum of the current assets is the working capital of business.”

From the above definitions, it is clear that working capital is a going concern, is a revolving fund. It consists of cash receipts, from sales which are to cover the cost of operation.

4. Objectives of Working Capital Management

(1) To minimize the amount of capital employed in financing the current assets. This will also lead to an improvement in the “Return on Capital employed”.

(2) To manage the current asset in such a way that the marginal return on investment in these assets is not less than the cost of capital acquired to finance them. This will ensure the maximization of the value of the business unit.

ADVERTISEMENTS:

(3) To maintain the proper balance between the amount of current assets and liabilities in such a way that the firm is always able to meet its financial obligations whenever due. This will ensure the smooth working of the unit without any production held ups due to paucity of funds.

5. Concepts of Working Capital

There are two concepts of working capital i.e. gross working capital and net working capital. Gross working capital is the amount of funds which are invested in current assets. Current assets are those assets which are converted into cash within a short period of time generally in one year. Current liabilities are those liabilities which can be payable within a short period of time generally in one year.

i. Current Assets – Cash in hand, cash at bank, sundry debtors, bills receivables, short term investments, inventories, marketable securities, prepaid expenses, accrued incomes etc.

ii. Current Liabilities – Sundry creditors, bills payable, outstanding expenses, accrued expenses, short term advances and deposits, dividends payable, bank overdraft etc.

6. Factors Determining Working Capital

ADVERTISEMENTS:

The working capital requirements of an enterprise depend on a variety of factors. These factors affect different enterprises differently and vary from time to time.

These factors are:

1. Nature of Business:

The working capital requirements of a firm is basically influenced by the nature of business undertaken by it. The ratio of current assets to total assets of a firm measures the requirements of working capital of various firms. The need for working capital is depend on operating cycle period i.e., shorter the operating cycle period, smaller the working capital requirements, larger the operating cycle period, larger the working capital requirements.

ADVERTISEMENTS:

E.g. Public utilities, hotels, restaurants etc. need small working capital requirements. Trading firms’ financial firms, Construction Companies Manufacturing firms etc. need larger working capital requirements.

2. Size of Business:

The size of a business firm affects the working capital requirements. The size indicates the scale of operation. Larger the scale of operation larger will be the working capital requirements. Smaller the scale of operation, smaller will be the working capital requirements.

3. Manufacturing Cycle:

Manufacturing cycle is the time gap between the purchase of raw materials and the production of finished goods. Shorter the manufacturing cycle, smaller will be the working capital requirements and larger the manufacturing cycle, larger will be the working capital requirements.

e.g., a distillery needs larger working capital whereas a bakery requires smaller working capital.

ADVERTISEMENTS:

4. Business Cycle:

The working capital requirements depend upon the supply and demand for the goods and services produced. The demand for the products will be expected well in advance and working capital requirements decided accordingly.

5. Firm’s Credit Policy:

The credit policy of the firm influences the requirement of working capital and it is based on credit allowed to the debtors and credit allowed by the creditors.

6. Operating Efficiency of the Firm:

The efficiency of the business operation improves the pace of the cash cycle, thereby strengthens the working capital turnover.

ADVERTISEMENTS:

7. Profit Margin and Dividend Policy:

A higher the net profit margin reduces the working capital requirements because it contributes towards working capital resources. Again, the policy of the management towards dividend strengthens the base for working capital requirements. If more will be the retained earnings there will be more cash available for working capital necessity of a firm.

8. Expansion and Growth of Business:

If the company goes for growth and expansion of business, it will require more working capital in terms of sales and fixed assets. Increasing sales require more working capital in the form of more stock of raw materials, inventory of work- in- progress and finished goods.

9. Suppliers’ Credit:

The purchasing policy of the business decides the working capital necessity. If the purchases on a cash basis only, more working capital required. If the purchases on credit basis, the period of credit allowed by the creditor decides the size of working capital requirements.

ADVERTISEMENTS:

10. Loans and Credit Facilities Available:

The working capital requirements of the firm depends upon access to the money market. The firms with readily available credit from banks and from other financial institutions at liberal terms, will be able to manage with less working capital.

11. Taxation Policy:

The industries which will be required to pay heavy taxes to the Government need larger working capital.

12. Level of Automation:

By adopting higher level of technology in the industry reduces employees, hence lesser working capital is needed. The industries which are more labour intensive require more working capital.

7. Importance of Working Capital

Working capital plays a vital role in business. It is the lifeblood of a business.

ADVERTISEMENTS:

The importance of working capital can be understood with the help of following points:

(i) Adequate working capital is required to meet the commitments towards short-term liabilities like salaries, wages, power and fuel expenses, taxes, etc.

(ii) It ensures to maintain the operations on a smooth basis by maintaining the required level of inventory.

(iii) It enhances liquidity and solvency of a business enterprise.

(iv) It provides necessary funds to meet the contingencies.

(v) It helps in the measurement and analysis of profits of a business enterprise.

(vi) It builds reputation in the market and it becomes easier to raise funds when working capital position is healthy and stable.

8. Components of Working Capital

Management of working capital means managing different components.

These are discussed hereunder:

1. Management of Cash:

Every enterprise irrespective of its scale requires a certain amount of cash to meet its day-to-day obligations. Hence, the enterprise needs to decide carefully how much should be carried in cash. Management of cash aims at striking a balance between two contradictory objectives of meeting the cash disbursement needs and minimizing the amount locked up as cash balance.

For this purpose, cash management addresses to the following four problems:

i. Controlling the level of cash.

ii. Controlling inflows of cash.

iii. Controlling outflows of cash.

iv. Optimum use of surplus cash.

2. Management of Inventory:

Inventories refer to raw material, work-in-progress and finished goods. These constitute a major portion, about 60%, of total current assets. There are three major motives for holding inventories in a firm, namely, transaction motive, precautionary motive and speculative motive. But, holding inventories involves costs, i.e., ordering costs and carrying costs.

Hence, inventories need to be maintained at an optimum size inventory management is a trade-off between cost of acquiring and cost of holding inventories. Among various models evolved for managing inventories, the commonly used model is Economic Ordering Quantity (EOQ) Model based on Baumol’s cash management model.

The other model of inventory management is ABC Analysis also known as Control by Importance and Exception (CIE). This method controls expensive inventory items more closely than less expensive items.

3. Management of Accounts Receivable:

Accounts receivable represent the amount of goods sold on credit with a view to increase the volume of sales. Accounts receivable constitute a major portion of current assets. According to the Indian Chamber of Commerce and Industry (ICCI) study of 417 companies, the ratios of accounts receivable to total assets, current assets and sales were, on average, 17%, 30% and 14-15% respectively.

The main objective of maintaining accounts receivable are achieving growth in sales, increasing profits and meeting competition. Like inventories, maintaining accounts receivable also involves certain costs such as – capital costs, administrative costs, collection costs and defaulting costs, i.e., bad debts.

The size of accounts receivable depends on the level of sales, credit policy, terms of trade, efficiency of collection, etc. A larger size of accounts receivable increases profitability and reduces liquidity and vice versa. Therefore, accounts receivable need to be maintained at an optimum size.

The optimum size of accounts receivable occurs at a point where there is a “trade-off” between profitability and liquidity.

4. Management of Accounts payable:

Accounts payable are just reverse to accounts receivable. Accounts payable emerge due to credit purchase. This refers to a learning of goods and inventories to the buyer. This is also called ‘buy-now, pay-later’. The underlying objective of accounts payable is to slow down the payments process as much as possible.

But, it should be noted that the saving of interest cost should be offset against loss of credit standing of the enterprise. The enterprise has, therefore, to ensure that the payments to the creditors are made at the stipulated time periods after obtaining the best credit terms possible.

The salient points to be noted on effective management of accounts payable are:

i. Obtain most favourable credit terms with the prevailing credit practice.

ii. Make payments on maturity or due dates.

iii. Keep a good track record of past dealings with the suppliers.

iv. Avoid the tendency to divert payables.

v. Provide full information to the suppliers.

vi. Keep a constant check on the incidence of delinquency.

9. Need for Working Capital

Working capital is a common measure of a firm’s liquidity, efficiency and overall health. As it includes cash, inventory, accounts receivable, accounts payable, the portion of debt due within one year, and other short-term accounts, a firm’s working capital reflects the results from a host of firm activities, including inventory management, debt management, revenue collection and payments to suppliers.

The needs for working capital vary from industry to industry, and they can even vary among similar firms. This is due to several factors, including differences in the collection and payment policies, the timing of asset purchases, the likelihood of a firm writing off some of its debt, and in some instances, capital raising efforts made by the firm.

Apart from this, different industries depend on different equipment, use different revenue accounting methods, and different approaches to other industry-specific matters. For these reasons, comparison of working capital is generally most meaningful among firms within the same industry.

A positive working capital generally indicates that a firm is able to pay off its short-term liabilities almost immediately. Negative working capital generally implies that a firm is unable to meet its short-term maturing obligations.

That is why analysts are sensitive to decreases in working capital as it suggests that a firm is becoming overleveraged, and is struggling to maintain or grow sales; is paying bills too quickly; or is collecting receivables too slowly.

Increases in working capital, on the other hand, suggest just the opposite. The working-capital formula assumes that a firm really would liquidate its current assets to pay current liabilities, which is not always realistic, considering that some cash is always needed to meet payroll obligations and also to maintain operations.

For instance, accounts receivable are not always readily available for collection. It is important to understand that cash outflows do not always coincide with cash inflows. Although it is possible to predict cash outflows resulting from payment of short-term obligations, the same is not true for cash inflows.

In case cash inflows are certain, a little or no net working capital is required. However, if cash inflows of a business concern are uncertain, adequate current assets are required to cover its current liabilities. When not managed carefully, businesses can grow themselves out of cash by needing more working capital to fulfill expansion plans than they can generate in their current state.

This usually occurs when a firm has used cash to pay for everything, rather than seeking financing that would smooth out the payments and make cash available for other uses. As a result, working capital shortages cause many businesses to fail even though they may be profitable ventures. The most efficient firms invest wisely to avoid these situations.

The working capital helps in achieving the twin objectives of profitability and liquidity for a concern.

10. Kinds of Working Capital

Working capital may be classified into two kinds such as:

(i) On the basis of concept, and

(ii) On the basis of time

Working capital on the basis of concept again classified into two categories such as gross working capital and net working capital. Working capital on the basis of time classified into two categories such as permanent working capital and temporary working capital.

Gross Working Capital – Total of all Current Assets

Net Working Capital – Total Current Assets – Total Current Liabilities

The accounting formula used to calculate the available working capital of a business is-

Working Capital = Current Assets – Current Liabilities

11. Aspects of Working Capital Management

Management of working capital involves the following four aspects, viz.:

1. Determining the total funds required to meet the current operations of the firm (i.e., determination of the level of current assets).

2. Deciding the structure of current assets (i.e., the proportion of long-term and short-term capital to finance current assets).

3. Evolving suitable policies, procedures and reporting systems for controlling the individual components of current assets (mainly cash, receivables and inventory), and

4. Determining the various sources of working capital.

For determining the sources of working capital (short-term and long-term capital), the net concept becomes useful and for determining the level and composition of working capital it is the gross concept, which becomes more meaningful.

12. Types of Working Capital

When we say working capital, we are referring to the net working capital. Gross working capital indicates the firm’s investment and financing of current assets. Net working capital, on the other hand, shows the liquidity of a firm.

Thus, net working capital indicates the financing needs of a firm, both through long-term and short-term financing sources. Working capital financing, however, can be a challenge for a business, especially for a small firm. The amount of funds needed for meeting requirements normally varies from time to time in every business.

In order to finance the working capital in an efficient manner, it is important to understand the difference between the two types of working capital:

1. Permanent Working Capital, and

2. Temporary Working Capital

1. Permanent Working Capital:

This is also called fixed working capital. A part of the investment in current assets is as permanent as the investment in fixed assets. It covers the minimum amount necessary for maintaining the circulation of the current assets in order to carry out the minimum level of business activities. It is that part of working capital that is permanently locked up in the circulation of the current assets. Tandon Committee had referred to this type of working capital as “Core current assets”.

The characteristics of this type of working capital are:

(a) The amount of permanent working capital remains in the business in one form or another. This is particularly important from the point of view of financing. The suppliers of such working capital should not expect its return during the lifetime of the firm.

(b) It also grows with the size of the business. In other words, the larger the size of the business, the greater is the amount of such working capital and vice versa.

Permanent working capital is permanently needed for the business and therefore, it should be financed out of long-term funds.

It does not depend on the level of production or sales. In a way, it is similar to fixed assets because of its permanent (or fixed) nature. However, its level can change over time. The level of permanent working capital depends on the business cycle as well as the growth of a firm.

Apart from a minimum amount of investment in the current assets that is required at all times, it also includes the reserve working capital that may be used for unforeseen contingencies as union strikes, recession, lockouts, rise in prices, etc.

2. Temporary Working Capital:

This is also called variable working capital. A business does not need the same level of current assets throughout the year. For example, during a slack time, a manufacturing firm does not need to invest too much into raw materials, work-in-process, or finished goods inventory because of the decrease in sales.

However, during peak seasons (e.g., Diwali), retail stores need higher levels of merchandise. Therefore, extra inventory has to be maintained to support sales during peak sales period. Similarly, receivables also increase and must be financed during the period of high sales. On the other hand investment in inventories, receivables, etc., will decrease in periods of depression.

The level of production and sales fluctuates, and thus, the need for current assets also varies from time to time on the basis of business activities. The temporary working capital represents the excess of permanent working capital that is required at different times during the operating year.

Suppliers of temporary working capital can expect its return during off season when it is not required by the firm. Hence, temporary working capital is generally financed from short-term sources of finance such as bank credit.

Temporary working capital includes the liquid capital needed during the particular season as well as variable capital which is needed for financing special operations such as the organization of special campaigns for increasing sales through advertisement or other sale promotion activities for conducting research experiments or execution of special orders of government that will have to be financed by additional working capital.

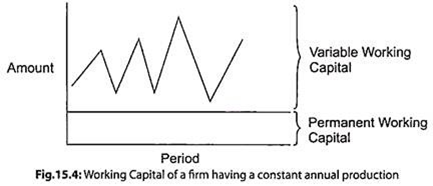

A firm having constant annual production tends to have constant permanent working capital and only variable working capital changes due to change in production caused by seasonal operations.

This has been depicted in Fig. 15.4:

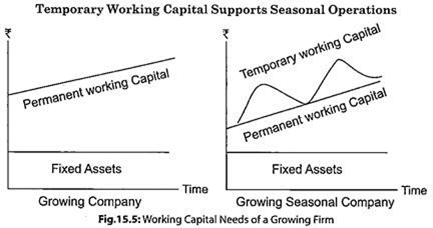

Similarly, a growing firm is the firm having unutilized capacity. The production and operations of such a firm continue to grow naturally. As its volume of production rises with the passage of time so also does the quantum of the permanent working capital. The permanent working capital is upward sloping for a growing firm. The temporary working capital will change due to changes in production caused by seasonal operations.

This is shown in Fig. 15.5:

The distinction between permanent and temporary working capital is important in arranging the finance for an enterprise. Permanent working capital should be raised in the same way as fixed capital is procured.

It is undesirable to bring regular (or permanent) working capital into the business on a short-term basis because a creditor can seriously handicap the business by refusing to continue lending permanently.

This may disrupt operations unless another lender can be found. Variable capital requirement can, however, be financed out of short-term loans from the banks or inviting public deposits.

13. Working Capital Cycle

Working Capital Cycle or Operating Cycle:

The time between the purchase of inventory items and their conversion into cash is called Operating Cycle. Funds required for investing in current assets (such as inventories, debtors, bills, etc.) keep on changing from one form of asset to another.

For e.g., A company has some cash in the beginning. Such cash is used for payment to the suppliers of raw materials, for payment of wages & salaries and to meet overhead costs.

These costs, viz., cost of raw materials, cost of labour and other expenses all together would be called work-in progress which will be converted into finished goods, on the completion of the production process on the sale of these goods they get converted into debtors or bills and when the debtors pay, the firm will get cash.

This cash will again be utilised for financing raw materials, work-in-progress, labours, overhead costs, etc., to produce finished goods, which when sold, will be converted into debts which will be finally converted into cash.

There will be a complete cycle when cash gets converted into raw materials W.I.P finished goods, debtors and finally again into cash. This time period is called the working capital cycle of the firm.

The Operating cycle on working capital is the length of time between a company’s paying for materials, entering into stock and receiving the inflow of cash from sales.

Thus, the duration of time required to complete the following sequence of events in case of a manufacturing firm is called the operating cycle.

i. Conversion of cash into raw material.

ii. Conversion of raw materials into WIP.

iii. Conversion of WIP into finished goods.

iv. Conversion of finished goods into debtors.

v. Bills receivable through sales.

vi. Conversion of debtors and bills receivable into cash.

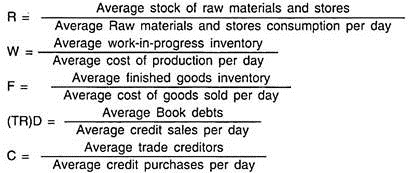

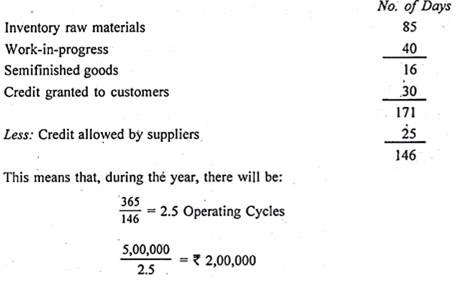

Calculation of Duration of Time i.e. Operating Cycle:

The duration of the operating cycle for the purpose of determining working capital requirements is equivalent to the sum of the duration of each of the stages less the credit period allowed by the creditors to the firm.

Symbolically, the duration of the working capital cycle can be put as follows:

O = R + W + F + D – C

O = Duration of operating cycle

R = Raw Materials and stores, storage period

W = Work-in-process period

F = Finished goods storage period

(TR) D = Debtors collection period

C = Creditors payment period

Each of the components of the operating cycle can be calculated as follows:

Note – As per the companies Amendment Act 2011 debtors are called trade receivables (i.e., TR)

14. Working Capital Leverage

Working Capital Leverage refers to the tendency of increasing profits of the firm by controlling the amount of working capital in relation to sales. It may also be possible to finance current assets from low cost funds or cost free funds or by current liabilities. If the current assets are financed fully, current liabilities and the current ratio will be 1:1

Current Ratio = CA/CL = 1 i.e., 1:1

Working capital Leverage is nothing but current assets leverage which refers to the asset turnover aspect of return on Investment. This reflects the Company’s degree of efficiency in employing current assets.

In other words the ability of the company to guarantee a large volume of sales with a small current asset base is a measure of the Company’s operating efficiency. This phenomenon is an asset turnover which is a real foot in the hands of a finance manager in a company to monitor the employment of funds on a comprehensive basis to result in a high degree of working capital leverage.

15. Methods of Estimating Working Capital

There are two methods which are usually followed in determining working capital requirements:

(1) Conventional Method:

According to the conventional method, cash inflows and outflows are matched with each other. Greater emphasis is laid on liquidity and greater importance is attached to current ratio, liquidity ratio, etc., which pertain to the liquidity of a business.

(2) Operating Cycle Method:

In order to understand what gives rise to differences in the amount of timing of cash flows, we should first know the length of time which is required to convert cash into resources, resources into final products, the final product into receivables and receivables back into cash. We should know, in other words, the operating cycle of an enterprise. The length of the operating cycle is a function of the nature of a business.

There are four major components of the operating cycle of a manufacturing company:

(i) The cycle starts with free capital in the form of cash and credit, followed by investment in materials, manpower and the services;

(ii) Production phase;

(iii) Storage of the finished products terminating at the time-finished product is sold;

(iv) Cash or accounts receivable collection period, which results in, and ends at the point of disinvestment of the free capital originally committed.

New free capital then becomes available for productive reinvestment. When new liquid capital becomes available for recommitment to productive activity, a new operating cycle begins.

This method is more dynamic and refers to working capital in a realistic way. Different components of working capital are directed scientifically in order that the fullest utilisation of plant and machinery may be made.

This method helps in increasing the profitability of a business. It enables a company to maintain its liquidity and preserve that liquidity through profitability. The operating cycle method considers production and other business operations, and forecasts the changes that may be necessary in the pursuit of the future activities.

To meet the day-to-day requirements of the trade, the need for working capital may be assessed by finding out the period during which liquid funds, except cash and bank balances would be locked up in current assets after deducting the credit received from the suppliers and the other credits received.

The operating cycle concept can be made clear with the following example:

Exhibit:

In other words, if the operating expenditure during the year is Rs.5, 00,000, each operating cycle will cost the business Rs.2, 00,000.

It is clear that the company will be interested in reducing the operating cycle period as much as possible.

Working capital is an investment in current assets. Like other investments, it costs money and therefore, is a drain on the profit. But the fact that working capital is a cost centre that it is an area with significant cost and that it needs an effective cost analysis and the control system is generally overlooked. The cost analysis and control system, however, commonly covers one segment of the working capital-the raw material inventory.

Like the one-eyed deer, the management keeps watch only on this cost point; and where this has been practiced, it has, like the one-eyed deer, invited danger from the other side of current assets, that is, the work-in-process and finished goods.

How the absence of a control system for finished products (automobiles) resulted in a crisis of liquidity for General Motors Ltd., in the twenties is an example which it will be worthwhile for the firm’s management to remember.

A company may indeed have a factory which is well equipped with modern machines and which has excellent sales at profit-yielding prices. The company may not, however, be able to sustain production in top gear, and thus lose sales, customers and consequently profitable business, if it suffers from the want of working capital. Infact, improper management or lack of working capital management may lead to the failure and even closure of a business undertaking.

16. Determinants of Working Capital

In a period of rising capital costs and scarce funds, the working capital is one of the most important areas requiring management review. A large number of factors influence the working capital needs of the firms.

These factors may not only vary for different firms in the same industry, but also for the same firm at different points of time. Therefore, an analysis of the relevant factors should be made in order to determine the total investment in working capital.

Generally, the following factors influence working capital requirements of the firm:

Determinant # 1. Nature and Size of the Business:

The working capital requirements of a firm are basically influenced by the nature and size of the business. Size may be measured in terms of the scale of operations. A firm with the larger scale of operations will need more working capital than a small firm. Similarly, the nature of the business also influences the working capital decisions.

In general, manufacturing firms need high amounts of working capital along with their fixed investment of stock, raw materials and finished products to meet their production requirements. Within the manufacturing sector, basic and key industries or those engaged in the manufacture of capital goods usually have a less proportion of working capital to fixed capital than industries producing consumer goods.

Trading and financial firms have less investment in fixed assets, but require higher working capital as most of their investment is concentrated in stock or inventory.

The firms that sell services and not goods, on a cash basis require least working capital because there is no requirement on their part to maintain heavy inventories. Public utilities and railway firms with huge fixed investment usually have the lowest need for current assets, partly because of their cash oriented business activities and partly because they provide a service instead of selling a commodity.

Determinant # 2. Production Cycle:

The average length of the period of manufacture, that is, the time which elapses between the commencement and end of the manufacturing process is an important factor in determining the amount of the working capital required. Longer this time period, the higher is the volume and value of work-in-progress and hence, higher the requirement of working capital and vice versa.

For instance, a baker requires one night time to bake his daily quota of bread. His working capital is, therefore, much less than that of a distillery which has an aging process and thus needs to make heavy investment in inventory. Between these two cases may fall other business concerns with varying periods of manufacture requiring different amounts of working capital.

Determinant # 3. Seasonal Fluctuations:

The working capital requirement varies with different market conditions and demand in different seasons. For example, the sugar industry produces practically all the sugar between December and April. Thus, more working capital will be needed at the time of crop and manufacturing.

If a firm sells most of its goods at one time of the year, it may need to build its inventory in advance of the selling season. For instance, the woollen textile industry makes its sales generally during winter.

Also, there are some raw materials that are available only during certain seasons so there is a need to buy and stock those raw materials when they are available to sustain uninterrupted and cost effective production.

Determinant # 4. Credit Policy:

Credit policy relates to purchasing and selling of goods on credit basis. If a firm purchases all goods on credit and sells on a cash basis, the firm needs a very low amount of working capital. But if a firm purchases on a cash basis and sells on credit basis, it means there is a time lag between cash outflow and cash inflow.

Therefore, a large amount of working capital is required for uninterrupted operations. Apart from this, the length of the period of credit, the collection policy and prevailing trade practices have a direct bearing on working capital.

For instance

(i) When the longer credit period is allowed to debtors as against the one extended to the firm by its creditors, more working capital is needed and vice versa.

(ii) A stringent collection policy might not only deter some credit customers, but also force the existing customers to be prompt in settling dues resulting in lower level of working capital. The opposite holds true for a liberal collection policy.

(iii) Prevailing trade practices and changing economic conditions generally influence the credit policy of a business enterprise. For instance, if there is keen competition in the market, the firm would be under pressure to grant easy credit terms.

Determinant # 5. Dividend Policy:

Dividend is an appropriation of profits and involves outflow of cash. The magnitude of working capital in a firm is dependent upon its profit margin and dividend policy. A high net profit margin contributes towards the working capital pool.

Distribution of a high proportion of profits in the form of cash dividends drains out cash resources and thus reduces firm’s working capital to that extent. The additional working capital requirement of the firm is less if the management follows conservative dividend policy and vice versa.

Determinant # 6. Business Cycle Fluctuations:

The requirements of working capital of a firm vary in different phases of the business cycle. During the periods of prosperity (or boom), the expansion of business units caused by the inflationary conditions creates demand for more and more capital for investing in the raw material and other goods. On the other hand, in the recessionary conditions, there is a fall in sales causing a decrease in book debts and requirement of cash.

Determinant # 7. Operating Efficiency:

The efficient utilization of a firm’s resources by reducing waste, improving coordination and control, better utilization of existing resources results in reducing costs. This results in improving net profit margin, which will, in turn, release greater funds for working capital purposes. The pace of the cash conversion cycle is accelerated with operating efficiency.

Determinant # 8. Growth and Expansion of Business:

Working capital requirements of a business firm tend to increase in correspondence with growth in sales and other business activities. A growing firm may need funds to invest in fixed assets in order to sustain its growing production and sales. This, in turn, increases investment in receivables and inventory to support increased scale of operations. Thus, a growing firm needs additional funds continuously.

There are many other factors that affect the working capital requirements of a business concern. Transport and communication facilities, tariff policies of government, availability of raw materials and the contingencies inherent in a particular type of business decide the magnitude of working capital to be maintained by a firm.

17. Sources of Working Capital

(1) Indigenous Bankers:

Private money tenders and other country bankers used to be the only source of finance prior to the establishment of commercial banks. They used to charge very high rates of interest and exploited the customers to the largest extent possible. Nowadays with the development of commercial banks they have lost their monopoly. But even today some businesses have to depend upon indigenous bankers for obtaining loans to meet their working capital requirements.

(2) Trade Credit:

Trade credit refers to the credit extended by the supplies of goods in the normal course of business. As present day commerce is built upon credit the trade credit arrangement of a firm with its supplies is an important source at working capital finance. The credit worthiness of a firm and the confidence of its suppliers are the main basis at securing trade credit.

(3) Advances:

Some business houses get advances from their customers and agents against orders and this source is a source of working capital finance for them. It is a cheap source of finance.

(4) Factoring or Accounts Receivable Credit:

Another method of raising short term finance is through accounts receivable credit offered by commercial banks and factors. A commercial bank may provide finance by discounting the bills or invoices of its customers. Thus, a firm gets immediate payment for sales made on credit.

A factor is a financial institution which offers services relating to management and financing debts arising out of credit sales.

(5) Commercial Banks:

Commercial banks are the most important source of short-term capital. The major portion of working capital loans are provided by commercial banks. They provide a wide variety of loans tailored to meet the specific requirements of a concern.

The different forms in which the banks normally provide loans and advances are as follows:

(a) Loans,

(b) Cash credits,

(c) Overdrafts,

(d) Purchasing and discounting of bills.

(6) Installment Credit:

This is another method by which the assets are purchased and the possession of goods is taken immediately but the payment is made in installments over a predetermined period of time.

Generally, interest is charged on the unpaid price or it may be adjusted in the price. But, in any case, it provides funds for some time and is used as a source of short term working capital by many business houses which have difficult fund positions.

(7) Deferred Incomes:

Deferred incomes are incomes received in advance before supplying goods or services. They represent funds received by a firm for which it has to supply goods or services in future.

These funds increase the liquidity of a firm and constitute an important source of short term finance. However, firms having great demand for its products and services and those having good reputations in the market can demand deferred incomes.

(8) Commercial Paper:

Commercial paper represents unsecured promissory notes issued by firms to raise short term funds. It is an important money market instrument in advanced countries like U.S.A. In India, the RBI introduced commercial paper in the Indian money market on the recommendations of the working group on Money Market (Vague Committee). But only large companies enjoying high credit rating and sound financial health can issue commercial paper to raise short term funds.

The maturity period of commercial paper, in India, mostly ranges from 91 to 180 days. It is sold at a discount from its face value, and redeemed at face value on its maturity.

18. Techniques of Forecasting Working Capital

Working capital can be forecasted on the basis of following techniques:

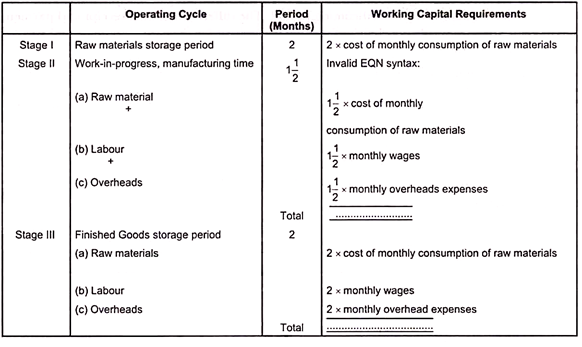

(1) Operating Cycle Method:

According to this method, the period for each stage of the operating cycle is estimated and then requirement of working capital is calculated on the basis of cost of different items.

Following points should be considered while forecasting working capital on the basis of this method:

(i) Cost of raw material, wages and overheads.

(ii) Period of storing raw material before being issued for production.

(iii) Period of production cycle.

(iv) Period of storing finished goods in the godown before sale.

(v) Period of credit allowed to customers and credit allowed by suppliers.

(vi) Lag in payment of wages and overheads.

Later, provision for contingencies should be added to the above estimates to arrive at the requirement of working capital

Working capital can be forecasted in following manner on the basis of this method:

(2) Forecasting of Current Assets and Current Liabilities Method:

According to this method, current assets and current liabilities are estimated on the basis of transactions for the coming years. The difference between current assets and current liabilities will determine the requirements of working capital. This estimate is made on the basis of factors like experience, credit policy of the previous years, etc.

(3) Cash Forecasting Method:

Under this method, forecasting of receipts and payments of cash is made for the forthcoming period. The difference in cash receipt and payment expresses surplus or deficit of cash. Arrangement for deficit cash is made and surplus cash is invested.

(4) Percentage of Sales Method:

Under this method, current assets and current liabilities are estimated as percentage of sales. These percentages are determined on the basis of past experience. Difference in current assets and current liabilities shows the requirement of working capital.

(5) Projected Balance Sheet Method:

Under this method, by forecasting current assets and current liabilities, a projected balance sheet for future date is prepared. The difference in assets and liabilities explains the surplus or deficit of cash.

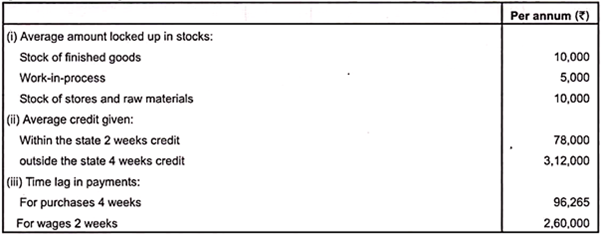

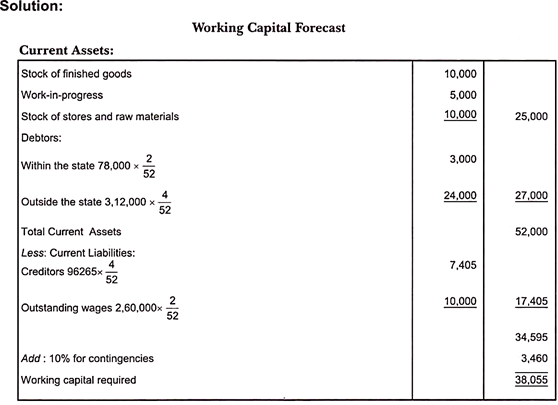

Illustration:

From the following information calculate the average amount of working capital required, allowing 10% for contingencies:

19. Advantages of Working Capital

The main advantages of maintaining adequate amount of working capital are as follows:

1. Indicator of the Solvency of the Business

Solvency is the ability to pay the debts. A firm having adequate working capital is able to pay his debts anytime so it helps in maintaining solvency of the business by providing uninterrupted flow of production.

2. Increase in Goodwill

A business concern having sufficient working capital enables it to make prompt payments to the creditors and hence helps in creating and maintaining goodwill in the market.

3. Help in getting Loan

A concern having adequate working capital, high solvency and good credit standing can arrange loans from banks and others on easy and favourable terms.

4. To Avail Cash Discounts

A concern having adequate working capital also enables to avail cash discounts on the purchases of material by paying in cash; it reduces the cost of production and increases in the profits also.

5. Regular Supply of Raw Material

Sufficient working capital ensures regular supply of raw materials and continuous production.

6. Timely payment of Expenses

A company having adequate working capital can make regular payment of salaries, wages and other day-to-day commitments which raises the morale of its employees, increases their efficiency, reduces wastages and costs and enhances production and profits.

7. Exploitation of Favorable Market Conditions

Only concerns with adequate working capital can exploit favourable market conditions such as purchasing its requirements in bulk when the prices are lower and by holding its inventories for higher prices.

8. Ability to Face Crisis

Adequate working capital enables a concern to face business crises such as depression because during such periods, generally, there is much pressure on working capital. So a firm having sufficient working capital can easily face the adverse conditions of the business.

9. Regular Return on Investments

Every investor wants a regular return on his investments. Sufficiency of working capital enables a concern to pay quick and regular dividends to its investors, as there may not be much pressure to plough back profits. This gains the confidence of its investors and creates a favourable market to raise additional funds in the future.

10. High Morale

Adequacy of working capital increases the morale also. Adequate working capital creates an environment of security, confidence, and high morale and creates overall efficiency in a business. As earlier mentioned with ample cash we can pay the salary and wages on time that will increase the morale of employees also.

20. Dangers of Inadequate Working Capital

The following are the dangers of inadequate working capital:

1. It stagnates growth because it is difficult to undertake profitable projects for non-availability of working capital.

2. It becomes difficult to implement operating plans and achieve the firm’s target profit.

Operating inefficiencies creep in when it becomes difficult even to meet day-to-day commitments.

3. It leads to inefficient utilisation of fixed assets.

4. It renders the firm unable to avail attractive credit opportunities, etc.

5. Firm loses its reputation when it is not in a position to honour its short-term obligations.

Therefore, the firm should maintain the right amount of working capital on a continuous basis. The right amount of working capital is influenced by several factors

21. Profitability v/s Liquidity Trade-off

Liquidity means the ability of the organization to pay the current liability. So we must have sufficient cash balance and other liquid securities so that at any time we can pay our liabilities. Now the question arises what amount a firm should invest in working capital?

Working capital involves the funds and the decision regarding the quantum of working capital affects the profitability and liquidity both.

If we go for liquidity (large amount of working capital) that will decrease the profitability, because greater liquidity involves cost also and affects the cash inflow. And if we go for profitability it will decrease the liquidity and can cause insolvency.

Thus the main problem of the finance manager is to determine the level of working capital. In this regard a firm should check its liquidity ratio and current ratio. Generally the optimum ratio of liquid ratio is considered 1:1 and for current ratio it is 2:1.

To maximize shareholders’ wealth, optimum level of current assets should be determined. There is always conflict between the liquidity and the profitability objectives. If current assets are held at a level more than the required one, profitability is decreased; though, there is enough liquidity.

If current assets are maintained at a level less than required, the solvency of the firm is threatened. Therefore, a proper balance is to be maintained between the two so that profitability is maximized without sacrificing solvency.

Thus, a trade-off between risk and return is attempted to be struck off. If the firm’s level of current assets is more than the desired level, there is excessive liquidity, leading to idle current assets and low return on assets. This reduction in profitability can be termed as the cost of liquidity, which has a positive correlation with the level of current assets.

In case, the firm maintains current assets at a level lower than the desired level, the position of illiquidity arises. It means that the firm may find difficulty in honoring its commitments as regards repayment obligations.

The firm may be required to borrow at high rates of interest. The firm may lose sales also because of shortage of stock and tight credit policy of the firm. Thus there is a cost of liquidity which increases with the less and less level of current assets. The optimum level of current assets can be determined by balancing the cost of liquidity and the cost of liquidity.

The optimum level is the point where the total cost is the minimum. So, there exists a trade-off between profitability and liquidity or a trade-off between risk (liquidity) and return (profitability). This may also be described as risk-return trade off.

22. Policies for Financial Current Assets

This is the most important aspect of working capital management to decide how to finance the current assets requirement, there are so many sources of funds such as Long term sources (this includes Shares, Debentures, Long term borrowings etc.).

Short term sources (this includes commercial papers, factoring, band credit etc.), spontaneous sources (this includes credit allowed by suppliers, outstanding labour and overhead expenses etc.).

While deciding the finance policy we must consider that a part of working capital is permanent working capital and other is variable working capital and we should plan according to their requirement.

There are different approaches to take this decision relating to financing mix of the working capital as follows:

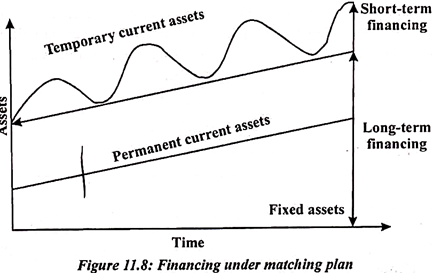

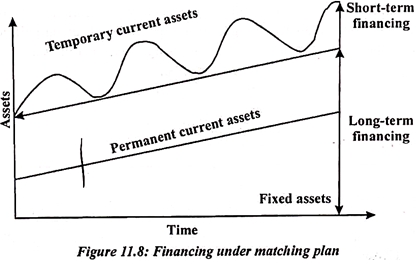

(i) Matching/Hedging Approach:

The general rule of matching policy is that the length of the finance should match with the life of the assets. So that’s why the fixed assets are financed by long term sources and current assets are financed by short term sources because, Using long-term financing for short-term assets is expensive as funds will not be utilized for the full period.

Similarly, financing long-term assets with short-term financing is costly as well as inconvenient as arrangements for the new short-term financing will have to be made on a continuing basis.

The firm can adopt a financial plan which matches the expected life of assets with the expected life of the source of funds raised to finance assets. Thus, a five-year loan may be raised to finance a plant with an expected life of five years; stock of goods to be sold in twenty days may be financed with a twenty day short term source of finance.

When the firm follows a matching approach, long-term financing will be used to finance fixed assets and permanent current assets and short-term financing to finance temporary or variable current assets. However, it should be realized that exact matching is not possible because of the uncertainty about the expected lives of assets.

The following figure is used to illustrate the matching approach:

The firm’s fixed assets and permanent current assets are financed with long-term funds and as the level of these assets increases, the long-term financing level also increases.

The temporary or variable current assets are financed with short-term funds and as their level increases, the level of short-term financing also increases. Under matching plan, no short-term financing will be used if the firm has a fixed current assets need only.

(ii) Conservative Approach:

A conservative approach is one which generally tries to avoid the risk. This approach emphasises more on the long term sources of finance. Under a conservative plan, the firm finances its permanent assets and also a part of temporary current assets with long-term financing.

In the periods when the firm has no need for temporary current assets, the idle long-term funds can be invested in the tradable securities to earn income.

The conservative plan relies heavily on long- term financing and, therefore, the firm has low profit and less risk of facing the problem of shortage of funds. The shaded area in the figure is showing the amount available for the investment.

The conservative financing policy is shown in following figure:

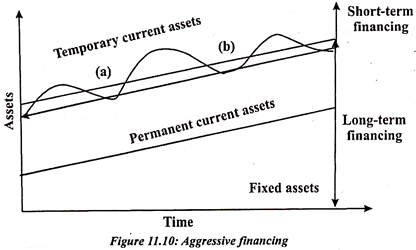

(iii) Aggressive Approach:

A firm may be aggressive in financing its assets. An aggressive policy is said to be followed by the firm when it emphasises more on the short term sources of funds. Under an aggressive policy, the firm finances a part of its permanent current assets with short-term financing.

Some extremely aggressive firms may even finance a part of their fixed assets with short-term financing. The relatively more use of short-term financing makes the firm more profitable but more risky also.

The aggressive financing is illustrated in figure as below: